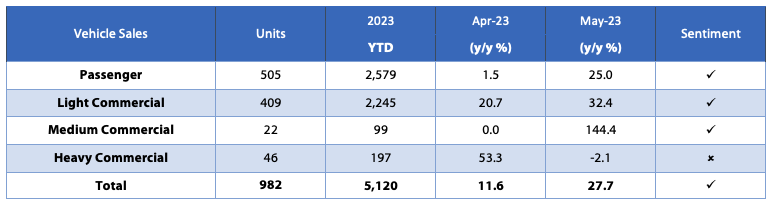

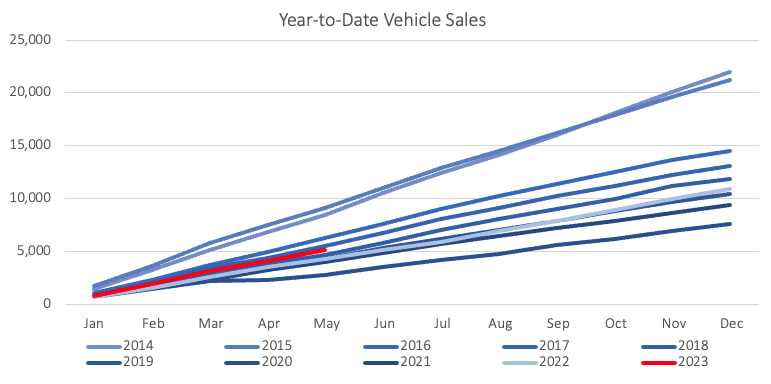

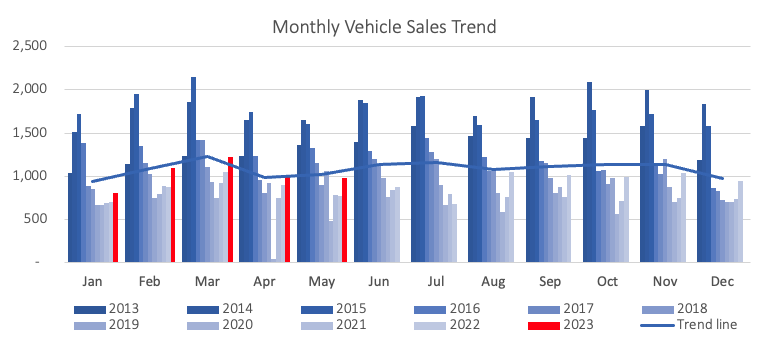

982 New vehicles were sold in May, down 2.2% m/m from the 1,004 vehicles sold in April, but 27.7% more than in May 2022. Year-to-date 5,120 new vehicles have been sold, of which 2,579 were passenger vehicles, 2,245 light commercial vehicles, and 296 medium- and heavy commercial vehicles. In comparison, 4,314 new vehicles were sold during the first 5 months of 2022, and 4,050 in 2021. On a twelve-month cumulative basis, a total of 11,729 new vehicles were sold at the end of May, representing a 21.0% y/y increase from the 9,691 sold over the comparable period a year ago.

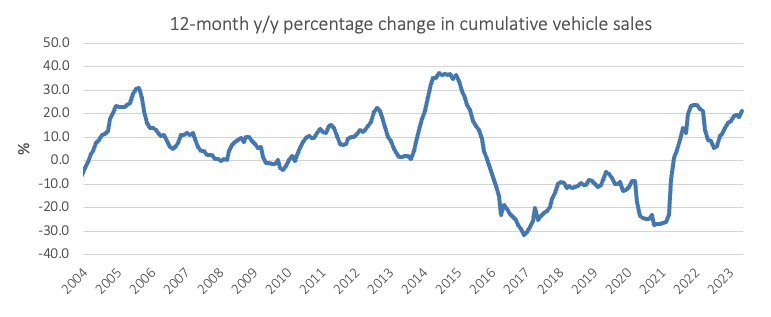

During the month, 505 new passenger vehicles were sold, surpassing the 493 monthly average over the last twelve months. Passenger vehicle sales rose by 7.9% m/m and 25.0% y/y. Of the 17 manufacturers who sold new passenger vehicles in May, 10 recorded a higher number of sales than in April. Year-to-date, 2,579 new passenger vehicles have been sold, 15.1% more than at the same point last year. On a twelve-month cumulative basis, new passenger vehicle sales rose to 5,913, up 21.2% y/y from the 4,877 vehicles sold over the corresponding period a year ago, and the highest 12-month cumulative figure since July 2017.

A total of 477 new commercial vehicles were sold in May, a decline of 11.0% m/m but 30.7% more than in May 2022. This was the second consecutive month we saw commercial vehicle sales decline, with May’s figure coming in below the monthly average of 485 vehicles observed over the last twelve months. The 12-month cumulative commercial vehicle sales figure however continues to tick up, reaching 5,816 in May, an increase of 20.8% y/y, and the highest since March 2020. Light commercial vehicles continue to make up the bulk of the new commercial vehicle sales with 409 sold in May, followed by 46 heavy and extra heavy commercial vehicles and 22 medium commercial vehicles sold during the month.

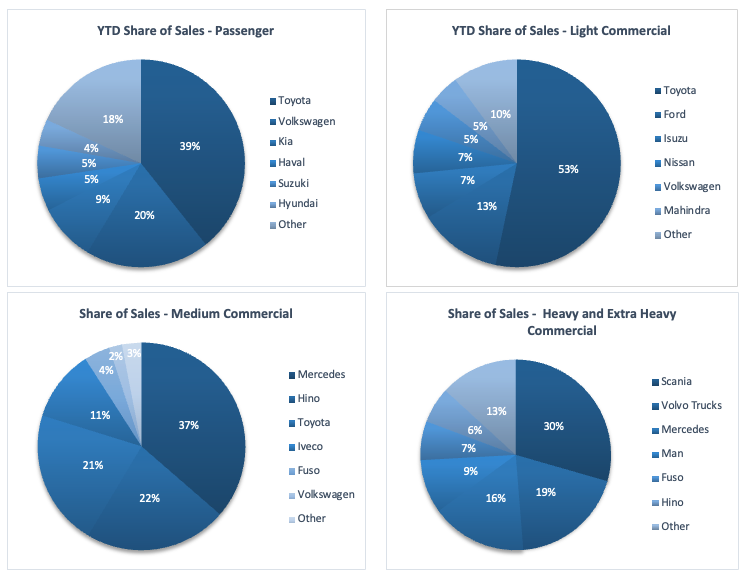

Toyota remains dominant in the new passenger vehicle sales segment with 39.3% of the segment sales year-to-date. The manufacturer has sold just over double the number of new passenger vehicles year-to-date than its closest competitor, Volkswagen. Volkswagen, which is sitting at 19.3% of segment sales year-to-date, is followed by Kia at 8.9%, and Haval and Suzuki, at 5.1% each.

Toyota also maintained its stronghold in the light commercial vehicle segment, claiming 53.3% of the sales year-to-date. Ford is next in line with 13.0% of the market share. Mercedes leads the medium commercial vehicle segment with 36.4% of the market share, while Scania remains on top in the heavy- and extra heavy commercial segment with 29.4% of the segment sales year-to-date

The Bottom Line

Despite coming in somewhat softer in May, new vehicle sales remain relatively strong, evidenced by the 12-month cumulative figure continuing to tick up month after month and trending around early 2019 levels. Both passenger and commercial vehicle segments have been recording positive year-on-year growth for 10 consecutive months, with rising interest rates seemingly doing little to dampen demand.