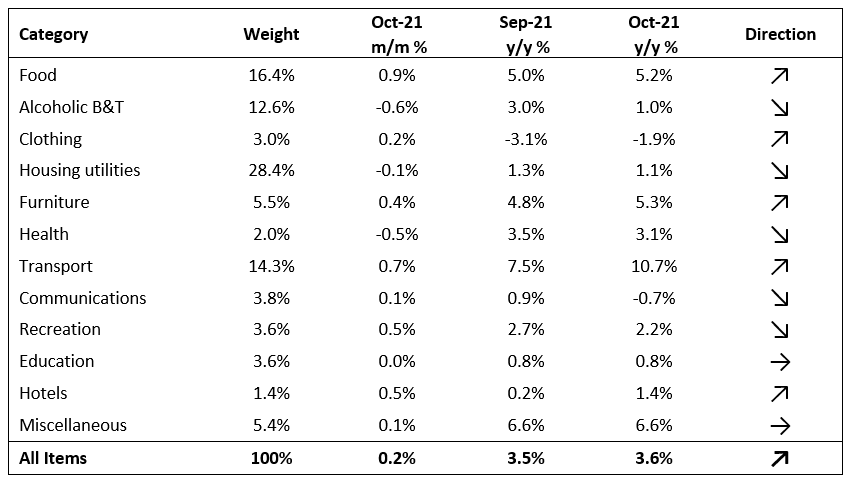

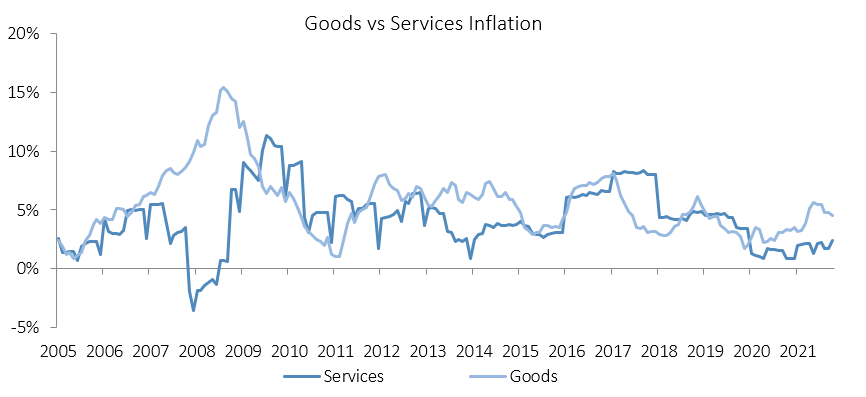

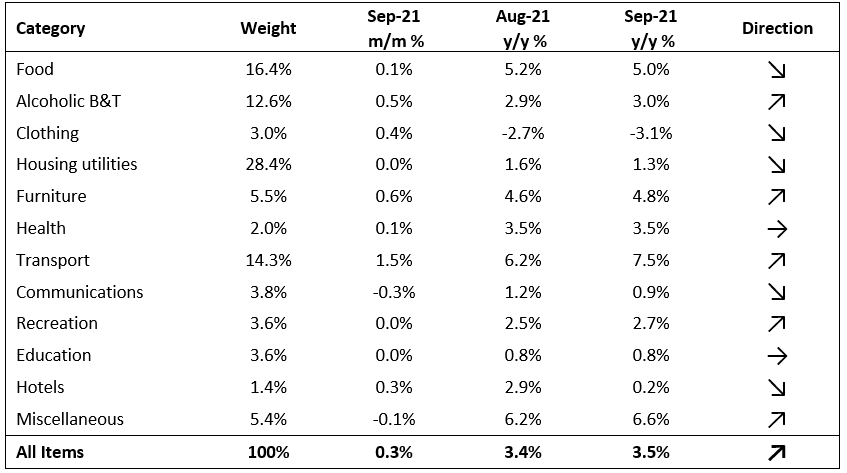

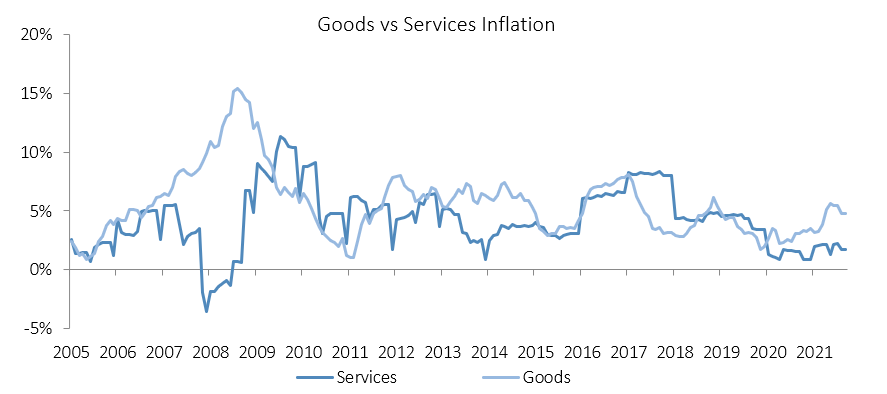

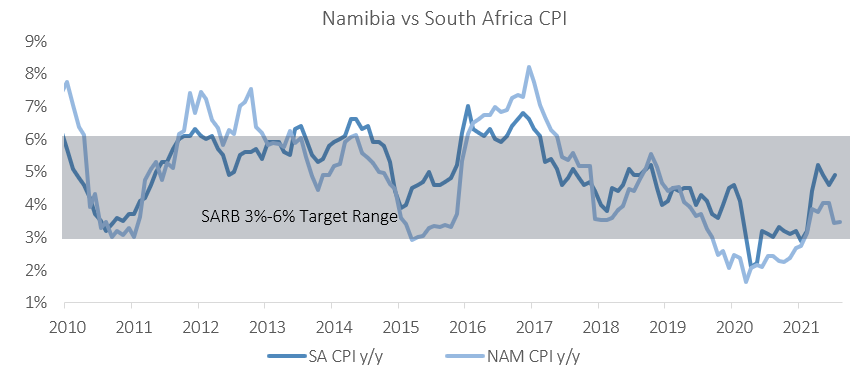

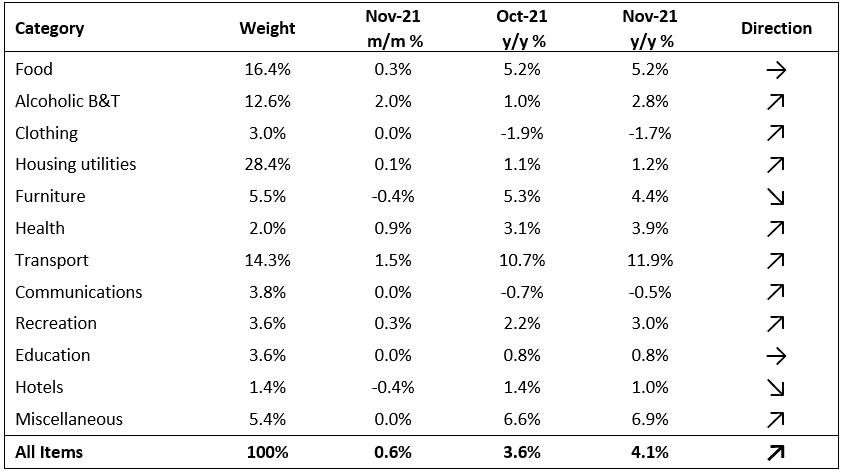

