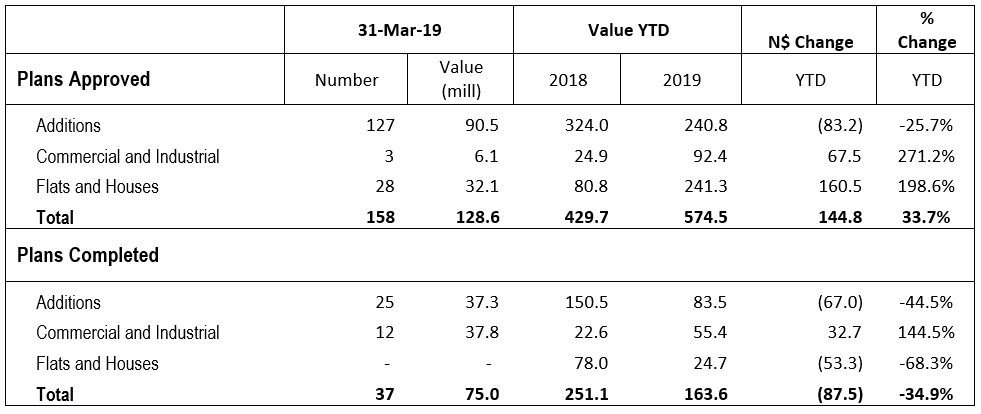

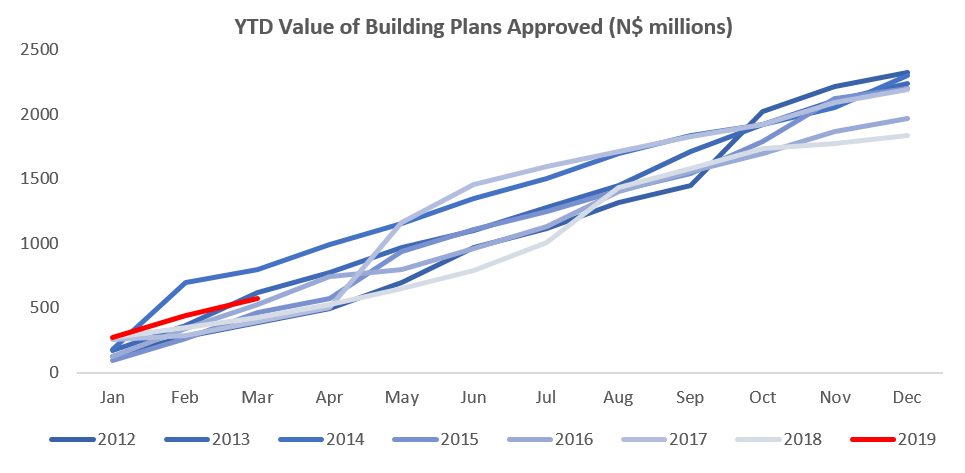

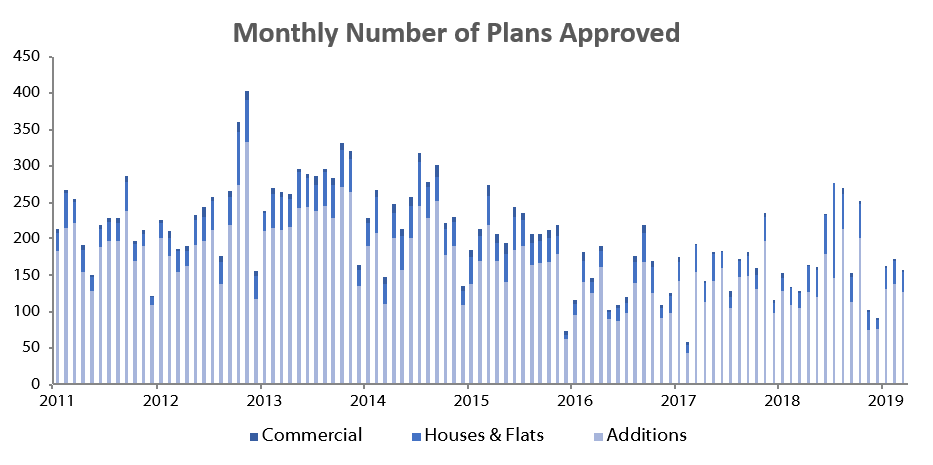

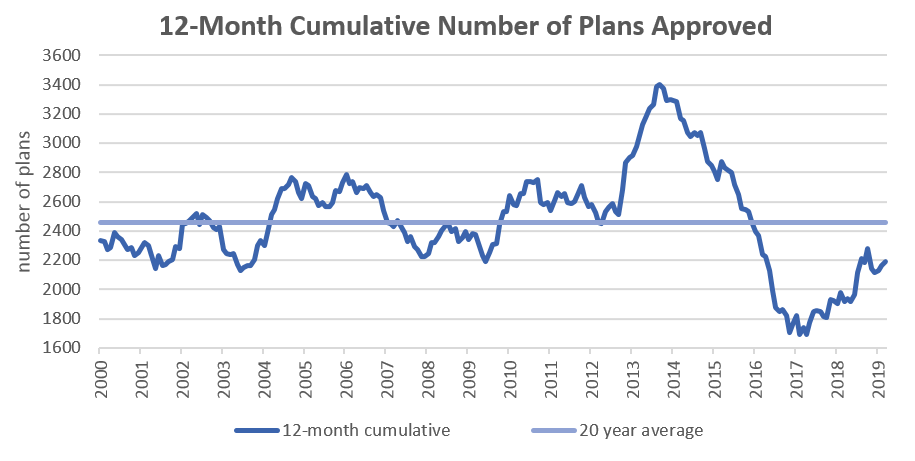

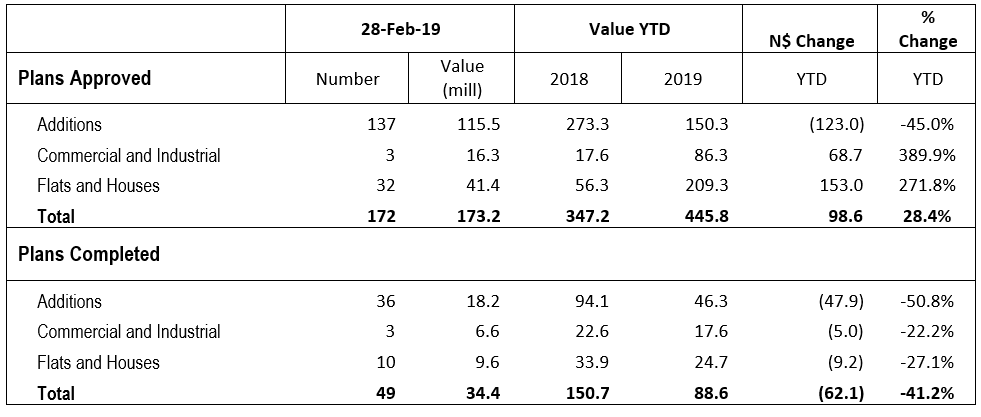

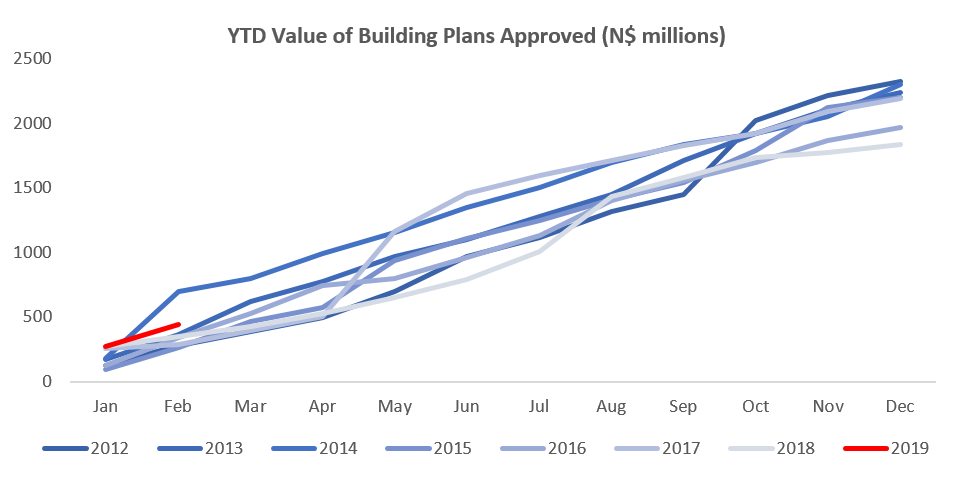

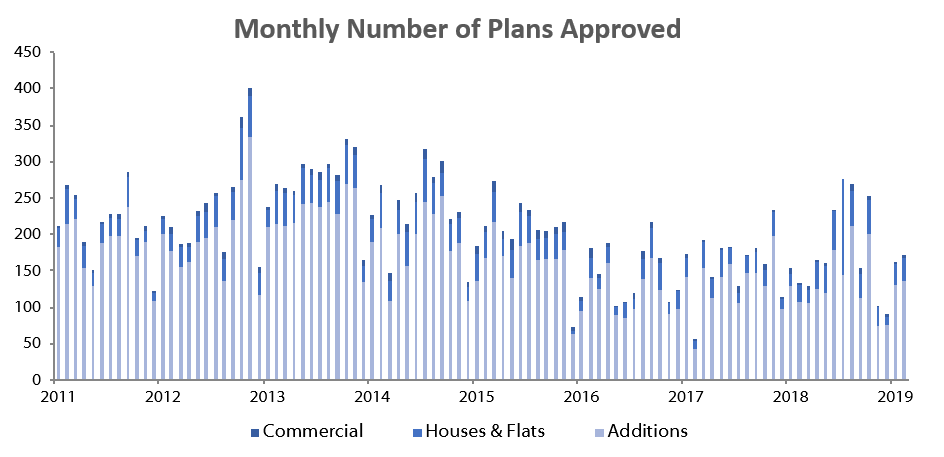

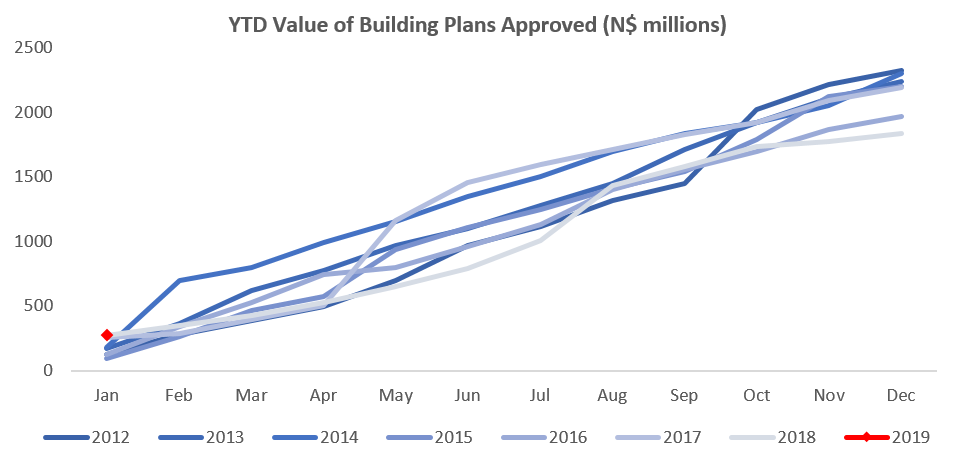

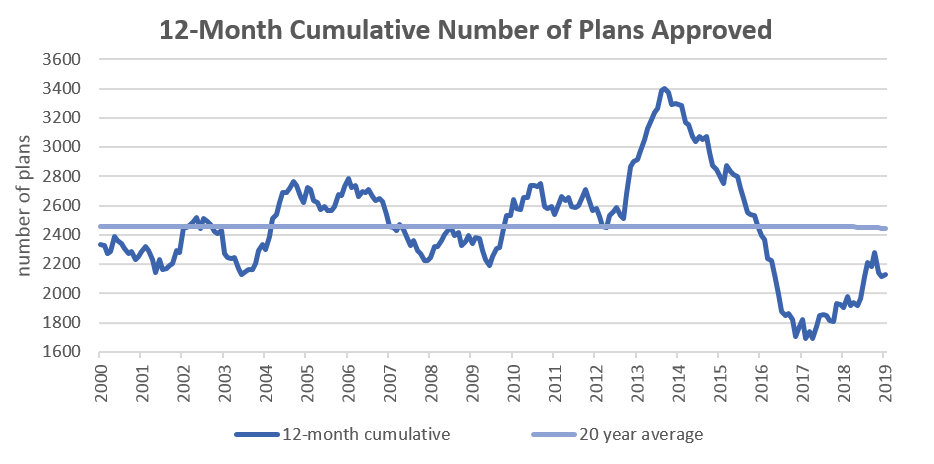

A total of 158 building plans were approved by the City of Windhoek in March, 14 fewer than the 172 approvals recorded in February. The value of approvals was N$44.5 million lower at N$128.6 million in March, a 25.7% m/m decrease. The number of completions for