A total of 559 new vehicles were sold in October, representing a 36.1% m/m decline from the 875 vehicles sold in September, and a 42.4% y/y contraction from the 971 new vehicles sold in October 2019. Year-to-date 6,215 vehicles have been sold of which 2,542 were passenger vehicles, 3,233 were light commercial vehicles, and 440 were medium and heavy commercial vehicles. On an annual basis, twelve-month cumulative basis, new vehicle sales continued its downward trend with 7,804 new vehicles sold over the last twelve months, a 27.3% y/y contraction from the corresponding period last year, and the lowest since March 2005.

296 new passenger vehicles were sold in October, an increase of 6.1% m/m, but contracting by 16.6% y/y. Year-to-date passenger vehicle sales rose to 2,542 units, down 34.6% when compared to the year-to-date figure recorded in October 2019. Twelve-month cumulative passenger vehicle sales fell 30.4% y/y as the number of passenger vehicles sold continued to decline. On a rolling 12-month basis, passenger vehicle sales are at their lowest level since April 2004 at 3,203 units, highlighting the severity of the slowdown in sales.

Following the strong uptick in commercial vehicle sales in September when 596 units were sold, new commercial vehicle sales fell to 263 in October, contracting by 55.9% m/m and 57.3% y/y. Of the 263 commercial vehicles sold, 217 were classified as light commercial vehicles, 18 as medium commercial vehicles, and 28 as heavy and extra heavy commercial vehicles. On a twelve-month cumulative basis, light commercial vehicle sales dropped 25.3% y/y, medium commercial vehicle sales fell 19.7% y/y, and heavy commercial vehicle sales contracted by 24.7% y/y, with all measures remaining on a downward trajectory on an annual basis.

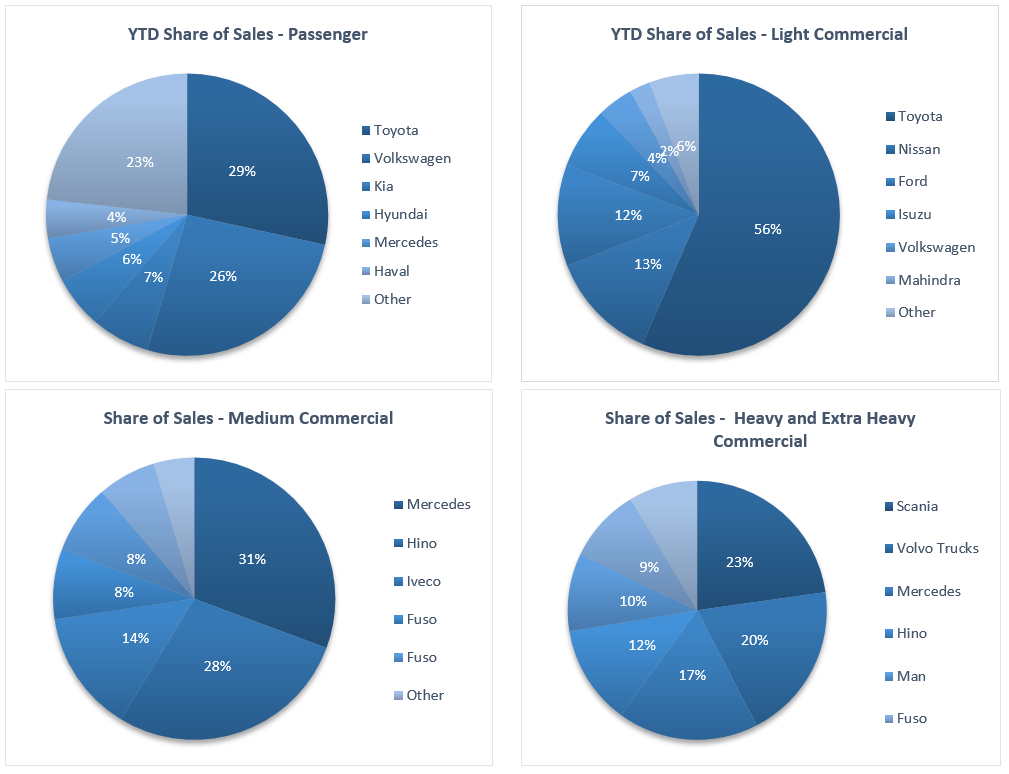

Toyota leads the passenger vehicle sales segment with 28.4% of the segment sales year-to-date, followed closely by Volkswagen with 26.1% of the market share. The two top brands maintained their large gap over the rest of the market with Kia and Hyundai following with 6.7% and 5.9% of the market respectively, leaving the remaining 32.8% of the market to other brands.

Toyota retains a strong year-to-date market share of 56.5% and remains the market leader in the light commercial vehicle segment. Nissan remains in the second position in the segment with 12.6% of the market, while Ford makes up third place with 11.6% of the year-to-date sales. Mercedes leads the medium commercial vehicle segment with 30.7% of the market. Scania remained number one in the competitive heavy and extra-heavy commercial vehicle segment with 22.8% of the market share year-to-date, closely followed by Volvo Trucks and Mercedes with 19.7% and 17.6% of the market respectively.

The Bottom Line

Following the relatively strong vehicle sales recorded in September, new vehicle sales reverted to the levels seen in prior months. The month of October has historically been one of the stronger months regarding new vehicle sales, but October 2020’s sales of 559 units lagged the average number of vehicles sold during the month by 682 vehicles. A slowdown in government spending in real terms, coupled with a halt in foreign direct investment brought on by poor policy guidance has resulted in a stagnant economy and as a result erosion of consumer and business confidence. This stagnation has been further intensified by strict lockdown measures aimed at slowing the spread of Covid-19.

While it is still early days, it does seem like the recently introduced 72-month vehicle loans have had a small positive impact on new passenger vehicle sales after two consecutive months of growth in this segment, albeit off a low base. However, as it is unlikely that economic conditions will improve significantly in the short- to medium-term, we expect the demand for new vehicles to remain low.