Overall

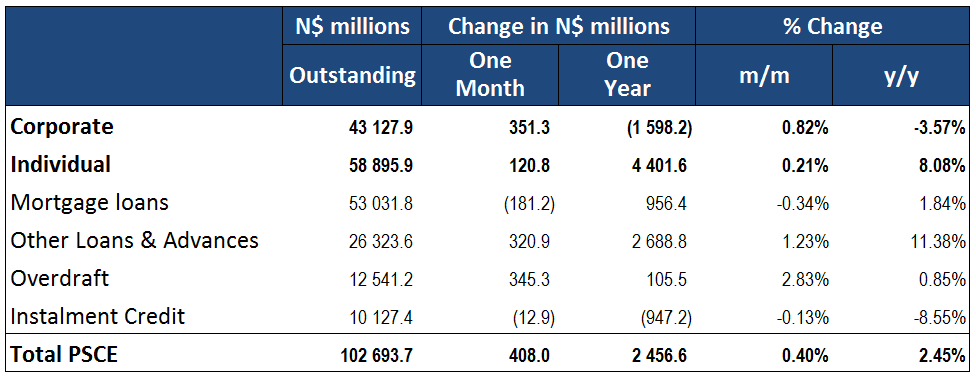

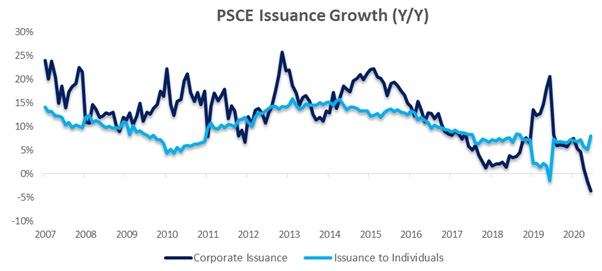

Total credit extended to the private sector (PSCE) increased by N$408.0 million or 0.40% m/m in June, bringing the cumulative credit outstanding to N$102.69 billion. On a year-on-year basis, private sector credit increased by 2.5%y/y in June, compared to 1.8% y/y in May. Although a slight uptick from the previous month, this represents the second-lowest level of annual growth on our records dating back to 2002. On a rolling 12-month basis, N$2.457 billion worth of credit was extended to the private sector. Of this cumulative issuance, individuals took up N$4.402 billion, while corporates decreased their borrowings by N$1.598 billion and the non-resident private sector paid back N$346.92 million of total outstanding loans and advances.

Credit Extension to Individuals

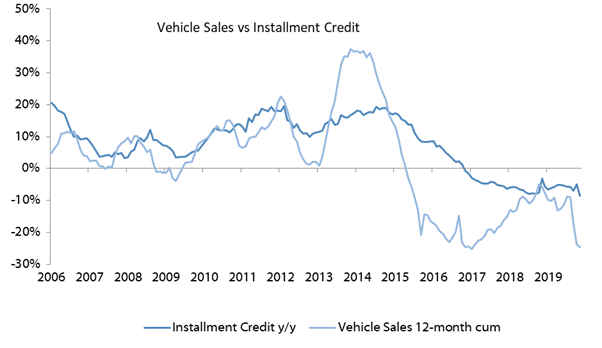

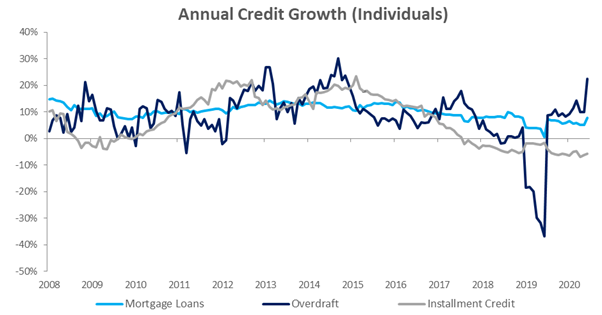

Growth in credit extended to individuals ticked up to 8.1% y/y from the 5.2% y/y in May. On a monthly basis, household credit increased by 0.3%. The increase was underpinned by strong mortgage growth of 0.4% m/m and 7.8% y/y, which could be indicative of a slight revival in property transactions. Instalment credit and leasing transactions (which have now been combined as a category by the BoN), remained flat m/m and contracted by 5.8% y/y as vehicle sales remain low, contracting by 24.7% y/y on a 12-month cumulative basis.

