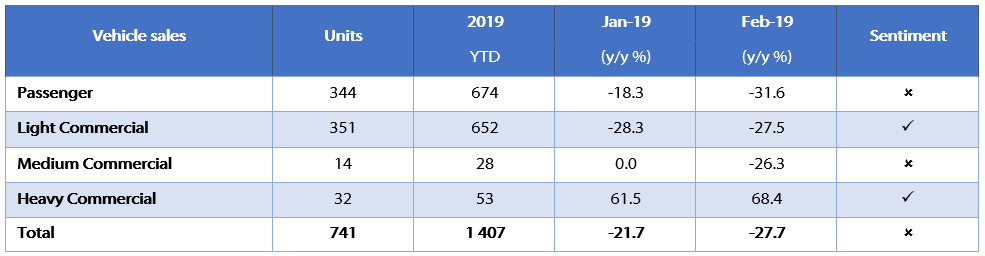

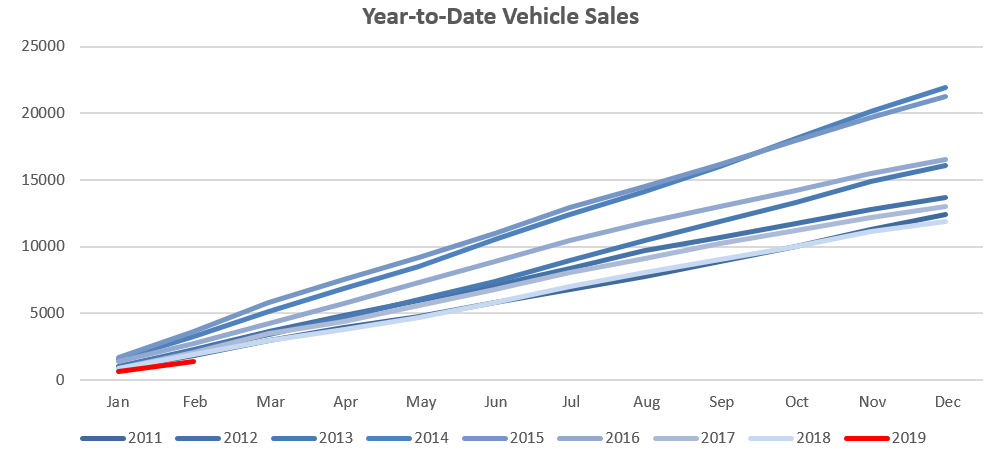

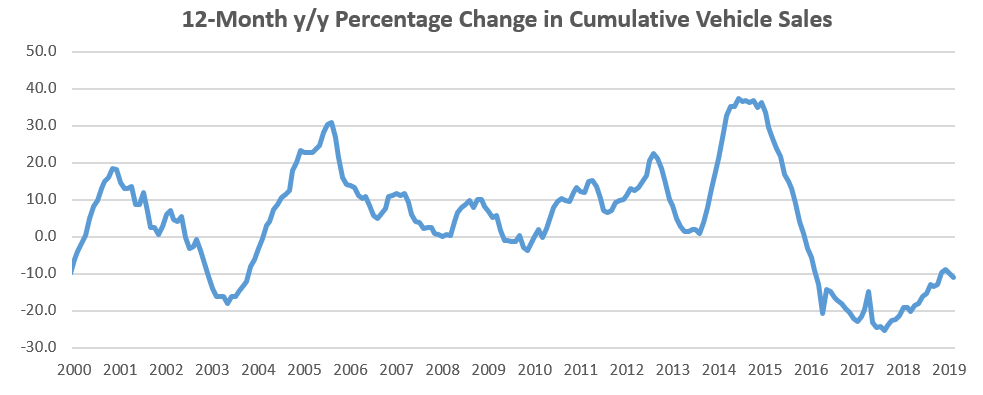

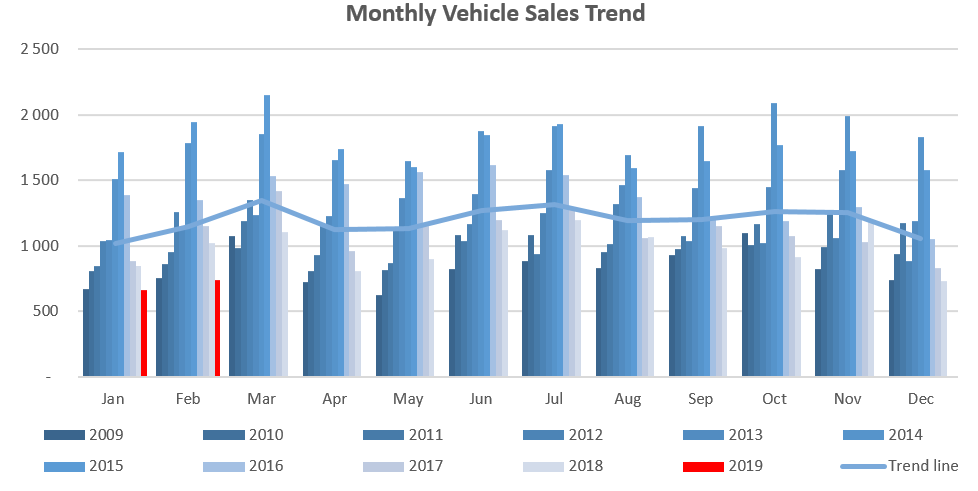

741 New vehicles were sold in February, an increase of 11.3% m/m from the 666 vehicles sold in January. This is however 27.7% lower than the 1,025 new vehicles sold in February 2018. Two months into 2019, 1,407 new vehicles have been sold of which 674 were passenger vehicles, 652 light commercial vehicles, and 81 medium and heavy commercial vehicles. The first two months of 2018 saw 1,876 new vehicles sold. On a twelve-month cumulative basis, a total of 11,437 new vehicles were sold as at February 2019 representing a contraction of 11.2% from the 12,873 sold over the comparable period a year ago.

A total of 344 new passenger vehicles were sold during February, increasing by 4.2% from the 330 passenger vehicles sold in January. On a year-on-year basis however, February new passenger vehicle sales were 31.6% lower than the 503 vehicles sold a year ago. Year-to-date, passenger vehicle sales rose to 674, reflecting lower annual sales than the preceding 8 years, and a 25.7% decline from February 2018. On a rolling 12-month basis, passenger vehicle sales are at their lowest level since January 2011, highlighting the severity of the slowdown in sales.

Commercial vehicle sales reflect a similar picture, declining by 24.4% year-to-date and 10.7% y/y on a rolling 12-month basis. A total of 397 new commercial vehicles were sold in February, representing an increase of 18.2% m/m, but a contraction of 23.9% y/y. 351 Light commercial vehicles, 14 medium commercial vehicles, and 32 heavy and extra heavy commercial vehicles were sold during the month. Light commercial vehicle sales have dropped 27.5% y/y, while medium commercial vehicle sales fell 26.3% y/y, and heavy and extra heavy