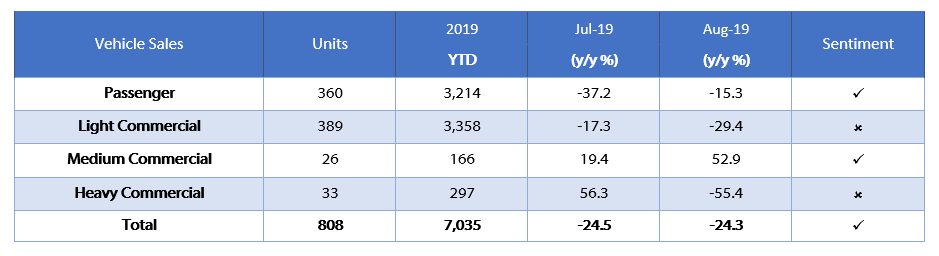

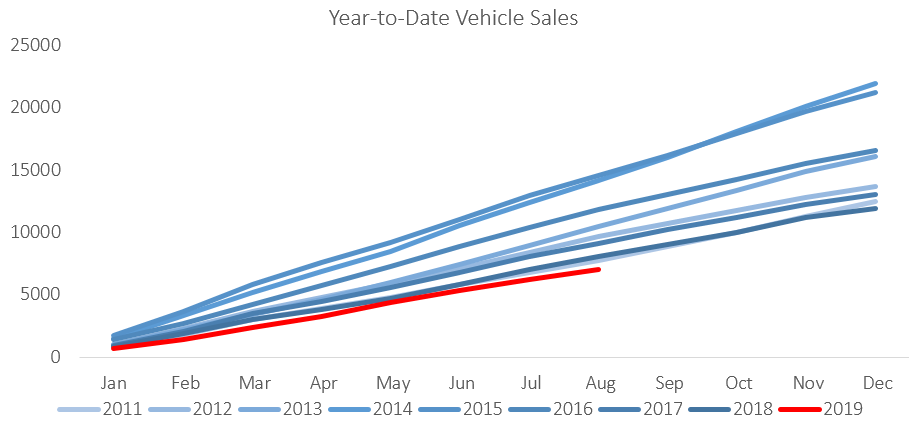

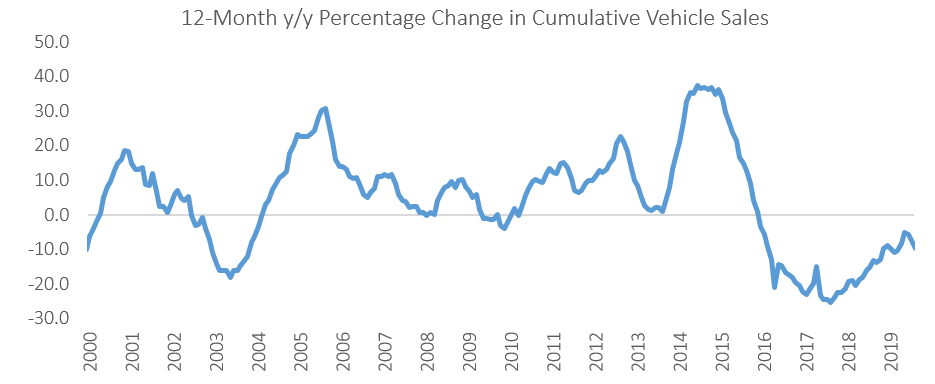

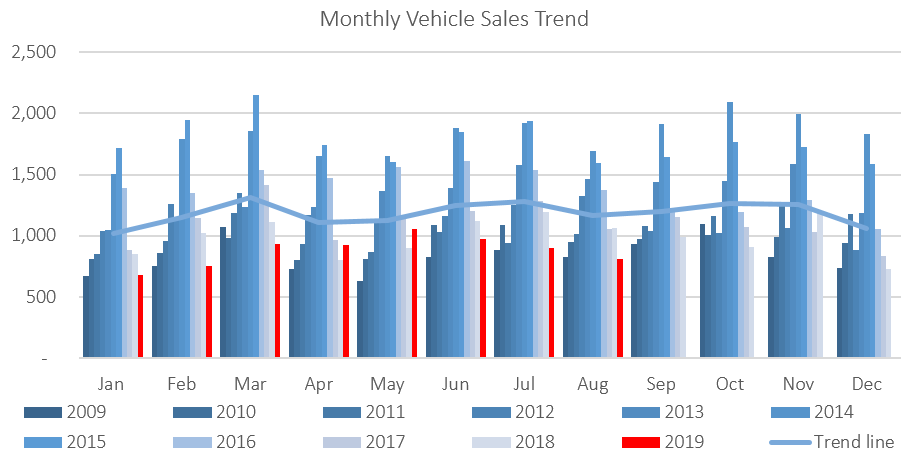

A total of 808 new vehicles were sold in August, representing a 10.6% m/m decrease from the 904 vehicles sold in July. Year-to-date, 7,035 vehicles have been sold of which 3,214 were passenger vehicles, 3,358 were light commercial vehicles, and 463 were medium and heavy commercial vehicles. This is the lowest year-to-date sales witnessed since 2009. On a twelve-month cumulative basis, new vehicle sale continued its downward trend. 10,860 new vehicles were sold over the last twelve months, a 9.8% contraction from the previous twelve months and also the lowest level since 2009.

360 new passenger vehicles were sold in August, contracting by 5.8% m/m and 15.3% y/y. Year-to-date passenger vehicle sales rose to 3,214 units, down 11.6% when compared to the year-to-date figure recorded in August 2018. On an annual basis, twelve-month cumulative passenger vehicle sales fell 10.9% y/y as the number of passenger vehicles sold continued to decline.

A total of 448 new commercial vehicles were sold in August, representing a contraction of 14.2% m/m and 30.2% y/y. Of the 448 commercial vehicles sold in August, 389 were classified as light commercial vehicles, 26 as medium commercial vehicles and 33 as heavy or extra heavy commercial vehicles. On a twelve-month cumulative basis, light commercial vehicle sales dropped 10.5% y/y, while medium commercial vehicle sales and heavy commercial vehicles rose 1.7% y/y and 6.9% y/y, respectively. Heavy commercial vehicles have seen some buoyancy in the last couple of months with 190 vehicles being sold since the beginning of May 2019.

