Overall

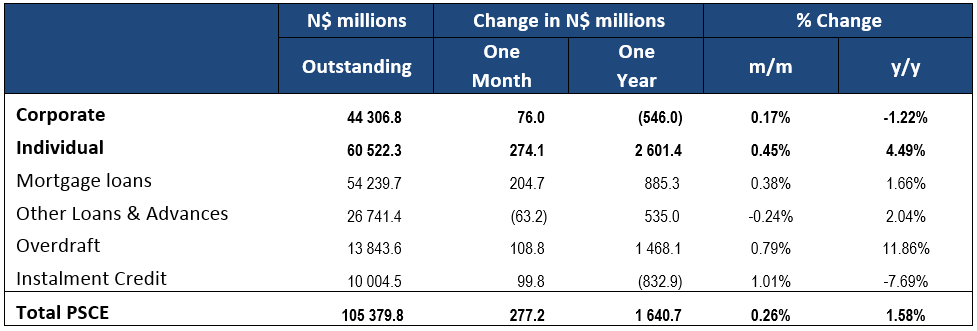

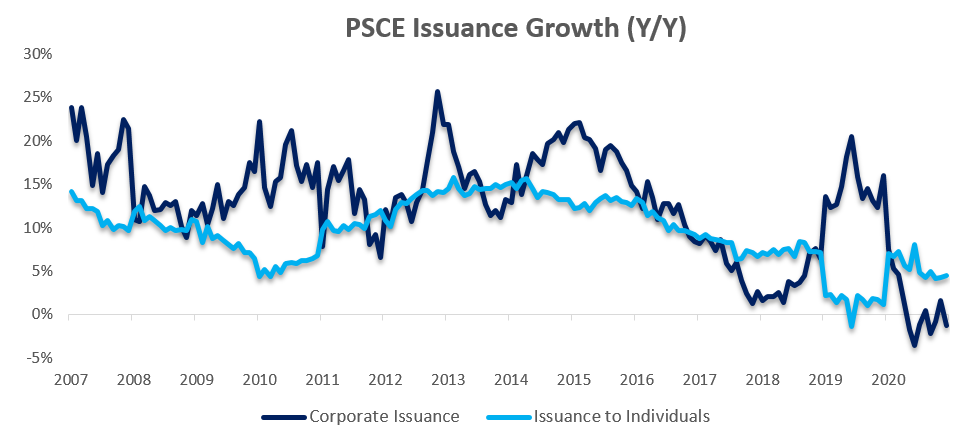

Private sector credit (PSCE) increased by N$277.2 million or 0.3% m/m in December, bringing the cumulative credit outstanding to N$105.4 billion. On a year-on-year basis, private sector credit increased by 1.6% in December, compared to 2.7% in November. On a rolling 12-month basis, N$1.64 billion worth of credit was extended to the private sector. Compared to the previous year, the rolling 12-month issuance is down 75.5% from the N$6.71 billion issuance observed by the end of December 2019. Of this cumulative issuance, individuals took up N$2.60 billion, while corporates reduced their borrowings by N$546.0 million and the non-resident private sector repaid N$414.7 million of their borrowings.

