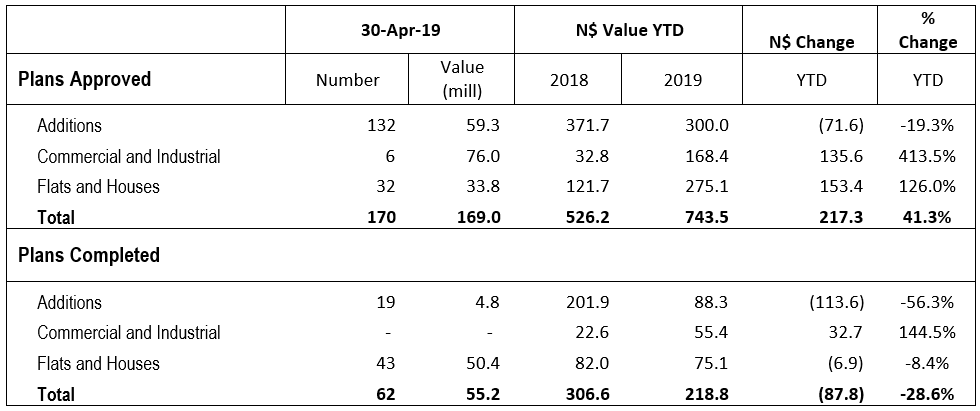

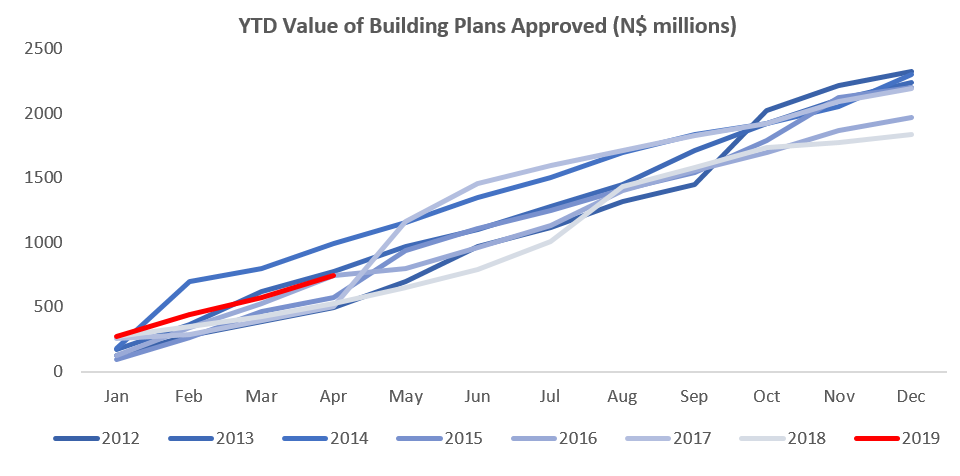

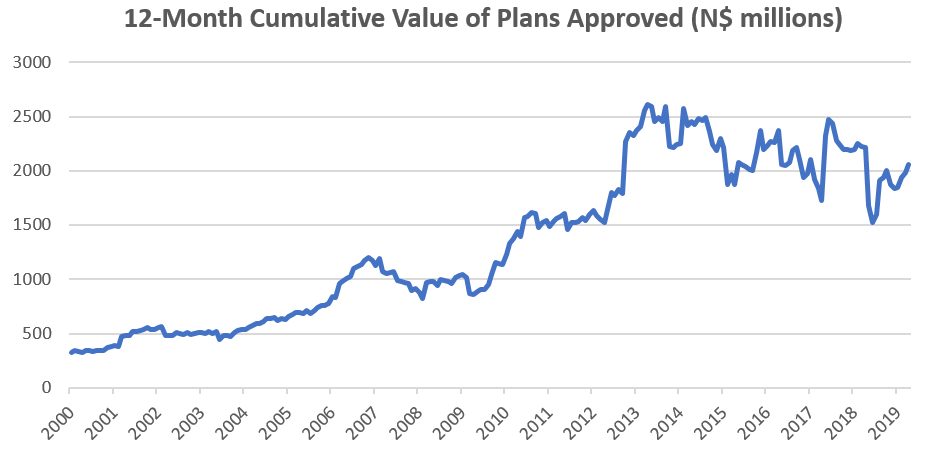

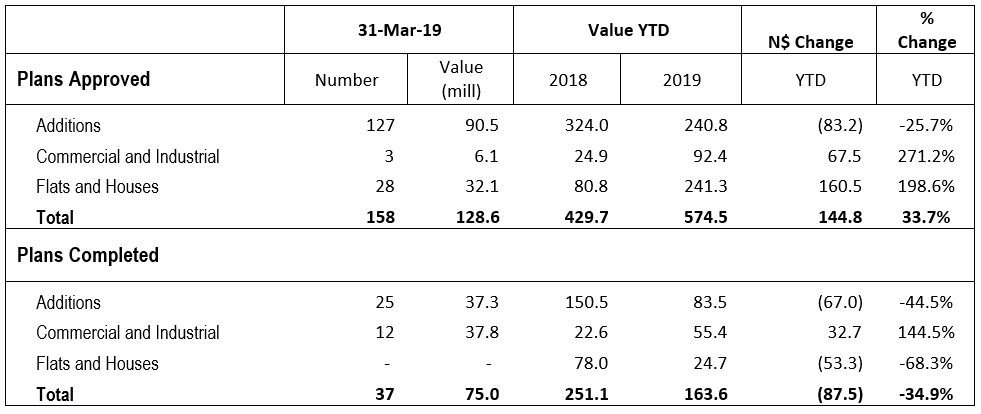

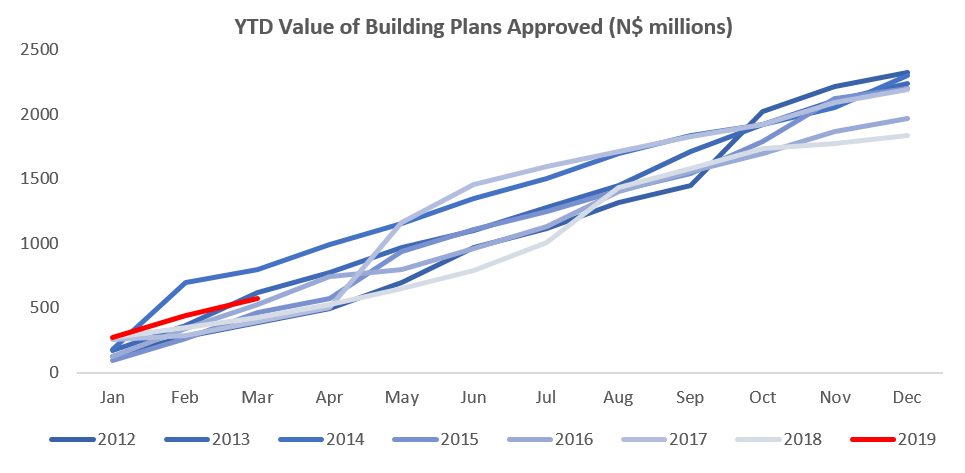

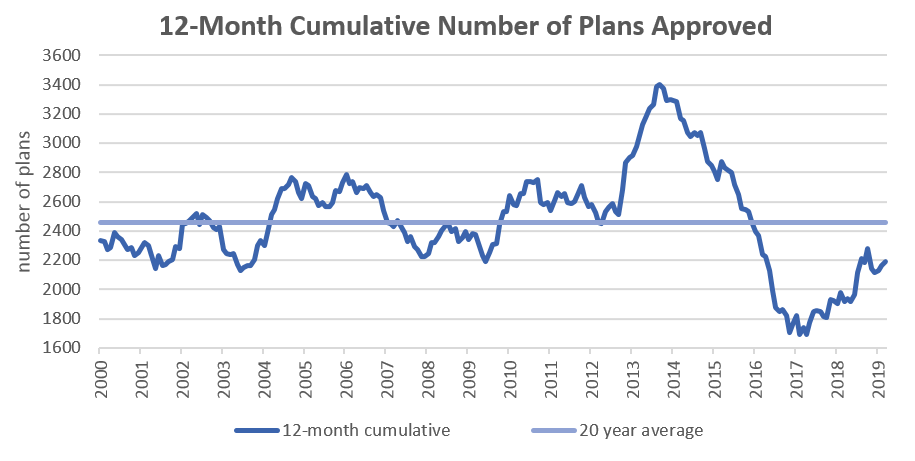

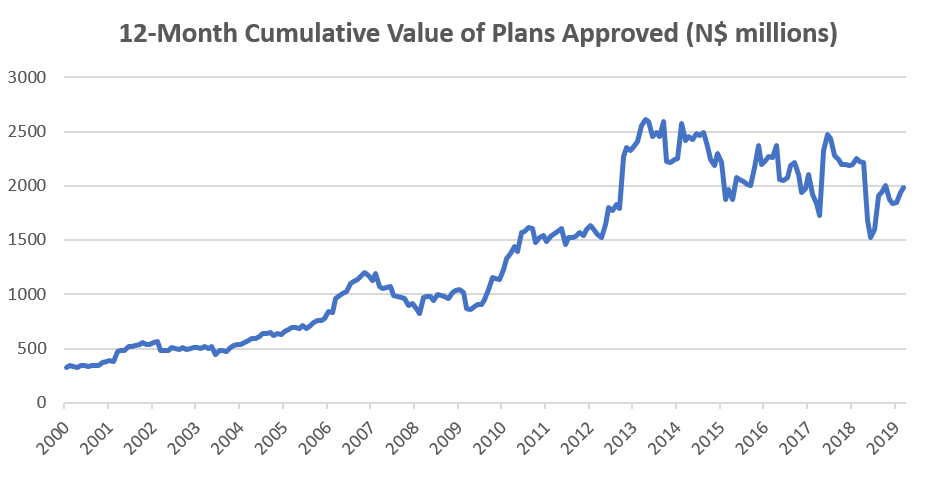

A total of 170 building plans were approved by the City of Windhoek in April, 12 more than in March. In values terms, approvals rose by N$40.4 million