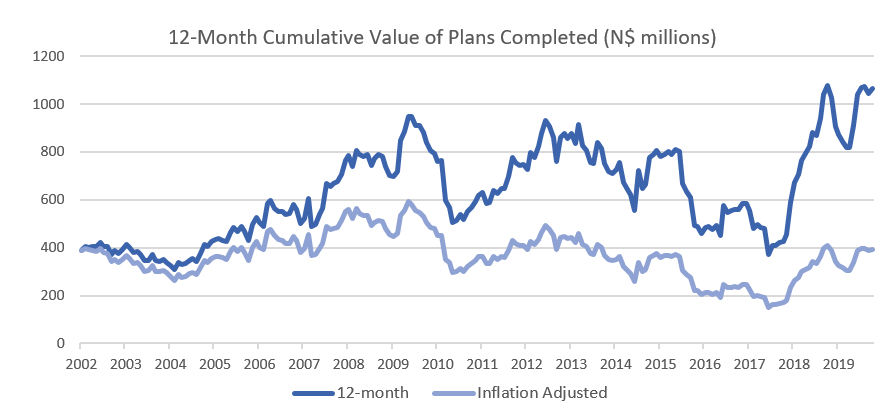

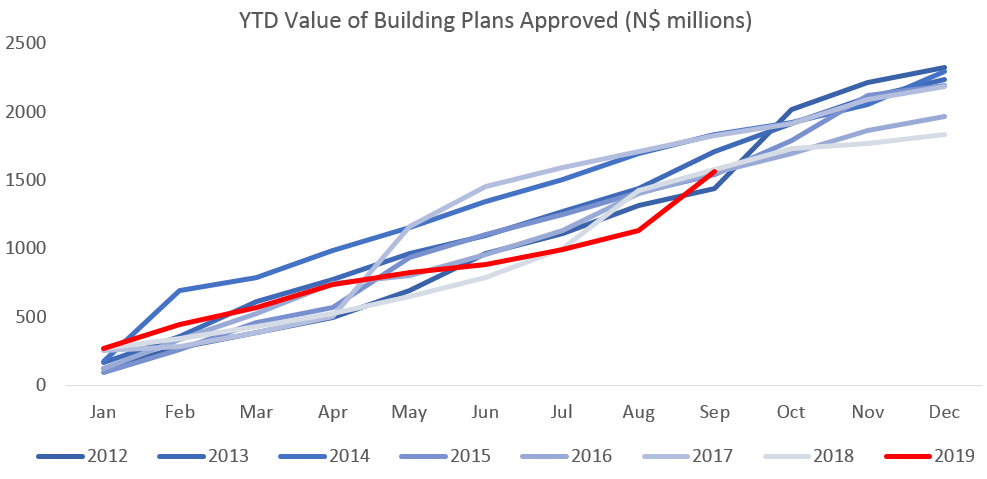

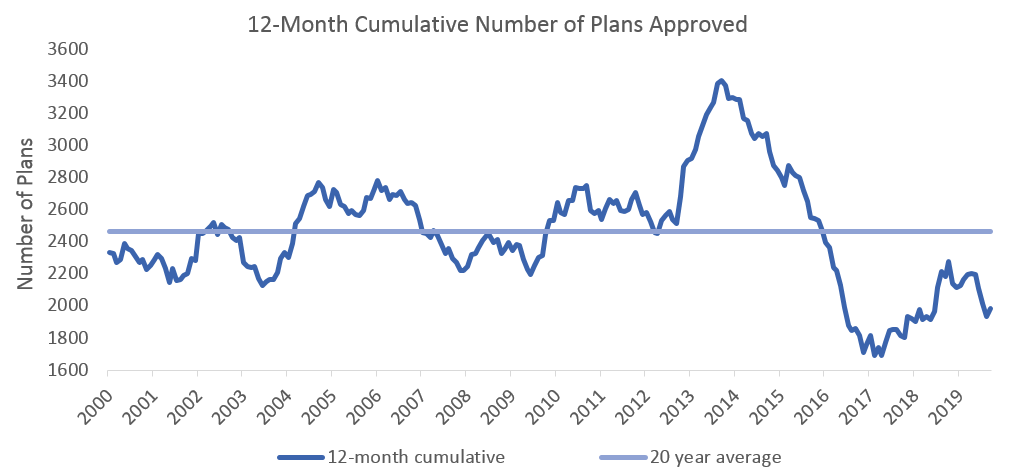

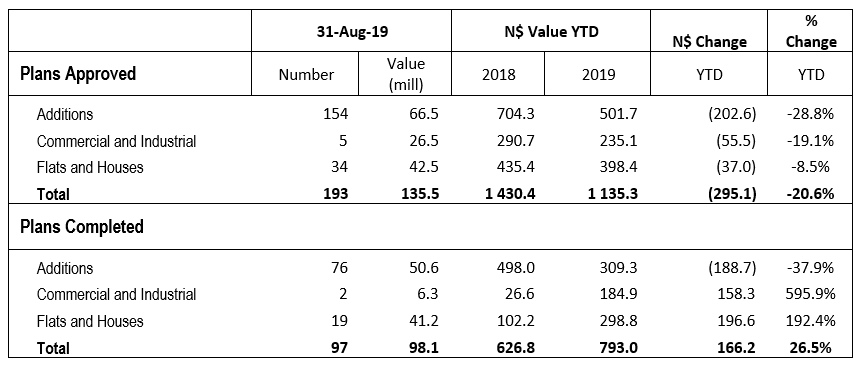

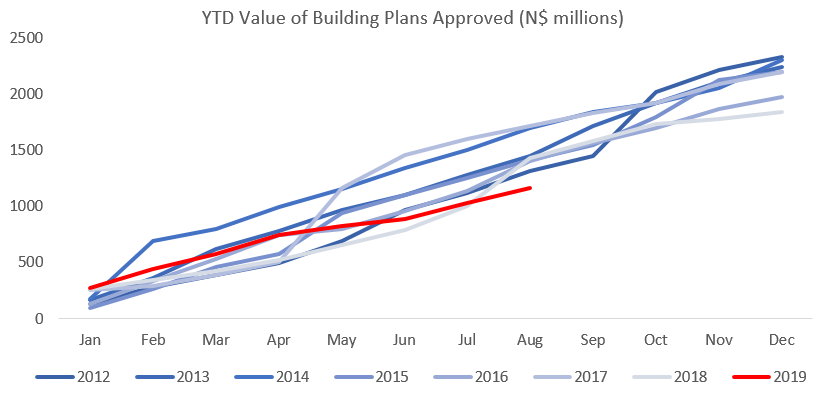

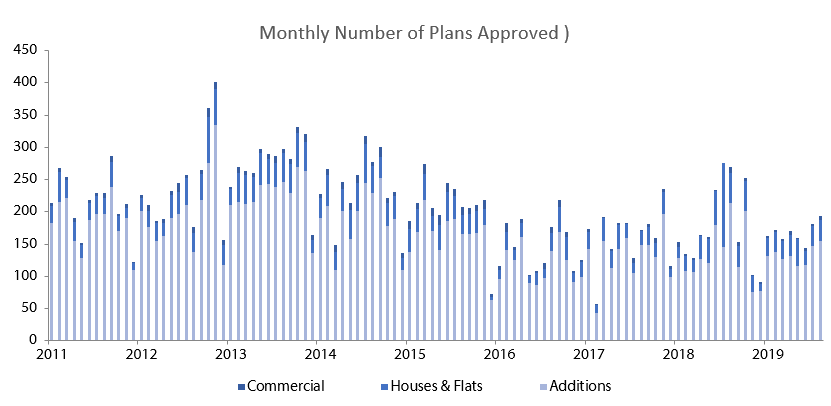

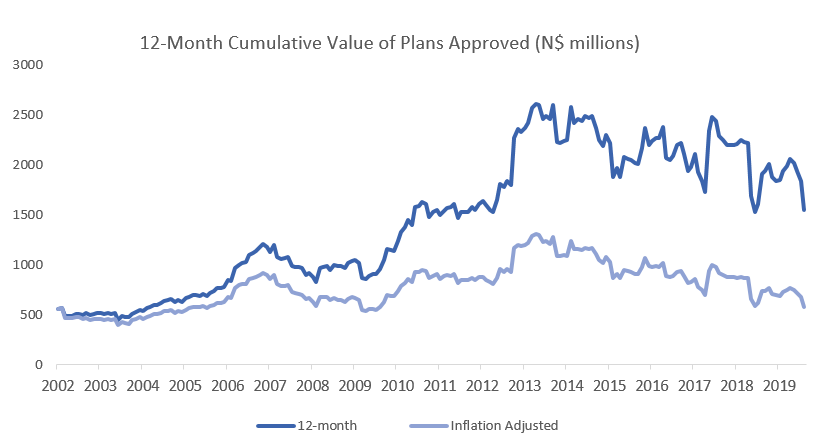

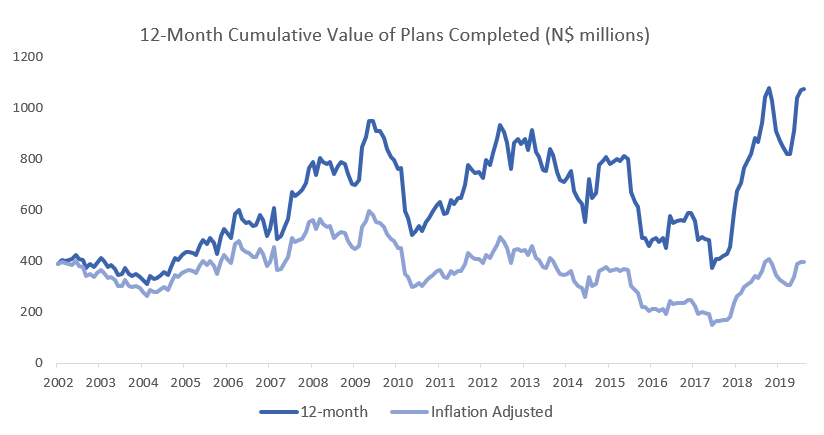

