Overall

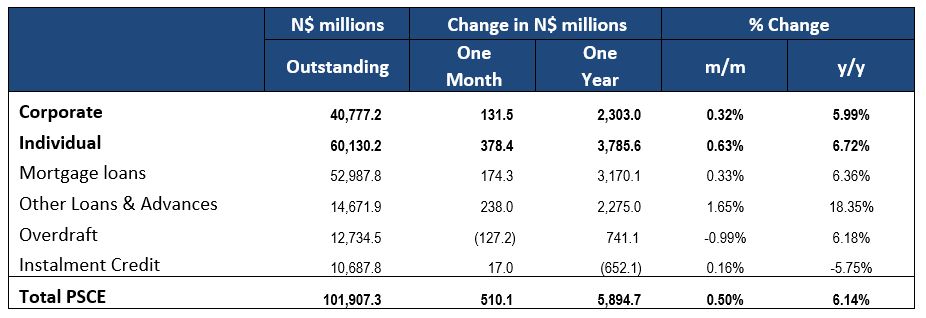

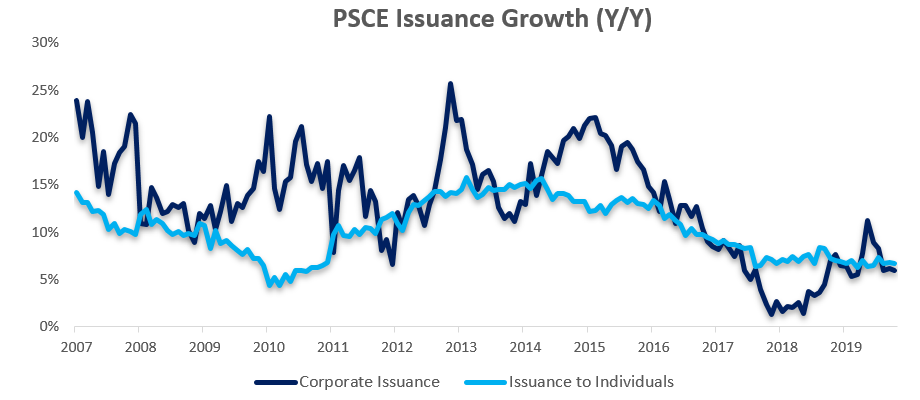

Private sector credit (PSCE) increased by N$510.1 million or 0.5% m/m in October, bringing the cumulative credit outstanding to N$101.9 billion. PSCE grew at a slower pace of 6.14% y/y in October compared to 6.24% y/y in September. On a rolling 12-month basis N$5.89 billion worth of credit was extended to the private sector, down 16.0% y/y. Individuals took up N$3.79 billion while N$2.30 billion was extended to corporates, and the non-resident private sector decreased their borrowings by N$193.7 million.

Credit Extension to Individuals

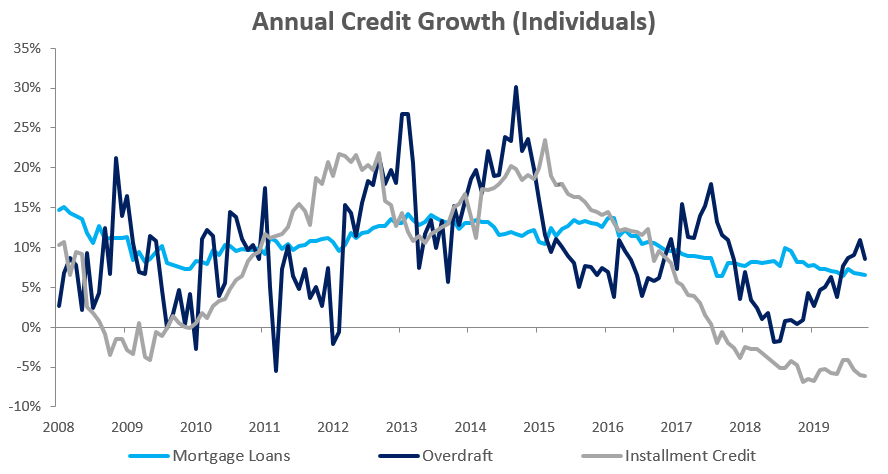

Credit extended to individuals increased by 6.7% y/y in October, a slight slowdown from the 6.8% y/y growth recorded in September. Mortgage loans extended to individuals increased by 0.6% m/m and 6.5% y/y. Installment credit continued to contract, by 0.1% m/m and 6.1% y/y. Other loans and advances (which is made up of credit card debt, personal and term loans) grew by 2.0% m/m and 24.2% y/y in October. Household demand for overdraft facilities declined in October, contracting by 2.0% m/m, although rising by 8.6% y/y.

