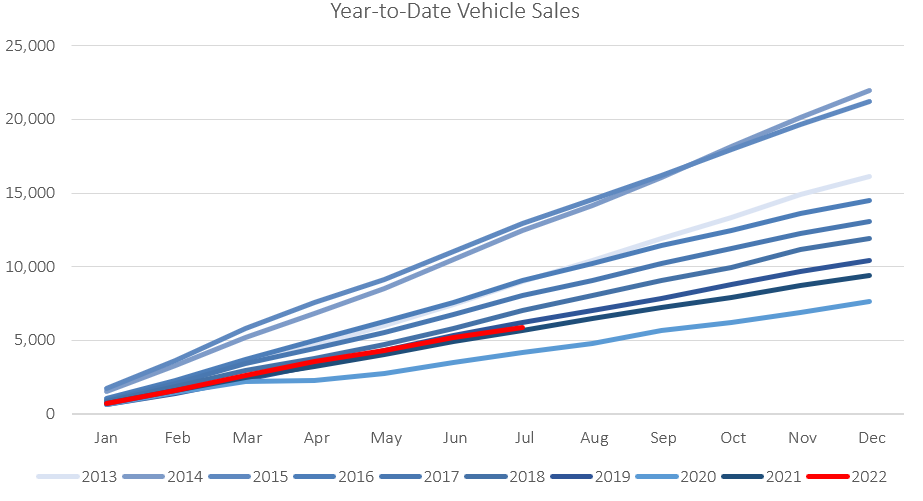

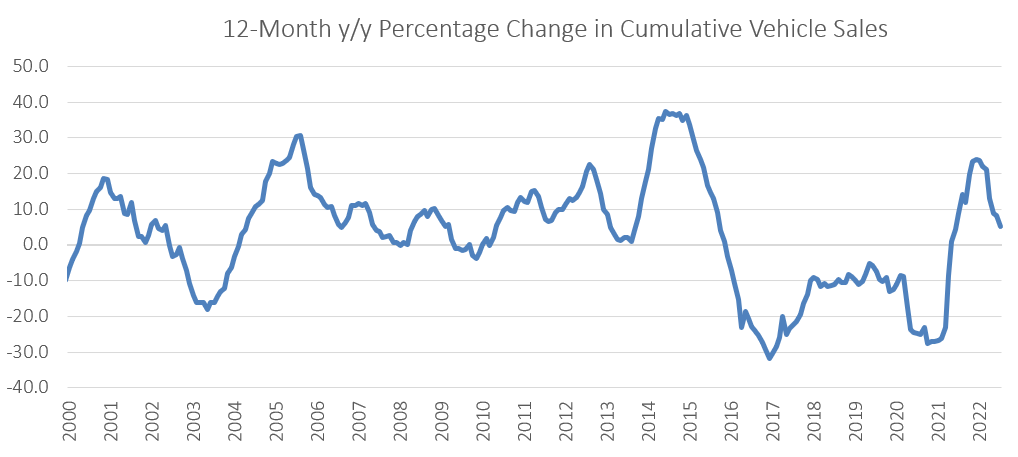

A total of 677 new vehicles were sold in July, representing a 22.4% m/m decline from the 872 new vehicles sold in June, and a 15.3% y/y drop from the 799 new vehicles sold July last year. Year-to-date 5,864 vehicles have been sold of which 3,055 were passenger vehicles, 2,442 were light commercial vehicles, and 367 were medium and heavy commercial vehicles. On a twelve-month cumulative basis, a total of 9,600 new vehicles were sold at the end of July, representing a 5.3% y/y increase from the 9,118 new vehicles sold over the comparable period a year ago.

382 new passenger vehicles were sold in July, the lowest monthly sales figure so far this year, down 11.6% from the 432 passenger vehicles sold in June. Toyota resumed full scale production again in July, after suspending production in April following the floods in KwaZulu-Natal. Despite Toyota ramping up its production at the plant, new passenger vehicles from Toyota declined by 27.1% m/m dipping below the 100 new vehicle sales mark for the second time this year. Year-to-date passenger vehicles sales rose to 3,055 in July, 14.6% higher than during the same period in 2021 and 73.6% higher than the same period in 2020. On a 12-month cumulative basis, new passenger vehicle sales increased by 18.4% y/y to 4,874.