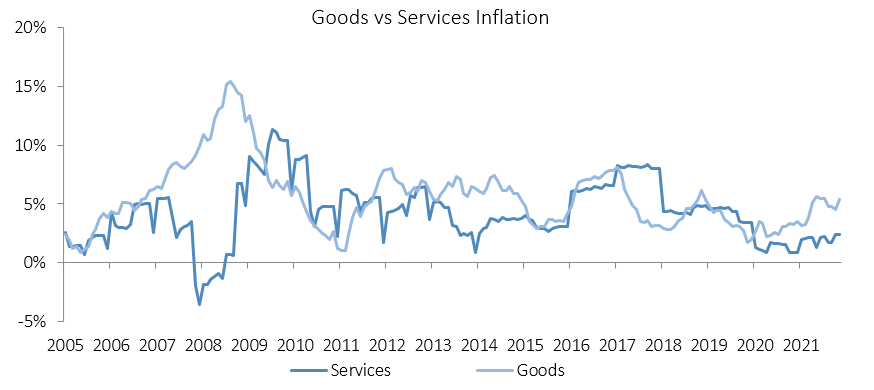

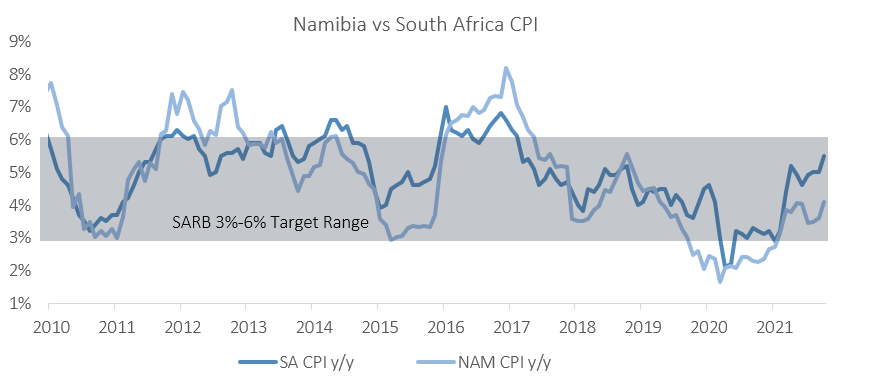

Namibia’s annual inflation rate rose to 4.1% y/y in November, with prices in the overall NCPI basket increasing by 0.6% m/m. Year-on-year, overall prices in eight of the twelve categories rose at a quicker rate in November than in October, two categories experienced slower rates of inflation and two categories posted steady inflation. Prices for services rose by 2.4% y/y and prices for goods rose by 5.4% y/y.