the month of March stood at 37, valued at N$75.0 million. The year-to-date value of approved building plans reached N$574.5 million, 33.7% higher than in the first quarter of 2018. On a twelve-month cumulative basis, 2,194 building plans have been approved as at the end of March, an increase of 14.5% y/y. The 12-month cumulative value of plans approved reached approximately N$1.98 billion, a decrease of 11.0% y/y.

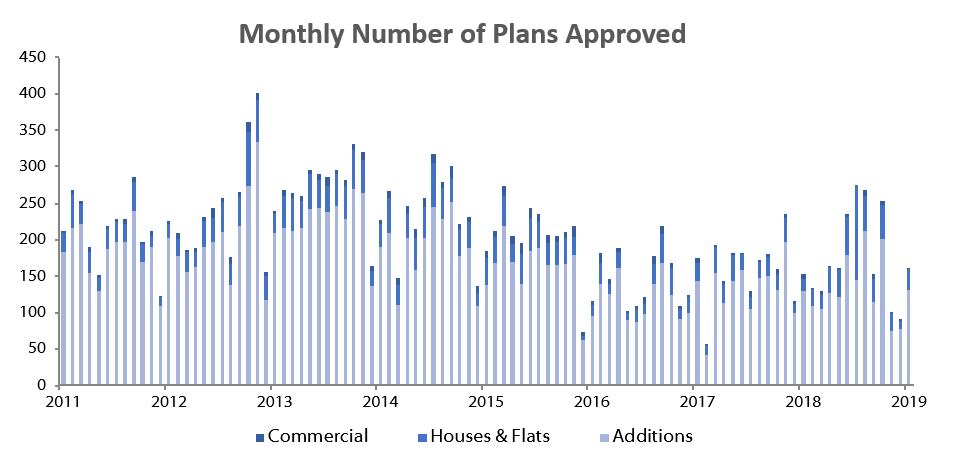

Additions to properties made up 127 of the 158 approved building plans recorded in March. This is a 7.3% m/m decrease in additions from the 137 additions recorded in February. Year-to-date 395 additions to properties have been approved with a value of N$240.8 million, a 25.7% y/y drop in terms of value.

New residential units were the second largest contributor to the number of building plans approved with 28 approvals registered in March, a 12.5% m/m decrease compared to the 32 residential units approved in February. In value terms, N$32.1 million worth of residential units were approved in March, 22.5% less than the N$41.4 million worth of residential approvals in February. 89 New residential units have been approved in the first quarter of 2019, 48% more than during the corresponding period in 2018. The year-to-date value of residential approvals reached N$241.3 million, 198.6% higher than during the first quarter of 2018.

Commercial and industrial building plans approved in March amounted to 3 units, worth N$6.1 million. This is the same number of units approved as in the prior month, but a decrease of 62.4% m/m and 15.9% y/y in value terms. Year-to-date, 8 plans for commercial and industrial purposes have been approved, valued at N$92.4 million. On a rolling 12-month perspective the number of commercial and industrial approvals have slowed to 38 units as at March, compared to the 54 approved over the corresponding period a year ago.

