Overall

Private sector credit (PSCE) decreased by N$318.7 million or 0.30% m/m in July. This decrease brings the total cumulative credit outstanding to N$105.0 billion. On a year-on-year basis, private sector credit increased by 2.72%. Over the past 12 months, N$2.78 billion in credit was extended to the private sector. Cumulative 12-month issuance is therefore up 47% from the N$1.89 billion issued by this time in 2020. Individuals have taken up the bulk of this issuance with debts over the past 12 months summing to N$2.18 billion or 78% of the total debt issuance.

Credit Extension to Individuals

Credit extension to individuals increased by 3.69% y/y, but fell by 0.05% m/m in July. This month-on-month decrease was driven by 1.0% m/m and 0.4% m/m contractions in other loans and advances (credit card debt, personal- and term loans) and instalment credit, respectively, offsetting a 0.2% m/m increase in mortgage loans. However, instalment credit expanded by 0.6% y/y in July. Mortgage loans extended to individuals increased by 4.4% y/y, slightly slower than the 4.9% y/y increase recorded in June. Individual overdrafts rose by 8.7% y/y, but by only 0.1% m/m. This comes after overdrafts fell 0.9% m/m in June.

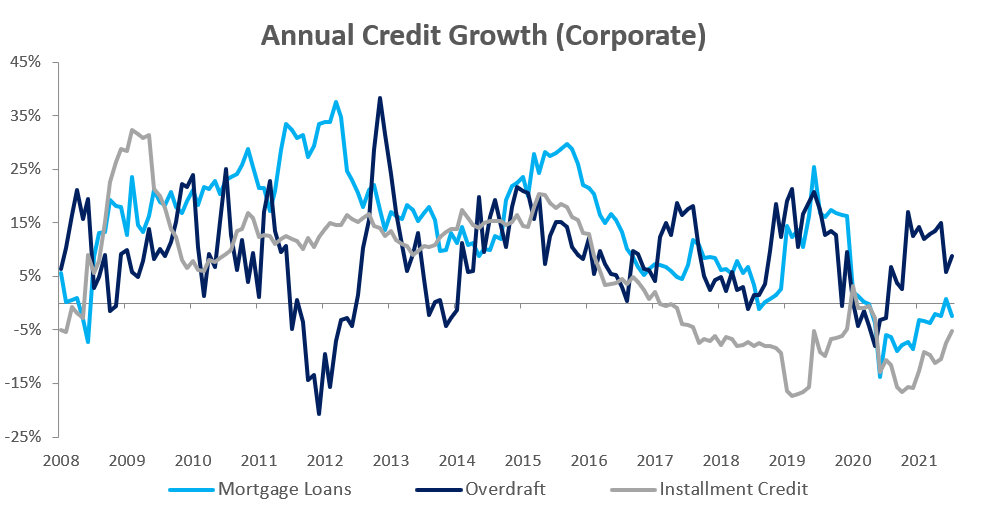

Credit Extension to Corporates

Credit extended to corporates contracted by 0.52% m/m while increasing by 1.78% y/y in July. This year-on-year increase in corporate credit extensions is in keeping with the trend in 2021, with only low single digit increases recorded thus far. Corporate overdrafts rose by 0.4% m/m and 8.7% y/y in July. Instalment credit increased by a more moderate 0.7% m/m and 0.6% y/y. Mortgage loans decreased by 1.7% m/m but rose by 4.4% y/y this July. This month-on-month decrease is unsurprising as new corporate mortgage loan issuance has been sporadic throughout 2021, with only January, April and June seeing month-on-month increases, while February, March and now July have seen month-on-month decreases in issuance.

Banking Sector Liquidity

The overall liquidity position of Namibia’s commercial banks was near enough unchanged in July, rising by only N$555,000 to an average of N$552.8 million. July saw a marked decrease in the balance of repo’s outstanding – as the starting balance outstanding of N$1.65 billion was cut to N$1.02 billion by the end of the month.

Reserves and Money Supply

The Bank of Namibia’s (BoN) latest figures show Broad Money Supply contracting by N$2.28 billion or 1.8% y/y in July after registering successive year-on-year contractions in May and June. As of the end of July, money supply stands at N$121.5 billion. The central bank’s stock of international reserves rose by 2.1% m/m to N$42.6 billion at the end of July. The BoN attributes the boost to the inflow of SACU receipts during the period.

Outlook

After large increases in credit extension to the private sector in the second half of 2020, with total outstanding private sector debt rising from N$102.2 billion in June 2020 to N$105.4 billion in December, PSCE growth in 2021 has been more subdued. Total PSCE has hovered between N$105.6 billion and N$105.0 billion this year. The marginal 0.30% m/m decrease in July came off the back of a 0.29% increase the previous month. Without making too many bold inferences from the data it suffices to say that macro-economic conditions remain uncertain in Namibia.

We expect the BoN to mirror South Africa and hold interest rates steady for the remainder of 2021 to aid overindebted consumers and to attempt to stimulate the economy. Namibian individuals continue to take on the most debt in this low-interest rate environment. Until larger businesses are in a financial position, and develop an appetite, to take on more debt it is unlikely that low interest rates and moderate increases in private sector credit extension will have a major positive impact on the macro economy.