to N$169.04 million in April from N$128.6 million worth of approvals in March. A total of 62 building plans were completed at a value of N$55.2 million in April. Year-to-date, N$743.5 million worth of building plans have been approved, 41.3% higher than the corresponding period in 2018. On a twelve-month cumulative basis, 2,200 building plans were approved worth approximately N$2.06 billion, 7.0% lower in value terms than cumulative approvals in April 2018.

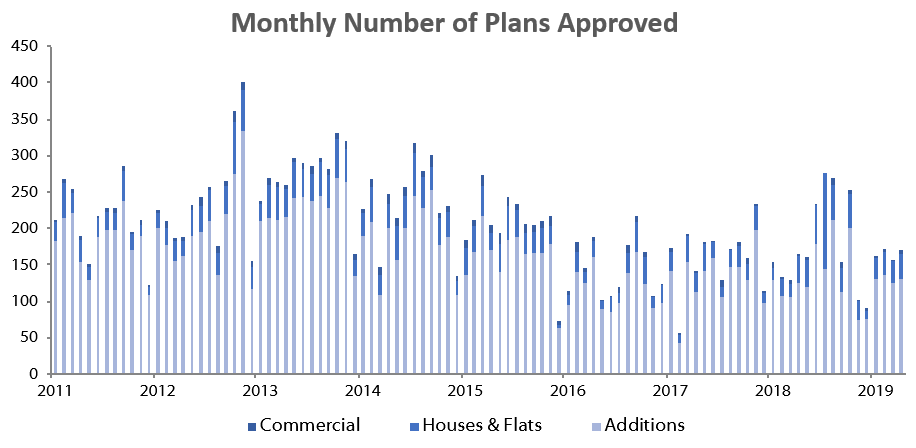

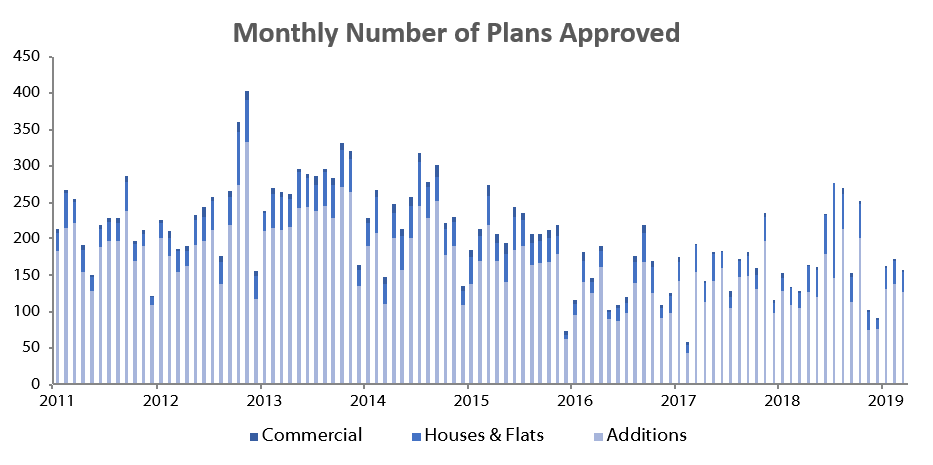

The largest number of building plan approvals in April were made up of additions to properties. 132 additions to properties were approved with a value of N$59.3 million, 24.3% more in value terms than in April 2018. Year-to-date 527 additions to properties have been approved with a value of N$300.0 million, a 19.3% y/y decline in value terms.