Credit Extension to Individuals

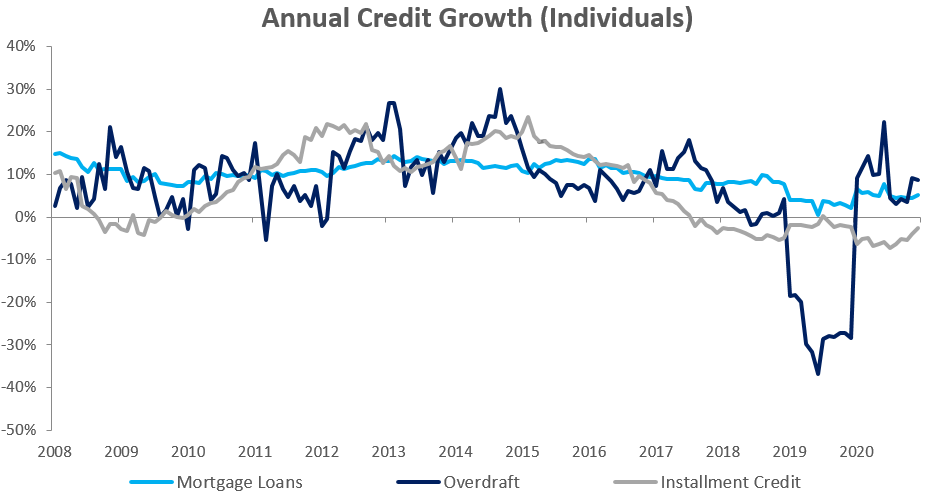

Credit extended to individuals increased by 0.5% m/m and 4.5% y/y in December, growing at a slightly quicker pace than the 4.2% y/y increase recorded in November. The month-on-month growth mostly stemmed from instalment credit which grew by 1.4% m/m. Instalment credit, however, remains down on an annual basis, falling by 2.6% y/y in December, although at a slower rate than in the prior 11 months. The value of mortgage loans extended to individuals rose by 0.5% m/m and 5.2% y/y. Overdrafts to individuals fell by 0.2% m/m, but increased by 8.6% m/m, following the strong increase of 5.6% m/m and 9.1% y/y in November.

Credit Extension to Corporates

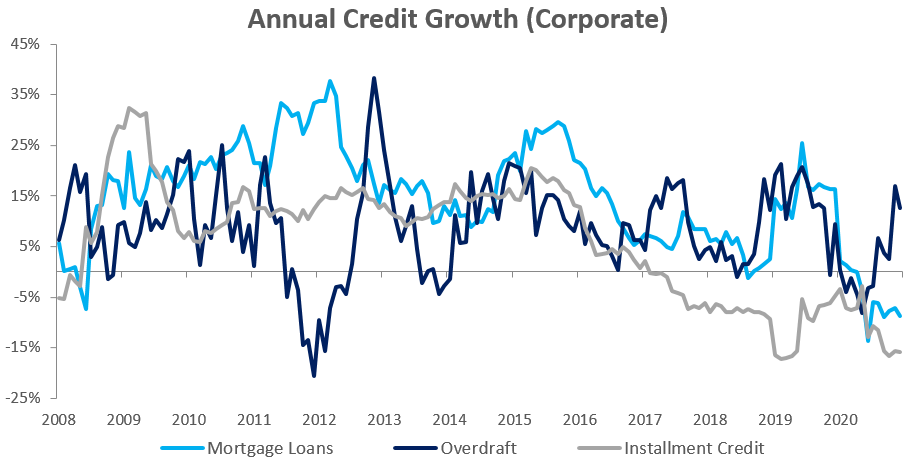

Credit extended to corporates grew by 0.2% m/m after increasing by 2.4% m/m in November. On an annual basis, credit extended to corporates contracted by 1.2% y/y. Overdrafts to corporates showed the strongest monthly increase, registering growth of 1.0% m/m and 12.6% y/y. Demand for instalment credit by corporates remained low, increasing by 0.3% m/m, but contracting by 15.8% y/y. Mortgage loans to corporates, which has been contracting on an annual basis since April 2020, remained depressed, contracting by 0.1% m/m and 8.7% y/y in December.