Credit Extension to Corporates

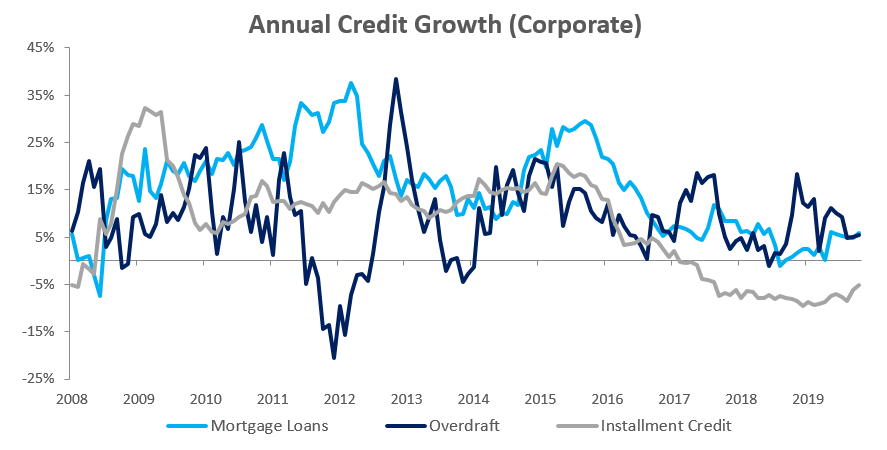

Credit extension to corporates grew by 0.3% m/m and 6.0% y/y. On a rolling 12-month basis N$2.30 billion was extended to corporates as at the end of October, a decrease of 9.1% y/y. Although the uptick in the general demand for credit by corporates over the last year seems positive, the biggest driver of the increase in credit extended to corporates was shorter-term debt. Overdraft facilities extended to corporates decreased by 0.6% m/m but rose 5.4% y/y, while other loans and advances to corporates increased by 1.3% m/m and 12.3% y/y. The increase in these categories indicates that businesses continue to rely on other short-term debt to keep the lights on. Mortgage loans by corporates contracted by 0.7% m/m but rose 5.8% y/y, while installment credit increased by 0.5% m/m, but contracted by 5.2% y/y.

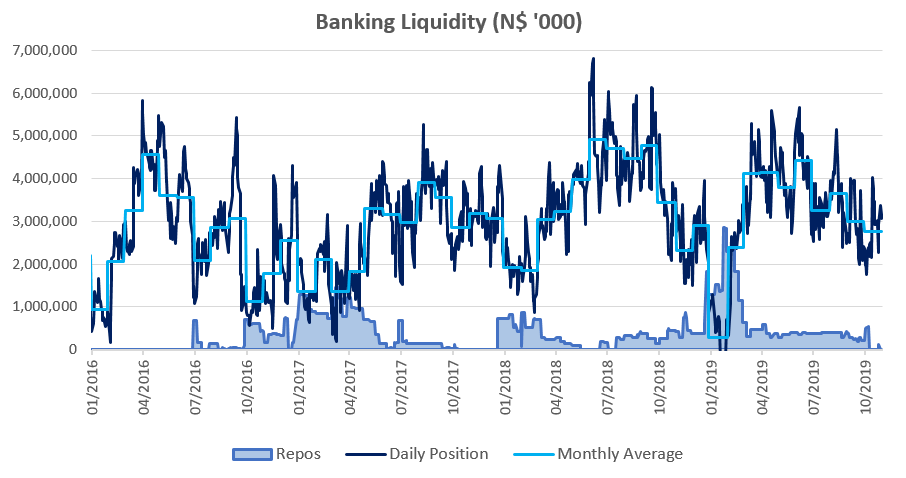

Banking Sector Liquidity

The overall liquidity position of commercial banks declined by N$227.3 million in October to reach an average of N$2.77 billion. The Bank of Namibia attributed the decline in liquidity to lower domestic Government spending mainly due to lower economic activity coupled with higher foreign currency outflows as a result of import payments during October 2019.

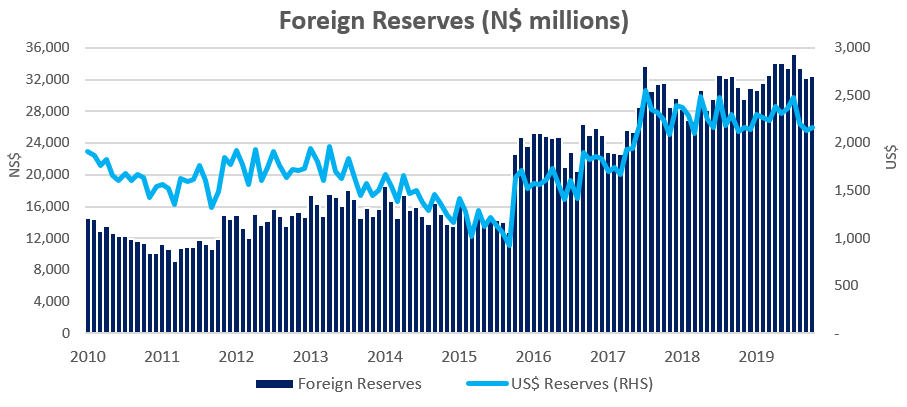

Reserves and Money Supply

As per the BoN’s latest money statistics release, broad money supply rose by N$7.16 billion or 6.7% y/y in October, following an 8.3% y/y increase in September. Foreign reserve balances rose by N$203.6 million to N$32.47 billion in October from N$32.27 billion in September. According to the BoN, the increase was mostly due to an inflow of SACU receipts as well as lower government payments during the period under review.

Outlook

Private sector credit extension continues to languish, increasing by 6.14% y/y during October compared to the 6.24% y/y growth rate recorded in September. It has been 36 months since PSCE last recorded double digit growth on an annual basis. As expected, the 25-basis point rate cut in August has not resulted in higher demand for credit as consumers are already over-indebted. With low economic activity and lack of demand, growth opportunities for businesses remain limited.

As mentioned earlier, corporates continue to rely on short-term debt to keep the lights on instead of taking on longer-term credit to invest in capital projects to expand operations. We do not expect conditions to improve in the short- to medium-term.