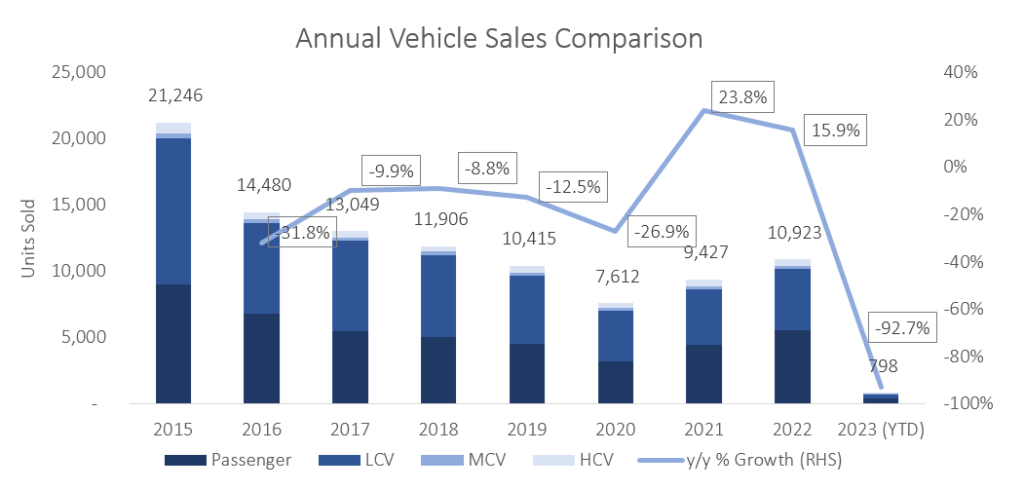

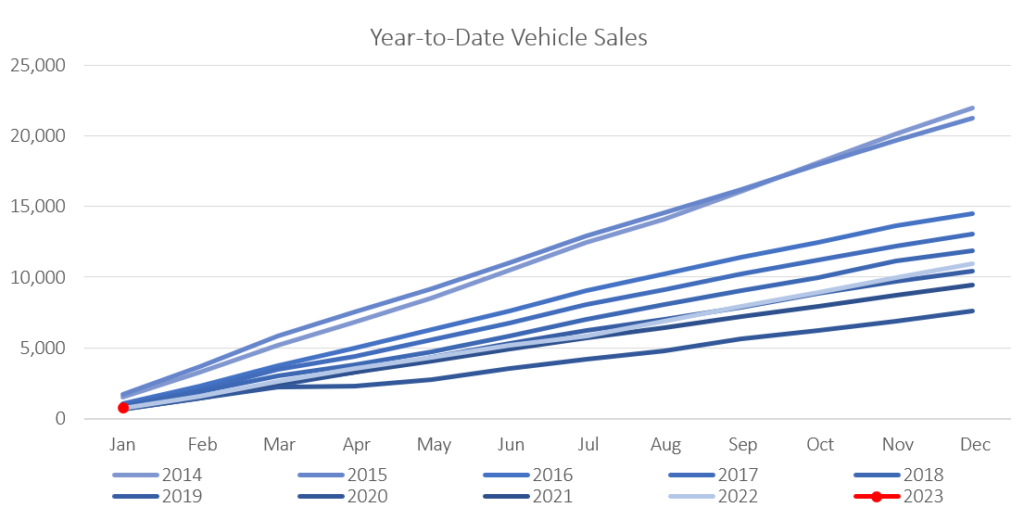

A total of 798 new vehicles were sold in January, which is 154 fewer than were sold in December, but represents a 12.7% y/y increase from the 708 new vehicles sold in January 2022. On a twelve-month cumulative basis, a total of 11,013 new vehicles were sold up to the end of January 2023, representing an increase of 16.6% from the 9,442 new vehicles sold over the same 12-month period a year ago. 2023 is off to a decent start with January’s new vehicle sales up for the 5th consecutive year.

468 New passenger vehicles were sold during January, a decrease of 7.1% m/m from the 504 sold in December, but 15.0% higher y/y from the 407 new passenger vehicles sold in January 2022. On a rolling 12-month basis, new passenger vehicle sales rose 24.2% y/y at the end of January. 12-month cumulative passenger vehicle sales continue to trend higher and are up by 77.0% from the pandemic low, trending at levels last seen in 2017.