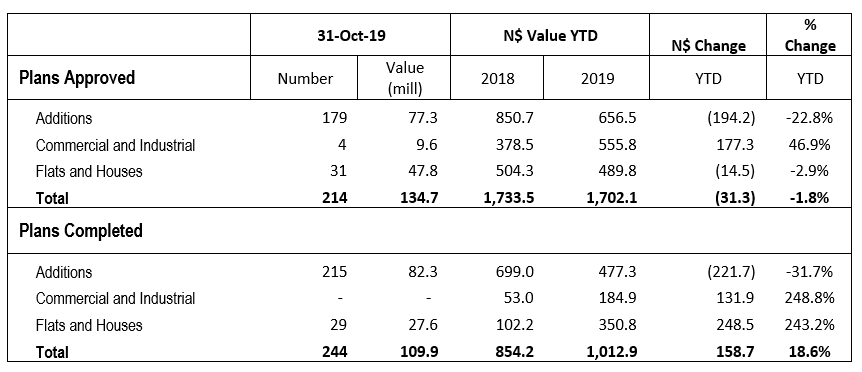

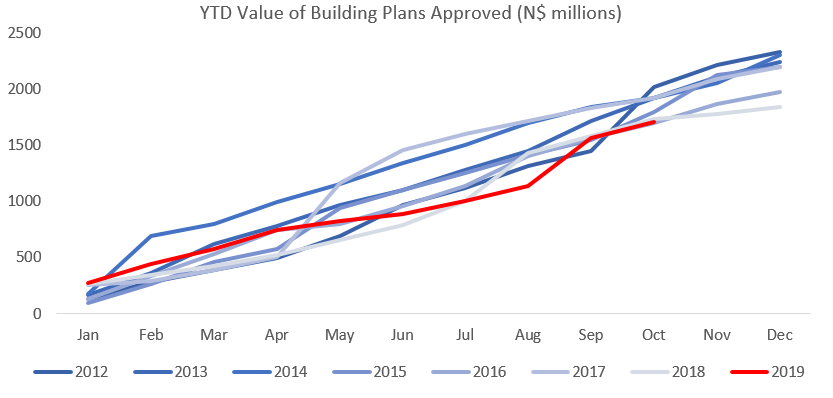

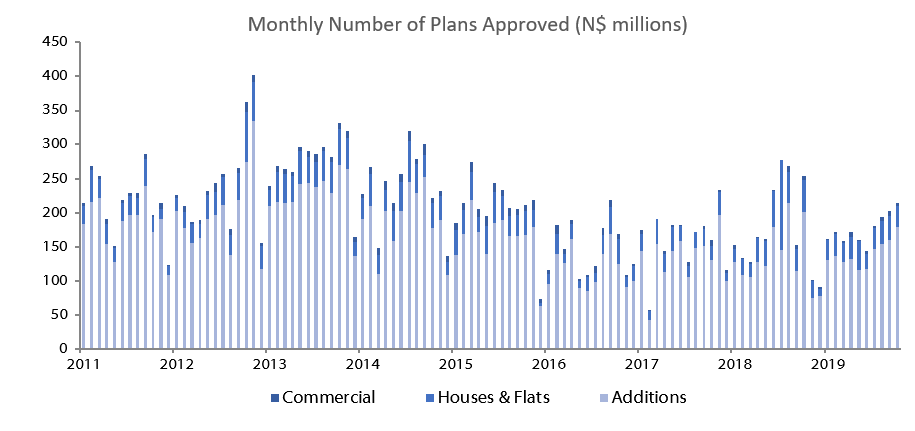

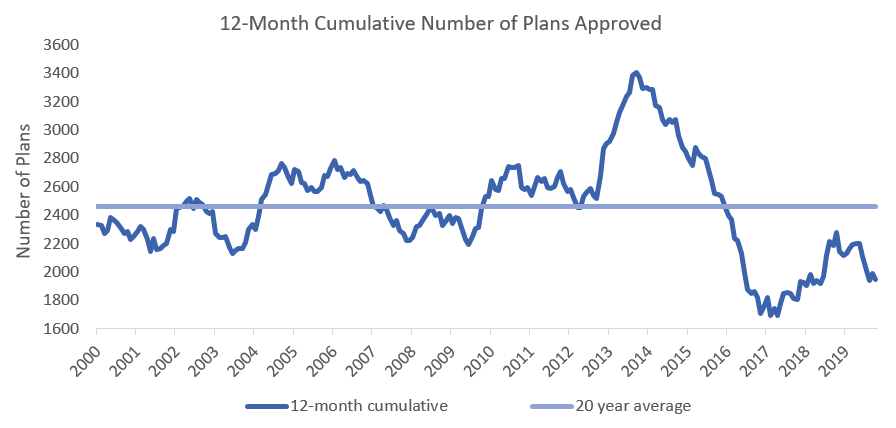

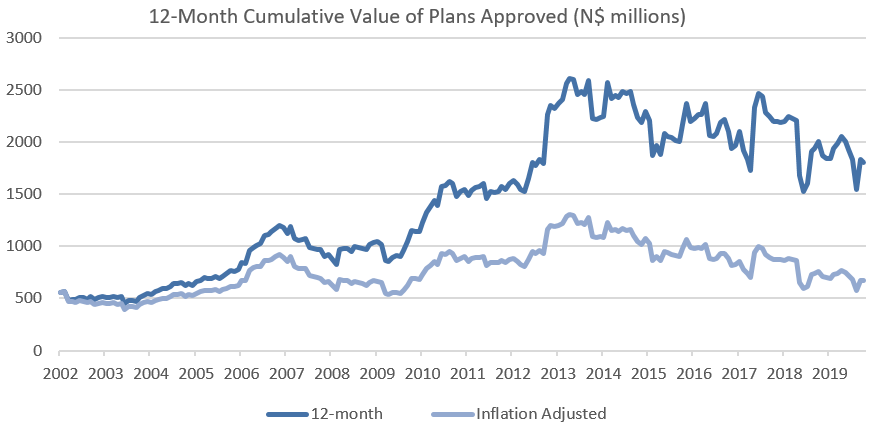

A total of 214 building plans were approved by the City of Windhoek in October. This is a 5.9% increase in the number of plans approved on a monthly basis when compared to the 202 building plans approved in September. The approvals were valued at N$134.7 million, a decrease of N$298 million or 68.8% compared to last month. The number of completions for the month of October stood at 244, valued at N$109.9 million. The year-to-date value of approved building plans currently stands at N$1.70 billion, 1.8% lower than at the end of October 2018. On a twelve-month cumulative basis 1,947 building plans worth approximately N$1.81 billion have been approved, a decrease of 14.5% y/y in number and a contraction of 9.8% in value terms over the prior 12-month period.

