Overall

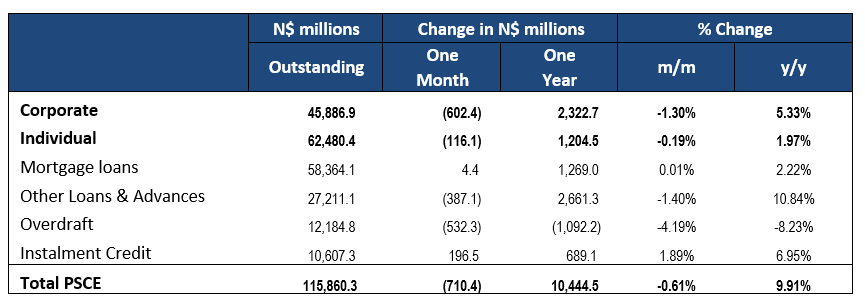

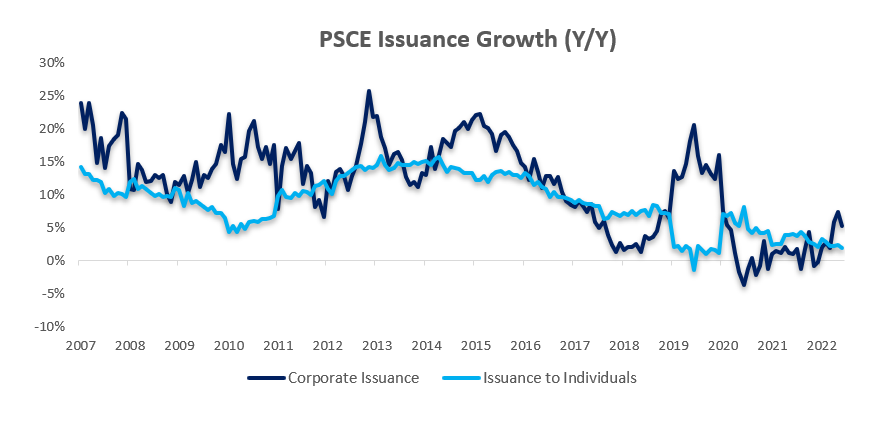

Private sector credit extension (PSCE) declined by N$710.4 million or 0.6% m/m in June, the first month-on-month decline this year, bringing the cumulative credit outstanding to N$115.9 billion. On a year-on-year basis, PSCE grew by 9.9% y/y in June, compared to the 11.0% y/y growth recorded in May. The growth figure slowed from 3.9% to 2.8% y/y in June when adjusted for the large increases in claims on non-resident private sectors observed between January and March this year. On a 12-month cumulative basis N$10.4 billion worth of credit was extended to the private sector. Of this cumulative issuance, individuals took up N$1.21 billion, corporates increased their borrowings by N$2.32 billion and the non-resident private sectors took up N$6.92 billion.

