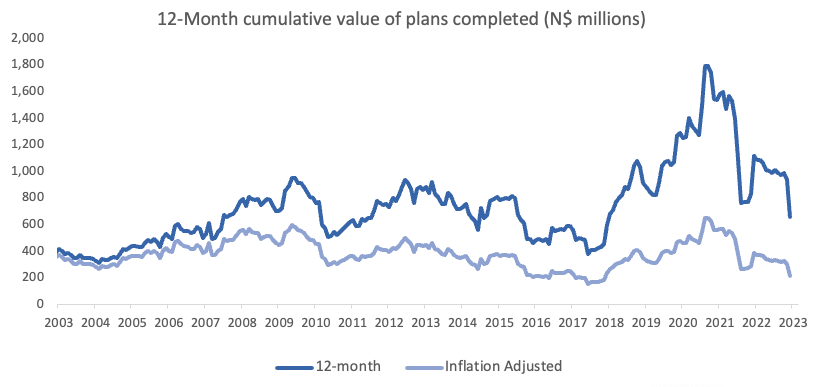

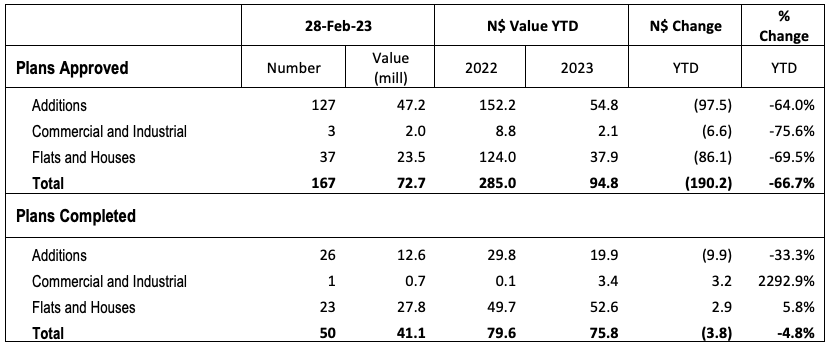

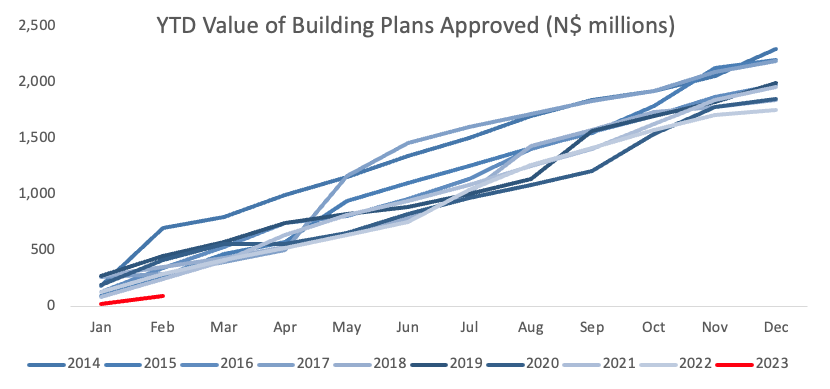

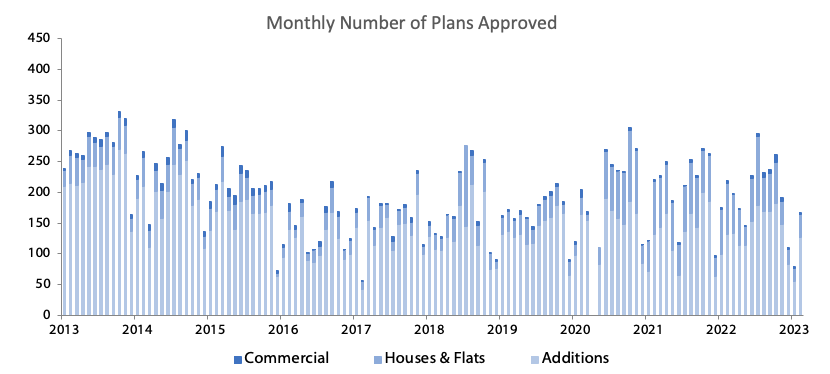

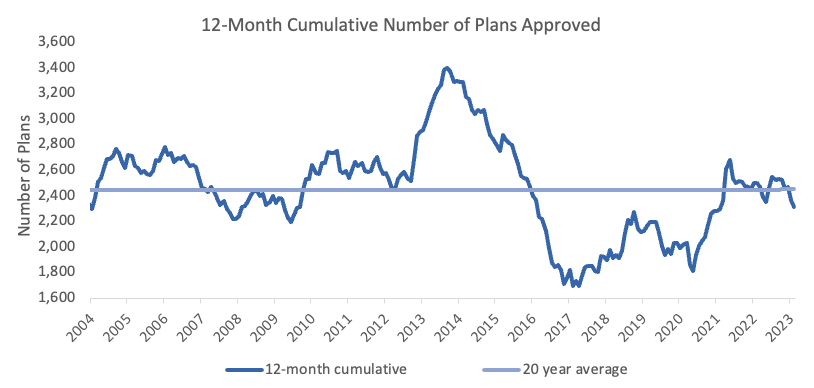

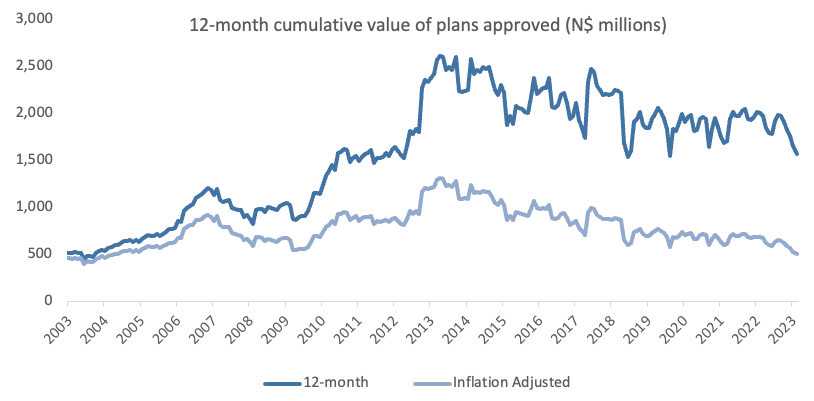

The City of Windhoek approved 167 building plans in February, a 111.4% m/m increase from January’s low base of 79 approvals. In monetary terms, the approvals were valued at N$72.7 million, a 229.0% m/m increase from January’s dismal N$22.1 million. Year-to-date 246 building plans worth N$94.8 million have got the nod, a decrease in number of 37.7% y/y and down 66.7% y/y in value terms. On a twelve-month cumulative basis, 2,318 buildings worth N$1.56 billion were approved, a contraction of 7.4% in number- and 21.8% in value terms over the comparative 12-month period a year ago. 50 building plans worth N$41.6 million were completed during the month.

Additions to properties made up the largest portion of building plan approvals in terms of both number and value of approvals. 127 additions to properties with a value of N$47.2 million were approved during the month, 5 fewer than in February 2022. While February’s additions to properties approvals data is significantly better than we saw in both January and December, it is still below the average monthly approvals we saw during 2022 in both number and value terms. On a 12-month cumulative basis, the number and value of additions to properties remain roughly in line with the levels seen during the same 12-month period a year ago. 26 Additions, worth N$12.6 million were completed during the month.