New residential units accounted for 32 of the total 170 approvals registered in April, an increase of 14.3% m/m compared to the 28 residential units approved in March. In value terms, N$33.8 million worth of residential units were approved in April, 5.3% more than the N$32.1 million worth of residential approvals in March. Year-to-date 121 residential units have been approved, 25 more than the corresponding period in 2018. In monetary terms, N$275.1 million worth of new residential plans have been approved year-to-date, an increase of 126.0% when compared to the corresponding period last year.

6 New commercial units valued at N$76.0 million were approved in April, bringing the year-to-date number of approvals to 14, worth a total of N$168.4 million. On al rolling 12-month perspective the number of commercial and industrial approvals have slowed to 43 units worth N$N$515.9 million as at April, compared to the 51 approved units worth N$680.0 million over the corresponding period a year ago.

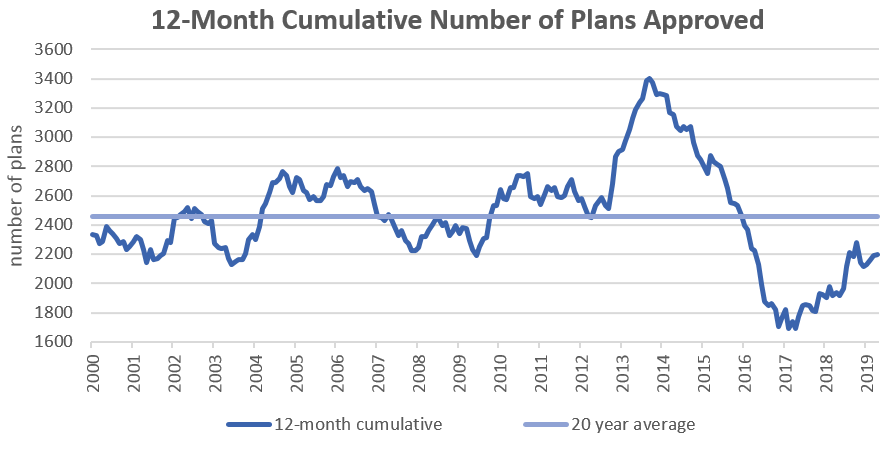

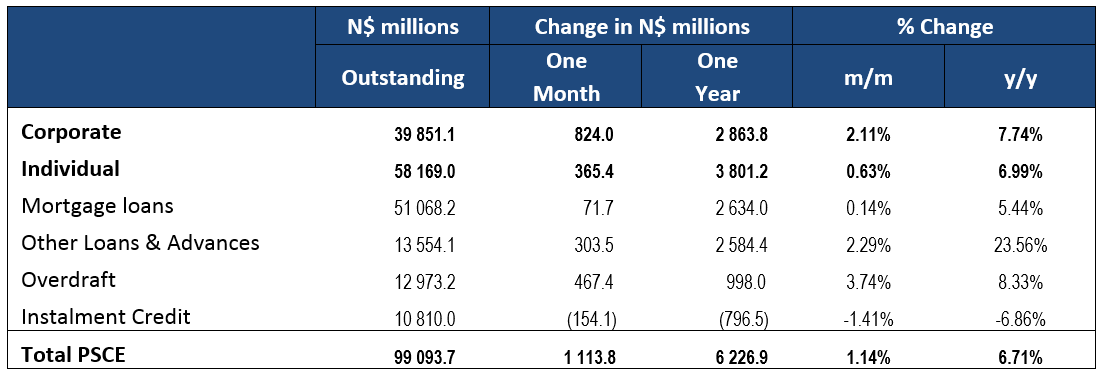

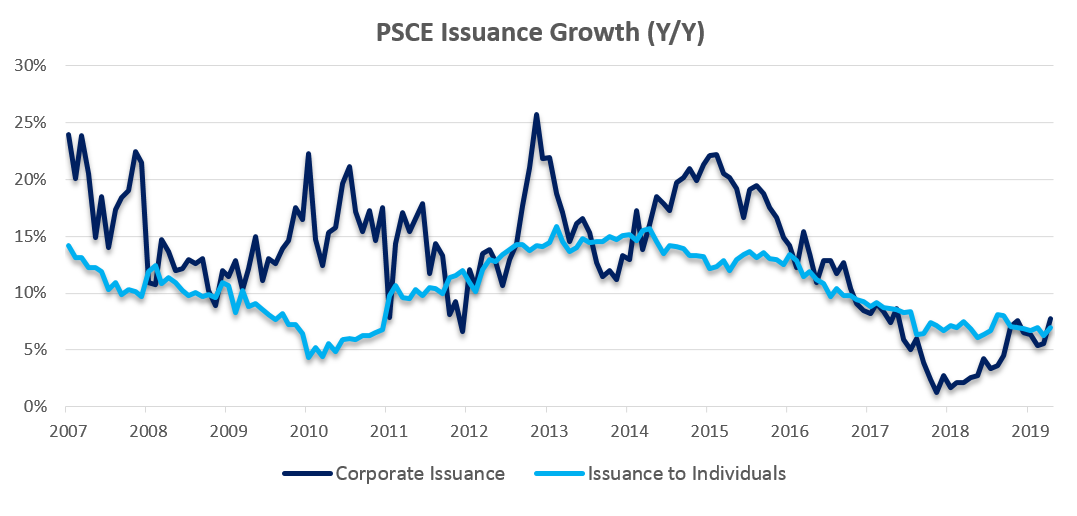

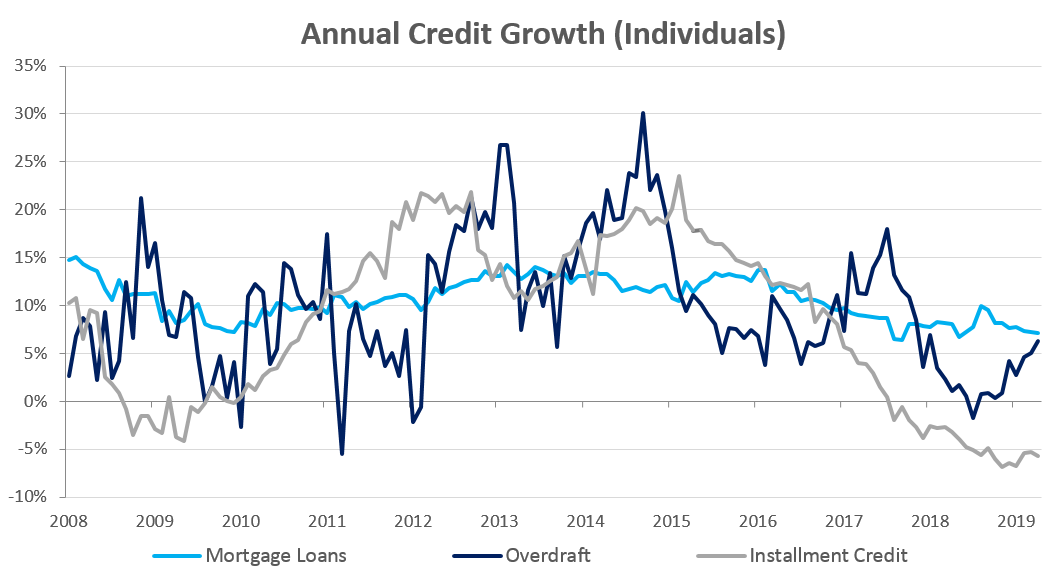

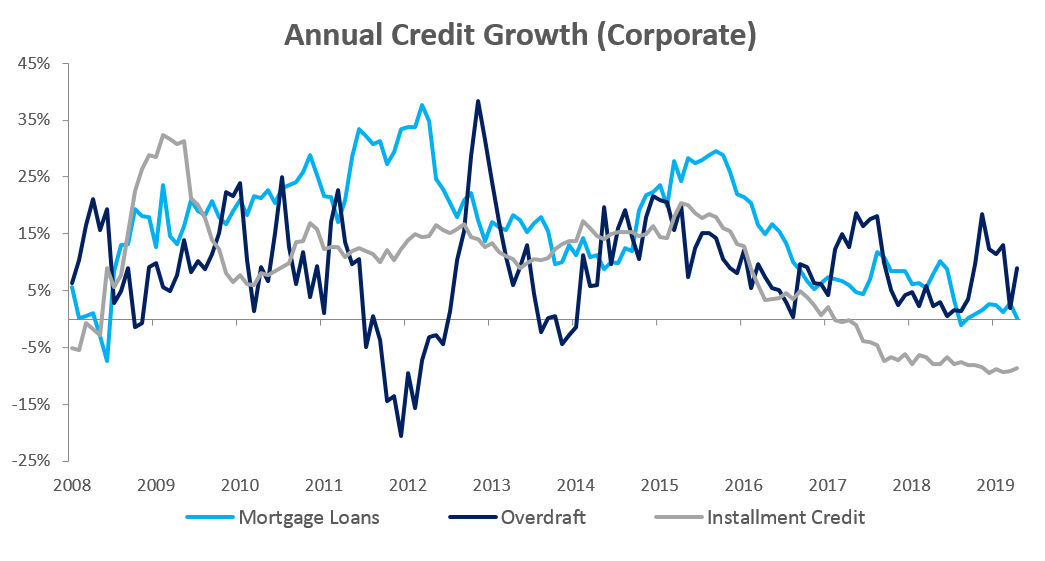

In the last 12 months 2,200 building plans have been approved, increasing by 13.6% y/y in terms of number of approvals, but contracting by 7.0% y/y in terms of value. The growth in the cumulative number of plans approved has been driven mainly by approvals in additions to properties and new