Overall

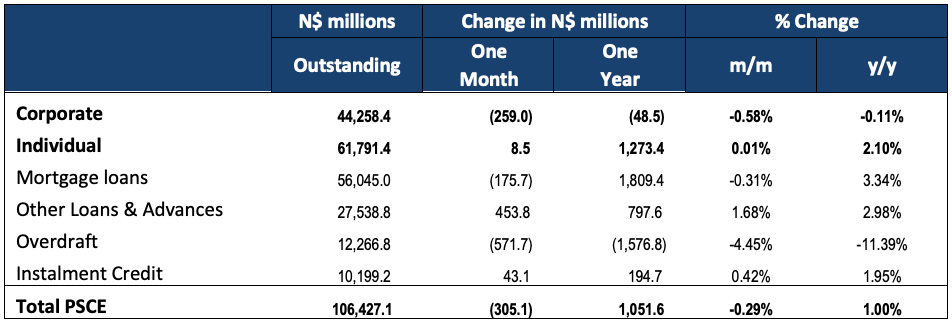

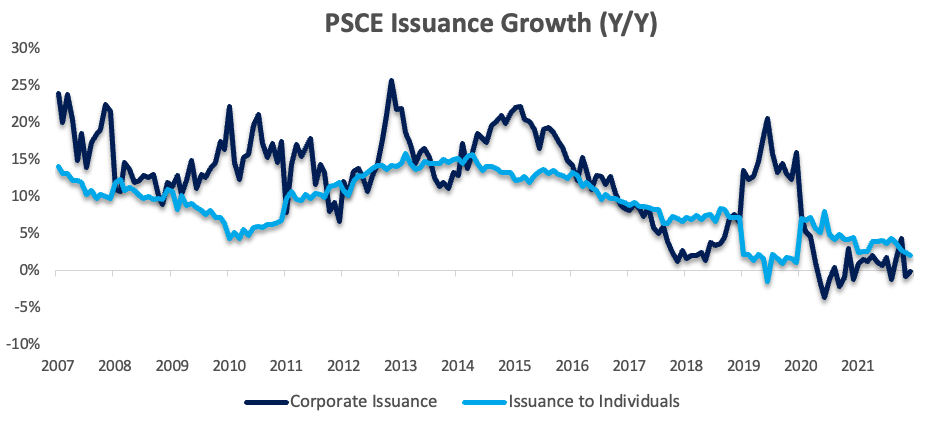

Private sector credit (PSCE) declined by N$305.1 million or 0.29% m/m in December, bringing the cumulative credit outstanding to N$106.4 billion. PSCE increased by just 1.0% y/y in 2021, following an already slow increase of 1.6% y/y in 2020, and the slowest increase on our records dating back to 2004. On a 12-month cumulative basis N$1.05 billion worth of credit was extended to the private sector. Of this cumulative issuance, individuals took up N$1.27 billion, while corporates reduced their borrowings by N$48.5 million and the non-resident private sector repaid N$173.3 million of their borrowings.

Credit Extension to Individuals

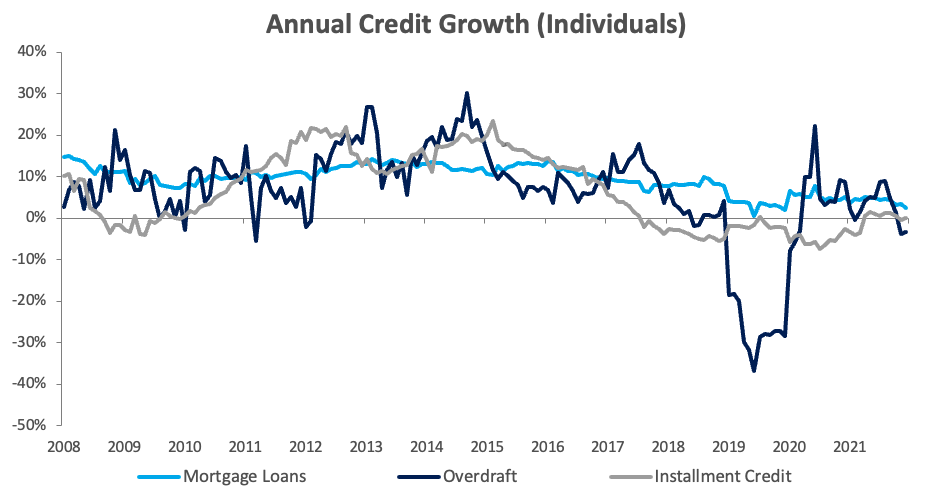

Credit extended to individuals remained steady in December. On a year-on-year basis, credit extended to individuals rose by 2.1% in December, although the growth has been slowing for four consecutive months. Overdraft facilities to individuals increased by 0.4% m/m, but declined 3.3% y/y in December. Other loans and advances (consisting of credit card debt, personal- and term loans) rose by 0.2% and 2.8% y/y. Growth in mortgage loans to individuals has been slowing since April, declining by 0.3% m/m but increasing by 2.6% y/y.

