714 new vehicles were sold in October, the second lowest monthly sales figures for 2021. This comes after 767 vehicles were sold in September. Fewer passenger vehicles, light commercial vehicles and heavy commercial vehicles were sold in October than in September. Only the number of medium commercial vehicles sold increased, from 16 in September to 22 in October. Year-to-date, a total of 7,935 new vehicles have been sold. Despite the low monthly sales figure, new vehicle sales increased by 27.3% y/y in October. On a 12-month cumulative basis, vehicle sales have grown by 19.7% to 9,339.

356 new passenger vehicles were sold in October, 24 fewer than in September. This translates to a 6.3% m/m decrease, but a 19.5% y/y increase. On a 12-month cumulative basis, new passenger vehicle sales have increased by 38.0% y/y to 4,414. Despite being a somewhat weaker month for passenger vehicle sales, October’s sale figure is not far off the average monthly sales figure for the past 12 months.

Total commercial vehicle sales declined by 7.5% m/m but increased by 36.1% y/y in October. The biggest month-on-month decline in both absolute number and percentage terms came in the heavy commercial vehicles category. The 41 heavy commercial vehicles sold is 26 fewer than in September, representing a 38.8% m/m decrease in sales. That said, heavy commercial vehicle sales are up 46.4% y/y. Light commercial vehicle sales followed a similar pattern. 295 light commercial vehicle sales in October translates to a 3.0% m/m decrease, but 35.9% y/y increase in sales. 22 medium commercial vehicles were sold in October, an increase of 37.5% m/m and 22.2% y/y.

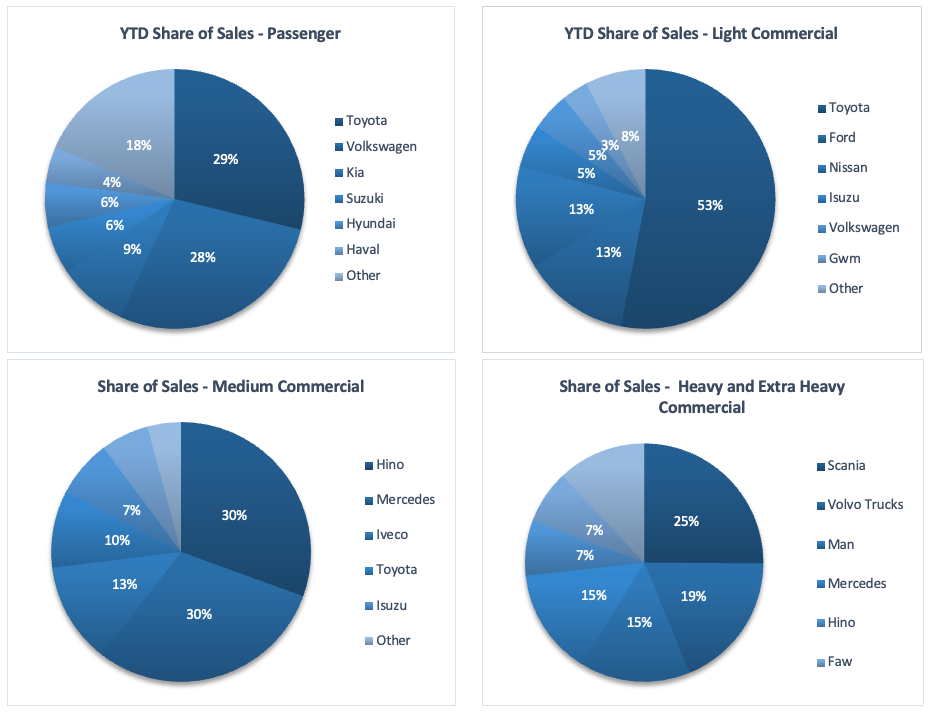

Toyota and Volkswagen remain the pre-eminent brands in the passenger vehicle market. Toyota’s year-to-date market share is 29% and Volkswagen’s is 28%. To illustrate their dominance, even if the market shares of the next four largest brands are combined (Kia, Suzuki, Hyundai and Haval, in that order) their stake is still smaller than that of Volkswagen.

On a year-to-date basis, Toyota has the largest market share of light commercial vehicles. Toyota’s market share in the category declined marginally from 54% in September to 53% in October. The medium commercial vehicles sector remains more competitive, with both Hino and Mercedes taking a 30% share of the market. Scania, Volvo and Man are the biggest players in the heavy and extra heavy commercial vehicle market, with 25%, 19% and 15% market shares respectively.

The Bottom Line

October 2021 was a below average month for both passenger and commercial vehicle sales in Namibia, all but confirming that 2021 will be the second worst year for new vehicle sales in the past decade. This did not necessarily appear to be the case at the beginning of the year. In the first two months of 2021 more new vehicles were sold than in the first two months of 2019. Then the figures started to diverge. Global headwinds in the form of supply chain bottlenecks and semiconductor shortages interacted with domestic lockdowns through-out the year to effectively drag down sales during 2021. Finally, as December usually sees below yearly-average vehicle sales, regardless of the underlying health of the economy, there is even less chance that new vehicle sales in 2021 will rise to, or past, 2019 levels.