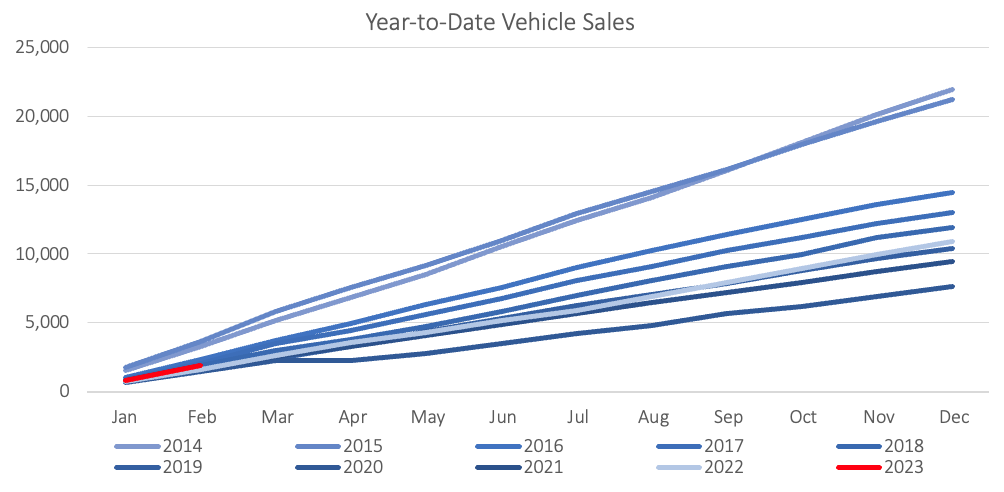

A total of 1,103 new vehicles were sold in February, 294 more than the upward revised figure of January, and represents a 24.9% y/y increase from the 883 new vehicles sold in February 2023. 1,912 new vehicles were sold during the first two months of 2023, of which 1,035 were passenger vehicles, 783 light commercial vehicles, and 94 medium- and heavy commercial vehicles. By comparison, the first two months of 2022 saw 1,591 new vehicles sold. 2023 is thus off to a strong start compared to last year. On a 12-month cumulative basis, new vehicle sales rose by 19.2% y/y to 11,244.

559 New passenger vehicles were sold during February, an increase of 17.4% m/m and 27.3% y/y. This is the highest monthly number of new passenger vehicle sales since July 2018. On a 12-month cumulative basis, new passenger vehicle sales have increased by 26.2% y/y to 5,763. The 1,035 new passenger vehicles sold so far this year marks the highest number of year-to-date sales by February since 2016. Compared to the same period in 2022, the year-to-date figure for February has increased by 189 units or 22.3% y/y.

February was a similarly strong month for new commercial vehicle sales, with the 544 units sold during the month the highest monthly figure since March 2021. New commercial vehicle sales rose 63.4% m/m and 22.5% y/y in February. The month saw 486 light commercial vehicles, 25 medium commercial vehicles, and 33 heavy commercial vehicles sold. On a year-on-year basis, light commercial sales rose by 32.8% y/y, medium commercial vehicles grew by 56.3% y/y, and heavy and extra heavy vehicle sales declined by 46.8% y/y from a high base in February 2022. All sub-categories, bar heavy- and extra heavy vehicles, have recorded growth on a twelve-month cumulative basis with light commercial vehicle sales increasing by 16.6% y/y, medium commercial vehicles sale rising by 12.4% y/y, while heavy commercial vehicle sales contracted by 16.7% y/y.

Toyota enjoy a strong lead in the new passenger vehicle sales segment, capturing 37.8% of the segment sales year-to-date, followed by Volkswagen with 24.3% of the market share. Both manufacturers have started the year off on a strong foot that will make it difficult for other manufacturers to catch up. They were followed by Kia and Suzuki with 8.3% and 5.4% of the market, respectively, leaving the remaining 24.3% of the market to other brands.

On a year-to-date basis, Toyota remained the leader in the light commercial vehicle space with a dominant 57.2% market share. Ford came in second place claiming a market share of 8.2%. Mercedes and Toyota continued to collectively lead the medium commercial vehicle market, each with a market share of 27.0%. Mercedes also claimed the top spot of heavy and extra-heavy commercial vehicles with a market share of 28.1%.

The Bottom Line

February’s new vehicle sales figure of 1,103 was the highest number since November 2018 when 1,197 new vehicles were sold. The month-on-month increase was mainly driven by the 211 unit increase in commercial vehicle sales, although the 83 unit increase in passenger vehicle sales is by no means insignificant. As mentioned in last month’s report, the 12-month new vehicle sales cumulative figure is trending at levels last seen in 2019. February’s 12-month cumulative figure is still down 50.4% from the peak of 22,664 recorded in April 2015, but the strong momentum in both the passenger- and commercial vehicle segments is encouraging to see.