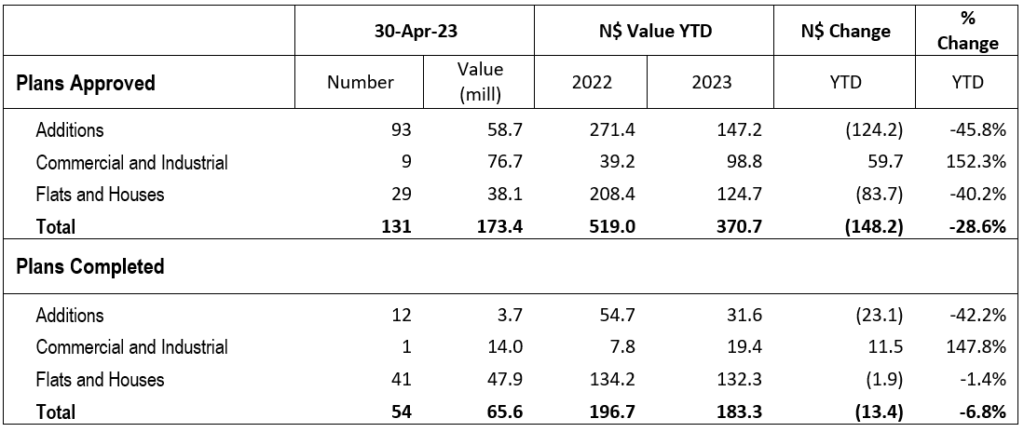

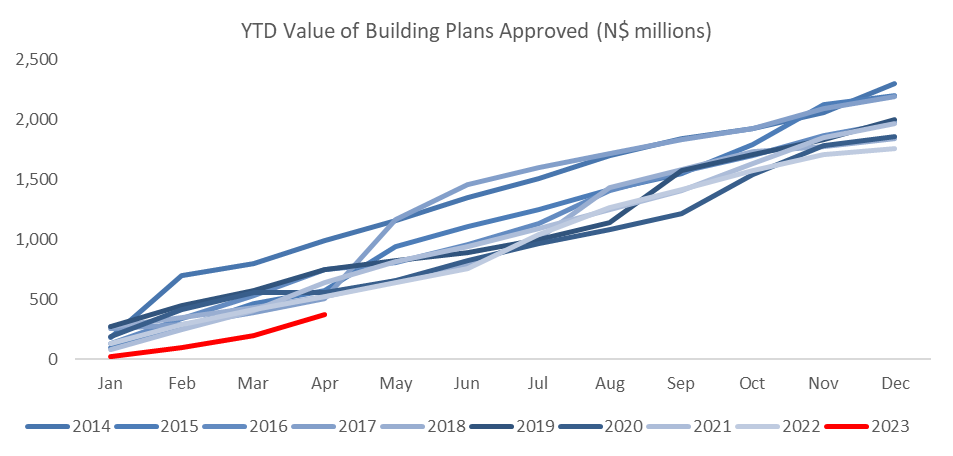

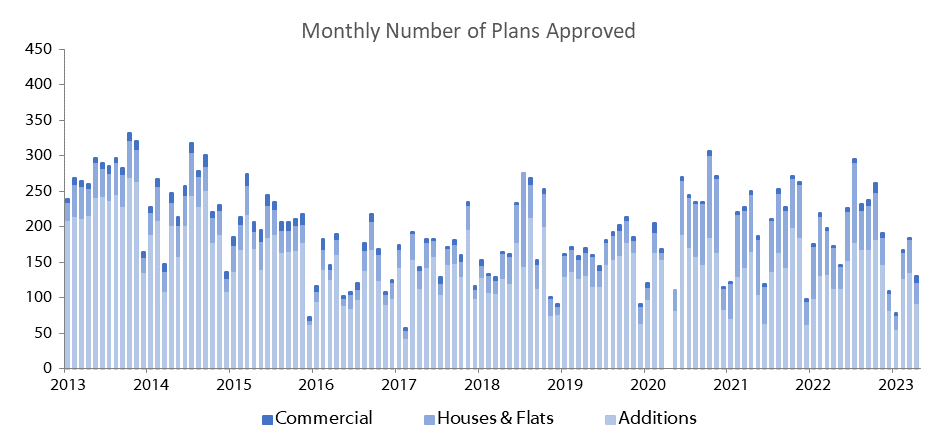

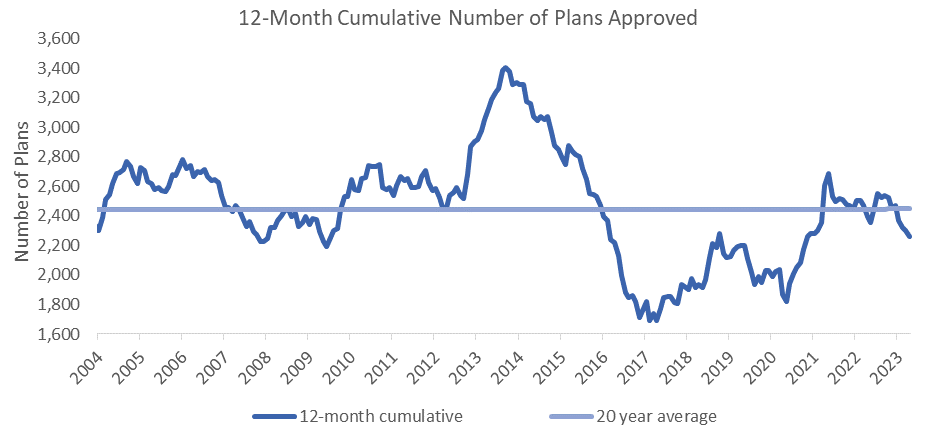

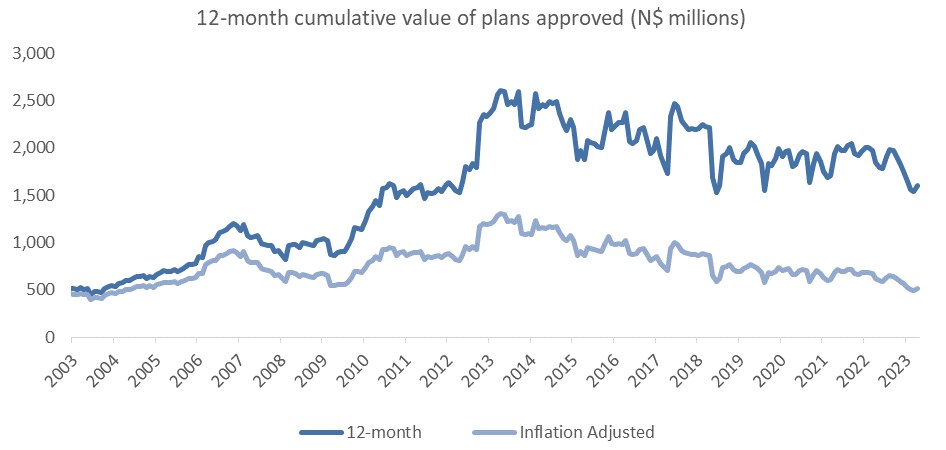

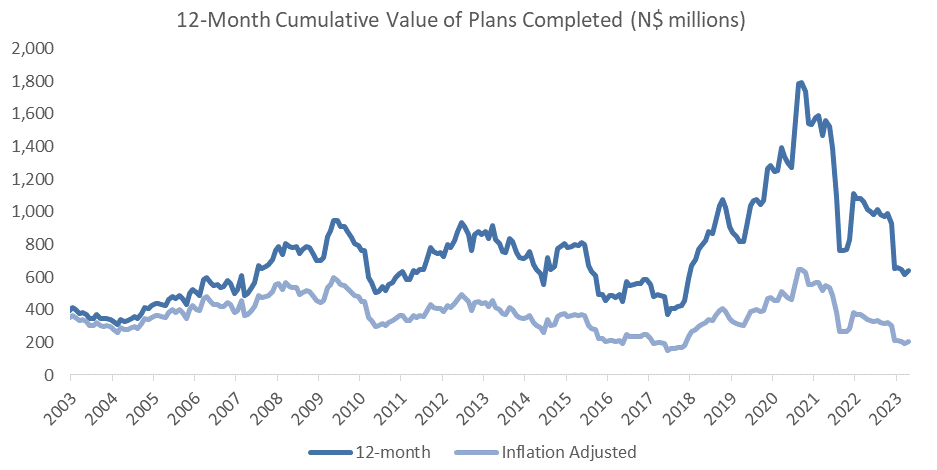

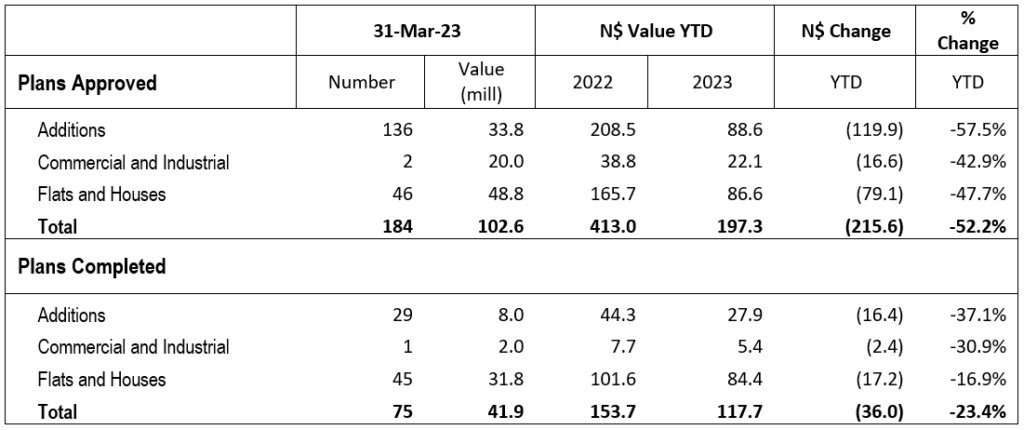

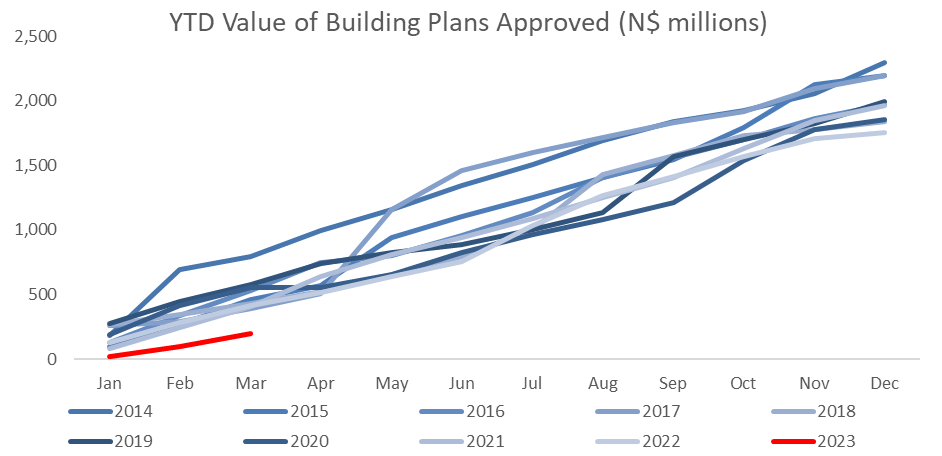

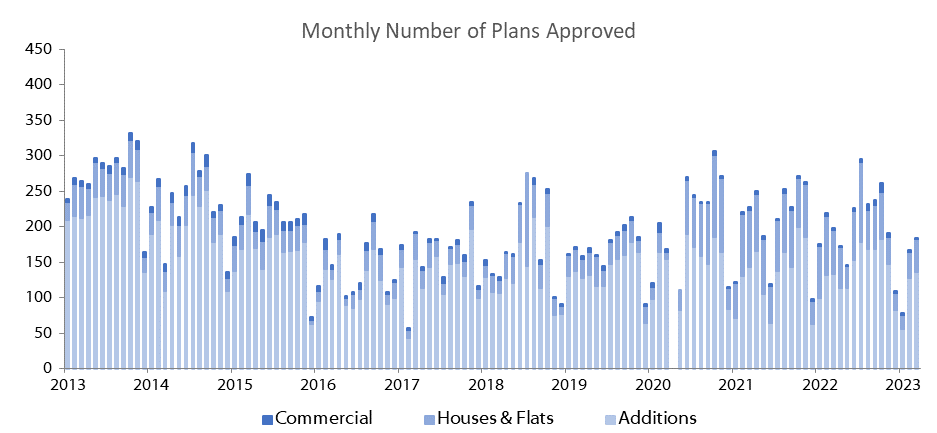

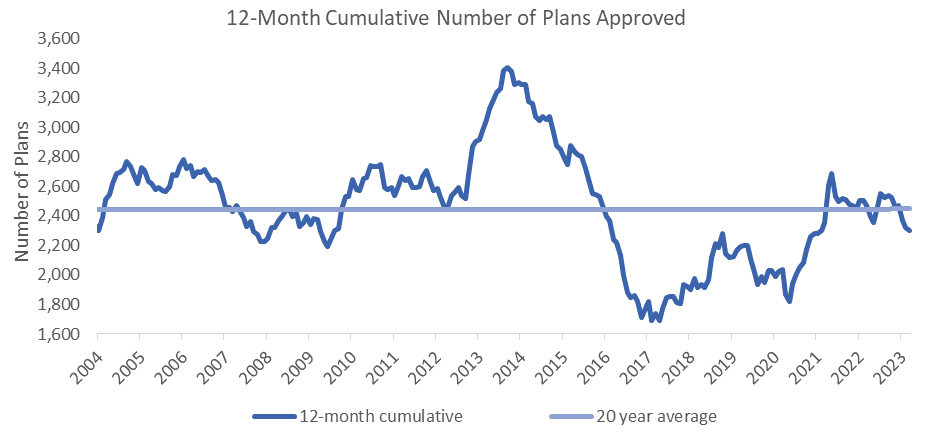

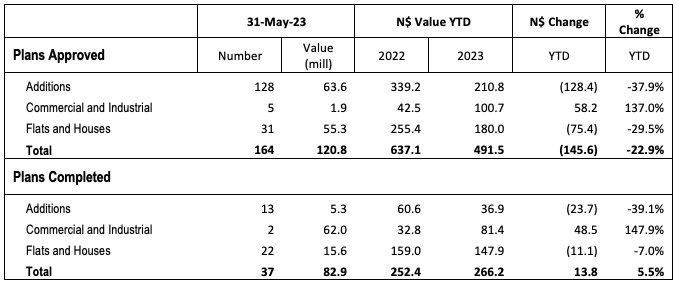

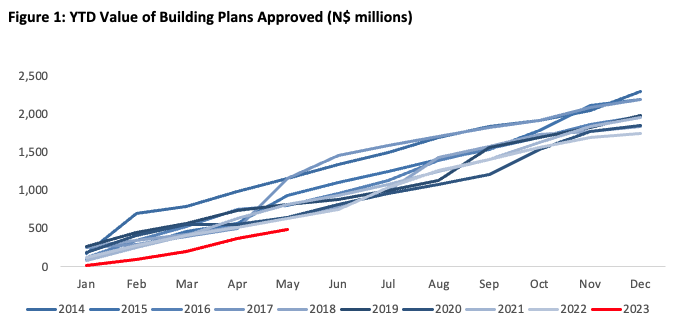

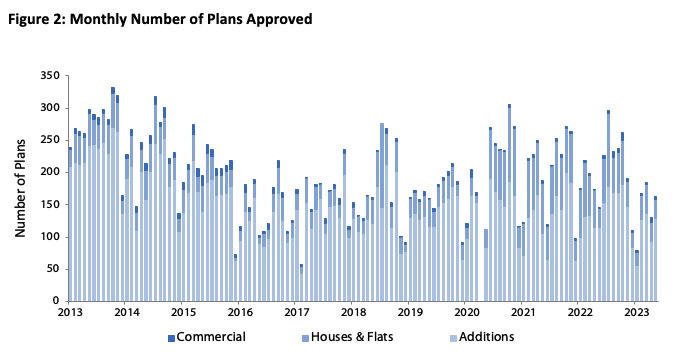

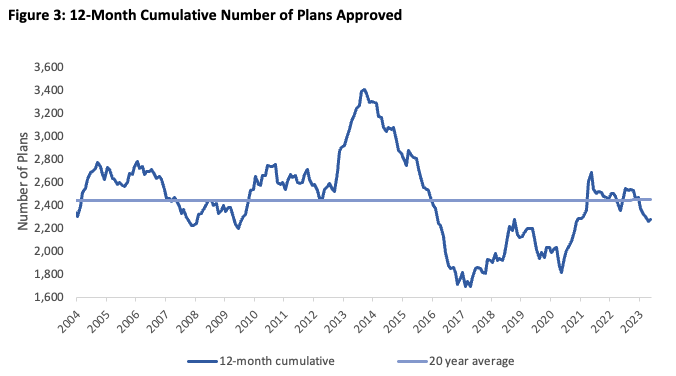

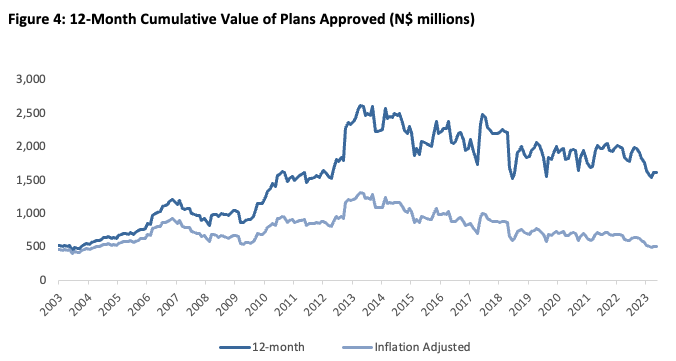