Following the uptick in commercial vehicle sales in June when 440 units were sold, new commercial vehicles sales fell to 295 in July, contracting by 33.0% m/m and 28.2% y/y. Light commercial vehicles continue to make up the bulk of the new commercial vehicle sales with 266 sold in July, followed by 17 heavy and extra heavy commercial vehicles and 12 medium commercial vehicles. Like the passenger vehicle sales, light commercial vehicles from Toyota declined and reached its lowest monthly sales level in two years. Light commercial vehicle sales from Nissan also recorded a sharp decline down 39.7% m/m from June, albeit from a high base. On a twelve-month cumulative basis, light and medium commercial vehicle sales fell 6.5% y/y and 6.3% y/y, respectively, while heavy commercial vehicle sales rose 3.2% y/y.

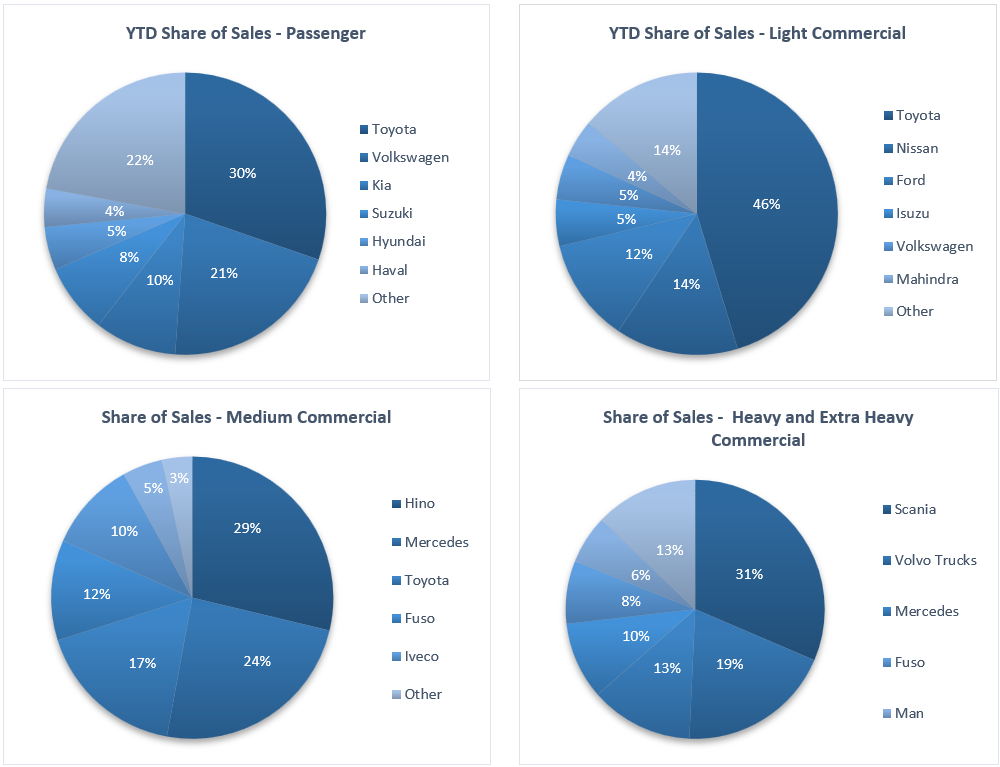

Despite having lower sales in July, Toyota continues to lead the new passenger vehicle sales segment with 30.3% of the segment sales year-to-date, followed by Volkswagen with 20.9% of the market share. The two top brands maintained their large gap over the rest of the market with Kia and Suzuki following with 9.4% and 8.0% of the market, respectively, leaving the remaining 31.5% of the market to other brands.

On a year-to-date basis, Toyota maintained its dominance in the light commercial vehicle space with a 45.3% market share, followed by Nissan with 14.0%. Hino continues to lead the medium commercial vehicle segment with 28.7% of sales year-to-date, closely followed by Mercedes-Benz with 24.1% market share. Scania retains its position as the leader in the heavy and extra-heavy commercial vehicle segment with 31.4% market share year-to-date.

The Bottom Line

New vehicle sales slumped in July. July’s sales figure is the lowest so far in 2022 but still in line with the monthly average for the year. On a 12-month cumulative basis, new passenger vehicle sales were 0.1% lower than in June, decreasing for the first time after rising for 19 consecutive months, possibly supply side driven by the flood induced problems for Toyota in South Africa. With the Toyota production plant in KwaZulu-Natal having re-commenced production in July, vehicle sales are expected to recover marginally. New commercial vehicle sales also contracted by 5.5% on a 12-month cumulative basis. Overall, year-to-date new vehicle sales are still roughly in line with those of 2021.