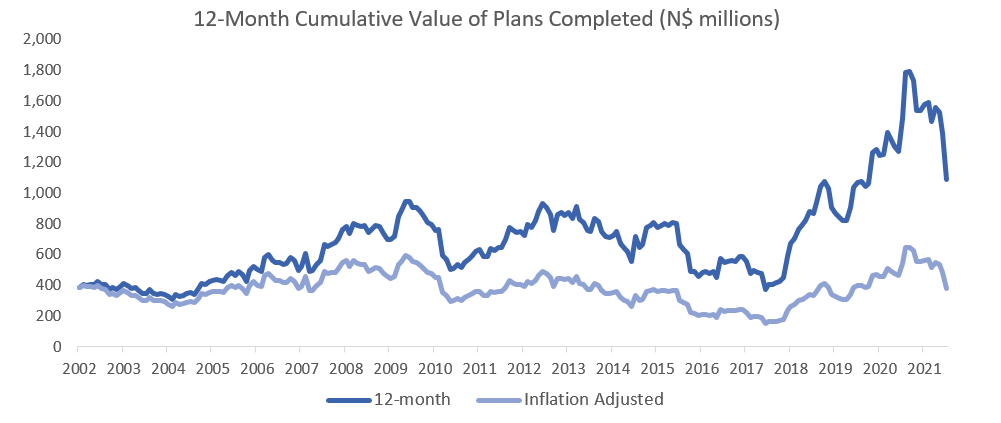

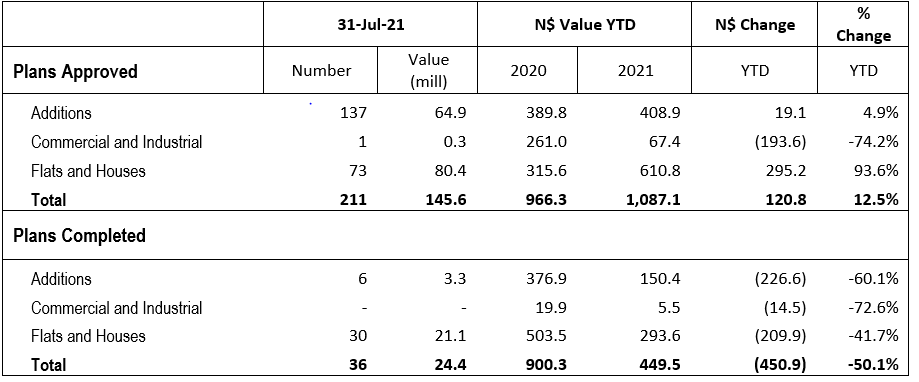

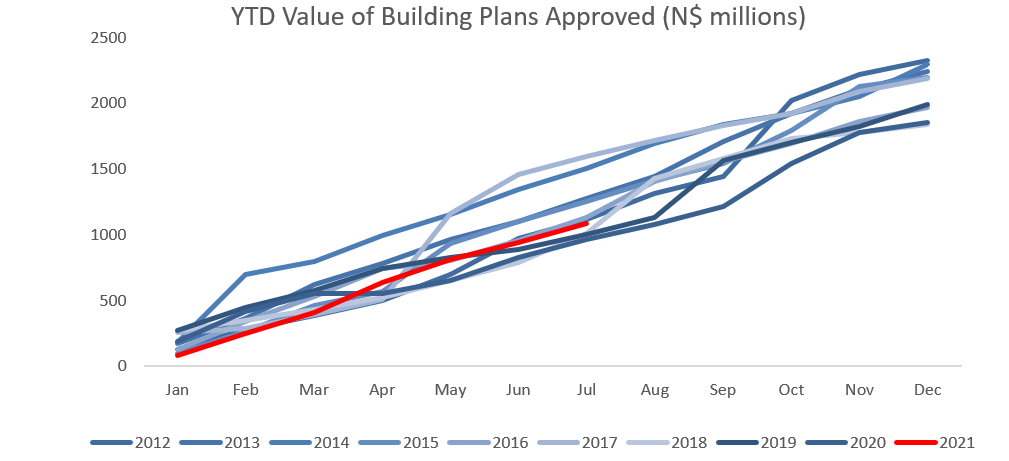

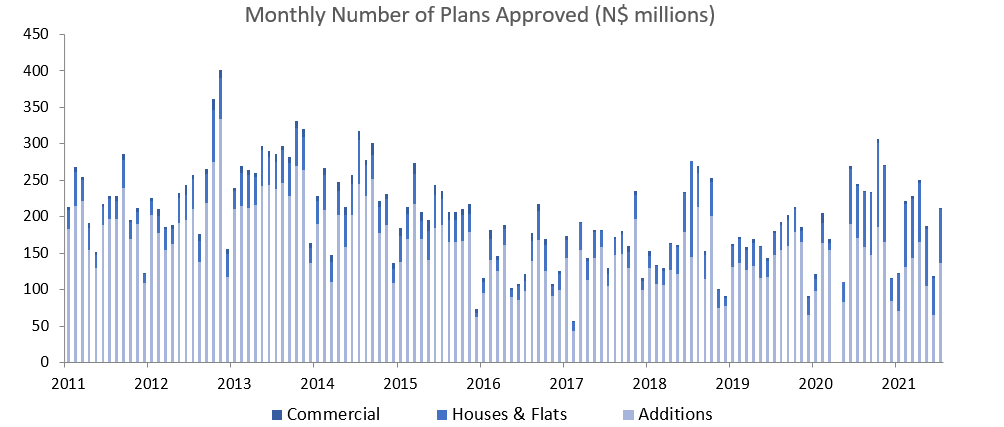

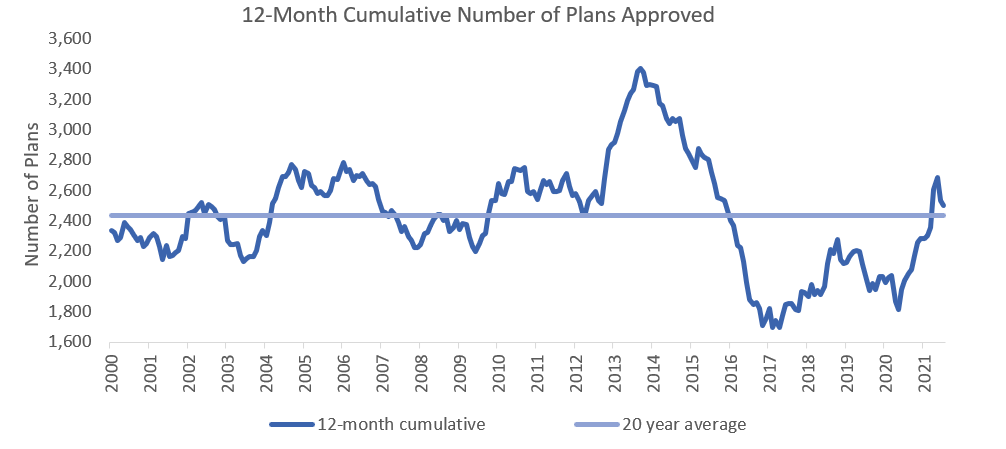

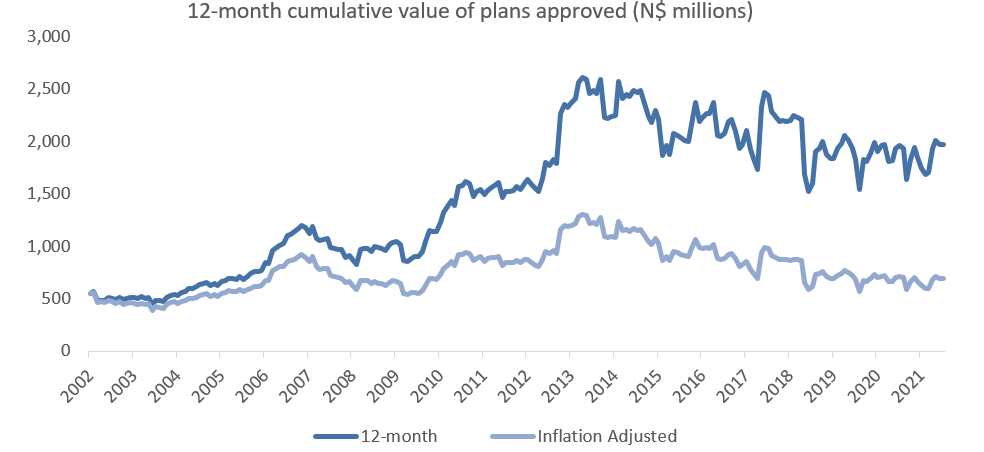

The City of Windhoek approved 211 building plans in July, a 77.3% m/m increase from the yearly low of 119 approvals in June. The value of the approvals increased by 13.4% m/m to N$145.6 million, compared to the N$128.4 million recorded in June. 2021 has now seen 1,338 approvals, valued at N$1.09 billion, 19.4% higher in number terms and 12.5% higher in value terms than during the same period last year. The increase is from a low base due to the strict lockdown measures early last year. On a twelve-month cumulative basis, building plan approvals rose by 24.5% y/y to 2,499, while the value of approvals rose 0.7% y/y to N$1.97 billion. A total of 36 completions to the value of N$24.4 million were recorded in July. Year-to-date, 838 building plans, valued at N$449.5 million have been completed, a 23.3% decline in number terms, and a 50.1% contraction in value terms, compared to the same period a year-ago.

Additions to properties made up most approvals. In July, 137 additions valued at N$64.9 million were approved, breaking a two-month streak of consecutive declines in both number and value terms. Year-to-date, 818 additions have been approved with a value of N$408.9 million, a 4.9% decrease in number, but a 4.9% y/y increase in value terms. Only 6 additions to properties were completed in July at a value of N$3.27 million, a 80.4% m/m decrease in value.

