Overall

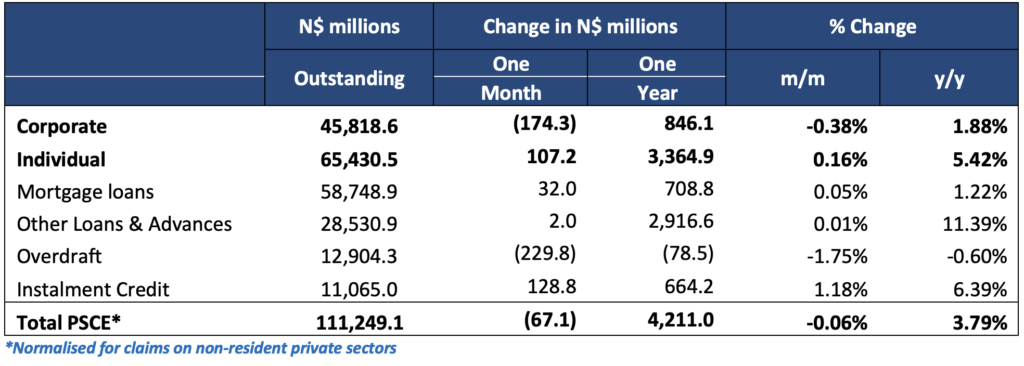

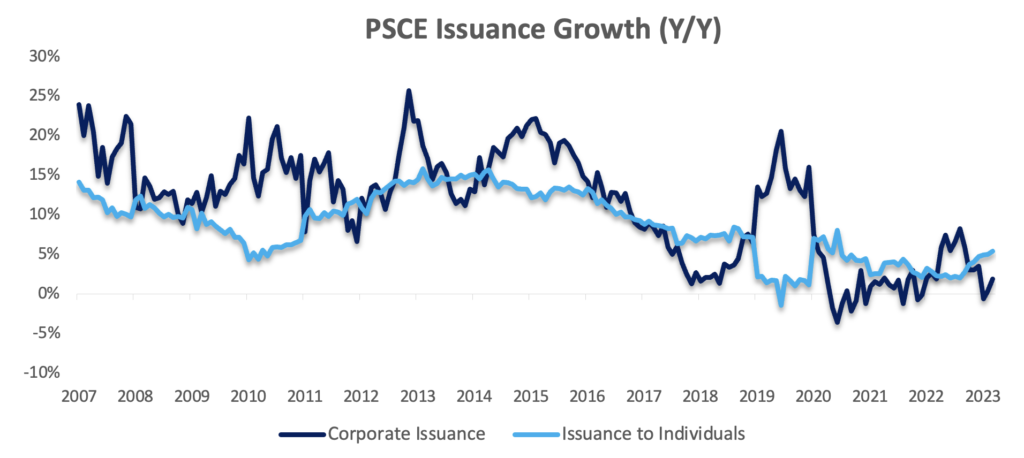

Private sector credit (PSCE) fell by N$67.1 million or 0.06% m/m in March, bringing the cumulative credit outstanding to N$111.2 billion on a normalised basis (removing the interbank swaps the Bank of Namibia (BoN) accounts for in non-resident private sector claims). On a year-on-year basis, PSCE grew by 3.9% in March, compared to a 3.1% growth rate in February. The impact of base effects plays a role in the quicker annual rate, as PSCE fell by nearly 1.0% in March 2022. N$4.21 billion worth of credit was extended to the private sector over the past 12 months. Individuals took up N$3.36 billion worth of credit, while corporates took up N$846.1 million.

