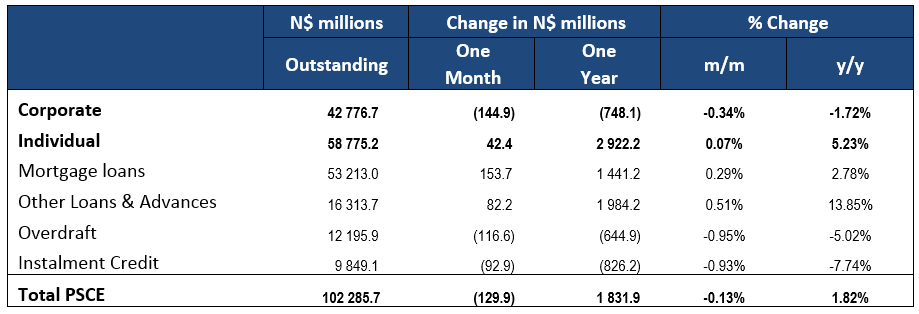

Overall

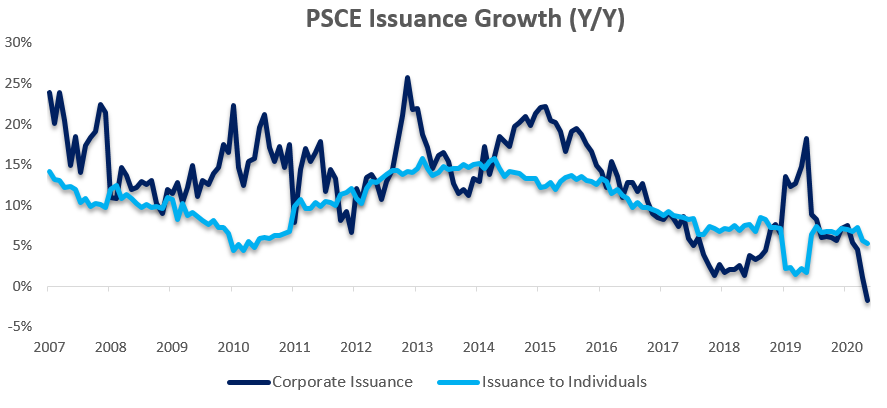

Total credit extended to the private sector (PSCE) declined by N$129.9 million or 0.13% m/m in May, bringing the cumulative credit outstanding to N$102.29 billion. On a year-on-year basis, private sector credit increased by 1.8% in May, compared to 3.4% in April. This is the lowest annual growth rate on our records dating back to 2002. On a rolling 12-month basis, N$1.83 billion worth of credit was extended to the private sector. Of this cumulative issuance, individuals took up N$2.92 billion, while corporates decreased their borrowings by N$748.1 million, and the non-resident private sector paid back N$342.3 million of their borrowings.

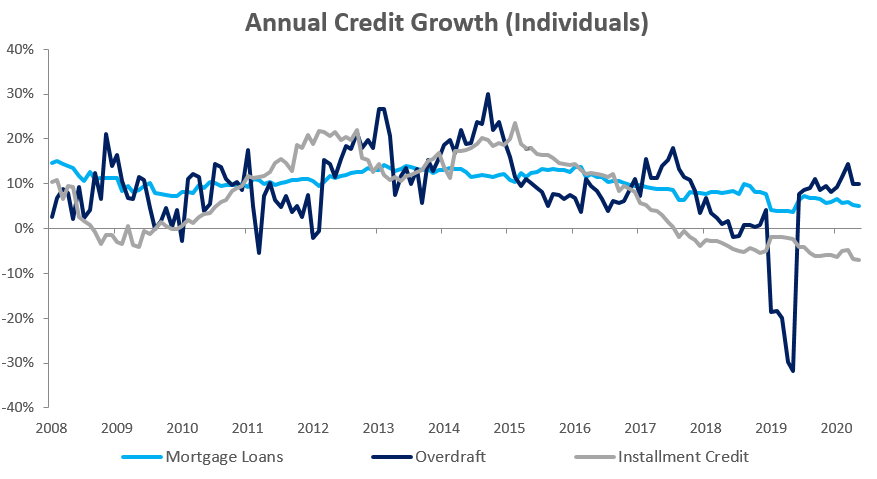

Credit Extension to Individuals

Growth in credit extended to individuals slowed to 5.2% y/y in May from the 5.7% y/y growth recorded in April. On a monthly basis household credit increased by 0.1%. Mortgage loans extended to individuals increased by 0.3% m/m and 5.0% y/y. Installment credit, often used to finance vehicle purchases contracted by 0.7% m/m and 7.0% y/y. Overdraft facilities extended to individuals have increased by 0.2% m/m and 10.0% y/y. Other loans and advances (or OLA, which is made up of credit card debt, personal and term loans) fell by 0.1% m/m, but grew by 20.0% y/y in May.