New residential units were the second largest contributor to the number of building plans approved with 73 approvals registered in July, 22 more than in June. In value terms, N$80.4 million worth of residential units were approved in July, a 4.0% m/m and 11.2% y/y increase. So far in 2021 500 units worth N$610.8 million have been approved. This translates to a year-to-date increase in value of 93.6% . On a 12-month cumulative basis the number of residential units approved increased by 146.6% y/y and by 86.3% y/y in value terms. 30 new residential units worth N$21.1 million were completed in July.

Only one commercial unit, valued at N$280,000 was approved in July. This brings the total number of commercial buildings approved in 2021 to 20, at a value of N$67.4 million. While 30 commercial buildings, valued at a N$137.6 million, have been approved in the last 12 months, no commercial units were completed for the fourth month running. Year-to-date, commercial and industrial completions account for only 1.3% of the total value of completions, well below the pre-pandemic 2019 average contribution.

On a 12-month cumulative basis, the number of building plans approved increased by 24.5% y/y. This increase is however from a low base. 2,499 building plans to the value of N$1.97 billion were approved in the last 12 months, representing a 0.7% y/y increase in value. Additions to properties made up 63.9% of the cumulative number of approvals, but only 36.3% of the total value of approvals. Commercial and industrial building plan approvals are on course to be even lower in 2021 than in 2020 with only 20 approvals worth N$67.4 million thus far, compared to 31 approvals worth N$261.0 million at the same point last year. As building plan approvals is a forward-looking measure of expected construction activity this does not bode well for economic activity in the capital in general. The construction industry thus remains fragile.