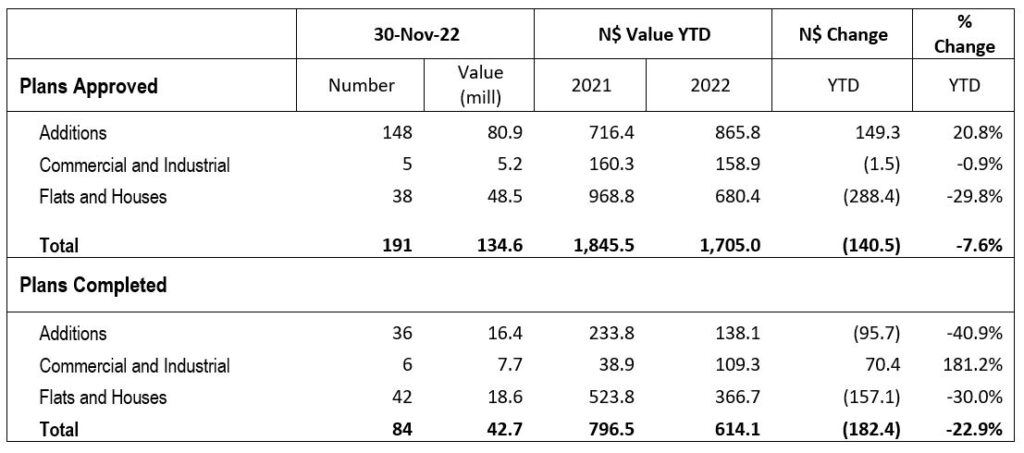

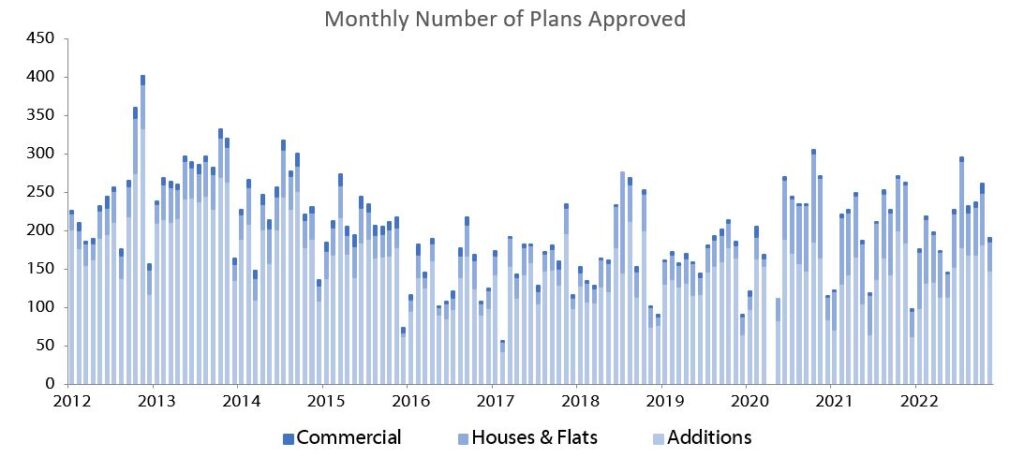

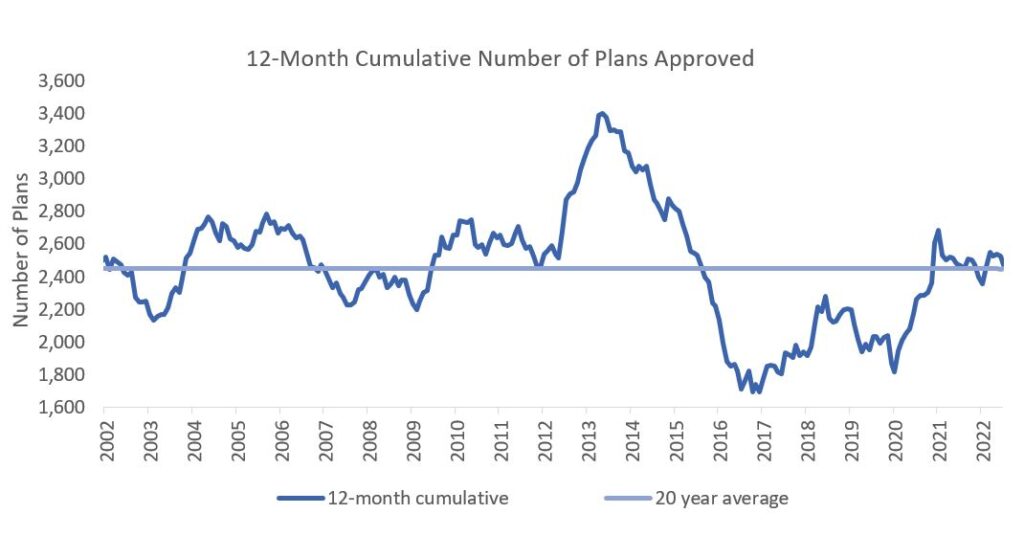

191 building plans were approved by the City of Windhoek in November, representing a 27.1% m/m decline from the 262 building plans approved in October. In value terms, the approvals were valued at N$134.6 million, down 38% m/m from the N$157.3 million worth of plans approved in October. Year-to-date, 2,357 building plans worth N$1.71 billion have been approved, up 0.2% y/y in number terms but falling by 7.6% y/y in value terms compared to the same period last year. On a twelve-month cumulative basis, the number of approvals fell by 0.5% y/y to 2,455 and in value terms declined by 5.2% y/y to N$1.82 billion. 84 building plans worth N$42.7 million were completed in November.

148 additions to properties were approved in November valued at N$80.9 million, 34 fewer than the 182 units worth N$84.6 million approved last month. Year-to-date, 1,592 additions to properties worth N$865.8 million were approved, representing a 5.4% y/y increase in number terms and a 20.8% y/y jump in value terms. On a 12-month cumulative basis, 1,655 additions to the value of N$902.2 million were approved in November, 60 more than over the same period last year, and a 21.9% y/y increase in value terms. A total of 36 additions worth N$16.4 million were completed in November, up from the 36 additions worth N$9.94 million completed in October.