Commercial vehicle sales declined to 330 units in January, representing a contraction of 26.3% m/m but is 9.6% higher year-on-year from the 301 new commercial vehicles sold in January 2022. During the month, 294 light commercial vehicles, 12 medium commercial vehicles, and 24 heavy commercial vehicles were sold. On a year-on-year basis, light commercial sales rose by 10.5% y/y, medium commercial vehicles grew by 140.0% y/y, and heavy and extra heavy vehicle sales declined by 20.0% y/y. All sub-categories, bar heavy- and extra heavy vehicles, have recorded growth on a twelve-month cumulative basis with light commercial vehicle sales increasing by 12.6% y/y, medium commercial vehicles sale rising by 9.5% y/y, while heavy commercial vehicle sales contracted by 12.3% y/y.

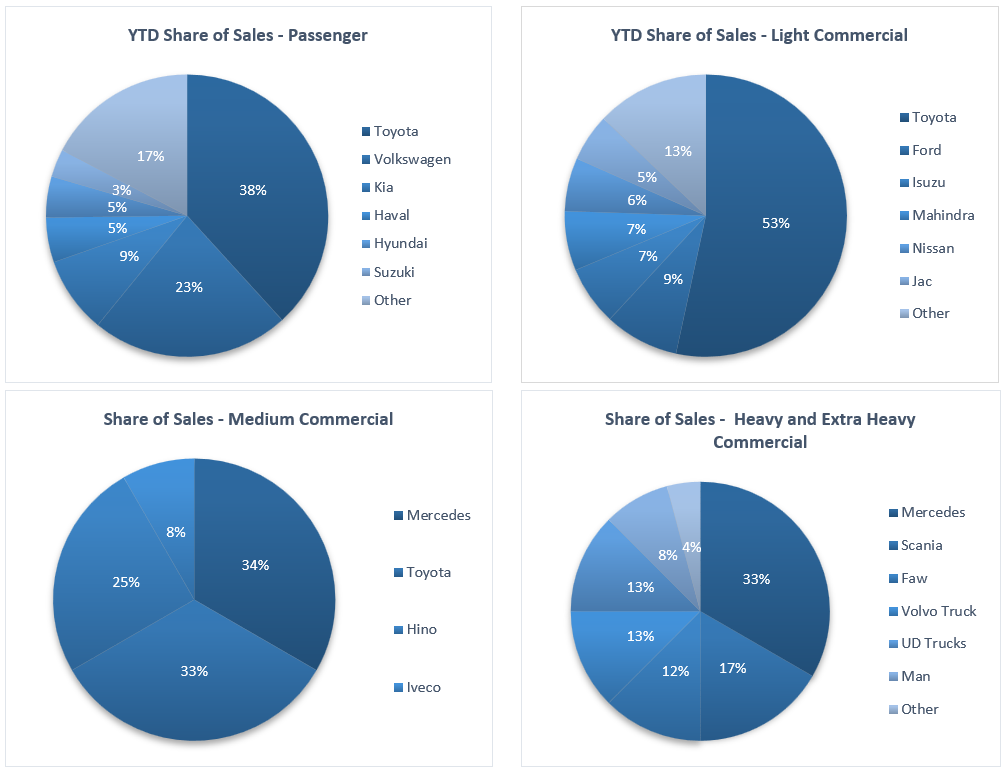

Both Toyota and Volkswagen started the new year strong and collectively sold more than half of the new passenger vehicles in January. Toyota captured the largest portion with 38.2% of the market share, followed by Volkswagen with 22.6%. Kia and Haval were the best of the rest, taking 8.8% and 5.1% of the market share, respectively. The other manufacturers consumed the remaining 25.2%.

Toyota also started the year off with a solid grip on the light commercial vehicle segment with a 53.4% market share. Ford came in second place with 8.5% of the market share, followed by Isuzu and Mahindra, with 6.8% each. Mercedes and Toyota collectively led the medium commercial vehicle market, each with a 33.3% market share during the month. Mercedes was also number one in the heavy and extra-heavy commercial vehicle segment, after taking 33.3% of the market share in January, followed by Scania with 16.7% of the market share during the month.

New vehicle sales started the year off on a solid footing. January’s new vehicle sales are the strongest start to a new year since 2018 with just under 800 vehicles sold during the month. Both passenger and commercial segments grew year-on-year in January and sales in both categories continued to rise on a 12-month cumulative basis during the month. Commercial vehicle sales growth is mainly being driven by light- and medium commercial vehicle sales, while the ‘heavy’ segment recorded lower 12-month cumulative sales for a 5th consecutive month.

The 12-month cumulative new vehicle sales figure of 11,013 is trending at levels last seen in 2019. While this is still less than half the high of 22,664 recorded in April 2015, the relatively strong sales figure reported for January is encouraging, considering that vehicle prices and borrowing costs have risen considerably over the past twelve months.