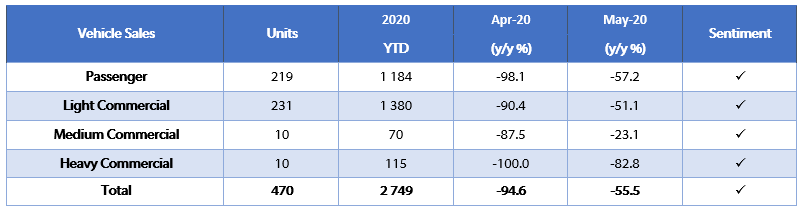

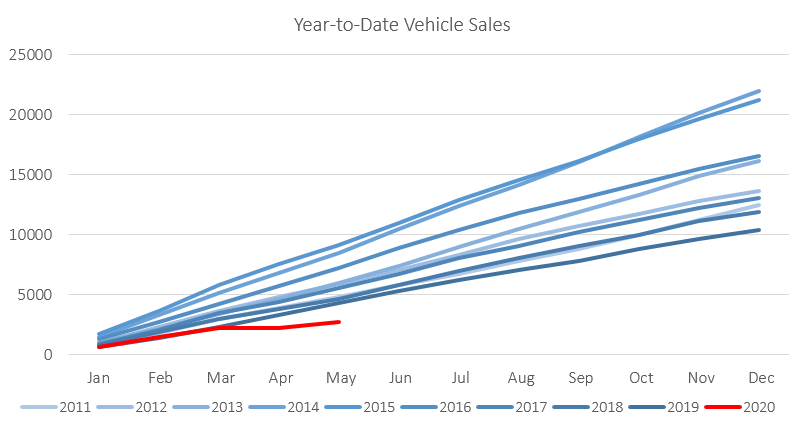

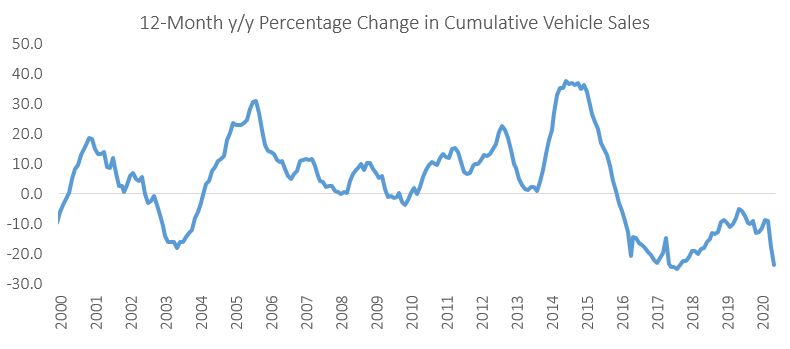

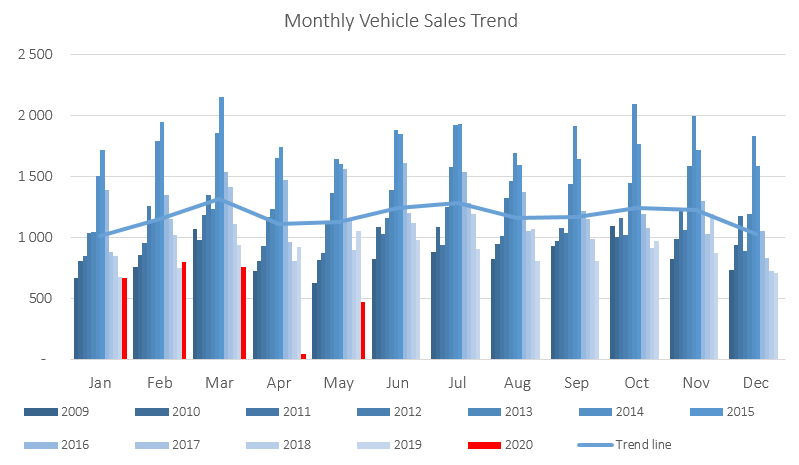

A total of 470 new vehicles were sold in May, an 840.0% m/m increase from the 50 vehicles sold in April, but a 55.5% y/y decrease from the 1,055 vehicles sold in May 2019. Year-to-date 2,749 vehicles have been sold, of which 1,184 were passenger vehicles, 1,380 were light commercial vehicles, and 185 were medium and heavy commercial vehicles. On a twelve-month cumulative basis, new vehicle sales continued to decline with a total of 8,804 new vehicles sold as at May 2020, down 23.8% from the 11,559 sold over the comparable period a year ago.