A total of 164 building plans was approved by the City of Windhoek in May, representing a 25.2% m/m increase from the 131 building plans approved in April. The approvals were valued at N$121.0 million, a 30.4% m/m drop from the N$173.4 million approved in April. Year-to-date, 725 building plans worth N$491.5 million have been approved, down 20.5% in number terms and 22.9% y/y less in value terms compared to the same period in 2022. On a twelve-month cumulative basis, 2,280 buildings worth N$1.61 billion were approved, a contraction of 3.2% y/y in number- and 10.0% y/y in value terms. 37 building plans worth N$82.9 million were completed during May.

May saw 128 additions to properties approved worth N$63.6 million. This figure represents the highest monthly value of approvals witnessed thus far in 2023. Year-to-date, 540 additions to properties worth N$210.8 million have been approved, representing an 8.8% drop in number terms and a 37.9% contraction in value terms compared to the corresponding period in 2022. On a 12-month cumulative basis, 1,623 additions worth N$758.3 million were approved over the past 12 months, compared to 1,550 additions worth N$783.2 million over the same period a year ago. 13additions worth N$5.32 million were completed during May, which falls below the average monthly additions completed so far this year.

A total of 31 new residential units valued at N$55.3 million were approved in May, exceeding the average monthly count of newly approved residential properties thus far this year. Moreover, May witnessed the highest residential approval value since November 2022. The 12-month cumulative new residential unit approval figure remained steady at 589, following 10 consecutive months of contraction. Year-to-date, 163 new residential units worth N$180.0 million have been approved, down 47.4% from the 308 units worth N$255.4 million approved over the same period a year ago. A total of 22 residential units valued at N$15.58 million were completed during May, marking the lowest residential completion figure observed year to date.

5 new commercial and industrial units worth N$1.92 million were approved in May. This brings 2023’s monthly average approvals to about 5 units worth N$20.2 million, up from N$13.6 million approved on average each month in 2022, but still well below the monthly average witnessed just prior to the pandemic, when N$45.9 million worth of units were approved on average each month in the 3 years leading up to the pandemic. 22 new commercial and industrial units valued at N$100.7 million have been approved year-to-date, an increase of 137.0% y/y in value terms. This increase is however mostly due to the relatively large N$76.7 million approval amount registered last month. On a rolling 12-month cumulative basis, 67 commercial and industrial units valued at N$221.1 million have been approved at the end of May, compared to 33 units worth N$162.8 million over the same period a year ago. 2 commercial and industrial units worth N$62.0 million were completed in May.

