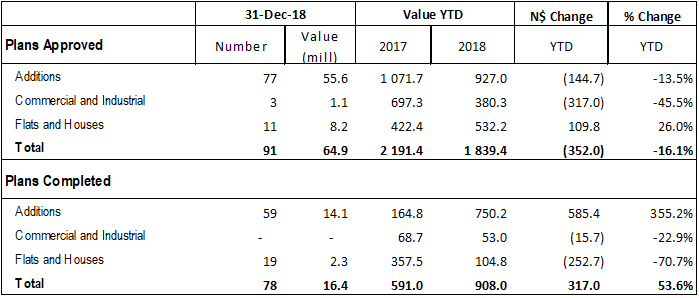

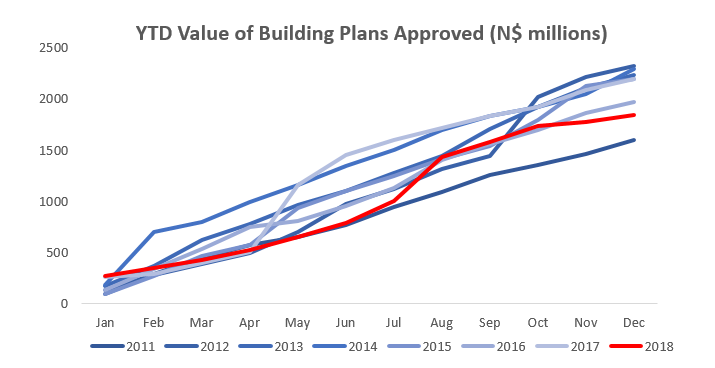

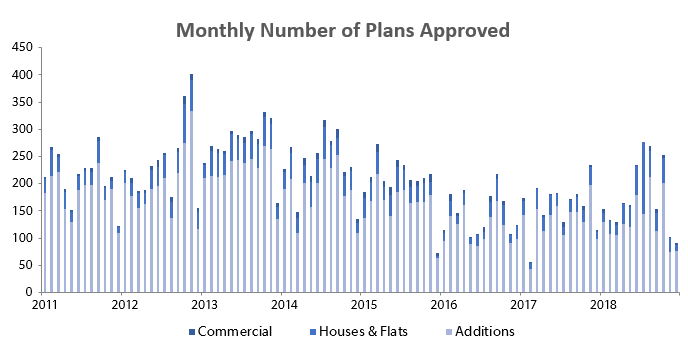

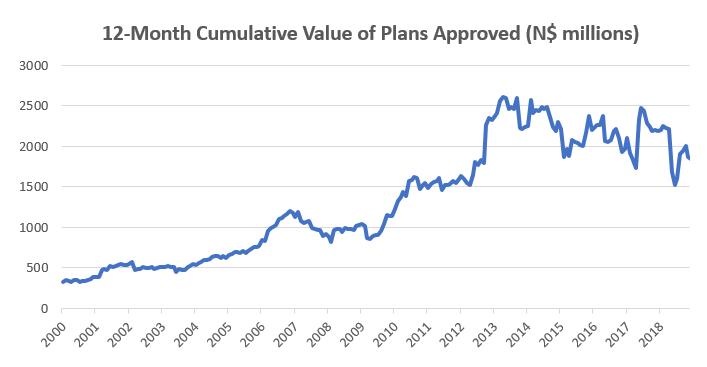

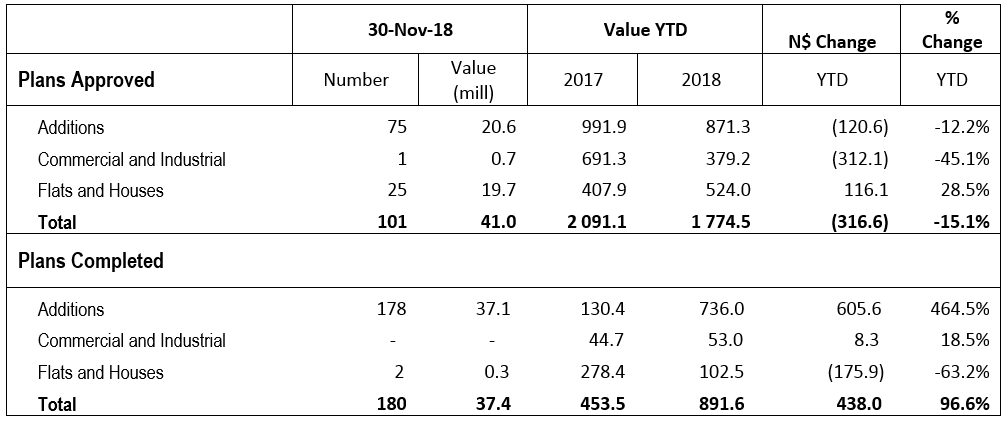

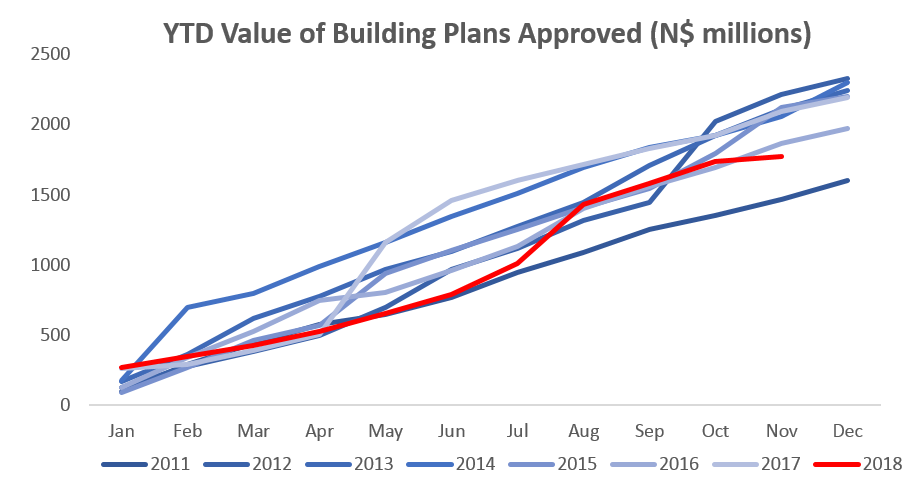

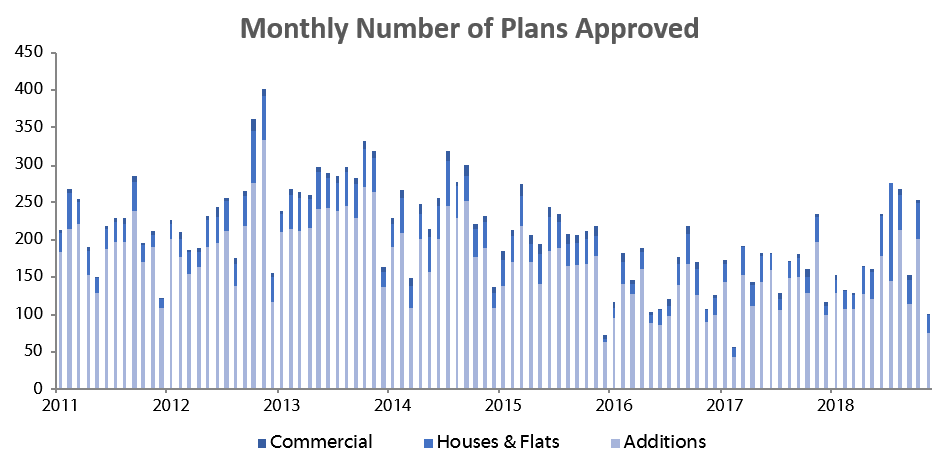

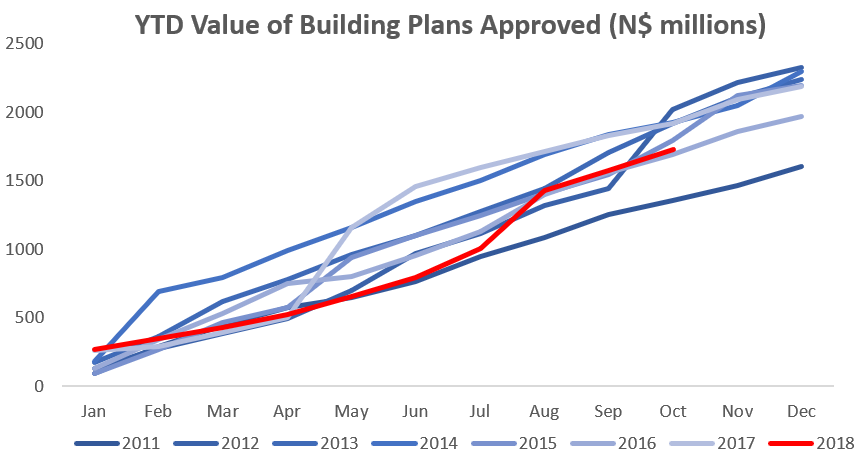

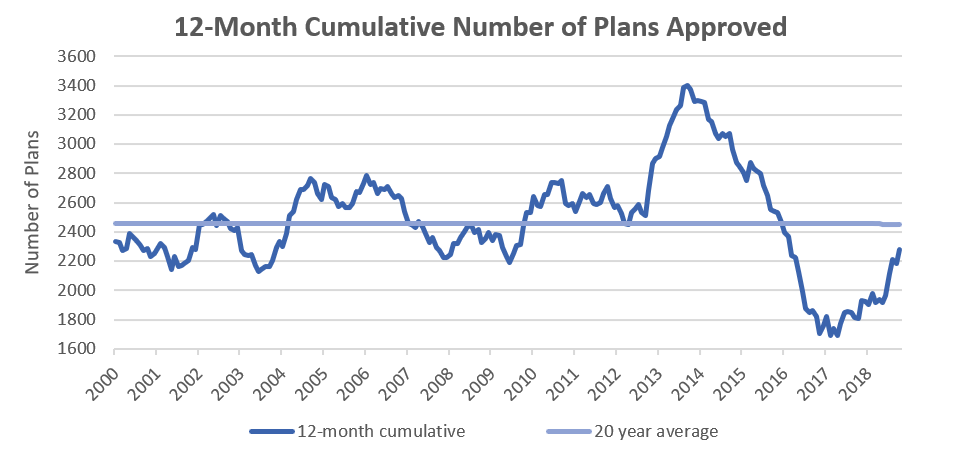

