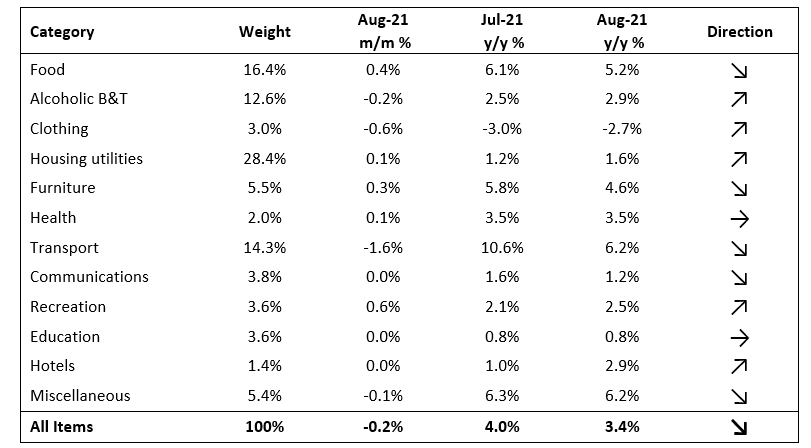

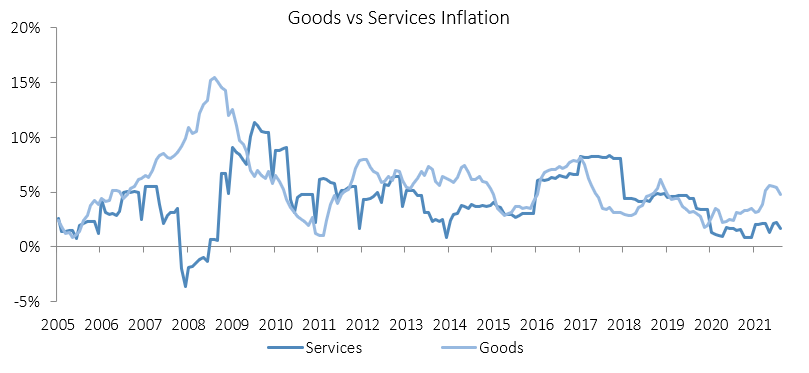

Namibian inflation slowed to 3.4% y/y in August on the back of a 4.0% y/y increase in prices in July. Accordingly, prices in the overall NCPI basket decreased by 0.2% m/m. On an annual basis, overall prices of five of the twelve categories rose at a quicker rate in August than July, while five categories experienced slower rates of inflation and two categories posted steady inflation. Tellingly, inflation in the food and non-alcoholic beverages category, which has the second largest weighting in the NCPI, slowed from 6.1% y/y in July to 5.2% y/y in August. Prices for goods increased by 4.8% y/y while prices for services increased by 1.7% y/y in August.

