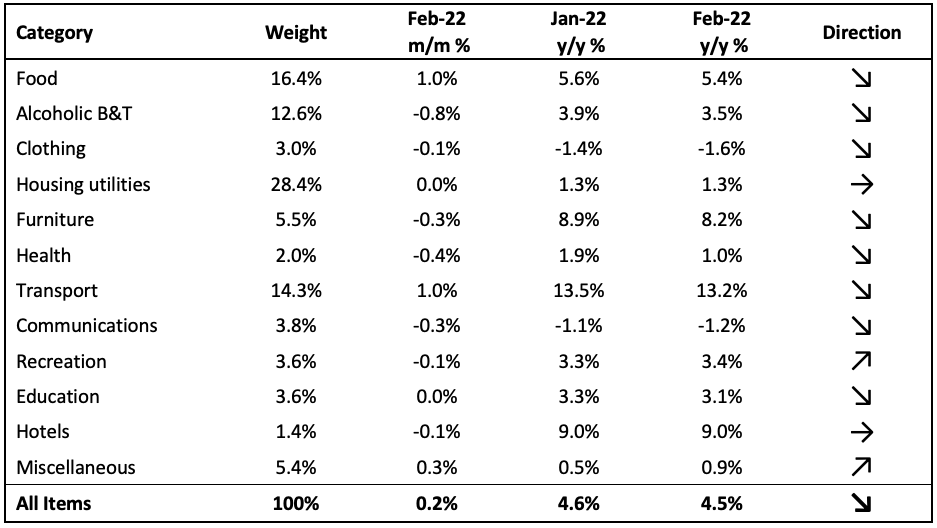

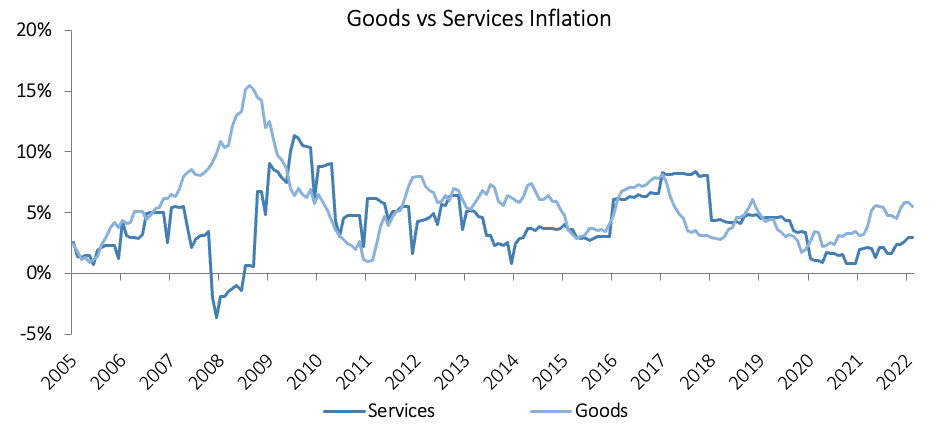

Namibian’s annual inflation rate slowed marginally to 4.5% y/y in February, following the 4.6% y/y increase in prices recorded in January. Prices in the overall NCPI basket increased by 0.2% m/m. On a year-on-year basis, overall prices in two of the twelve basket categories rose at a quicker rate in February than in January, eight recorded slower rates of inflation and two remained steady. Prices for goods increased by 5.5% y/y and prices for services increased by 3.0% y/y.

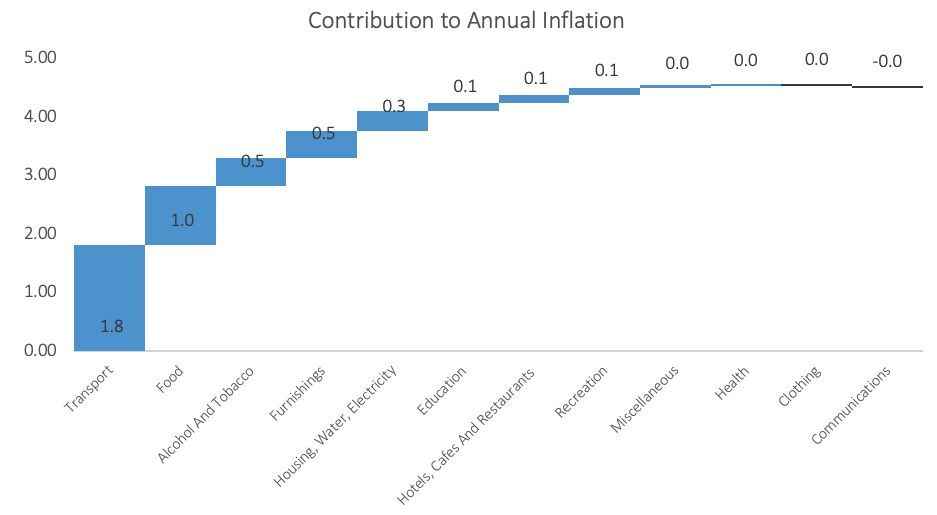

Transport was the largest contributor to the annual inflation rate in February, with prices in this category increasing by 1.0% m/m and 13.2% y/y. This basket item contributed 1.8 percentage points to the annual inflation rate in February. Prices in all three sub-categories recorded price increases on a year-on-year basis. The operation of personal transport equipment recorded the largest increase in prices of 1.7% m/m and 18.5% y/y. This was largely due to fuel prices being up 33.3% y/y in February. The purchase of vehicles sub-category recorded slower inflation at 3.7% y/y while the prices of public transportation services rose by 9.6% y/y.