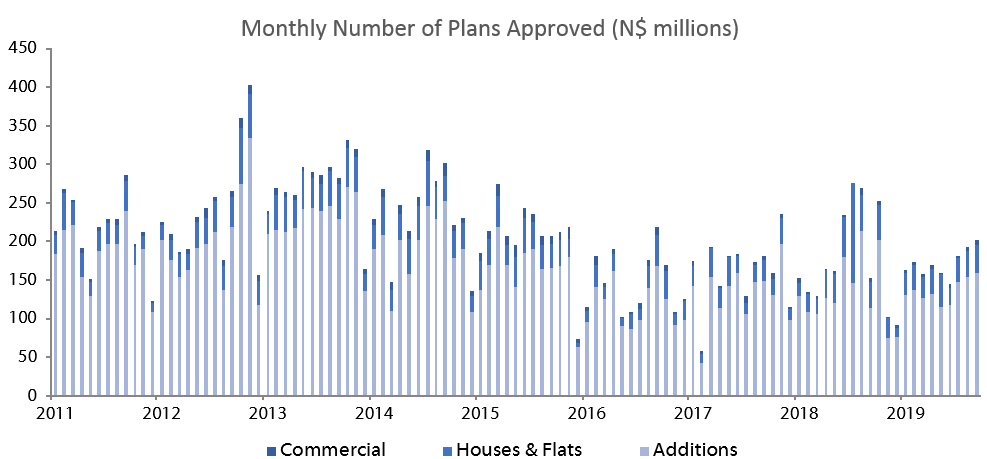

The largest portion of building plan approvals was once again made up of additions to properties. 179 additions to properties were approved in October, an 11.9% increase over the number of additions approved in September. Year-to-date 1,400 additions to properties have been approved with a cumulative value of N$656.5 million, a decline of 22.8% y/y in terms of value compared to the same period in 2018. Completed additions amounted to 215, valued at N$82.3 million, an increase of 4.4%% y/y in number but a contraction of 3.9% y/y in value. Year-to-date 1,028 additions have been completed to a value of N$477.3 million, a drop of 49.5% y/y in number and 31.7% y/y in value.

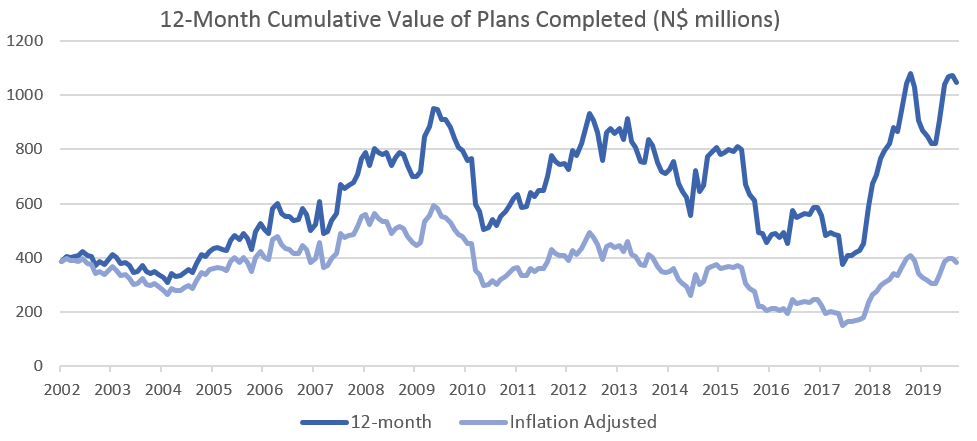

New residential units were the second largest contributor to the number of building plans approved with 31 approvals registered in October, compared to 35 in September. In value terms, N$47.8 million worth of residential units were approved in October, increases of 9.6% m/m and 8.4% y/y. 316 New residential units valued at N$489.8m were approved in the first ten months of 2019, 28.8% y/y less in number and 2.9% y/y less in value than during the corresponding period in 2018. 29 Residential units valued at N$27.6 million were completed in October bringing the year-to-date number to 254, up 323.3% y/y, and value to N$350.8 million, up 243.2% y/y.