Credit Extension to Individuals

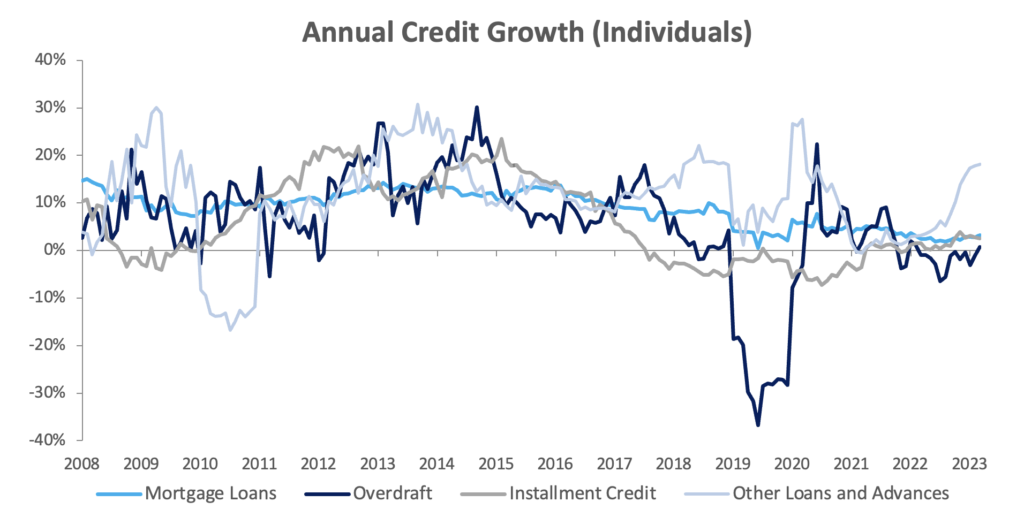

Credit extended to individuals rose by 0.2% m/m and 5.4% y/y. All sub-categories, bar instalment credit, recorded growth on a month-on-month basis. Mortgage loans were again the biggest contributor of the month-on-month increase, registering growth of 0.1% m/m and 3.2% y/y. ‘Other loans and advances’ (consisting of credit card debt and personal- and term loans) continues to post strong growth, increasing by 0.4% m/m and 18.2% y/y in March, the quickest annual growth rate for this sub-category since March 2020. Overdraft facilities to individuals grew by 0.6% m/m and 0.8% y/y, while instalment credit fell marginally by 0.1% m/m but rose 2.5% y/y.

Credit Extension to Corporates

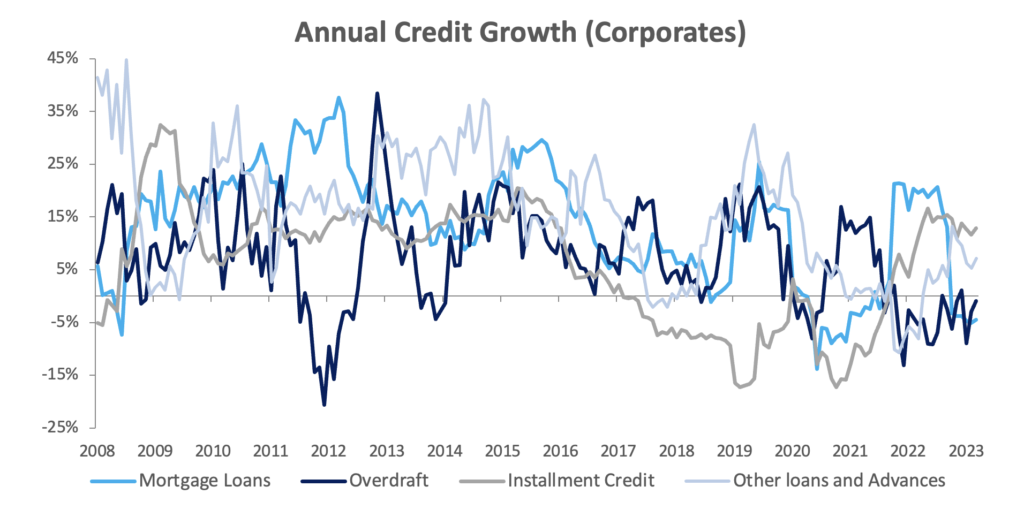

Corporate credit extension fell by 0.4% m/m but rose 1.9% y/y. In contrast to credit extended to individuals, instalment credit to corporates was the only sub-category which posted monthly growth in March, growing by 3.2% m/m and 12.8% y/y, ahead of inflation, but from a low base. Mortgage loans declined by 0.2% m/m and 4.5% y/y. Other loans and advances contracted by 0.2% m/m but rose 7.1% y/y. Overdraft facilities to corporates fell by 2.3% m/m and 0.9% y/y.