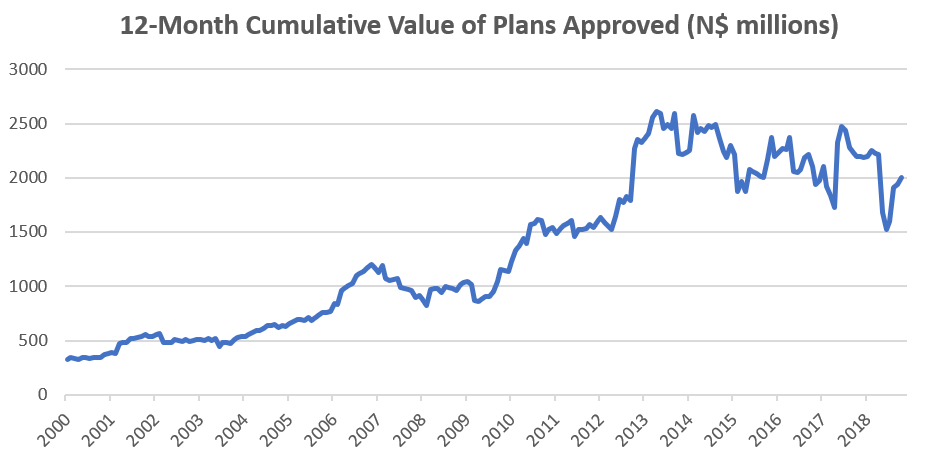

Building plans statistics for the remaining two months of 2018 were recently released by the City of Windhoek. A total of 91 building plans were approved in December, which is a 9.9% m/m decline from the 101 plans approved in November. In value terms, however, approvals increased by 58.3% m/m to register N$65 million worth of approvals in December compared to N$41 million in November. A total of 78 buildings with a total value of N$16.4 million were completed during December, representing declines of 57% m/m and 56% m/m in the number and value of completions, respectively. A total of 2,118 building plans were approved in 2018, 195 more than in 2017. However, in value terms approvals declined by 16.1% in 2018, falling to N$1.84 billion from N$2.19 billion in 2017.