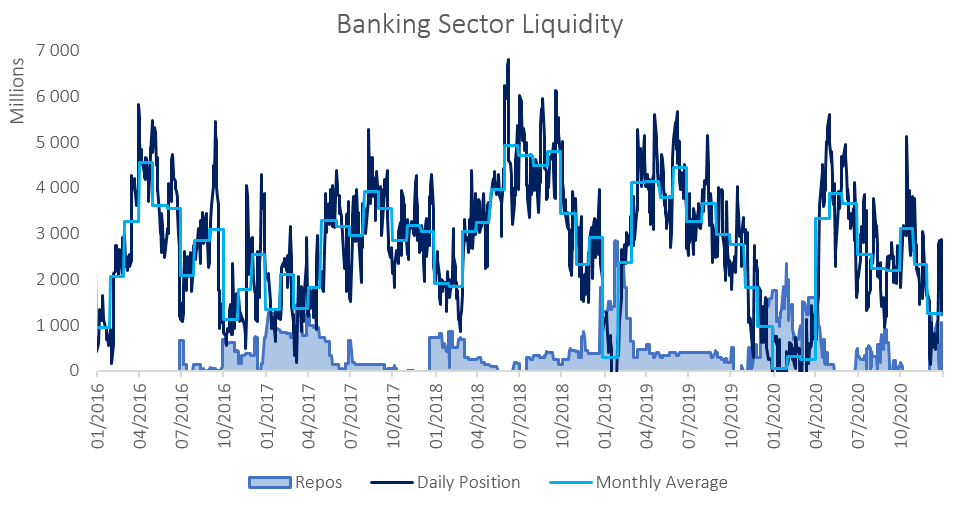

Banking Sector Liquidity

The overall liquidity position of commercial banks deteriorated significantly during December, declining by N$1.09 billion to reach an average of N$1.25 billion. The Bank of Namibia ascribed the decline to periodic corporate tax payments to the government during December. The relatively low liquidity position has prompted commercial banks to utilize the BoN’s repo facility, with the balance of repo’s outstanding increasing from N$0 at the start of December to N$1.04 billion at the end of the month.

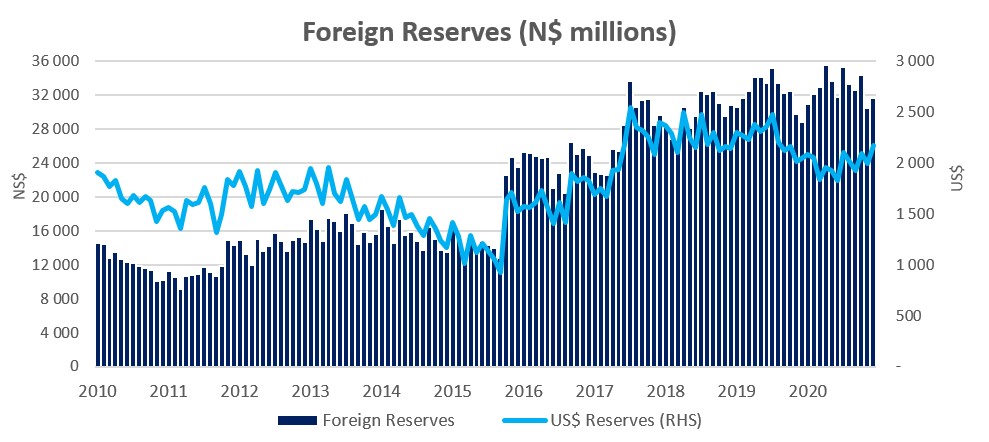

Reserves and Money Supply

Broad money supply rose by N$12.2 billion or 7.4% y/y in December, as per the BoN’s latest monetary statistics release. Foreign reserve balances rose by N$1.23 billion or 4.0% m/m to N$31.75 billion in December. According to the BoN, the increase is due to net inflows of rand currency from commercial banks during the month.

Outlook

Overall, private sector credit growth remained depressed in 2020, slowing from the roughly 6% y/y growth observed at the beginning of the year to the 1-2% range at the end of the year. The slowdown in growth was especially evident from May onwards, as corporates started repaying their debt. What is also evident from the data is that mortgage demand by individuals was relatively strong compared to corporate demand for mortgages, with the average annual growth rate for individuals registered at 5.4% compared to the average corporate growth rate of -4.9% in this category. Corporate demand for instalment and leasing credit contracted sharply during the year, indicating that corporates are hanging on to their existing fleet and machinery. This is to be expected in the current economic climate where the is little reason for businesses to expand their current operations as no significant improvement in economic growth is expected.