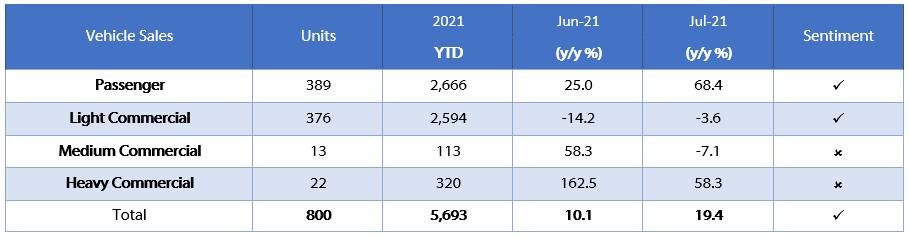

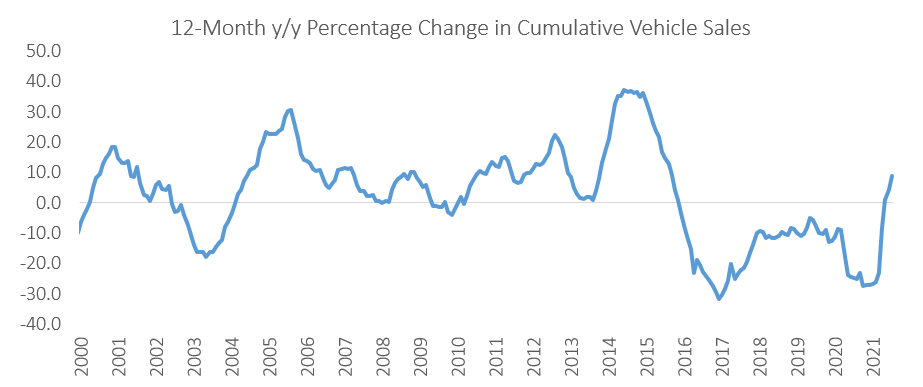

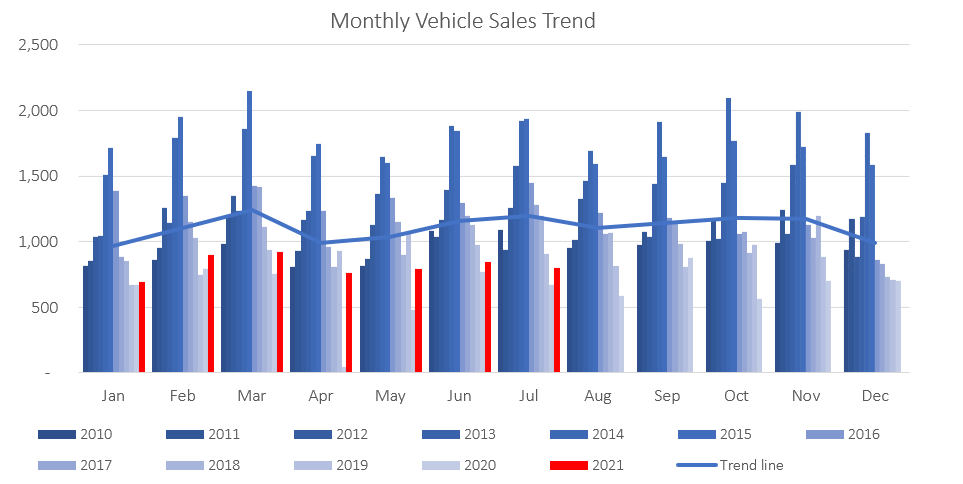

800 new vehicles were sold in July, a 5.1% m/m decrease from the 843 sold in June. This brings the total number of vehicle sales in 2021 to 5,693. Despite this monthly drop, over the past 12 months total vehicle sales have grown by 8.9% y/y to 9,119 with passenger and light commercial vehicles continuing to make up the bulk of the sales. On a year-on-year basis, new vehicle sales rose 19.4% in July.

389 new passenger vehicles were sold in July, a 9.5% m/m decrease from the 430 sold in June. Year-on-year passenger vehicle sales increased by 68.4%. Year-to-date passenger vehicle sales have increased by 51.5% y/y, as 1,760 vehicles were sold by this time last July compared to the 2,666 figure this year. Beating 2020’s figures should, and is so far proving, to be an easy task. However, new passenger vehicle sales continue to trail the (already low) pre-pandemic levels of 2019. On a 12-month cumulative basis, the number of passenger vehicles sold increased by 18.6% y/y in July.