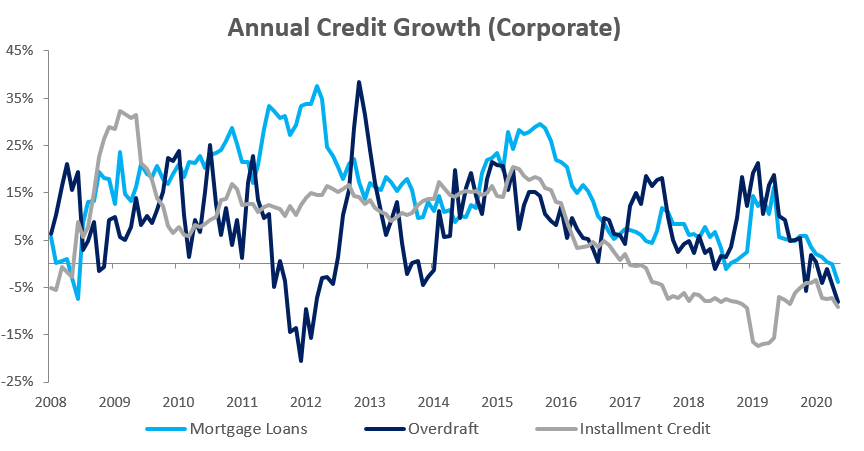

Credit Extension to Corporates

Credit extended to corporates contracted by 0.3% m/m and 1.7% y/y in May. This is the first contraction in corporate credit extension on an annual basis since December 2005. The Bank of Namibia (BoN) attributes this contraction to repayments made by corporates as some businesses restructured their credit exposure, coupled with write-offs during the period. This was expected as economic activity remained muted during the month as a result of the lockdown. Overdraft facilities extended to corporates fell by 1.2% m/m and 8.1% y/y. The persistent contraction in installment credit continued in May, declining by 1.4% m/m and 9.1% y/y. Mortgage loans extended to corporates grew by 0.4% m/m, but contracted 3.7% y/y.

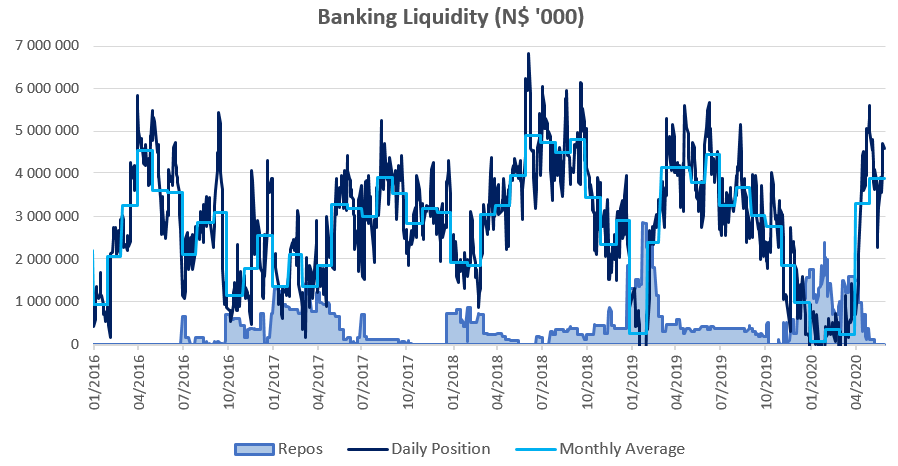

Banking Sector Liquidity

The overall liquidity position of commercial banks improved during May, increasing by N$572.4 million to reach an average N$3.90 billion. The balance of repo’s outstanding fell from N$147.4 million at the start of May to zero at the end of the month. The BoN ascribed the improved liquidity position to higher government expenditure in the form of the emergency income grant, the settlement of outstanding invoices for services rendered and the acceleration of VAT refunds.

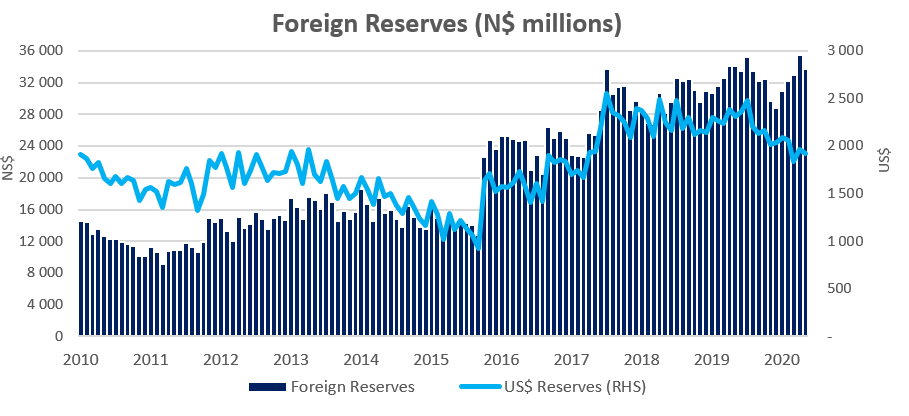

Reserves and Money Supply

Broad money supply rose by N$4.50 billion or 11.4% y/y in May, as per the BoN’s latest monetary statistics release. Foreign reserve balances declined by 5.1% m/m to N$33.7 billion in May. According to the BoN, the decline is due to government payments as well as revaluation effects after the Namibian dollar strengthened against the US Dollar during the period.

Outlook

Private sector credit extension remained depresses at the end of May, increasing by only 1.8%, with annualised growth slowing for a fourth consecutive month. Cumulative 12-month private sector credit issuance is down 75.5% from the N$7.46 billion figure as at May 2019. Rolling 12-month issuance of N$1.83 billion is now at levels last seen in 2005.

Despite Namibian interest rates now being at their lowest levels yet, we do not expect either consumers or corporates to rush to commercial banks to take up large sums of debt any time soon. Economic activity remains very low and a lack of demand means that growth opportunities for businesses remain extremely slim. Businesses that do make use of credit will likely mostly do so to keep their doors open, instead of investing in capital projects. Banks will furthermore remain cautious in extending loans as their risk appetite will be low given the current economic environment.