219 New passenger vehicles were sold during May, increasing by 2,333.3% m/m. The monthly comparison is somewhat meaningless seeing that only 9 new passenger vehicles were sold in April due to the lockdown restricting dealerships from selling vehicles. On a year-on-year basis May new passenger vehicle sales were 57.2% lower than the 512 vehicles sold a year ago. Year-to-date passenger vehicle sales rose to 1,184, a 43.5% decrease from May last year. On a rolling 12-month basis new passenger vehicle sales were down 63.0% from the peak in April 2015, and down 27.9% y/y.

A total of 251 new commercial vehicles were sold in May, 512.2% more than in April, but 53.8% less than in May 2019. Of the 251 commercial vehicles sold in May, 231 were classified as light commercial vehicles, 10 as medium commercial vehicles and 10 as heavy or extra heavy commercial vehicles. On a twelve-month cumulative basis light commercial vehicle sales dropped 23.3% y/y, while medium commercial vehicle sales rose 16.8% y/y, and heavy commercial vehicle sales fell by 5.9% y/y.

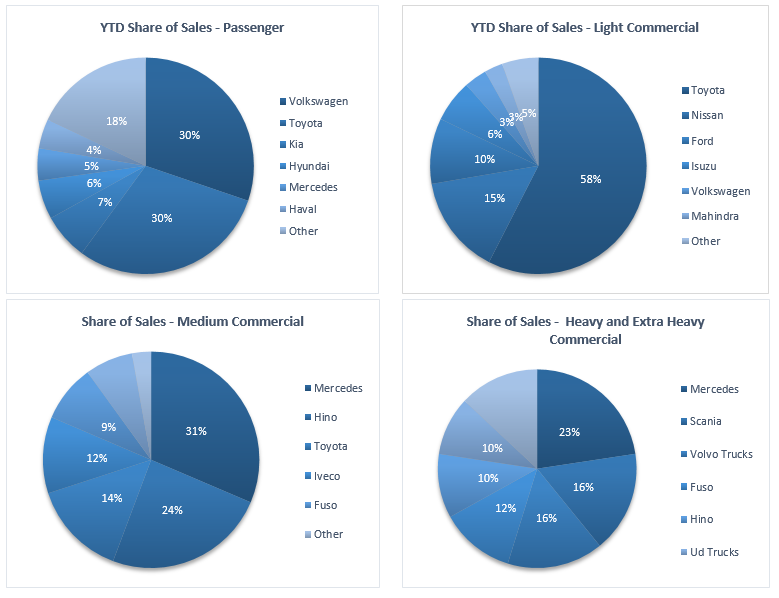

During the month, Volkswagen retook the lead from Toyota in terms of year-to-date market share of new passenger vehicles sold. Volkswagen claimed 30.2% of the market, followed closely by Toyota with 29.8% of the market. They were followed by Kia and Hyundai with 6.9% and 5.8% of the market respectively, while the rest of the passenger vehicle market was shared by several other competitors.

Toyota remained the leader in the light commercial vehicle space with a robust 57.5% market share, with Nissan in second place with a 14.8% share. Ford and Isuzu claimed 9.8% and 6.3%, respectively, of the number of light commercial vehicles sold thus far in 2020. Mercedes leads the medium commercial vehicle segment with 31.4% of sales year-to-date. Mercedes was also number one in the heavy and extra-heavy commercial vehicle segment with 22.6% of the market share year-to-date.

The Bottom Line

While May’s vehicle sales figure of 470 is considerably higher than that of April’s 50 vehicles, the number of new vehicles sold fell to roughly halve of the number sold a year ago or a quarter of what was sold five years ago. It remains unlikely that new vehicle sales will return to the levels seen in recent months and years as economic conditions are expected to remain dire. The fact that the Erongo region was placed under a further lockdown will continue to weigh down on vehicle sales in June. Furthermore, the revenues of most businesses in the country will be depressed due to the government imposed lockdowns and as a result will not be able to expand/replace their existing vehicle fleets. The tourism sector continues to be affected by the lockdown of the country’s borders is currently sitting with an oversupply of vehicles and will thus not be needing new vehicles in the short- to medium term. During the month the government too announced that they will not be renewing their vehicle fleet for the next five years. For the most part we expect consumers who haven’t lost their jobs or been forced to take a pay cut, and who can still afford to buy vehicles, to either be more prudent with their finances and defer vehicle purchases or to opt for second-hand models while the current economic uncertainty remains.