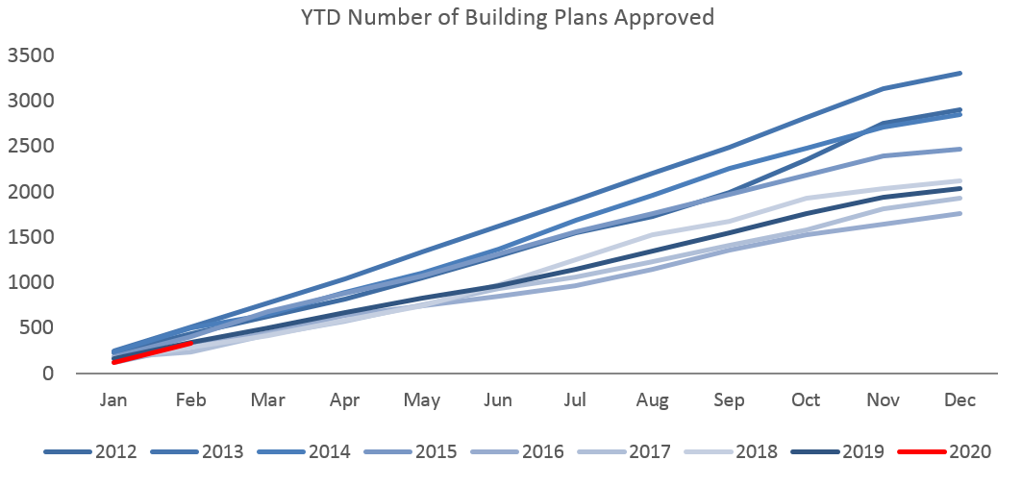

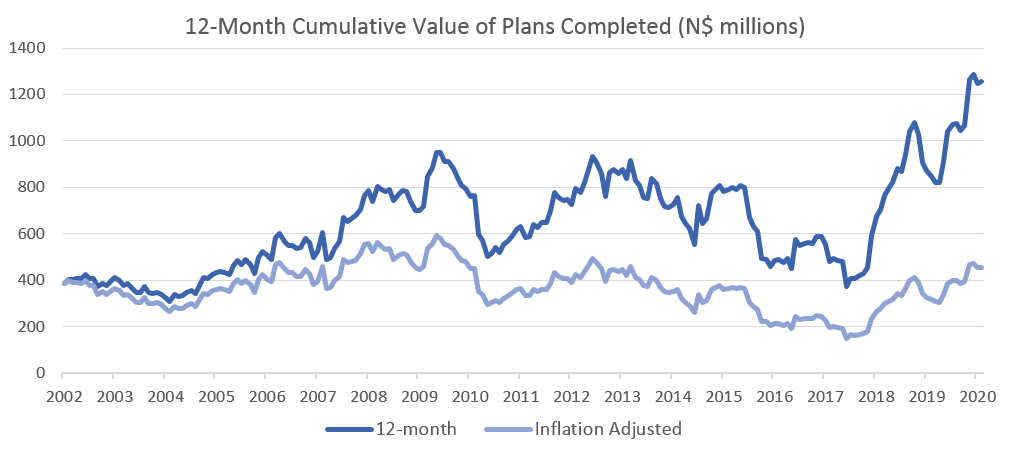

A total of 111 building plans were approved by the City of Windhoek in May, which is 58 fewer than the 169 approvals in March. In value terms, approvals declined by N$47.6 million to N$94.8 million, a 33.4% decrease from March. No building plans were approved or completed during April. A total of 208 building plans were completed during the month with a value of N$103.7 million. Year-to-date, N$651.5 million worth of building plans have been approved, 21.0% less in value than during the corresponding period in 2019. On a twelve-month cumulative basis, 1,817 building plans have been approved worth approximately N$1.82 billion, 9.5% lower in value terms than cumulative approvals in May 2019.

83 additions to properties were approved in May with a value of N$60.7 million, an increase of 41.5% in terms of value from the additions approved in March and 78.0% y/y higher than May 2019. Year-to-date 499 additions to properties have been approved with a total value of N$233.6 million, a decrease of 22.4% y/y in number and a decrease of 30.1% y/y in value terms. On a 12-month cumulative basis, the number of additions approved has declined by 9.8% y/y and 17.1% y/y in value terms. During the month 161 additions have been completed with a combined value of N$53.9 million.

New residential units accounted for 28 of the approvals registered in May, 18 more than in March, but 14 fewer than in May 2019. In value terms, N$34.1 million worth of residential units were approved in May, up 225.1% m/m (from March), but down 25.7% y/y. Year-to-date residential unit approvals have dropped by 49.1% y/y in number terms and 46.7% in value. The 12-month cumulative residential approvals paint a similar picture, recording a 46.1% y/y decrease in number of approvals and 28.0% y/y decrease in value. As building plan approvals are a leading indicator it points to diminishing construction activity going forward, albeit in the residential space. 46 new residential units worth N$49.8 million were completed during the month.

For the first time since July 2018 there were no approvals for commercial and industrial building plans (excluding the lockdown in April). The lack of approvals in May is somewhat unsurprising given that businesses were severely hit by the lockdown with few financially able to invest in capital investment projects. On a 12-month cumulative basis, the number of commercial and industrial approvals has increased by 36.6% y/y in May to 56 units, worth approximately N$652.9 million, an increase of 27.0% in value terms over the prior 12-month period. One commercial and industrial unit worth N$30,000 was completed during May.

Building plan approvals were unsurprisingly low in May as the country’s lockdown restrictions were somewhat lifted. Consumers and businesses have both been adversely affected by the lockdown with few still financially able to invest in capital expansion projects.