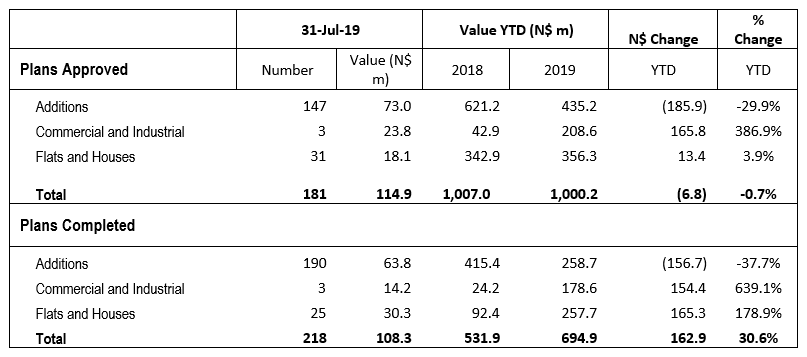

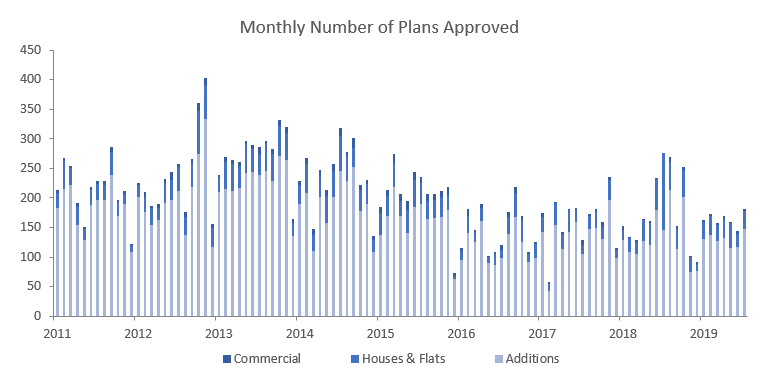

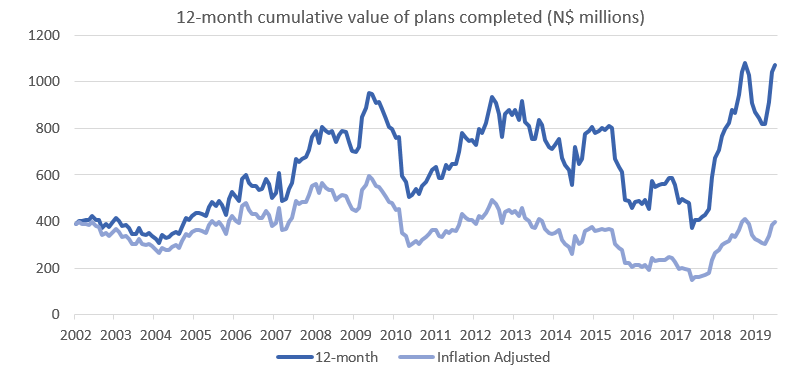

A total of 181 building plans were approved by the City of Windhoek in July, 37 more than in June. The value of approvals increased to N$114.9 million in July as opposed to N$60.5 million in June. A total of 218 building plans were completed during the month with a value of N$108.3 million. Year-to-date N$1.0 billion worth of building plans have been approved, 0.7% lower than over the comparative period a year ago. On a twelve-month cumulative basis 2,013 building plans have been approved worth approximately N$1.83 billion, 14.5% higher in value terms than cumulative approvals by the end of July 2018.

147 additions to properties were approved in July with a value of N$73.0 million, increasing by 159.4% m/m but dropping by 24.6% y/y in value terms. Year-to-date 907 additions to properties have been approved with a total value of N$435.2 million, a decrease of 0.9% y/y in number and 29.9% y/y in value terms. On a 12-month cumulative basis the number of additions approved has decreased by 3.1% y/y and by 27.4% y/y in value terms. Year-to-date 531 additions have been completed with a combined value of N$258.7 million, down 60.1% y/y in number and 37.7% y/y in value terms.

