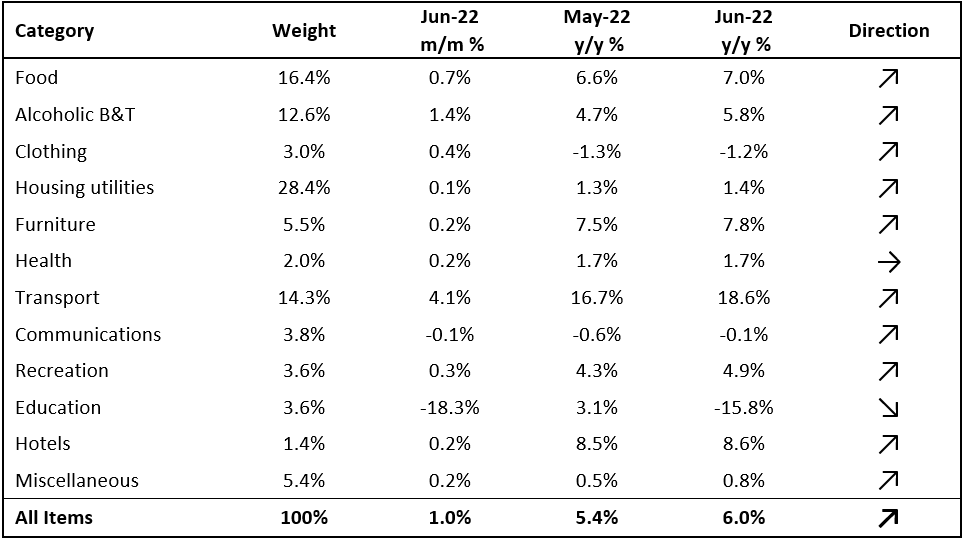

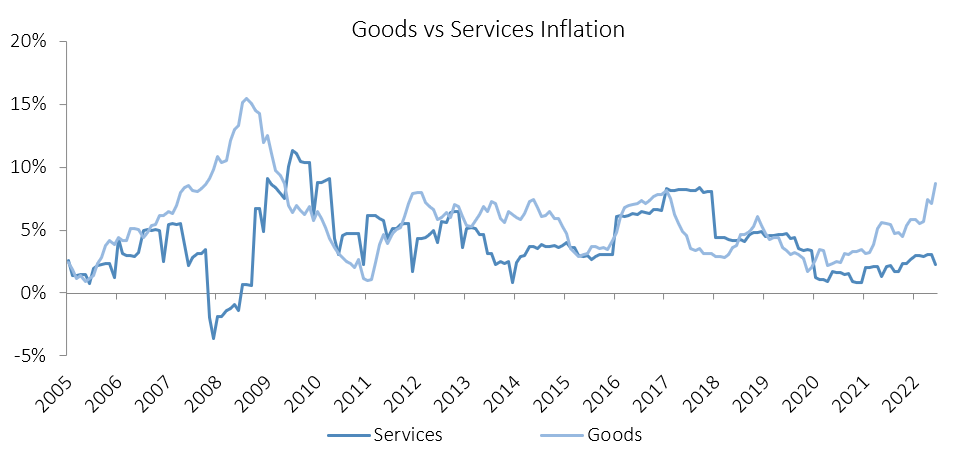

Namibia’s annual inflation rate ticked up to 7.3% y/y in August, following the 6.8% y/y increase in prices recorded in July. August’s annual CPI rate was the quickest increase since February 2017. On a month-on-month basis, prices in the overall NCPI basket rose 0.3% m/m. On an annual basis, overall prices in six of the twelve basket categories rose at a quicker rate in August than in July, three categories recorded slower rates of inflation and three categories recorded prices consistent with the prior month. Prices of goods increased by 10.2% y/y, while prices for services increased by 3.3% y/y in August.