Overdraft facilities extended to individuals have displayed a sharp jump, increasing by 3.7% m/m and 22.4% y/y, while other loans and advances (or OLA, which is made up of credit card debt, personal and term loans) fell by 2.1% m/m and 17.7% y/y. The heightened uptake of short-term personal debt and overdrafts is a sign of a stretched consumer, many of whom will have been negatively impacted by the effect of the pandemic and resultant lockdowns.

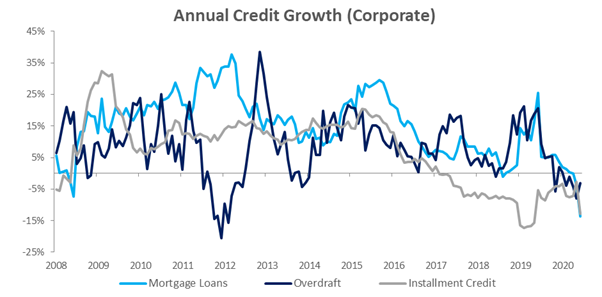

Credit Extension to Corporates

Credit extended to corporates grew by 0.8% m/m, but contracted by 3.6% y/y in June. This is the second consecutive month of year-on-year contraction, following the 1.7% y/y decline in May. This is quite a worrying trend, as corporate investments in the economy continue to slow as economic activity remains muted and corporates aim to decrease leverage where possible. Annual credit growth was negative for all corporate subcategories except for other loans and advances, which grew by 8.1% y/y. Overdraft facilities extended to corporates increased by 3.7% m/m but declined by 3.1% y/y. The contraction in instalment credit continued unabated in June, declining by 0.3% m/m and 12.9% y/y. Mortgage loans extended to corporates contracted by 2.7% m/m and 13.7% y/y.

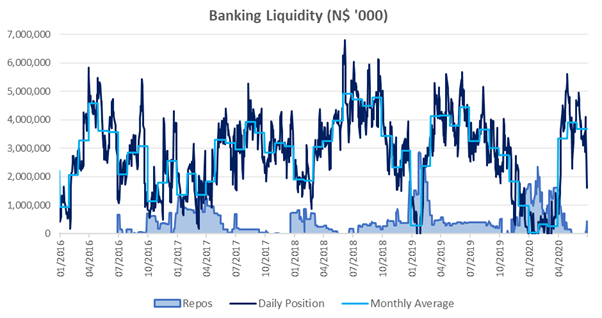

Banking Sector Liquidity

The average liquidity position of commercial banks declined slightly in June, decreasing by N$232.1 million to an average of N$3.672 billion. However, towards the end of the month, the liquidity position dropped down to N$1.613 billion while repos outstanding picked up from zero to N$449.7 million. The BoN ascribed the lower liquidity position due to corporate tax payments.

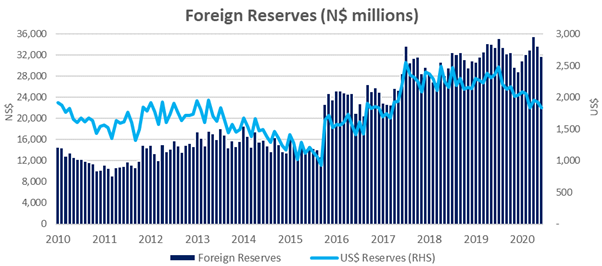

Reserves and Money Supply

Broad money supply rose by N$15.85 billion or 14.7% y/y in June, as per the BoN’s latest monetary statistics release. Foreign reserve balances declined by 5.9% m/m or N$1.984 billion to N$31.76 billion in June. According to the BoN, the decline is due to government payments as a result of efforts to mitigate the effects of the COVID-19 pandemic coupled with the redemption of the JSE bond.

Outlook

Private sector credit extension remains subdued at the end of June, ticking up slightly to 2.5% y/y from 1.8% y/y in May. Rolling 12-month issuance has ticked up slightly to N$2.46 billion. However, cumulative 12-month private sector credit issuance is still down 63.1% from the N$6.65 billion figure as at June 2019. Most of the growth has been from mortgages to individuals where the 12-month cumulative issuance stands at N$2.93 billion, which may indicate some revival of activity in the Namibian property market. However, corporates have been reducing their debt over the last 12 months and have seen N$1.60 billion in repayments as businesses de-risk and deliver their operations. Despite Namibian interest rates now being at their lowest levels yet, and expectations are for possibly one more rate cut, this has not seemed to stimulated lending much. Economic activity remains muted and the outlook for the next two years remains extremely uncertain as the global effect of the pandemic and lockdowns still have to run their course. As a result, we do not expect to see a strong recovery in credit extension in the medium term.