Credit Extension to Corporates

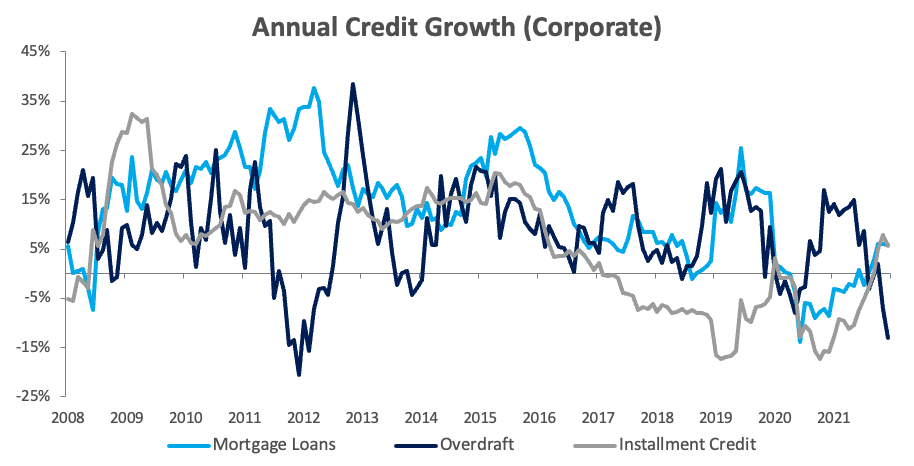

On both a monthly and annual basis credit extended to corporates contracted for a second consecutive month, decreasing by 0.58% m/m and 0.11% y/y, as corporates continued to de-lever their balance sheets in 2021. Overdrafts declined by 5.5% m/m and 13.1% y/y. Mortgage loans to corporates fell by 0.3% m/m, but rose by 5.8% y/y. Instalment credit growth remained subdued, decreasing by 1.8% m/m, but increasing by 5.6% y/y, although it is from a very low base. Other loans and advances rose by 2.5% m/m and 3.1% y/y in December.

Banking Sector Liquidity

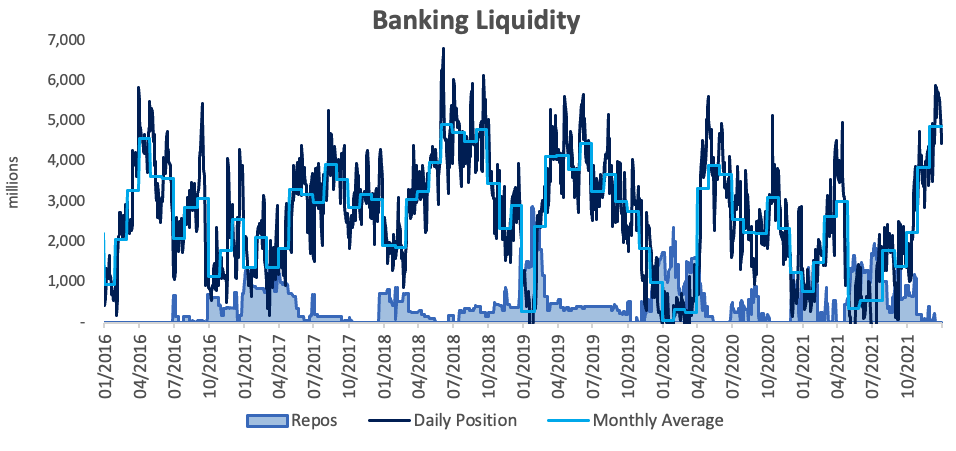

The overall liquidity position of the commercial banks strengthened during December, rising by N$1.01 billion to an average of N$4.86 billion. The BoN ascribed the increase to seasonal movements driven by corporates, in preparation for their annual tax payments. The strong liquidity position meant that the repo balance stood at zero at the end of the month after ending November at N$393.7 million.

Reserves and Money Supply

According to the BoN’s latest monetary statistics, Broad Money Supply (M2) rose by N$5.30 billion or 4.2% y/y in December to N$129.9 billion. The stock of international reserves increased by 6.9% m/m to N$43.9 billion in December. The increase was attributed to increased foreign asset swaps during the month, according to the BoN.

Outlook

Overall, PSCE growth remained very subdued in 2021, with half of the months recording a contraction on a month-on-month basis. The 12-month issuance of N$1.05 billion is 35.7% lower than the issuance of 2020. Historically-low interest rates continued to provide overindebted consumers and businesses relief in the form of lower interest payments, but did not stimulate lending as consumer and business confidence remained low.

We expect the BoN to raise rates by 25 basis points at its February MPC meeting, following the SARB’s decision to do so in January. The interest rate buffer between the two central banks that has been in place for most of 2020 and 2021 has been closed, after the BoN decided to not raise rates in December. Namibia’s reserve level remains strong, and we therefore do not expect the BoN to raise rates higher than SA’s in the short-term. Inflationary pressure is gradually picking up in both South Africa and Namibia and as a result we expect both central banks to increase rates between 75- and 125-basis points during the year.