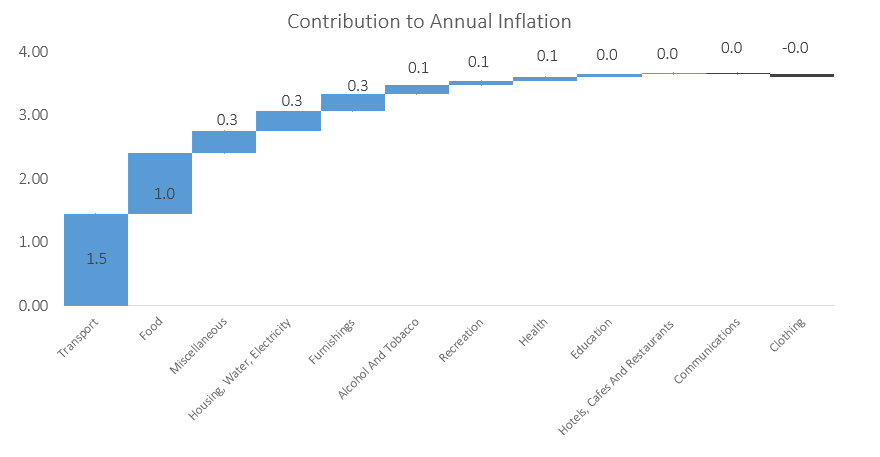

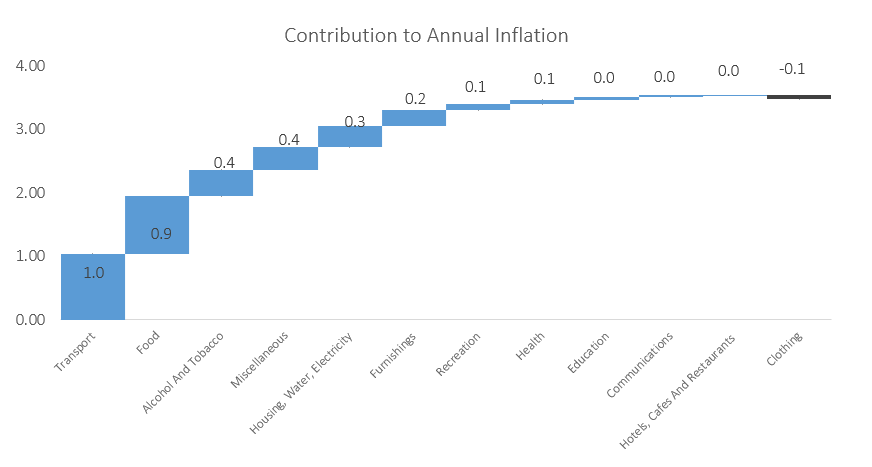

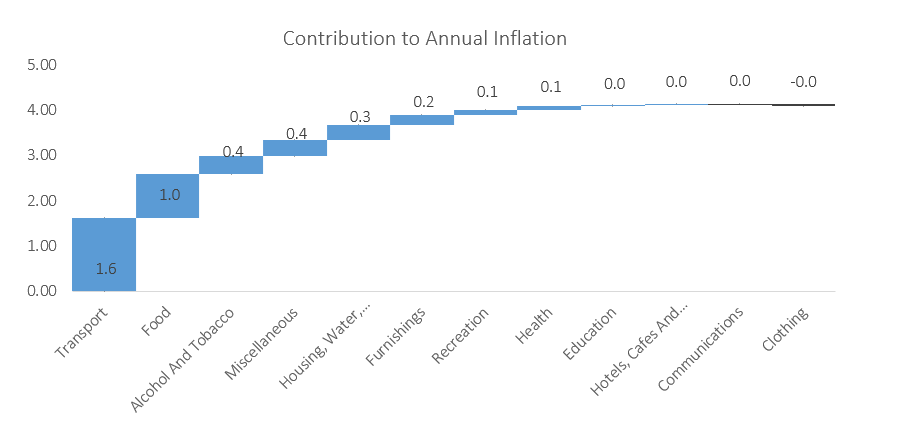

Transport was the largest contributor to annual inflation in November, with prices in this category increasing by 1.5% m/m and 11.9% y/y. This basket item contributed 1.6 percentage points to the annual inflation rate in November. Prices in all three sub-categories recorded price increases, with the sharpest increase coming in “operation of personal transport equipment”. This is due mostly to a 27.4% y/y increase in the price of petrol and diesel. This is the largest year-on-year price increase in fuel seen so far this year. As was the case last month, this increase is explained by both base effects and an ongoing shortage in global oil supply.

Predictably, food & non-alcoholic beverages was the second biggest contributor to the annual inflation rate in October, contributing 1.0 percentage points. Prices in this basket item increased by 0.3% m/m and 5.2% y/y. On a yearly basis all sub-categories, except for vegetables & tubers, registered price increases. Namibia’s continued reliance on South Africa for food imports means than whenever transport costs rise it is all but inevitable that the price of food will rise accordingly.

Inflation rates in the remainder of the categories were relatively subdued. Alcohol & Tobacco was the third largest contributor to November’s annual inflation rate, with prices increasing by 2.0% m/m and 2.8% y/y. The prices of alcoholic beverages, the more heavily weighted of the two sub-categories in this basket, increased by 2.3% y/y while the price of tobacco products, the other sub-category, increased by 5.2% y/y in November.