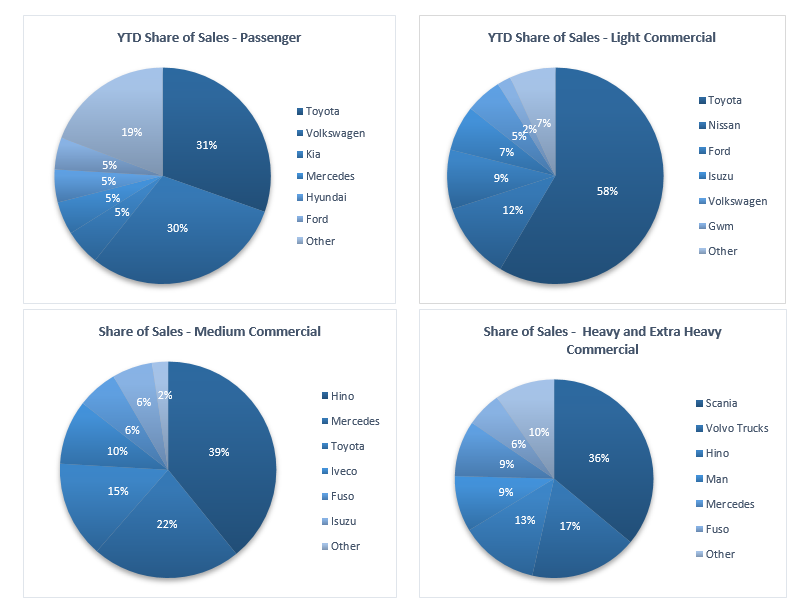

Toyota continues to lead the passenger vehicle sales segment with 30.4% of the segment sales year-to-date. Volkswagen in a close second place with 30.3% of the market-share as at the end of August. Kia, Mercedes, Hyundai and Ford each command around 4.9% of the market in the passenger vehicles segment, leaving the remaining 19.3% of the market to other brands.

Toyota with a strong market share of 58.5% year-to-date remains the market leader in the light commercial vehicle segment. Nissan remains in second position in the segment with 11.6% of the market, while Ford makes up third place with 8.8% of the year-to-date sales. Hino leads the medium commercial vehicle segment with 39.2% of sales year-to-date, while Scania was number one in the heavy- and extra-heavy commercial vehicle segment with 36.0% of the market share year-to-date.

The Bottom Line

Vehicle sales remain under pressure, with the year-to-date new vehicle sales in 2019 currently below 2010 levels, and the total new vehicle sales for the last 12 months down 9.8 from the same period in 2018. Vehicle sales is a lagging economic indicator and thus tells us little about what to expect going forward, but continues to illustrate the extent of the economic downturn. Presently, vehicle sales continue to point to low consumer and business confidence. This is evident as number of commercial vehicles sold year-to-date contracted by 14.0%, which shows a slowdown in the demand for durable goods by businesses.