New residential units accounted for 31 of the approvals registered in July, an increase of 40.9% m/m. In value terms N$18.1 million worth of residential units were approved in July, increasing by 5.8% m/m but contracting by 84.6% y/y. Year-to-date residential unit approvals have decreased by 31.9% y/y in number but are up by 3.9% y/y in value. On a 12-month cumulative basis a 12.5% y/y decrease in number of residential unit approvals was recorded, although increasing by 16.6% y/y in value. Year-to-date 187 residential units have been completed with a combined value of N$257.7, up 289.6% y/y in number and 178.9% in value.

3 new commercial units valued at N$23.8 million were approved in July, bringing the year-to-date number of commercial and industrial approvals to 23, worth a total of N$208.6 million. This is 21.1% up in number from July last year and 386.9% up in value terms. On a rolling 12-month basis the number of commercial and industrial approvals rose to 47 units worth N$546.1 million as at July. This is an increase of 6.8% y/y in number and 386.9% y/y in value. Year-to-date 26 commercial units have been completed with a combined value of N$178.6 million, an increase of 333.3% in number and 639.1% in value terms. This is encouraging despite both figures coming off a very low base.

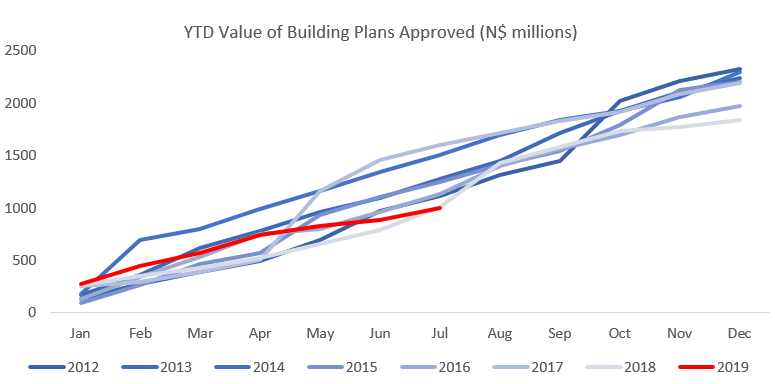

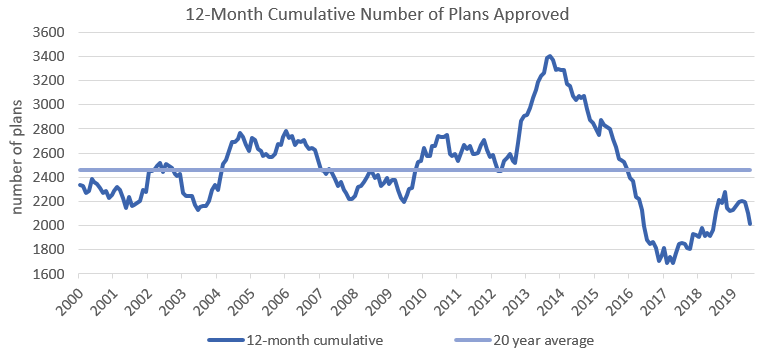

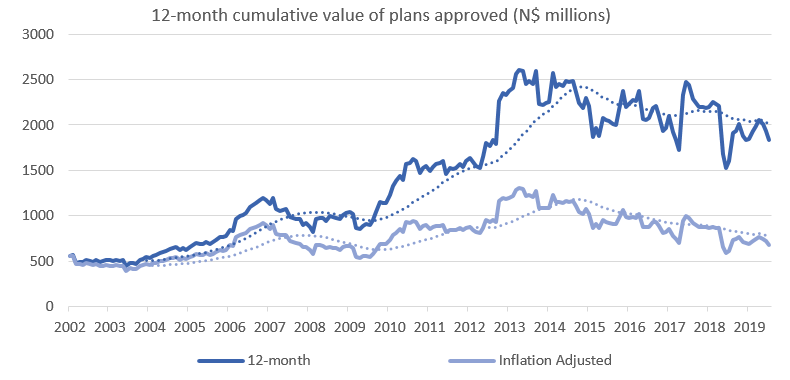

In the last 12 months 2,013 building plans have been approved, decreasing by 4.8% compared to July 2018. These approvals are valued at N$1.83 billion, an increase in value of 14.5% y/y. As can be seen in the figure above the cumulative value of building plans approved in Windhoek has been trending downward in both nominal terms as well as simple inflation adjusted terms. Despite various spikes in the nominal figure the average value of plans approved continues to decline. As building plan approvals is a leading indicator this does not paint a particularly rosy picture for the construction industry in the capital city in the short term. This outlook concurs with the view of the Bank of Namibia that construction activity is likely to record a fourth consecutive annual contraction in 2019.