Credit Extension to Individuals

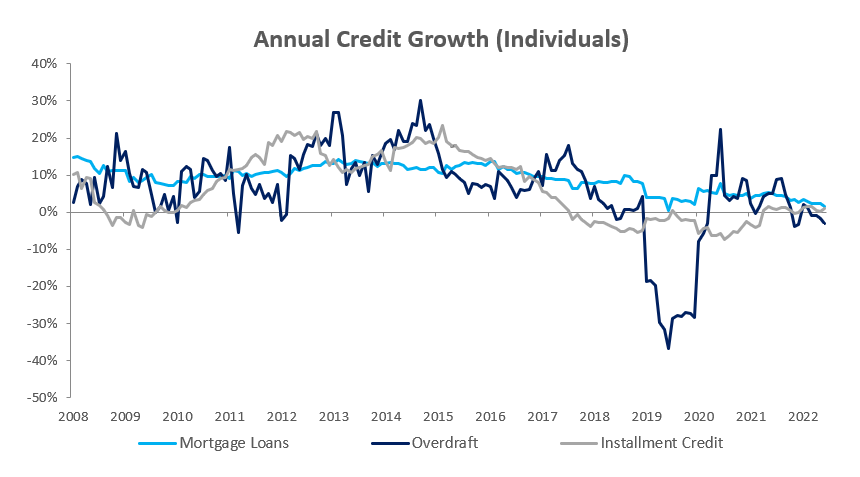

Credit extended to individuals contracted by 0.2% m/m while year-on-year growth slowed to 2.0% y/y in June compared to the 2.4% y/y increase recorded in May. The decline in credit extended to individuals is primarily due to weaker demand for mortgage and overdraft credit by households during June. Mortgage loans to individuals contracted by 0.5% m/m but increased 1.5% y/y. This is the lowest year-on-year growth in mortgage loans observed since June 2019. Mortgage loan growth has been slowing since July 2020 on an annual basis, possibly indicating that the willingness of commercial banks to extend credit to individuals to buy, renovate or build new houses since the pandemic remains low. Overdraft facilities to individuals contracted by 2.1% m/m and 3.0% y/y. Other loans and advances (consisting of credit card debt, personal- and term loans) rose by 1.5% m/m and 5.8% y/y, continuing a steady rise since April 2021.

Credit Extension to Corporates

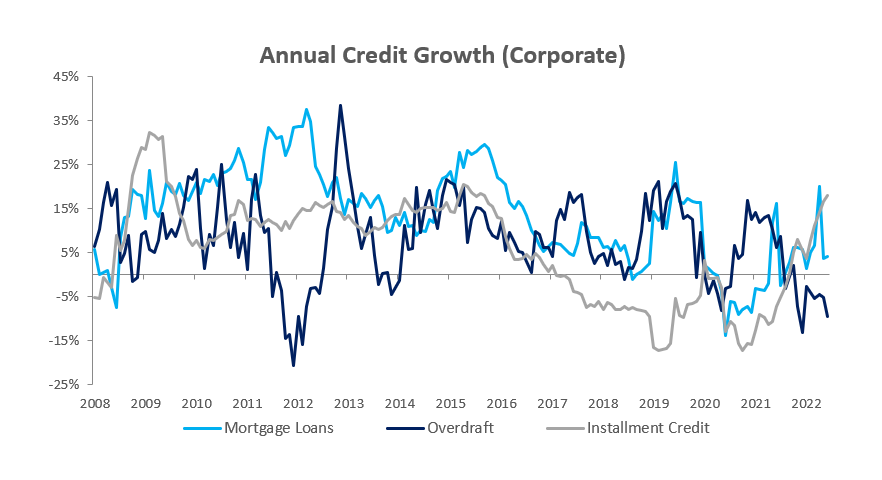

Credit extended to corporates grew by 5.3% y/y in June, slowing from the 7.4% y/y increase recorded in May. On a month-on-month basis, credit extension to corporates fell by 1.3% m/m. According to the Bank of Namibia (BoN), the decline in credit extended to corporates is mainly due to weaker demand for short-term credit facilities, specifically in the energy, mining, and commercial services sectors. Overdraft facilities to corporates contracted by 4.4% m/m and 9.4% y/y, the 8th consecutive contraction on a year-on-year basis. Other loans and advances to corporates contracted by 3.1% m/m but increased 14.1% y/y, albeit from a low base. Instalment credit by corporates rose by 4.6% m/m and 18.1% y/y. While the year-on-year growth in instalment credit was achieved from a low base, the month-on-month increase was the largest since June 2019, with the amount outstanding starting to reach pre-pandemic levels. Mortgage loans to corporates rose by 1.2% m/m and 3.6% y/y.

