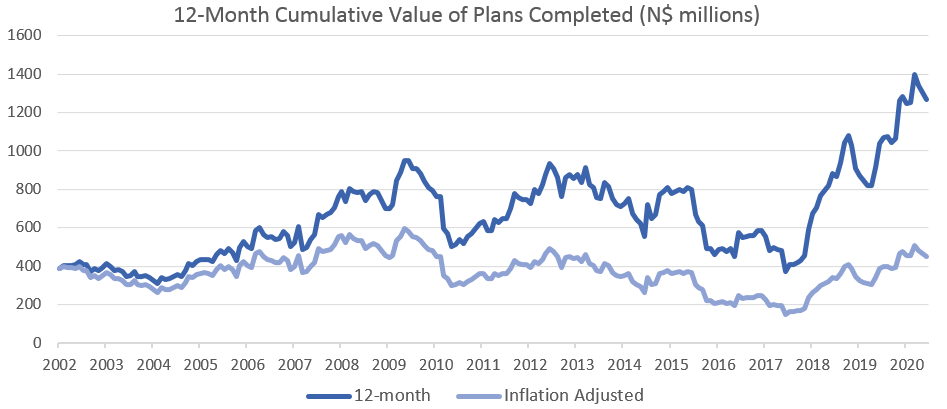

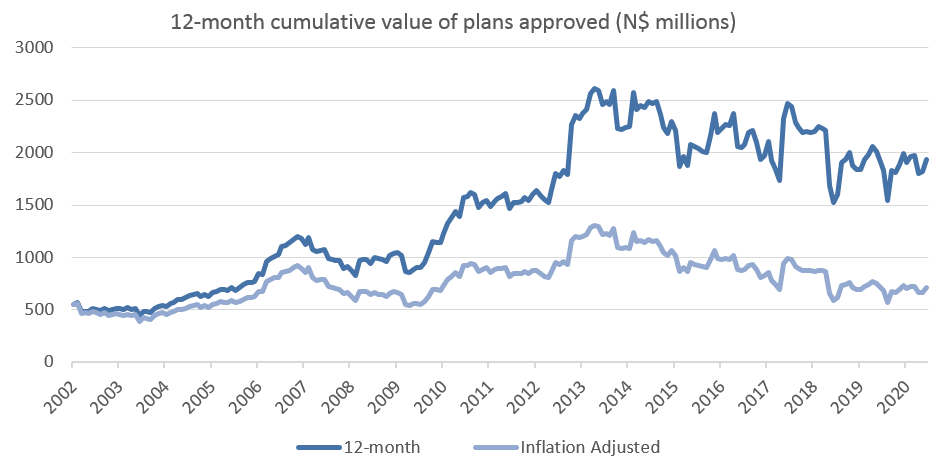

A total of 270 building plans were approved in June by the City of Windhoek, 159 more than in May. In value terms, approvals increased by N$78.9 million to N$173.7 million, an 83.2% m/m increase from May. A total of 289 completions to the value of N$192.1 million were recorded in June. Year-to-date 876 plans have been approved, 89 fewer than the 965 plans approved over the same period last year. The year-to-date value of approved building plans currently stands at N$825.2 million, which is 6.8% lower than during the first half of 2019. On a twelve-month cumulative basis, 1,943 building plans were approved worth approximately N$1.93 billion, equal in value terms compared to the same period in 2019.

The majority of the number of building plan approvals were made up of additions to properties. For the month of June, 190 additions to properties were approved with a value of N$96.2 million. Year-to-date 689 additions to properties have been approved with a total value of N$329.8 million, falling by 9.3% y/y in terms of number of approvals and 9.0% y/y in terms of value of additions. 203 additions to properties worth N$95.7 million were completed during the month.

New residential units were the second largest contributor to the number of building plans approved with 76 approvals registered in June, 48 more than in May. In value terms, N$72.3 million worth of residential units were approved in June, an increase of 112% m/m and 321.5% y/y. In the first half of 2020, 159 new residential units were approved worth N$243.3 million, representing a 14.1% y/y decrease in number and 28.1% y/y decrease in value. On a 12-month cumulative basis the number of additions approved has decreased by 31.3% y/y as well as by 15.4% y/y in value terms. 84 new residential units worth N$93.9 million were completed during the month.

4 new commercial units valued at N$5.3 million were approved in June, bringing the year-to-date number of commercial and industrial approvals to 28, worth a total of N$252.2 million. This is 40.0% up in number terms from June last year and 36.4% y/y in value terms. On a rolling 12-month basis, the number of commercial and industrial approvals have risen to 55 units worth N$643.0 million, compared to 44 units worth N$522.3 million during the corresponding period a year ago. 2 commercial and industrial units worth N$2.5 million were completed during June.

The number of both building plan approvals and completions came in slightly above our expectations during the month and this is somewhat encouraging. This does however not indicate that there will be a significant increase in construction activity in the coming months. City of Windhoek’s data shows that the average waiting period from submission to approval was 118 days, meaning that most of the submissions were done before the lockdown period. It thus remains to be seen how many of these approvals will result in actual building activity as both businesses and consumers are still recovering from the impact of the lockdowns and are unlikely to still be in the financial position to go ahead with these building projects.