Overall

Total credit extended to the private sector (PSCE) increased by N$774.1 million or 0.76% m/m in August, bringing the cumulative credit outstanding to N$103.0 billion. On a year-on-year basis, private sector credit extension increased by 2.2% in August, somewhat quicker than the 1.9% growth recorded in July. On a rolling 12-month basis N$2.23 billion was extended to the private sector, with individuals taking up N$2.41 billion while N$188.9 million was extended to corporates. The non-resident private sector decreased borrowings by N$366.7 million.

Credit Extension to Individuals

Credit extended to individuals remained steady m/m, but increased by 4.3% y/y. The only category which recorded positive growth on a monthly basis was mortgage loans, which grew by 0.3% m/m and 4.4% y/y. Over the last twelve months N$1.73 billion worth of mortgage loans were extended to individuals, making up the majority of overall credit extended over the period. Instalment credit and leasing transactions (which have been combined as a category by the BoN) contracted by 0.4% m/m and 6.3% y/y, also reflected in the low demand for new vehicles. The other loans and advances category, comprising of shorter-term credit such as personal and card loans declined by 0.9% m/m, but rose by 12.4% y/y.

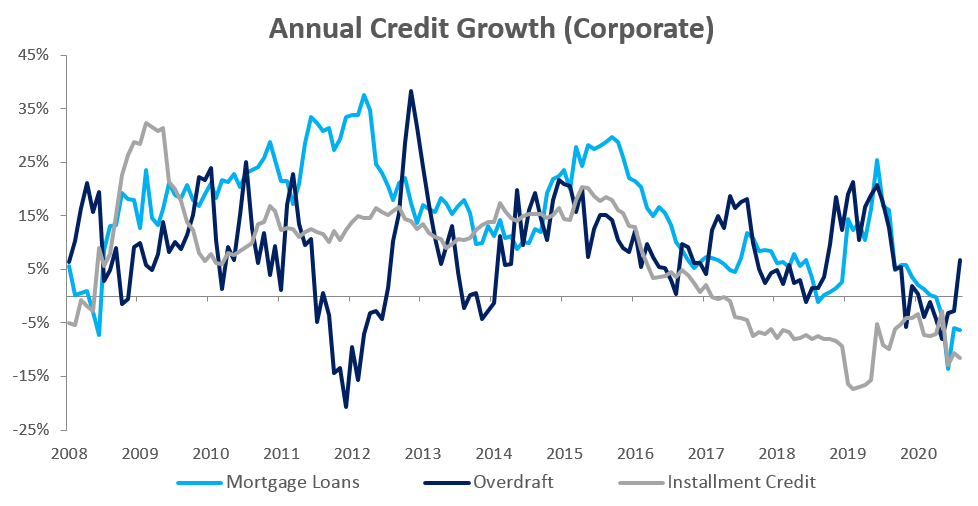

Credit Extension to Corporates

Credit extended to corporates grew by 1.8% m/m and 1.7% y/y in August, following the 1.5% m/m and 1.2% y/y contraction in July. The growth was mostly driven by increased demand of overdraft facilities by corporates, as the category recorded relatively strong growth of 6.5% m/m and 6.7% y/y. Mortgage loans extended to corporates contracted by 0.8% m/m and 6.3% y/y. The persistent contraction in installment credit continued in August, declining by 1.2% m/m and 11.6% y/y. Corporates continued to rely on short-term credit with the other loans and advances recording growth of 1.6% m/m and 5.3% y/y in August.

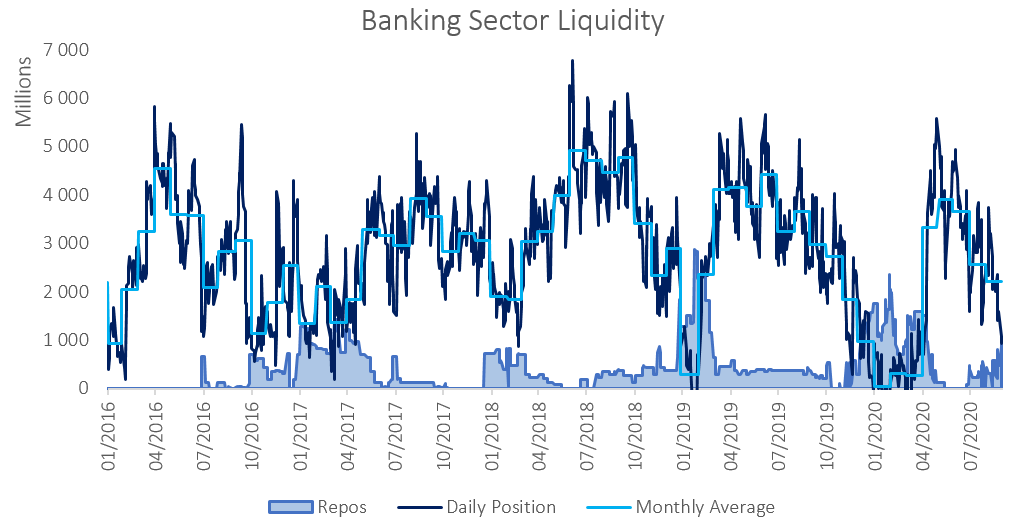

Banking Sector Liquidity

The overall liquidity position of commercial banks declined by N$341.1 million in August to reach an average of N$2.23 billion. The Bank of Namibia attributed the decline to an increase in net ZAR outflows as well as investments into government debt instruments. The outstanding balance of repo’s increase from N$429.8 million at the start of August to N$899.8 million by month end.

Reserves and Money Supply

As per the BoN’s latest money statistics release, broad money supply rose by N$12.6 billion or 11.3% y/y in August. Foreign reserve balances fell by N$2.01 billion or 5.7% m/m to N$33.4 billion in August. According to the BoN, the decline in foreign reserves was mainly due to net Rand purchases by commercial banks as well as increased foreign payments by the government during the month.

Outlook

As expected, the various rate cuts by the BoN thus far this year have not led to a significant increase in uptake of credit. With economic activity remaining very low and banks being prudent in extending credit, most of the credit uptake in August has been short-term borrowings by corporates. Continued reliance on short-term credit is a sign of businesses that are under financial pressure as short-term credit is not typically used to invest in capital projects. The uptake in mortgage loans by individuals is somewhat encouraging, although it could simply be that individuals are taking advantage of the low interest rate to borrow against their existing home loans as it is a relatively cheap source of funding. There are very few catalysts for economic growth at present, and as a result we do not expect to see a recovery in credit extension in the short term.