37 New residential units valued at N$23.5 million were approved in February. Again, while this is 17 more, and nearly double the value we saw approved for this category in January, it remains significantly lower than the approvals recorded for most months during 2022. For added perspective, the monthly average approvals in 2022 was 61 residential units worth N$58.7 million. The slowdown is also evident in the 12-month cumulative figures which stands at 635 units worth N$618.0 million, a decline of 26.2% y/y in number terms and a contraction of 39.3% y/y in value terms. A total of 23 residential units worth N$27.8 million were completed during the month.

February saw 3 new commercial and industrial units approved for the third consecutive month. In value terms, the approvals amounted to just N$1.95 million. This brings the year-to-date approvals to 6 commercial buildings worth N$2.1 million, which translates to a 14.3% y/y decrease in the number of plans approved and a 75.6% y/y decrease in value terms. On a rolling 12-month perspective, the number of commercial and industrial approvals stood at 56 worth N$156.2 million, compared to the 40 units worth N$172.7 million over the corresponding period a year ago. Only 1 commercial unit valued at N$700,000 was completed in February.

The building plans data for February showed an improvement in planned construction activity from January, although the increase was from a very low base, and the month’s approvals were well below the average monthly approvals witnessed in 2022, as mentioned a couple of times in this report. The total value of approvals in February (at N$72.7 million) was more than three times reported in January, but still below half the monthly average recorded last year.

2023 is thus off to a particularly slow start in terms of planned construction activity in the capital. As we pointed out in last month’s report, building plan approvals is a leading indicator of economic activity in the country and the above data implies that certain sectors of the Namibian economy are still faced with hardship.