sales rose 68.4% y/y. On a twelve-month cumulative basis, light commercial vehicle sales dropped 11.9% y/y, while medium commercial vehicle sales rose 10.1% y/y, and heavy commercial vehicle sales fell 2.9% y/y. This is the fifth consecutive month that medium commercial sales have showed positive growth on a twelve-month cumulative basis.

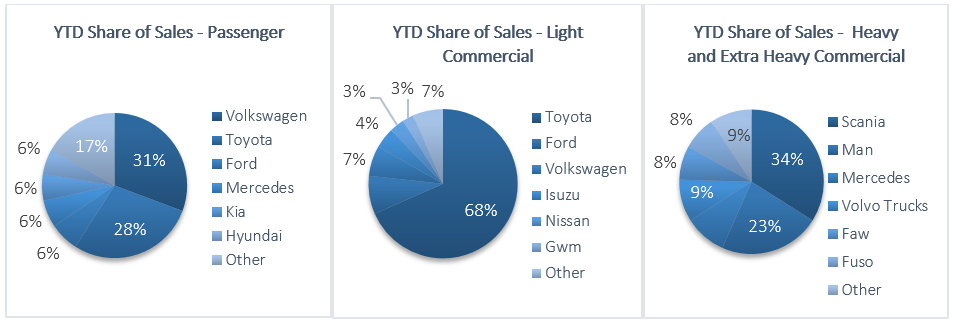

During February, Volkswagen overtook Toyota in terms of year-to-date market share of new passenger vehicles sold. Volkswagen claimed 30.7% of the market, followed closely by Toyota with 28.3% of the market. They were followed by Ford and Mercedes with 6.5% and 6.1% of the market respectively, while the rest of the passenger vehicle market was shared by several other competitors.

Toyota remained the leader in the light commercial vehicle space with a 68.4% market share, with Ford in second place with an 8.3% market share. Volkswagen and Isuzu claimed 6.6% and 4.4%, respectively, of the number of light commercial vehicles sold thus far in 2019. Hino leads the medium commercial vehicle segment with 35.7% of sales while Scania was number one in the heavy and extra-heavy commercial vehicle segment with 34.0% of the market share year-to-date.

The Bottom Line

New vehicle sales remained dismal in February as 12-month cumulative new vehicle sales have declined by 11.2% y/y to 11,437 at the end of February. While historical data indicates that new vehicle sales typically pick up somewhat in March, we are of the view that the increase in sales for the month will be small as both consumer and business confidence remain depressed and as such, the prospects for new vehicle sales remain dim in the short- to medium-term. Recent new vehicle sales figures suggest that vehicle owners are holding on to the vehicles they already own or purchasing second hand and imported vehicles.