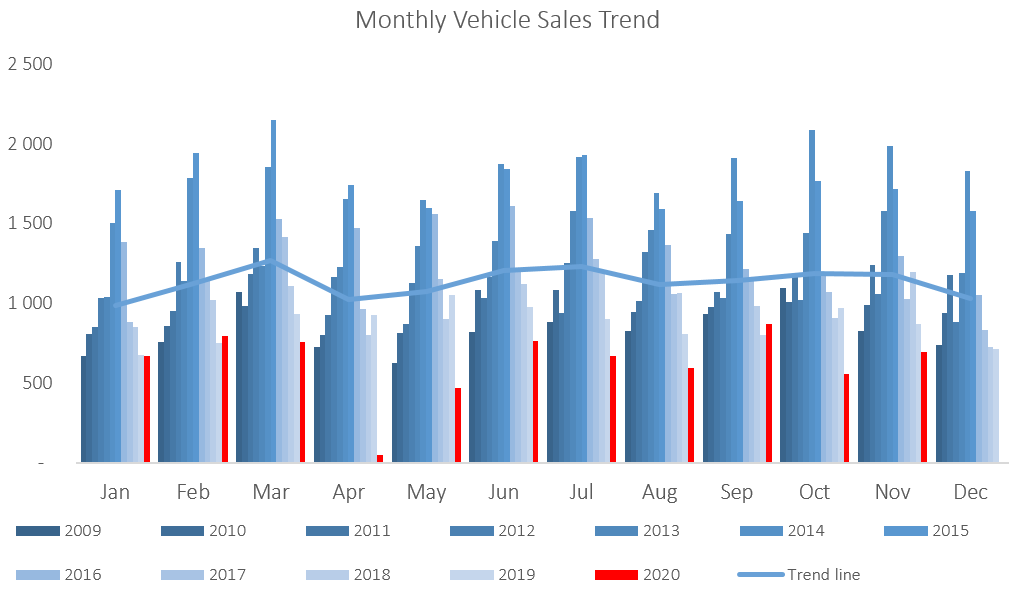

698 new vehicles were sold in November, representing a 24.9% m/m increase from the 559 vehicles sold in October, but a 20.2% y/y decline from the 875 new vehicles sold in November 2019. Year-to-date 6,913 vehicles have been sold of which 2,881 were passenger vehicles, 3,554 were light commercial vehicles, and 478 were medium and heavy commercial vehicles. On a twelve-month cumulative basis, a total of 7,627 new vehicles were sold as at 30 November, representing a contraction of 26.8% from the 10,417 sold over the comparable period a year ago.

A total of 339 new passenger vehicles were sold during November, an increase of 14.5% m/m, but a decrease of 2.3% y/y. Year-to-date passenger vehicle sales rose to 2,881, down 32.0% compared to the number of new passenger vehicles sold by November last year. On a rolling 12-month basis, passenger vehicle sales are down 29.7% y/y at 3,195 units, the lowest level since April 2004, highlighting the severity of the slowdown in sales.

Commercial vehicles sales reflect a similar picture. 359 New commercial vehicles were sold in November, representing a 36.5% m/m increase, but a year-on-year contraction of 32.0%. 321 light commercial vehicles, 9 medium commercial vehicles, and 29 heavy and extra heavy commercial vehicles were sold during the month. On a twelve-month cumulative basis, light commercial vehicle sales dropped 24.5% y/y, medium commercial vehicle sales fell 29.7% y/y, and heavy commercial vehicle sales contracted by 22.3% y/y, with all measures remaining on a downward trajectory on an annual basis.

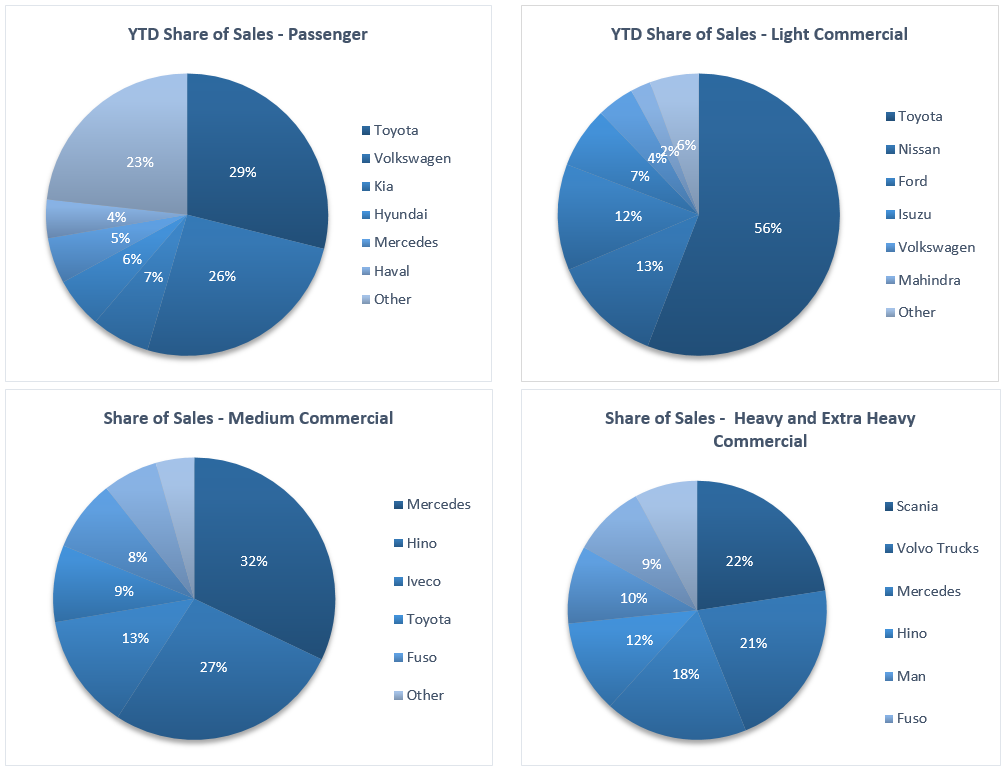

Toyota remains the leader in terms of year-to-date market share of new passenger vehicles sold with 28.9% of the market, followed closely by Volkswagen with 25.6%. The two top brands maintained their large gap over the rest of the market with Kia and Hyundai following with 6.7% and 5.8% of the market respectively. The only other manufacturer that managed to breach the 5% market share mark was Mercedes-Benz with 5.2% of the market leaving the remaining 27.7% of the market to other brands.

Toyota also remains the leader in the light commercial vehicle space with a dominant 55.9% market share. Nissan and Ford were the only other manufacturers to breach the 10% market share level with 12.7% and 12.2% of the market respectively. Mercedes leads the medium commercial vehicle segment with 32.1% of the market. Scania remained number one in the competitive heavy and extra-heavy commercial vehicle segment with 22.6% of the market share year-to-date, followed closely by Volvo Trucks and Mercedes with 21.3% and 17.9% of the market respectively.

The Bottom Line

Black Friday specials and the recent introduction of 72-month vehicle loans could likely have been the cause for the month-on-month uptick in new vehicle sales in November, however the general trend in new vehicle sales remains negative as every sector recorded lower sales than during the same month last year. The fact that the 12-month cumulative figure is hovering around levels last seen in 2005 is a consequence of the recessionary environment we find ourselves in. Eroded consumer and business confidence, coupled with government’s commitment to fiscal consolidation as well as a halt in foreign direct investment brought on by poor policy guidance means that domestic economic growth (and by extension new vehicle sales) are expected to remain muted for the foreseeable future.