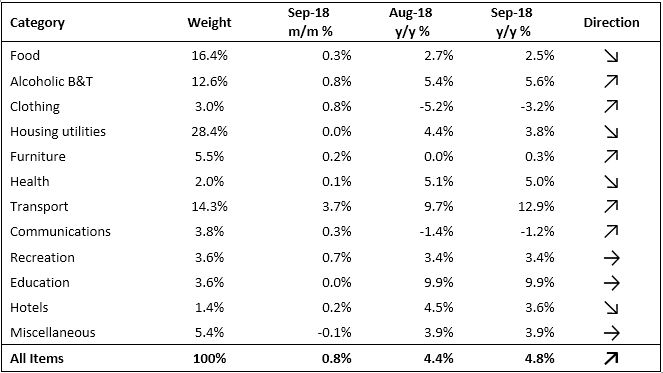

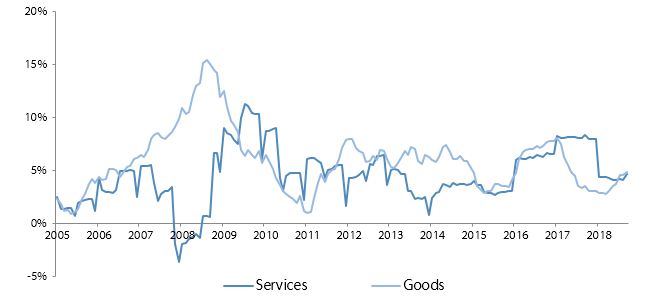

The Namibian annual inflation rate accelerated to 4.8% y/y in September, after moderating to 4.4% y/y in August. Notably, prices in the overall NCPI basket increased by 0.8% m/m in September compared to August where there was no overall change in the price index. On an annual basis prices in five of the twelve basket categories rose at a quicker rate in September than in August. Three categories remained unchanged, while the rate of price increases in four categories slowed for the month of September. Prices for goods increased at a rate of 4.9% y/y in September, quicker than the 4.6% y/y increase in August. Prices for services increased at a rate of 4.7% y/y following a 4.1% y/y increase in August.

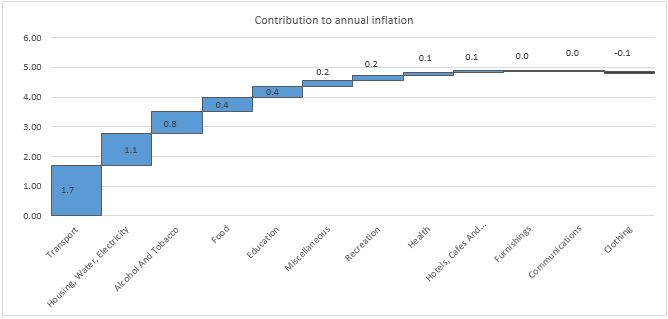

Transport was once again the largest contributor to annual inflation in September, accounting for 1.7% of the total 4.8% annual inflation rate. This was largely expected considering the wave of increases in fuel pump prices seen over the last five consecutive months, including September. Transport prices increased at a rate of 3.7% m/m in September, rising much faster than the 0.8% m/m increase recorded in August. On an annual basis, the increase in transport prices has reached double digits for the first time since June 2014. Transport prices increased by 12.9% y/y in September, faster than the 9.7% y/y increase recorded in August. Prices in the three sub-categories all recorded increases on a year-on-year basis. Prices relating to the purchase of vehicles increased at a rate of 8.5% y/y, while prices relating to the operation of personal transport equipment increased by 13.3% y/y. The biggest increase was realised in the public transport services sub-category. The 20% increase in taxi fares that was approved in August came into effect in September and attributed to the 18% y/y increase for this sub-category.

The Housing and utilities category was the second largest contributor to annual inflation due to its large weighting in the basket. Prices for this category increased by a rate of 0.3% m/m and 3.8% y/y. Prices in the electricity, gas and other fuels subcategory increased at 9% y/y, which was slower than inflation of 13.2% recorded in August. Month-on-month, prices in this subcategory increased marginally at 0.2%. The water supply, sewerage service and refuse collection subcategory prices remained unchained on a monthly basis, while the regular maintenance and repair of dwellings subcategory showed prices decreasing by 0.1% m/m.

Prices for the alcoholic beverages and tobacco category increased at a rate of 5.6% y/y and 0.8% m/m. Prices of alcoholic beverages increased at a rate of 6.3% y/y while tobacco prices increased at a rate of 2.6% y/y.

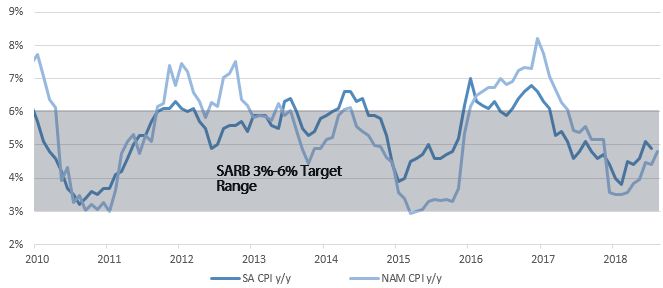

The Namibian annual inflation rate of 4.8% is closely tracking that of neighbouring South Africa (August: 4.9% y/y). Having endured sharper increases to fuel pump prices than in Namibia, SA’s annual inflation surprisingly moderated from 5.1% y/y in July. The price of Brent crude oil has been hovering above US$80 since mid-September and has come down over 5.6% from a high of US$85/bbl on the 9th of October. Oil is likely to range above US$80/bbl due to downside risks to global oil supply. The US once again faces another hurricane that will affect US production in the interim. Further exacerbating matters is US sanctions on Iranian supply while OPEC is exercising restrictive measure at the same time. These events could tilt the oil price upward, putting more pressure on fuel pump prices going forward amidst a rand that has depreciated from a September best of R14.04 to the US dollar.

The near-term outlook for the rand hinges on two major events, both scheduled for October. First up is the imminent announcement of Moody’s credit review decision, scheduled for release on the 12th of October, and thereafter the tabling of the Medium-Term Budget Policy Speech (MTBPS) on the 24th of October. Moody’s review decision comes in the same week that saw Nhlanhla Nene request that President Ramaphosa relieve him of his duties as finance minister. Former SARB governor Tito Mboweni has since been appointed has finance minister, a move welcomed by the market as shown in the firming of the rand since the change in finance ministers was brought about. Minister Mboweni will table a budget many expect will be positive in terms of expenditure remaining within set bounds, which is crucial as shortfall’s in revenue collection are expected due to the struggling economy. Moody’s had previously warned that diverting from fiscal consolidation will be seen as a credit negative, although Moody’s decision will likely precede the mid-term budget speech. Any adverse outcomes from Moody’s review decision and the MTBPS could lead to more rand weakness and subsequently accelerated inflation. This would force the SARB to hike interest rates in an attempt to contain inflation, with Bank of Namibia likely to follow suit in order to maintain the reserve position. Risks to inflation thus remain to the upside, the consequences of which could be higher interest rates and further pressure on the economy.