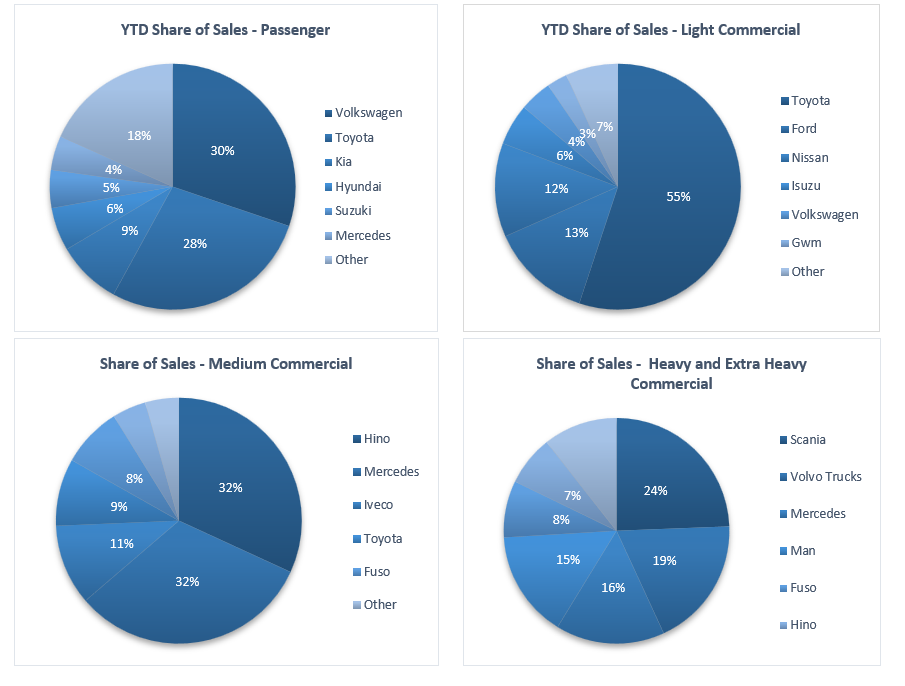

On a year-to-date basis, Toyota remains the preeminent seller of light commercial vehicles with a 55% share of the market. This is more than four times the share of their nearest competitor, Ford at 13%. Hino and Mercedes each make up 32% of the total medium commercial vehicles sales on a year-to-date basis. The heavy and extra heavy commercial vehicle market is the most competitive of the vehicle markets, with no one seller amassing more than a quarter of total market share.

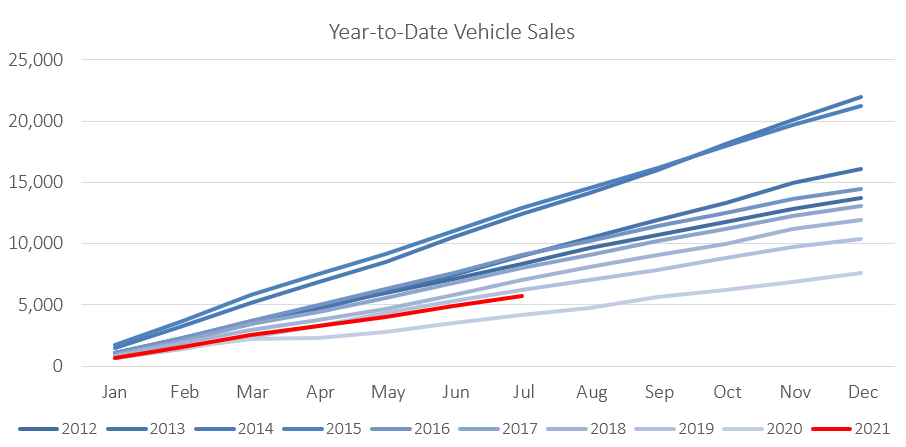

July’s new vehicle sales figures bear no marked difference to June’s. 2021 remains on track to be the second worst year for vehicle sales in the past decade. By this time in 2019, itself a below par year for vehicle sales over the last 10 years, 6,227 new vehicles were sold, in 2021 that number is only 5,693. Naturally this is an improvement on 2020’s sales figures (4,186 total) but as noted earlier, that is not difficult to accomplish. More tellingly, sales figures for new passenger and commercial vehicles are below pre-pandemic averages, showing that both individual and business spending remains depressed. As vehicle sales and most other high-frequency data is indicating, the economic recovery has a long way yet to go.