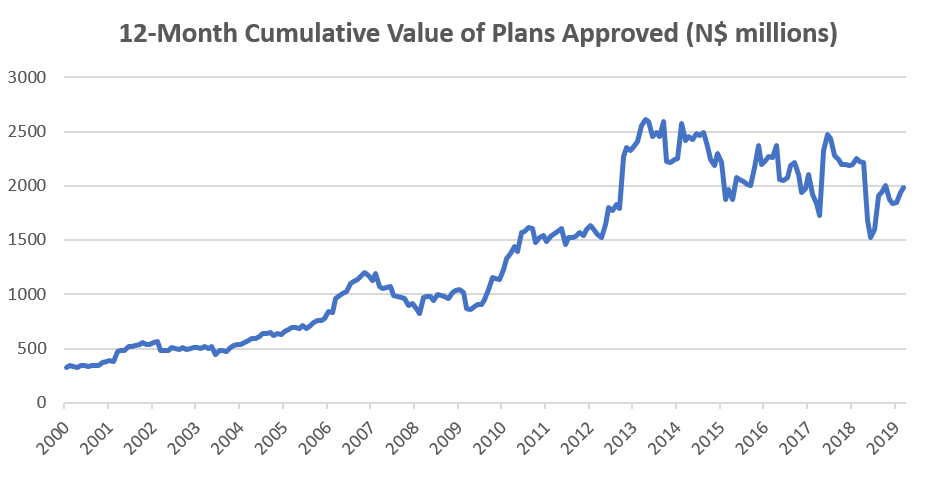

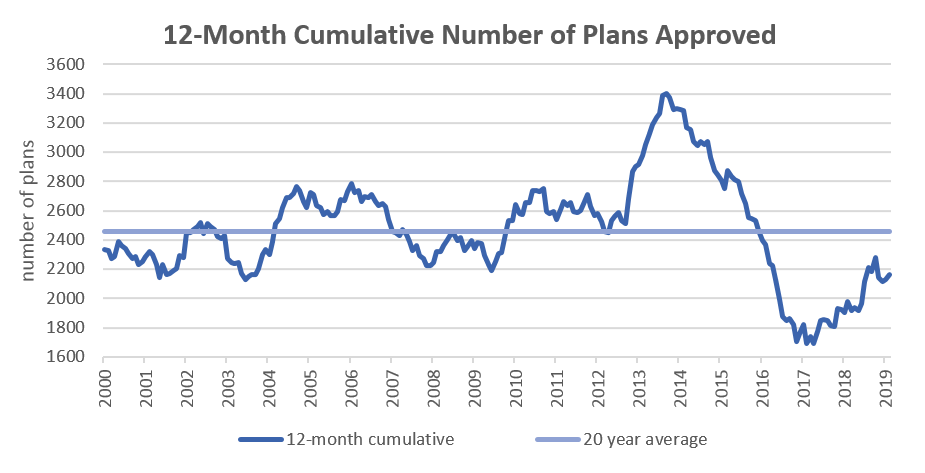

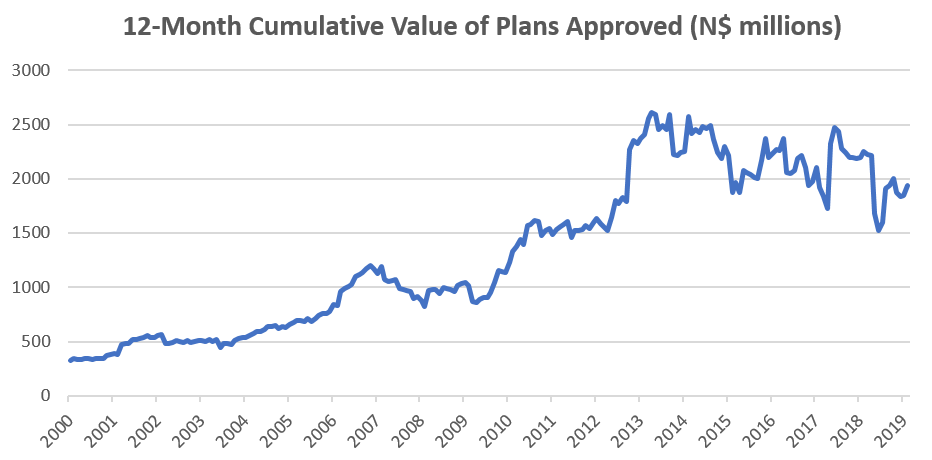

The 12-month cumulative number of building plans approved increased by 14.5% as at the end of March when compared to the corresponding period in 2018. A total of 2,194 building plans to the value of N$1.98 billion were approved over the last 12 months which represents a decrease in value of 11.0% y/y. The number of building plans approved, on a cumulative 12-month basis, has been increasing steadily since December 2017, but the value of cumulative plans has been decreasing since May 2018. We expect the economy, and construction activity as a result, to remain under pressure over the short-term, as both consumer and business confidence remains low.