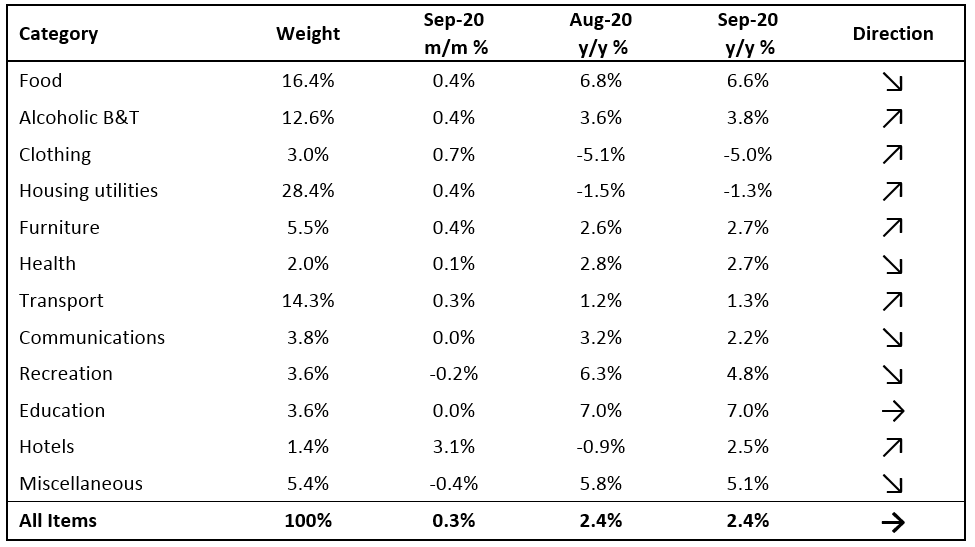

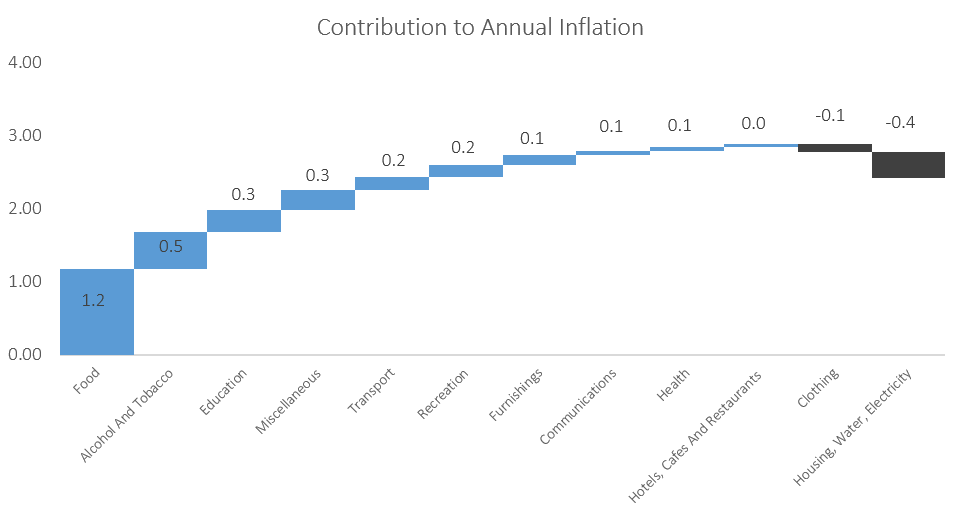

The Namibian annual inflation rate remained at 2.4% y/y in September, with prices in the overall NCPI basket increasing by 0.3% m/m. On a year-on-year basis, overall prices in six of the twelve basket categories rose at a quicker rate in September than in August, with five categories recording slower rates of inflation and one category recording an increase consistent with the prior month. Prices for goods increased by 3.1% y/y while prices for services rose 1.5% y/y.

The food & non-alcoholic beverages category remained the largest contributor to annual inflation in September, accounting for 1.2 percentage points of the total 2.4% annual inflation rate. The category recorded price increases of 1.2% m/m and 6.6% y/y. Prices in all thirteen sub-categories recorded increases on a year-on-year basis with the largest increases being observed in the prices of fruits which increased by 17.9% y/y and vegetables which increased by 12.2% y/y. Price increases in meat products and fish also remained elevated at 9.4% y/y and 9.0% y/y respectively.

Alcoholic beverages and tobacco prices, making up approximately 12.6 of the overall inflation basket, was the second largest contributor to the annual inflation rate in September, with prices of the basket item increasing by 3.8% y/y. On a month-on-month basis prices of the basket item rose by 0.4% m/m. Prices for alcoholic beverages rose by 0.2% m/m and 3.4% y/y, while tobacco prices increased by 1.2% m/m and 5.6% y/y.

Transport, one of the largest inflation basket categories, continues to experience relatively low inflation at 1.3% y/y. This is largely as a result of low oil prices, which remain down in Rand terms when compared to a year ago. A notable exception however is the 13.4% y/y inflation on public transportation services as a result in the increase in bus and taxi fares due to campaigning by the Namibia Transport and Taxi Union (NTTU) in light of government’s restriction on the number of passengers allowed per vehicle. This highlights just one of the ways in which lockdown measures have increased costs on the public, and often specifically on the more vulnerable members of society.

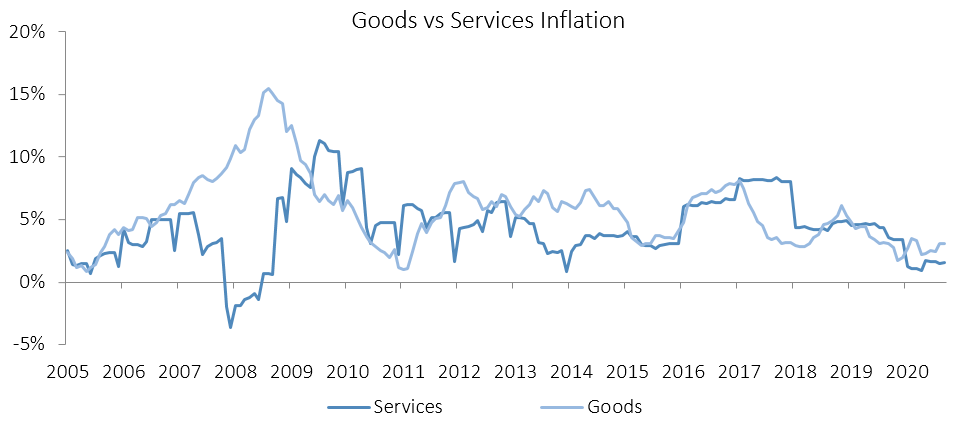

Global growth remains under pressure and monetary policy remains very accommodative, pointing to low global inflation expectations. Monetary easing by developed markets has reached previously unknown levels and to a large extent enabled developing markets and emerging economies to follow suit, albeit to a lesser extent. The BoN noted in its August Monetary Policy Statement that most developing markets and emerging economies have cut interest rates at their most recent monetary policy meetings, with the notable exception of China which kept rates steady. The inflation environment is expected to remain benign in most markets which should underpin a global economic recovery.

Inflationary pressure in Namibia remains weak and continues to trend below South African inflation. IJG’s inflation model forecasts an average inflation rate of 2.3% y/y in 2020 and 3.7% y/y in 2021. While risks remain to the upside we see these as muted in the short term in what is currently a very accommodative global monetary environment. Oil prices and a further escalation of the US-China trade war remain the largest risks in the short-term, while domestic and South African fiscal deterioration pose medium-term risks as debt levels increase unchecked, eating into the already limited productive portion of expenditure.