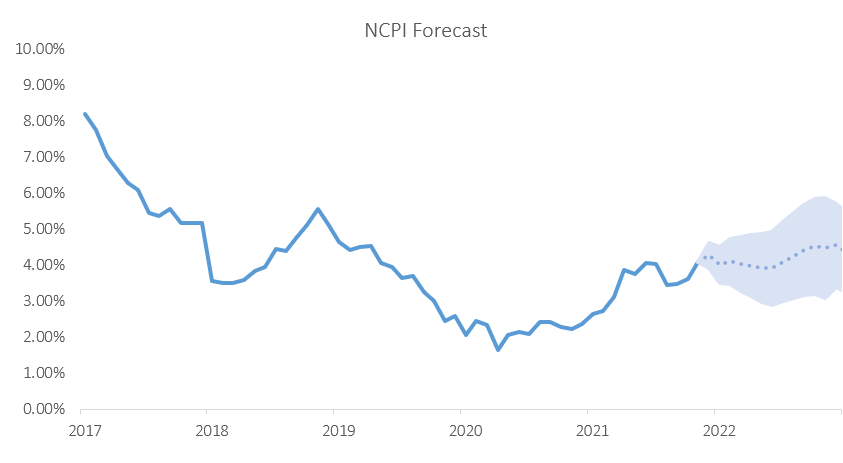

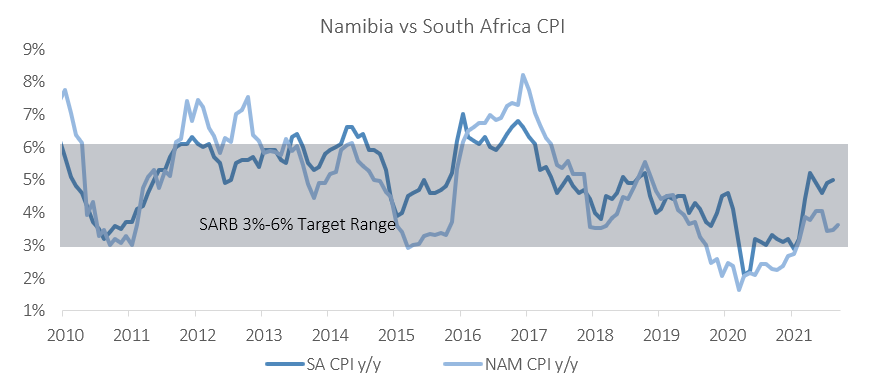

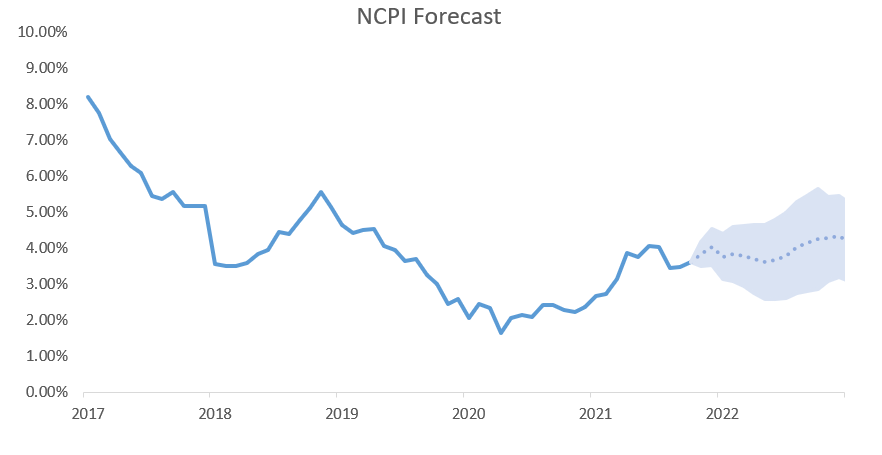

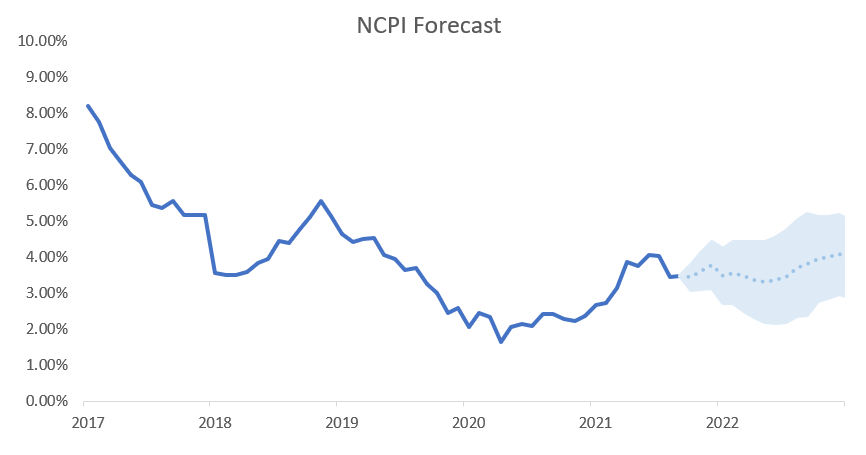

The 4.1% y/y annual inflation rate for November came in above IJG’s average inflation forecast for the month. IJG’s last estimate was that inflation would rise to 3.8% y/y in November. A hawkish shift in the Fed’s tone has led to debate as to whether the US central bank will taper asset purchases at a faster rate than it had previously indicated. This, as well as a 25bps SARB rate hike in late November, lends credence to the argument that inflation risks both globally, and in southern Africa, remain to the upside. In our previous report our inflation model forecast average annual inflation for 2022 at 3.9% y/y. A spike in Namibia’s CPI and a deterioration in the rand has pushed that estimate up to 4.2% y/y. The estimated upper bound for average annual inflation in Namibia for 2022 is now 5.2% y/y.