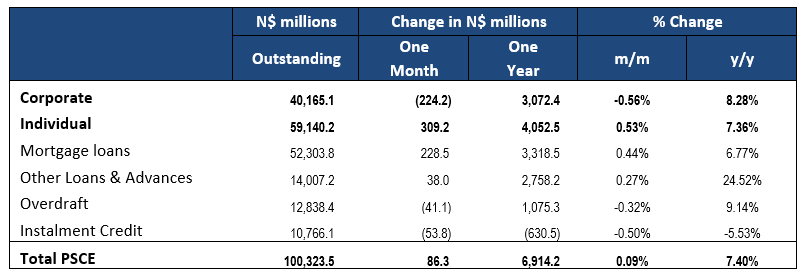

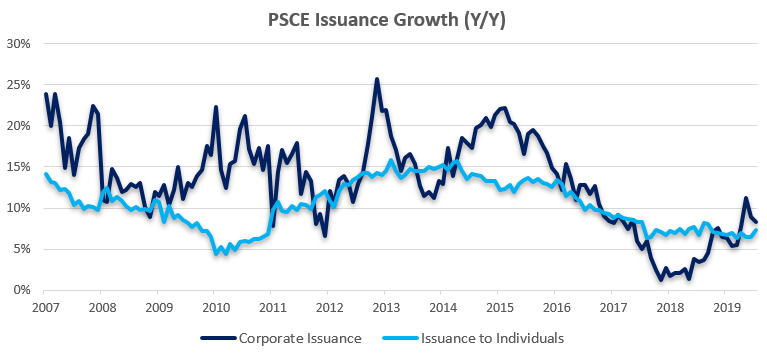

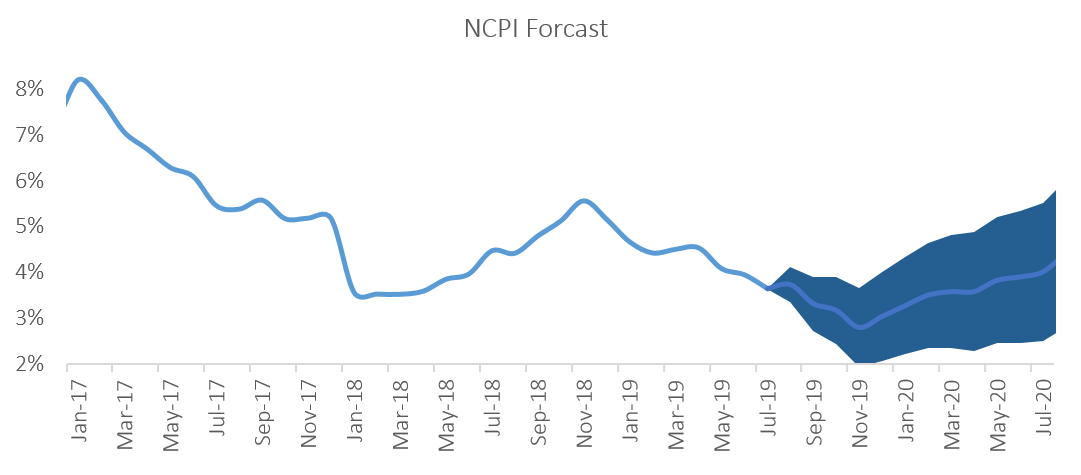

As we expected Bank of Namibia took the decision at its MPC meeting to cut interest rates by 25 bps. The decision to cut the Repo rate will bring some relief to indebted consumers and businesses. The central bank’s decision to cut interest rates comes as the domestic economy is projected to contract by 1.7% in the current year. This aims to boost economic growth given the current low consumer and business confidence.

According to the Bank of Namibia’s Economic Outlook for July 2019, growth in the construction industry is expected to remain negative with improvements expected to occur in 2020. Activity in the construction industry is set to recover due to the increase in government’s development budget for 2019/20 and 2020/21.