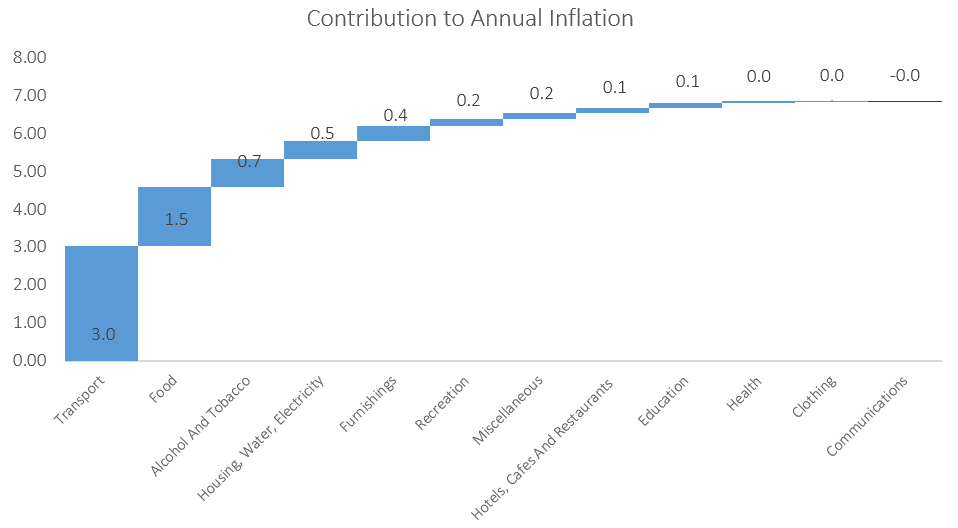

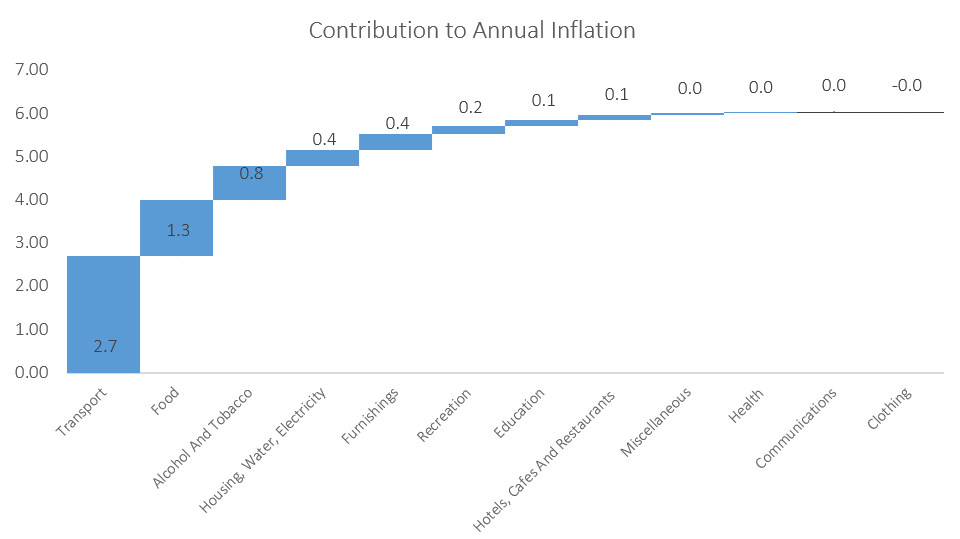

Transport continues to be the largest contributor to the annual inflation rate, accounting for 3.3 percentage points of the total 7.3% y/y inflation rate in August. Prices in the transport category rose 0.2% m/m and 23.2% y/y, the quickest year-on-year increase in our database stretching back to 2003. The three subcategories in the transport basket items all recorded increases on a month-on-month and year-on-year basis. The operation of personal transport equipment subcategory, which recorded price increases of 0.2% m/m and 35.4% y/y, continues to fuel most of the inflation in this basket item, with global oil prices remaining elevated. The Ministry of Mines and Energy’s announcement at the beginning of September to cut petrol prices by 120 cents per litre and diesel prices by 65 cents per litre should ease inflation of the transport category somewhat going forward, although fuel prices remain considerably higher than they were last year. The purchase of vehicles subcategory recorded inflation of 0.5% m/m and 5.5% y/y. Prices of public transportation services rose were steady month-on-month but rose 6.4% y/y.

Food & non-alcoholic beverages, the second largest basket item by weighting, was the second largest contributor to the annual inflation rate in August, contributing 1.6 percentage points. Prices in this basket item rose by 0.8% m/m and 8.8% y/y, the quickest year-on-year increase since February 2017. As has been the case in the past seven months, all thirteen sub-categories recorded price increases on an annual basis. The biggest increases were observed in the prices of oils and fats which rose by 26.1% y/y, followed by fruit which recorded prices increases of 20.0% y/y.