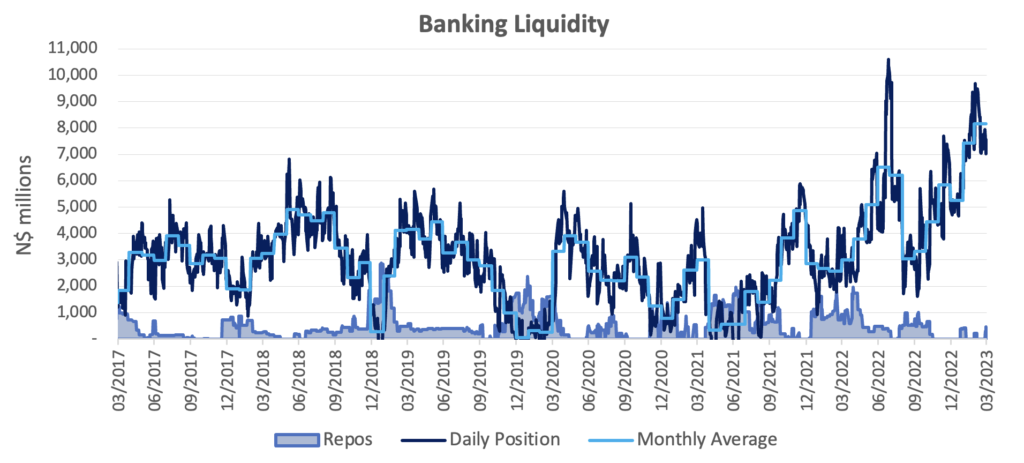

Banking Sector Liquidity

The overall liquidity position of the commercial banks strengthened further during March, rising by N$718.4 million to an average of N$8.15 billion. According to the Bank of Namibia (BoN), the increase is due to improved diamond sales, coupled with government payments which were high due to the fiscal year end. Despite the strong liquidity position, the repo balance rose from zero at the start of the month to N$458.4 million at month end.

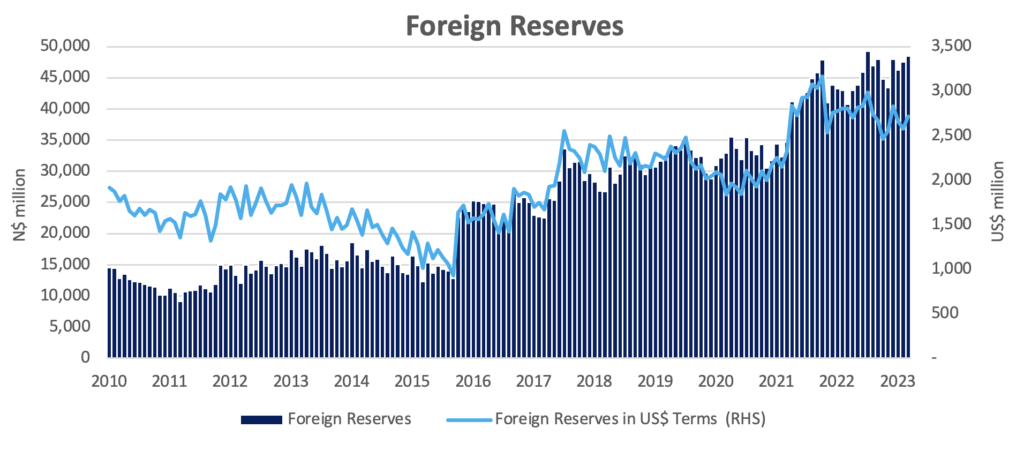

Money Supply and Reserves

The BoN’s latest monetary statistics show that broad money supply (M2) rose by N$2.32 billion or 1.8% y/y in March. The stock of international reserves climbed by 2.1% m/m or N$980.0 million to N$48.5 billion, translating to 5.1 months of import cover. The BoN attributed the increase to Customer Foreign Currency (CFC) placements.

Outlook

The cumulative credit outstanding fell in March as debt repayments by corporates outpaced credit uptake by individuals. As mentioned earlier in the report, the quicker year-on-year PSCE growth rate is mainly due to base effects, following a nearly 1.0% m/m drop in credit outstanding in March 2022. The subsequent increase in April 2022 of 1.6% m/m should result in a slower annual increase in April 2023 (closer to 2.5% y/y), all else equal.

Corporate credit uptake remains low, with only short-term ‘other loans and advances’ and instalment credit exhibiting positive growth on an annual basis, with the latter primarily from a low base. Credit uptake by individuals is faring better, by comparison, although the annual growth is primarily driven by short-term credit uptake in the form of credit card debt, and personal- and term loans.

Overall PSCE growth continues to trend well below inflation. We do not expect this to change in the short-term, given that inflation remains sticky after March’s print came in at 7.2% y/y and continues to trend above our forecasts.