Commercial and industrial building plans approved in October amounted to 4 units, worth N$9.6 million. The number of approvals for commercial and industrial properties has been languishing in single digit territory since September 2016 and has an average approval rate of less than 4 approvals per month over the last 12 months. On a 12-month cumulative basis, the number of commercial and industrial approvals has decreased by 10.4% y/y in October to 43 units, worth approximately N$557.7 million, an increase of 39.2% in value terms over the prior 12-month period. No commercial and industrial building plans were recorded as completed in October.

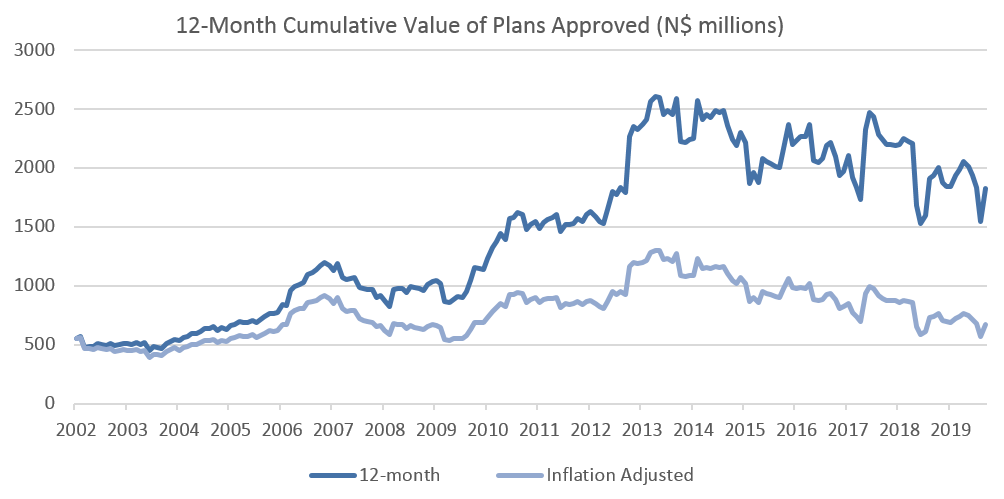

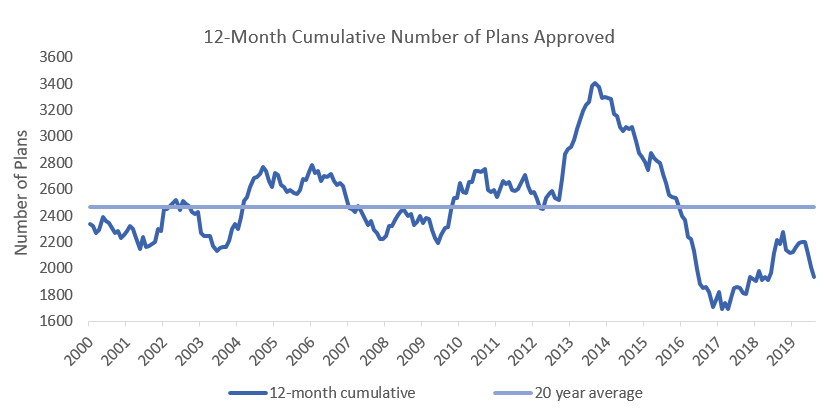

During the last 12 months, 1,947 building plans have been approved, decreasing by 14.5% y/y. These approvals were worth a combined N$1.81 billion, a decrease in value of 9.8% y/y. The number of building plans approved, on a cumulative 12-month basis, continued to contract over the last four months. The overall decrease in both number and value of cumulative plans approved is concerning as, even in nominal terms, this indicates a continuing decrease in construction activity in the capital. Low consumer and business confidence means that growth in construction activity will likely remain subdued over the short- to medium-term.