38 New residential units were approved in November, notably down from the 67 approved in October and the monthly average of 65 for the year. In value terms, N$48.5 million worth of residential units were approved during the month, representing a 23.2% m/m drop from the N$63.18 million approved in October and 54.0% less than a year ago. Year to date, 711 residential units valued at N$680.4 million were approved, representing a 12.0% y/y decline in number terms and a 29.8% y/y contraction in value terms. November saw 743 residential units approved over the last twelve months, an 11.3% y/y decline from the 838 units approved over the same period a year ago. In value terms, N$749.4 million worth of residential units were approved over the past 12 months, representing a 24.6% y/y decrease. 42 New residential units worth N$18.63 million were completed during November, down from the 52 residential units worth N$62.92 million completed in October.

5 New commercial and industrial units valued at N$5.18 million were approved in November, down from the 13 commercial units worth N$9.55 million approved last month. Year-to-date, 54 commercial and industrial buildings valued at N$158.9 million were approved, compared to the 34 commercial buildings worth N$160.3 million over the same period last year. This represents a 58.8% y/y increase in number but a 0.9% y/y contraction in value. On a rolling 12-month perspective, 57 commercial and industrial buildings valued at N$169.9 million were approved in November, compared to the 35 buildings approved worth N$186.5 million over the corresponding period a year ago. This represents an increase of 62.9% y/y in the number of units approved but an 8.9% y/y contraction in value. 6 Commercial and industrial units worth N$7.65 million were completed in November, the highest number of commercial and industrial units since May 2019 after only 2 units worth N$2.98 million were completed last month.