Alcohol & tobacco inflation slowed from 5.4% y/y in July to 5.2% y/y August. On a monthly basis, prices in the basket item decreased by 0.3% m/m. The prices of alcoholic beverages decreased by 0.2% m/m but rose by 5.4% y/y, while tobacco prices fell by 0.9% m/m but rose by 4.5% y/y.

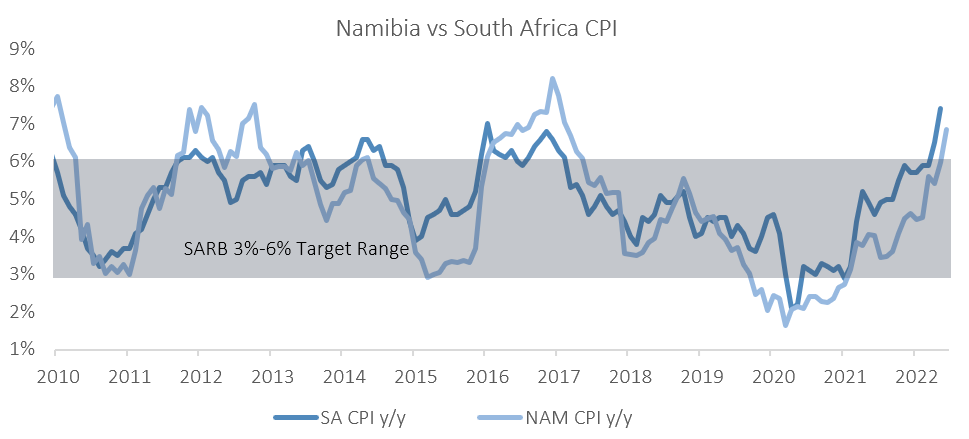

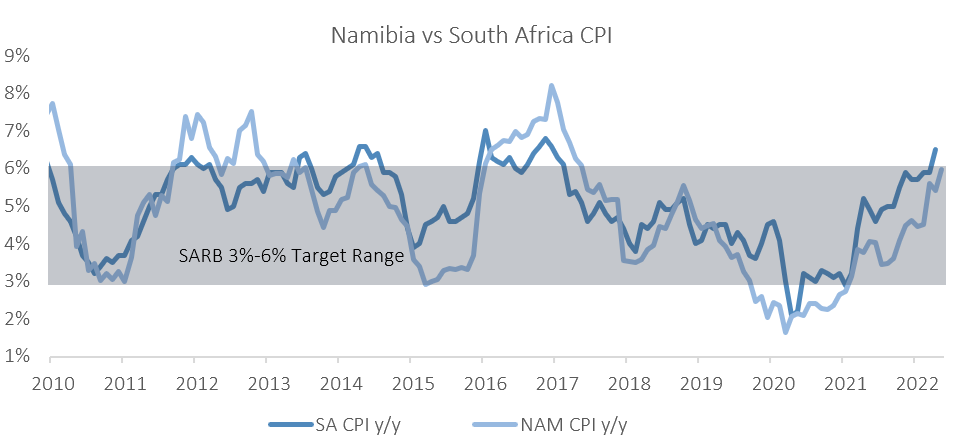

The annual inflation rate in Namibia continues to rise and as mentioned earlier, August’s rate was the quickest since February 2017. While the rate is high, it is by no means extraordinary for Namibia, as it has reached (and breached) the 7.0% level a couple of times over the past two decades. Unsurprisingly, transport and food prices remain the main drivers of the Namibian inflation rate, contributing 68% to the country’s annual rate in August. The fuel price cuts announced at the beginning of the month should ease inflation pressure somewhat, but risks remain to the upside. South Africa’s inflation rate of 7.8% y/y in July continues to trend above the SARB’s 3-6% target band and expectation are that its MPC will hike rates by between 50-75bps in September. The BoN will respond in kind to any decision taken by the SARB. IJG’s inflation model currently forecasts the annual inflation rate to remain elevated for the remainder of 2022, and for it to end the year at around 7.1%.