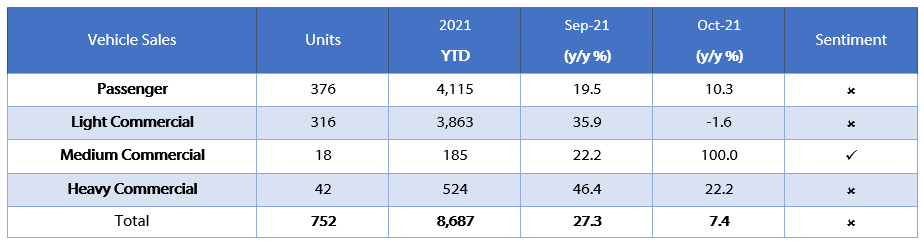

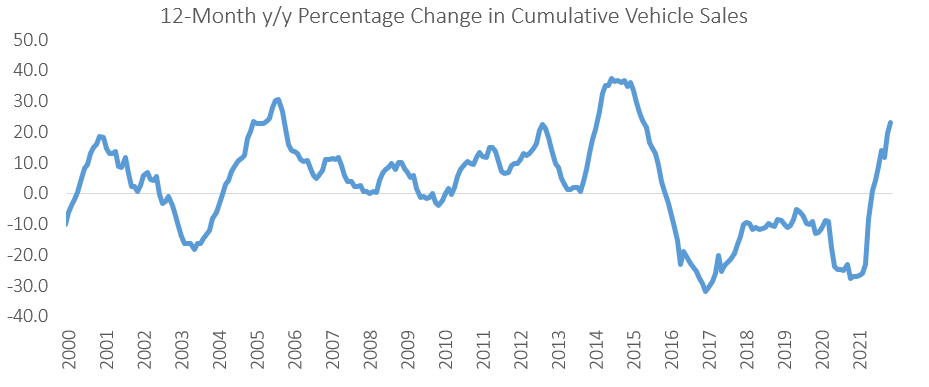

752 new vehicles were sold in November, a 5.3% m/m increase from the 714 sold in October and a 7.4% y/y increase from the 700 sold last November. In November, more passenger vehicles, light commercial vehicles and heavy commercial vehicles were sold than in October. Fewer medium commercial vehicles were sold. On a 12-month cumulative basis, vehicle sales have grown by 23.3% y/y to 9,391. Year-to-date, new vehicle sales have increased by 25.8% to 8,687. However, this is 10.5% lower than the year-to-date figure for November 2019, when 9,706 vehicles were sold. As such, 2021 remains on track to be the second worst year for new vehicle sales in the past decade.

376 new passenger vehicles were sold in November, 20 more than in October, translating to a 5.6% m/m increase and a 10.3% y/y increase. On a 12-month cumulative basis, new passenger vehicle sales have increased by 39.7% y/y to 4,449. Year-to-date, 4,115 new passenger vehicles have been sold. This represents a 43.1% increase from the year-to-date figure for November 2020, when only 2,876 new passenger vehicles were sold. Encouragingly, on a year-to-date basis, new car sales for November almost reached 2019 levels, with the 4,115 sold so far this year only 140 fewer than the 4,255 sold by November 2019. Compared to commercial vehicle sales (4,572 year-to-date sales in 2021 vs 5,451 year-to-date sales in 2019), passenger vehicle sales have enjoyed a stronger recovery in 2021.

376 commercial vehicles were sold in November, a 5.0% m/m increase and 4.7% y/y increase. 316 light commercial vehicles were sold, translating to a 7.1% m/m increase but a 1.6% y/y decrease. 18 medium commercial vehicles were sold, four fewer than the 22 sold in October. So far this year the average number of medium commercial vehicle sales per month is 17. 42 heavy commercial vehicles were sold in November, a near identical number to the 41 sold in October.

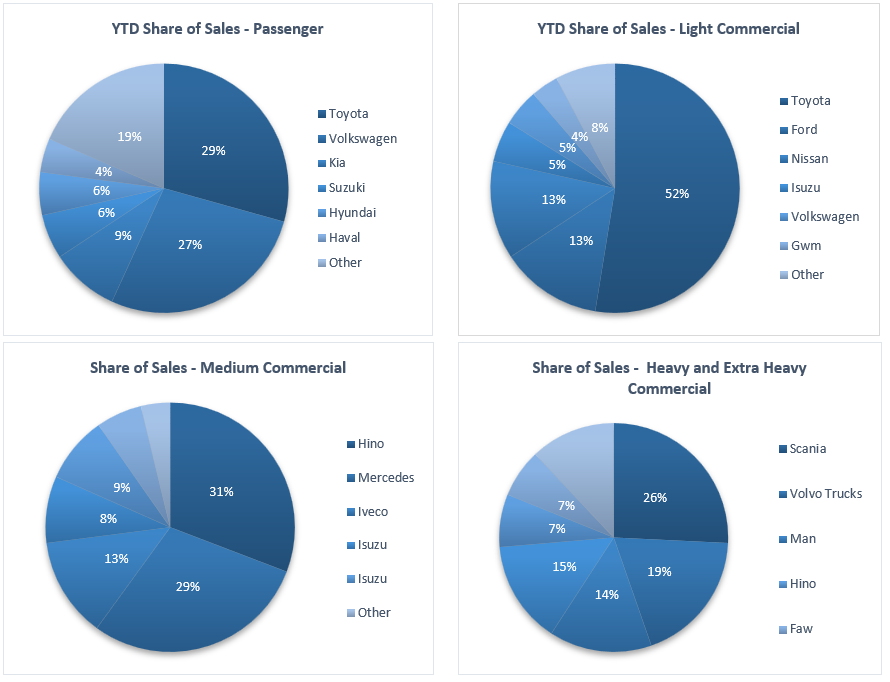

Toyota and Volkswagen retain the largest year-to-date market shares in the passenger vehicle market. Toyota’s year-to-date market share is unchanged from October’s figure of 29%, while Volkswagen’s dropped 1% m/m to 27%. Kia, Suzuki and Hyundai have market shares of 9%, 6% and 6% respectively.

On a year-to-date basis, Toyota continues to dominate the light commercial vehicles market. Toyota’s market share currently stands at 52% in 2021. Ample competition in the medium commercial vehicle sector means that Hino and Mercedes both capture a significant share of the market, with year-to-date market shares of 31% and 29% respectively. In the heavy and extra-heavy commercial vehicle market Scania, Volvo and Man continue to enjoy strong market shares, with 29%, 19% and 15% respectively.

In the context of 2021, November was an average month for vehicle sales in Namibia. Therefore, 2021 remains on track to be the second worst year for vehicle sales in the past decade. As alluded to earlier in this report, the marginal recovery from the nadir that was 2020 has been driven predominantly by a recovery in passenger vehicle sales, with commercial vehicle sales still lagging well behind 2019 levels. With persistent global headwinds such as supply chain bottlenecks and semiconductor shortages conspiring to drag down vehicle sales globally, and in Namibia, there is no guarantee that 2022 will be a markedly better year for new vehicle sales.