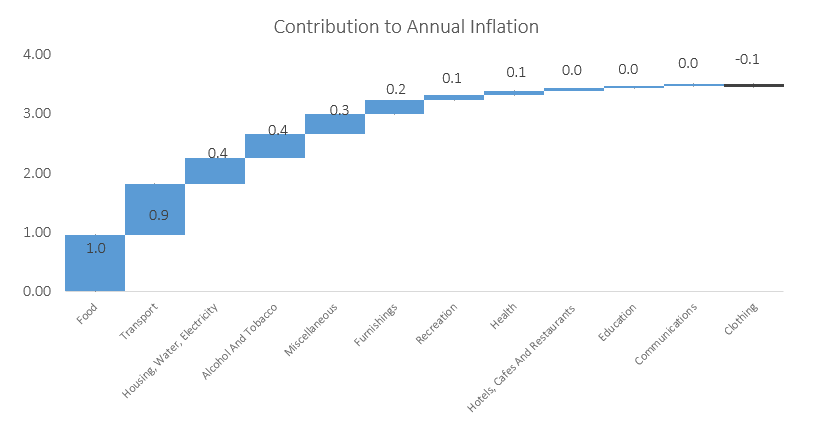

Predictably, food and non-alcoholic beverages, alongside transport, accounted for most of the 3.5% y/y increase in the NCPI in August. Food and non-alcoholic beverages contributed 1.0 percentage points while transport contributed 0.9 percentage points to the annual inflation figure. Prices in these categories are highly correlated, with increases in one category often predicting increases in the other. Prices for transport, the third largest basket item in weighting, decreased by 1.6% m/m in August. This is the largest month-on-month decrease of all categories in the NCPI. The NSA data, somewhat bizarrely, shows that the prices for public transportation services fell by 9.9% m/m and 8.7% y/y. No explanation was given for this decline.

Housing, water and electricity contributed 0.4 percentage points to the annual inflation figure in August, recording an increase of 0.1% m/m and 1.6% y/y. The regular maintenance and repair of dwelling was the only sub-category which recorded a slower rate of increase at 8.3% y/y. The electricity, gas and other fuels and water supply, sewerage service and refuse collection sub-categories posted quicker inflation of 2.8% y/y and 1.4% y/y, respectively. Alcohol and tobacco products round off the top five biggest contributors to inflation this month alongside miscellaneous goods.

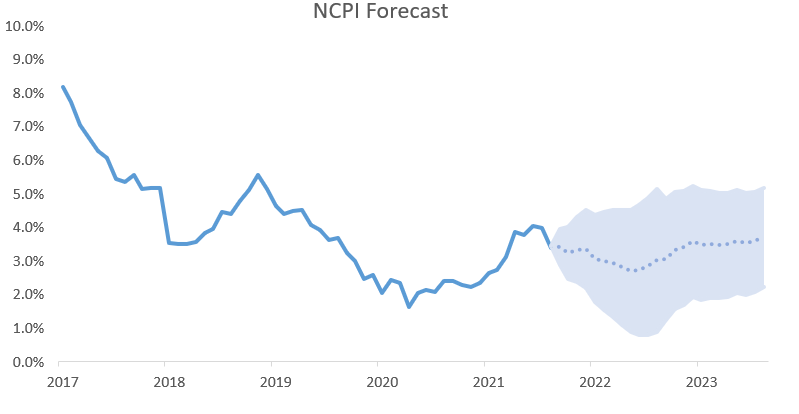

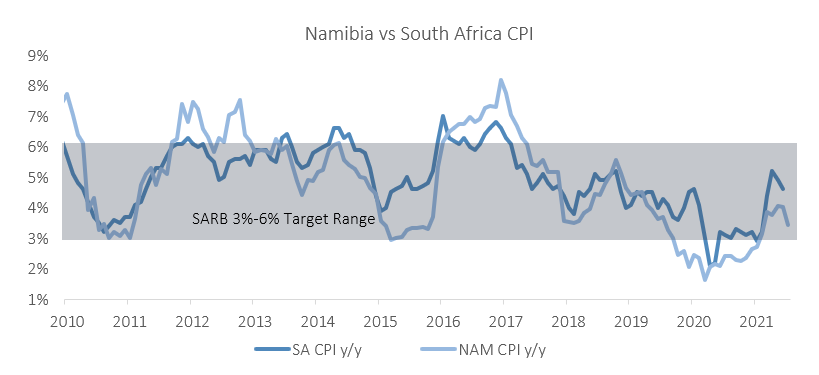

The 3.4% y/y inflation rate is exactly in line with IJG’s inflation forecast for the year. Risks remain to the upside, with the Delta variant threatening to slow economic growth in much of the world, coupled with microchip shortages threating the global supply of tech products and new vehicles as well as escalating shipping costs. However, significant price shocks are unlikely to materialise in short term given that businesses are unlikely to raise prices as consumer confidence and disposable income both remain low. IJG’s inflation model currently forecasts an average inflation of 3.4% y/y in 2021 and 3.0% y/y in 2022. Economic growth is likely to remain slow in the coming years and inflation is likely to remain muted.