residential units which are of lower relative value. Growth in commercial and industrial construction activity remains extremely subdued as the decrease (on a 12-month cumulative basis) in credit extended to corporates also reflects.

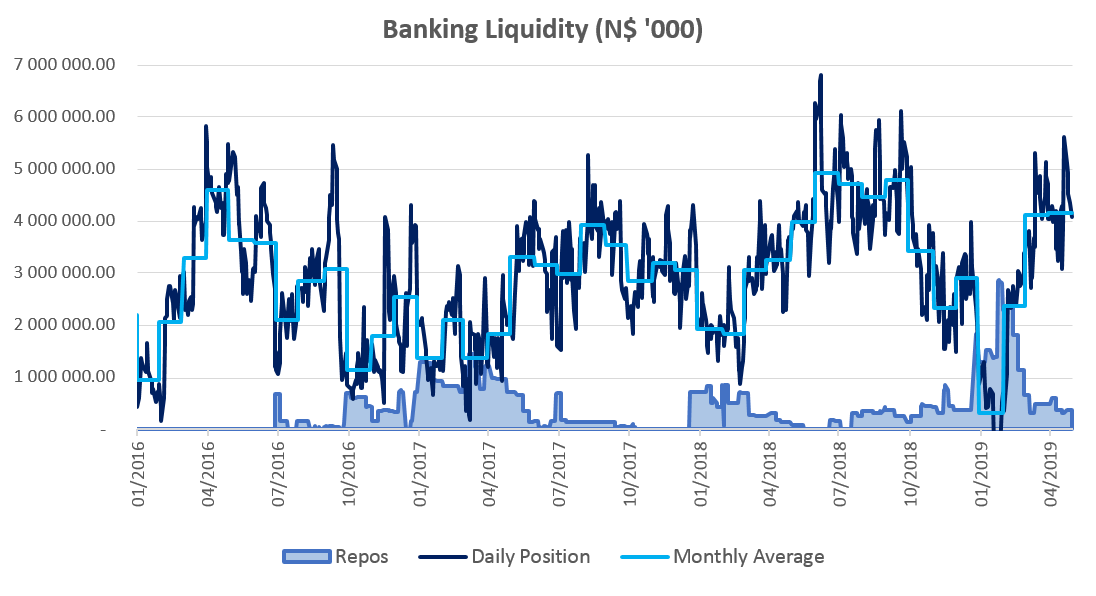

Commercial banks currently carry a healthy monthly average liquidity position of N$3.79 billion, providing sufficient levels of loanable funds. Consumers and corporates alike therefore seem curtailed by waning appetite for credit, or are simply not meeting affordability requirements for loans with which to pursue construction projects. A lack of confidence in the economy is acting on both willingness to invest form individuals and corporates as well as appetite for risk from banks.