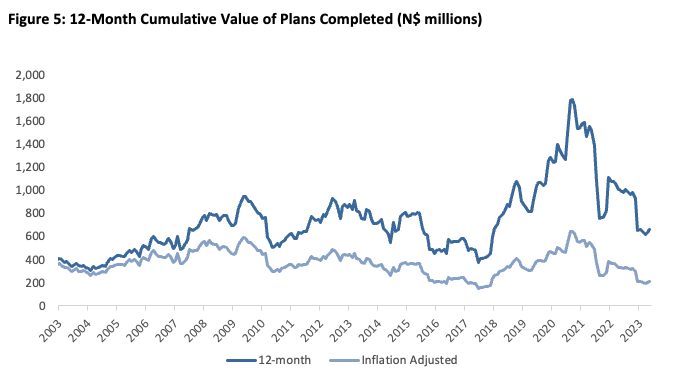

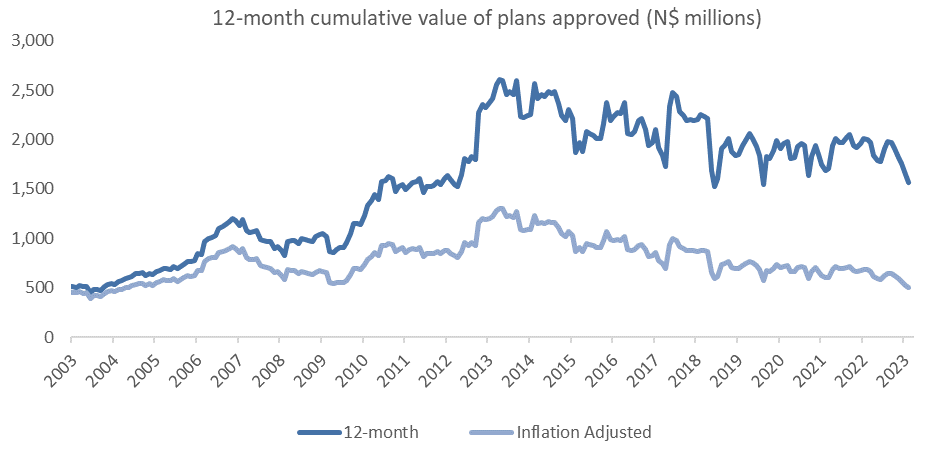

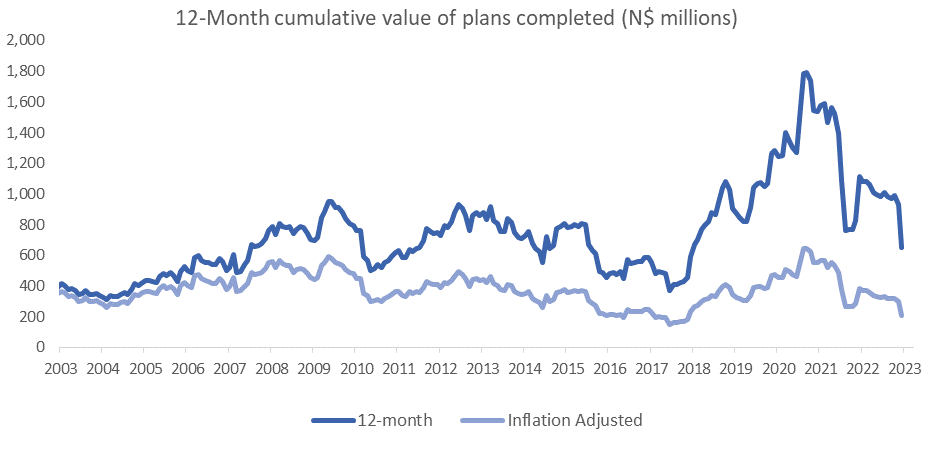

While May’s building plan approvals data was one of the better months so far this year, overall planned activity remains weak. 2023 is off to the slowest start in value terms since 2009, even before accounting for inflation.

According to the Q1 GDP data released by the Namibian Statistics Agency (NSA) in May, the construction sector recorded marginal quarter-on-quarter growth of 0.9% in real terms during the quarter of 2023. This growth comes after the sector had encountered six consecutive quarterly contractions. The NSA attributed the growth to a 13.2% increase in government construction spending during the quarter. The 12-month cumulative value of approvals has consistently been trending down in real terms for most part of the last decade, as the graph above shows.