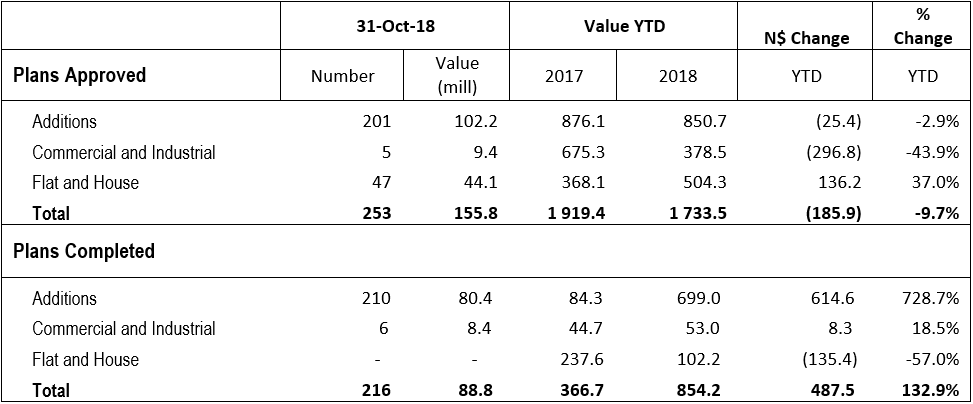

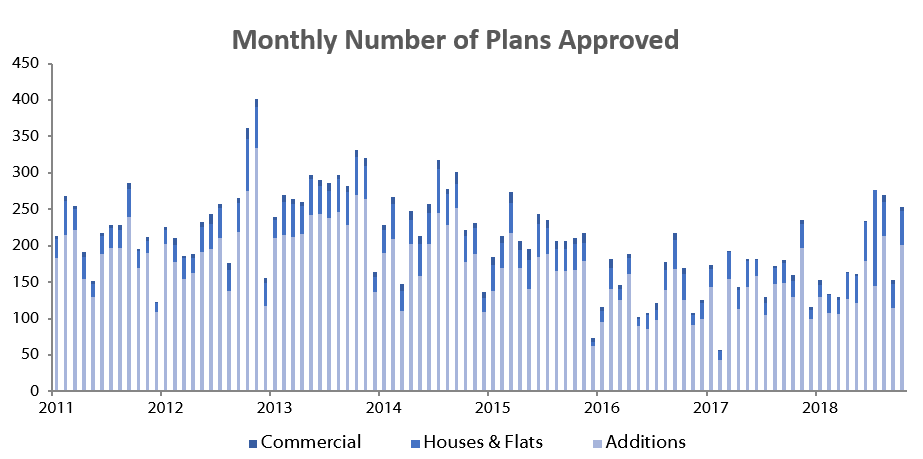

Additions to properties once again made up the majority of building plans approved in 2018. Of the 2,118 building plans approved in 2018, additions accounted for 1,595 of those approvals, 12 more than in 2017. In value terms however, approvals of additions for the year declined by N$145 million or 14.0% y/y. The value of additions approved has been contracting for the past three years, with the 2018 decline less pronounced than the 41.9% contraction in 2016 and the 36.7% contraction in 2017. 77 additions were approved in December, only 2 more than in November, although 170.4% higher in value terms at N$55.6m.

New residential units were the second largest contributor to the total number of building plans approved with 480 approvals registered in 2018, 190 more than in 2017. In value terms new residential units approved increased from N$422.4 million in 2017 to N$532.2 million in 2018. Residential approvals were the third largest contributor of the total building plans approved in 2017 but returned to second in 2018 due to a slowdown in commercial and industrial approvals. On a month to month basis, the number and value of new residential approvals declined by 15.4% and 44%, respectively.

The subdued level of business confidence is on display in terms of the commercial and industrial building plans approved in 2018. A total of 43 commercial and industrial units were approved in 2018 compared to the 50 approved in 2017. In value terms commercial and industrial approvals fell by N$317 million or 45.5% for the year in 2018 from the N$697.3 million in 2017. This highlights the lack of capital expenditure in the Windhoek area. On a month-on-month basis, a total of three commercial and industrial projects worth N$1.1 million were approved in December, which represents a 59% m/m increase from November.