Food & non-alcoholic beverages, the second largest basket item by weighting, contributed 1.0 percentage point to the annual inflation rate in February. Prices in this basket item rose by 1.0% m/m and 5.4% y/y. All thirteen sub-categories recorded price increases on an annual basis. The biggest increases were recorded in the prices of oils and fats which rose by 13.5% y/y, followed by the prices of fruits, which increased by 12.6% y/y, and meat which increased by 7.2% y/y.

Alcohol and tobacco inflation slowed to 3.5% y/y in February from the 3.9% y/y increase recorded in January. On a monthly basis, prices in the basket item decreased by 0.8%. The alcoholic beverages sub-category recorded a price decrease of 0.6% m/m and up 3.4% y/y. Tobacco prices were down 2.0% m/m but rose 3.8% y/y.

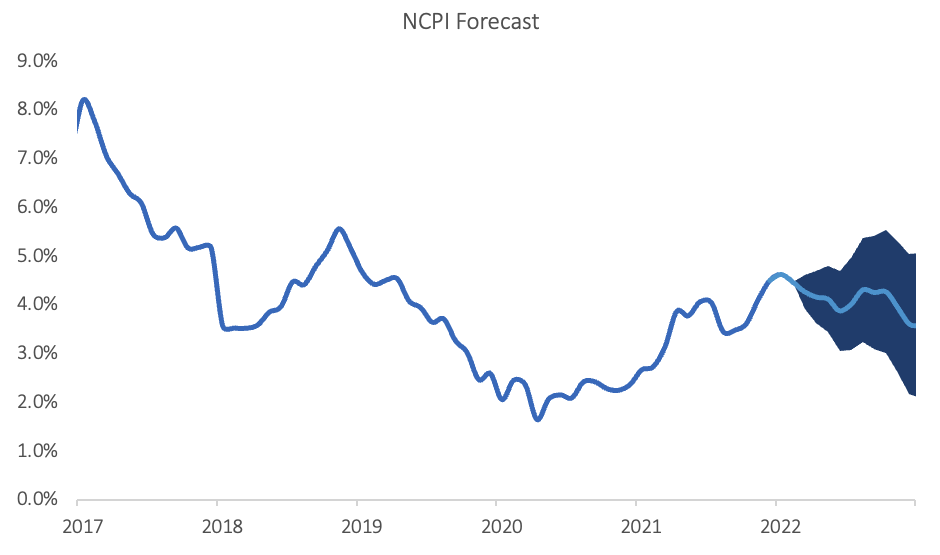

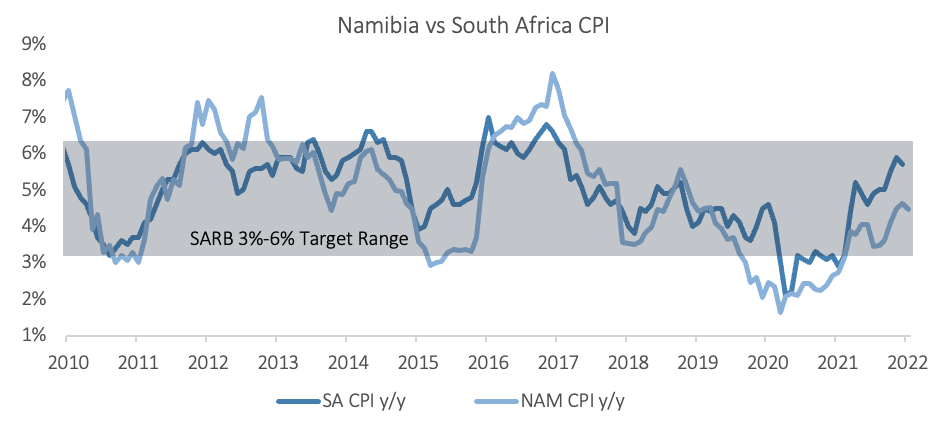

February’s inflation print of 4.5% is the first month of (marginally) slower price increases following five consecutive months of rising inflation. Transport and food costs continue to be the main drivers of Namibian inflation, with the two categories contributing 62% to February’s annual rate.. IJG’s inflation model currently forecasts inflation to average between 3.4% and 5.0% in 2022, although the upper end of the range seems more likely at this stage as risks remain tilted to the upside.