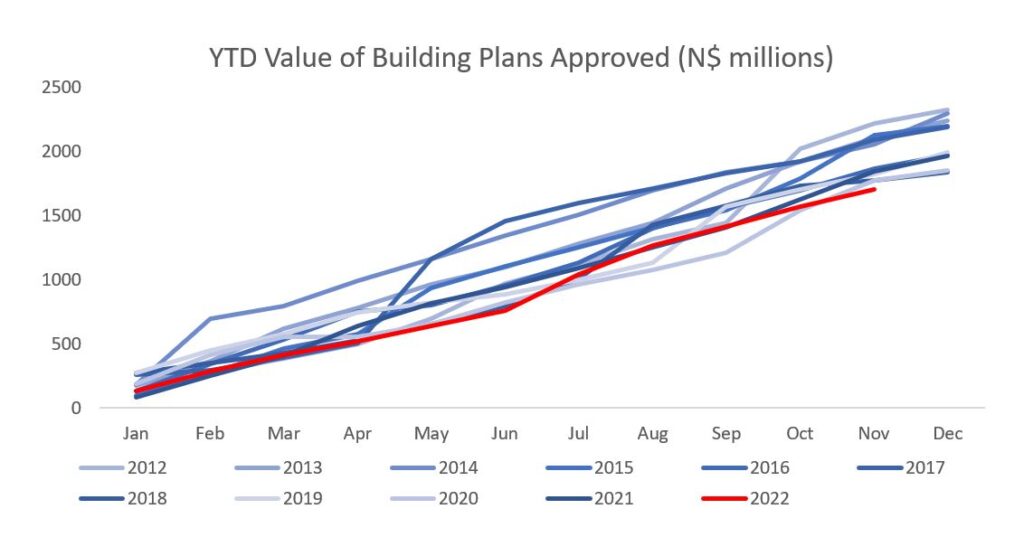

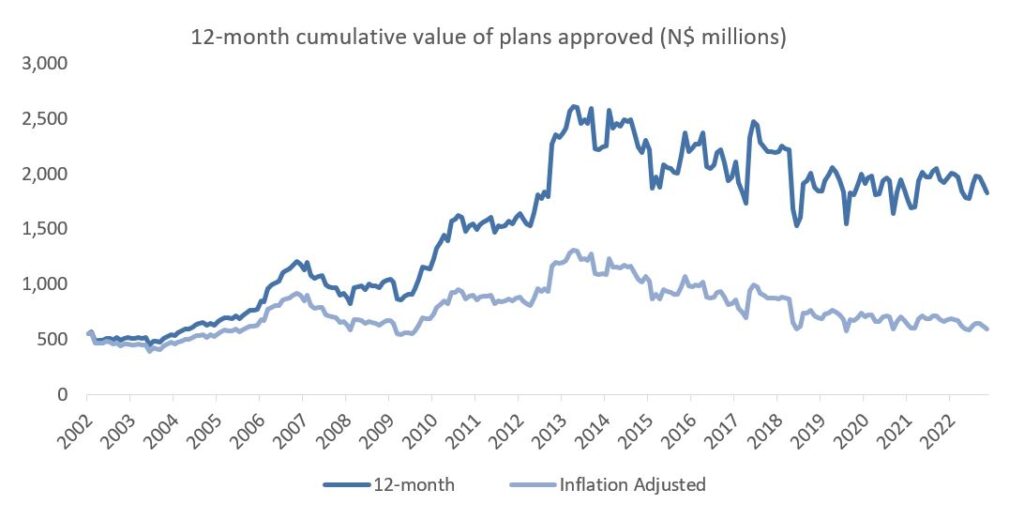

November saw the 12-month cumulative value of building plans approved continue to fall in both nominal and inflation-adjusted terms, as shown in the figure above. The 12-month cumulative value of both commercial and residential units approved dropped in November with the latter contracting for the 8th consecutive month on an annual basis.

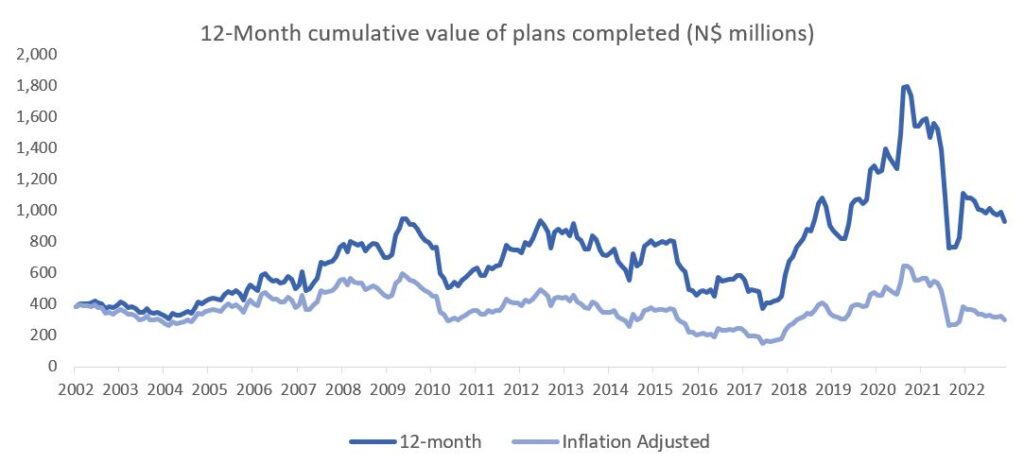

The 12-month cumulative value of completed plans also dipped in both nominal and real terms, as displayed below. The cumulative number of building plans completed declined for the 19th consecutive month (year-on-year) to 1,004 in November.

The demand for the construction of new buildings hit a new low in November with the year-to-date value of building plans approved as the lowest value reported over the past decade. As observed last month, 2022 is on course to close out with the lowest annual building plan approval value over the past 10 years. We do not see support for a turnaround in construction demand in the short term. Instead, lacklustre construction activity is likely due to high inflation and ever-rising borrowing costs, conditions which are unfavourable to ignite demand for construction.