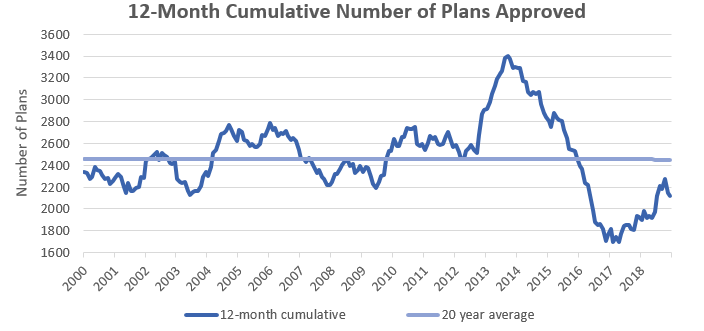

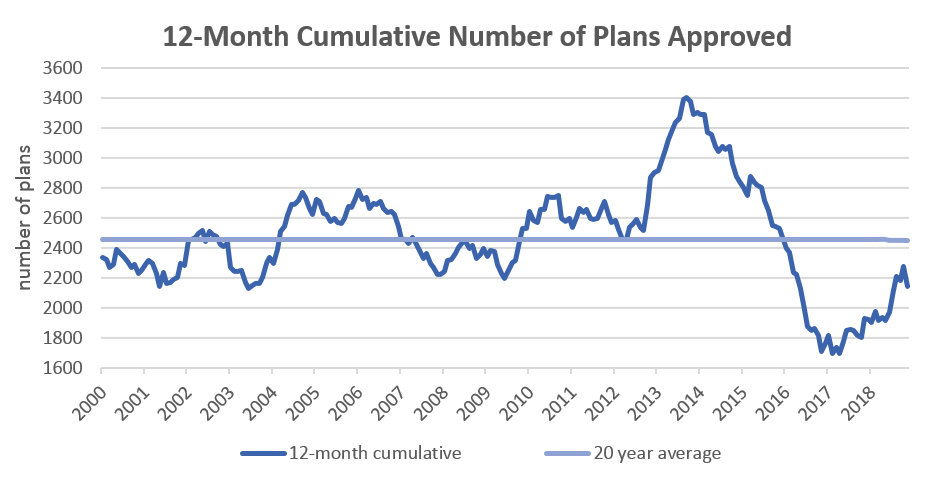

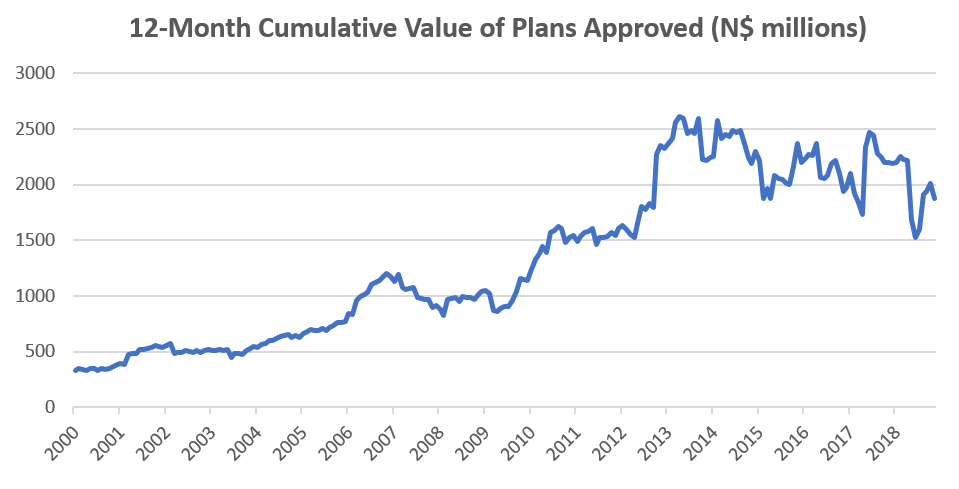

Although there has been a 10.1% increase in the number of building plans approved in 2018 compared to 2017, the cumulative number of plans is almost 40% down from its peak in 2013. The value of approvals has slowed to only N$1.84 billion worth of approvals in 2018 compared to the N$2.19 billion worth of plans approved a year ago. The biggest driver of approvals remains additions, which are enhancements and refurbishments to existing properties. The number of additions has increased by 0.8% y/y, but in terms of value, additions have declined 13.5% y/y. We’ve been concerned by the lack of commercial and industrial approvals in 2018, noting that these were signs of businesses not making capital investments. The largest commercial project approvals in 2018 were recorded in August and September of N$248 million and N$78 million, respectively. These two approvals alone make up 86% of the total commercial approvals registered in 2018.

Bank of Namibia in its December Economic Outlook Update noted that it expects the domestic economy to rebound in 2019 and register growth of 1.5% following two contractionary years. 3Q2018 GDP data released by the NSA shows that growth in the construction industry is still in negative territory, contracting 6.5% y/y as at 3Q2018. Year-to-date figures do however show a 13.5% improvement in construction when compared to the corresponding three quarters of 2017. The year-to-date improvement is owed largely to base effects, but the outlook for the sector is certainly focused more to the upside rather than the downside. Risks to the outlook of building plans also hinges on service delivery from the City of Windhoek, and reports that the municipality’s capital budget for the current financial year has been slashed by 88% are worrisome. The budget has been reduced to only N$83 million for 2018/19, which pales in comparison to the N$716 million approved the previous year. The City of Windhoek has stated that current plot servicing projects are undertaken through public-private partnerships and as such are not affected. However, future projects and new developments will be affected by the budget cut, and thus provides some pessimism for the 2019 outlook for building plans.