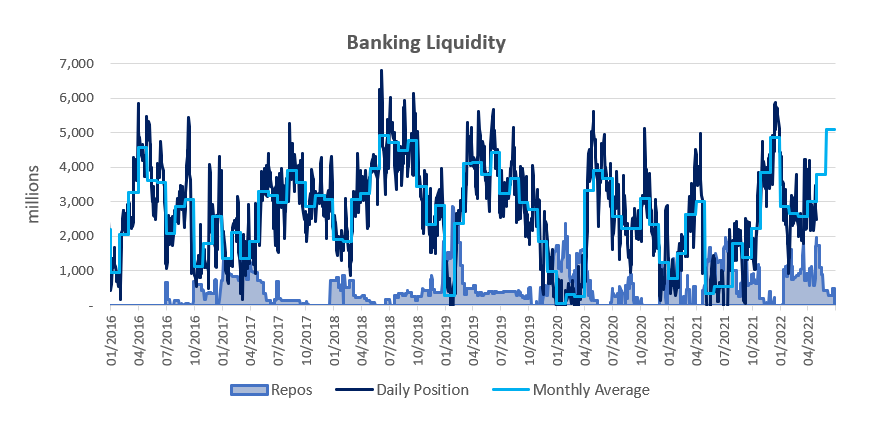

Banking Sector Liquidity

The overall liquidity position of the commercial banks continues to rise. Commercial banks’ liquidity increased by N$1.31 billion to an average of N$5.10 billion in June. According to the BoN, the rise in the market cash position is partly attributable to an increase in diamond sales proceeds and investment liquidations by asset managers in preparation for tax payments. The repo balance rose marginally to N$488.0 million at the end of the month, after ending at N$438.9 million in May.

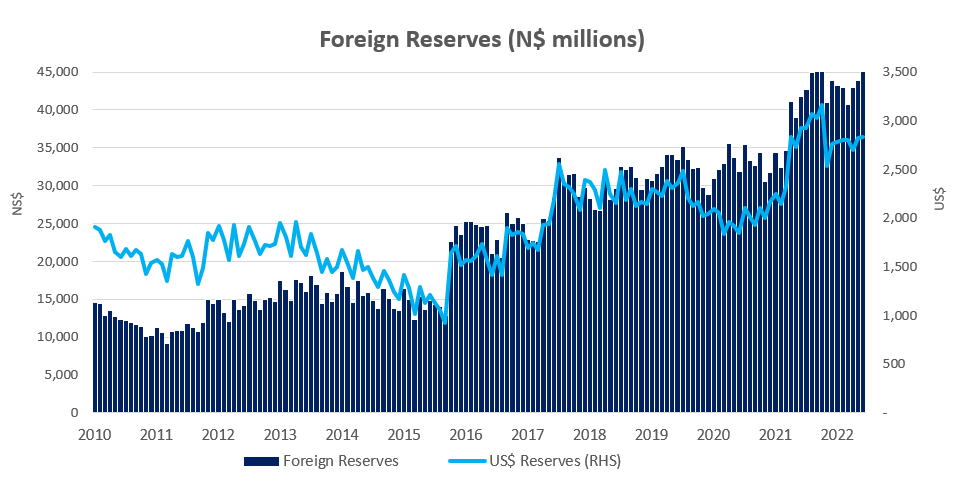

Reserves and Money Supply

Broad money supply (M2) rose by N$829.5 million or 5.4% y/y to N$128.4 billion, according to the BoN’s latest monetary statistics. The BoN ascribed the increase in M2 growth to a rise in net claims on central government by the depository corporations, as commercial banks increased their holdings of government securities. Foreign reserve balances rose by 4.7% m/m or N$2.07 billion to a total of N$46.0 billion. The BoN ascribed the rise in the foreign reserve stock to increased commercial bank foreign currency inflows and Rand seigniorage payments.

Outlook

While PSCE grew by 9.9% y/y in June, above the average for the year to date, it should be noted that it has been achieved from the unusually large increase in credit extensions to non-residents observed earlier this year. When the growth figure is normalised as noted above, year-on-year PSCE growth slows to a mere 2.8% and remains subdued when compared to pre-pandemic levels. Overall, credit uptake by both individuals and businesses remains relatively muted partly due to a lack in their ability to take up credit under the prevailing inflationary and monetary tightening environment. We expect PSCE growth to remain low while the BoN continues its monetary tightening stance in line with other central banks around the world. The BoN’s MPC is expected to raise the repo rate by 75 basis points at its next MPC meeting scheduled for 17 August 2022 in line with the rate hike by the SARB at its last MPC meeting held in July.