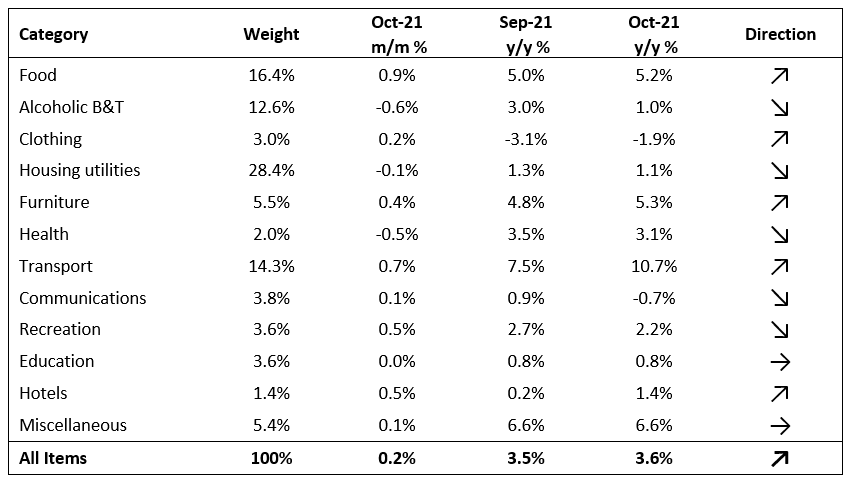

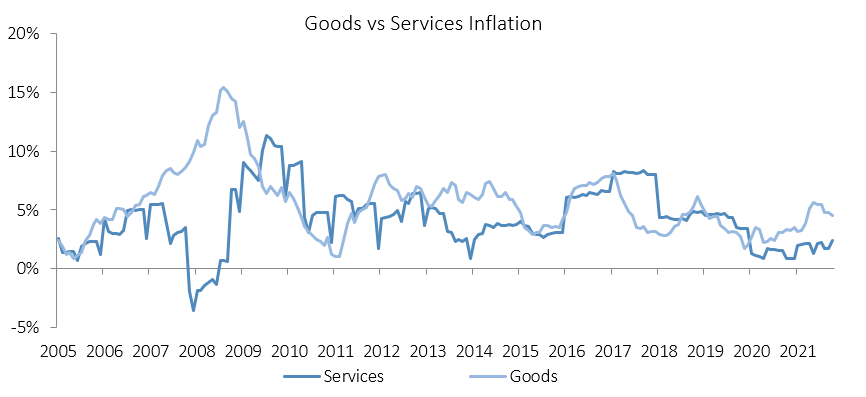

The Namibian annual inflation rate rose to 3.6% y/y in October of the back of a 3.5% y/y increase in prices in September. Prices in the overall NCPI basket rose by 0.2% m/m. Year-on-year, overall prices in five of the twelve categories rose at a quicker rate in October than September, five categories experienced slower rates of inflation and two categories posted steady inflation. Prices for services rose by 2.4% y/y and prices for goods rose by 4.5% y/y.

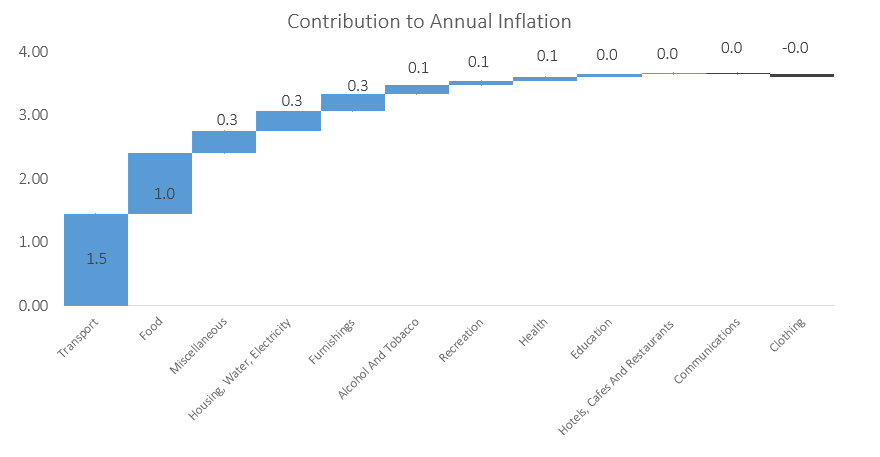

Prices in the transport category increased by 0.7% m/m and 10.7% y/y. As such, transport was the largest contributor to annual inflation in October, contributing 1.5 percentage points to the total 3.6% y/y inflation rate. Prices in all three of the sub-categories recorded increases on an annual basis. Vehicle prices increased by 10.4% y/y, public transport costs increased by 3.5% y/y and prices in the sub- category “operation of personal transport equipment” increased by 13.6% y/y. A 22.4% y/y increase in the price of petrol and diesel is responsible for much of this increase. This increase is due partially to base effects as the price of fuel decreased by 11.3% m/m and 12.5% y/y in October 2020. A global shortage in oil supply is the other major factor contributing to increases in the price of fuel.

The last year and a half have seen taxi fares at their most volatile. The price of taxis increased by 3.9% y/y in October. This comes after two-consecutive months of 8.7% y/y decreases. Looking further back, in May 2020 taxi fares rose by a remarkable 13.6% m/m, held steady for a few months and then declined by 11.3% m/m in October 2020, according to the Namibia Statistics Agency. Another month-on-month spike in June 2021, a 14.6% m/m increase, was followed by a 9.9% m/m decrease in August 2021. This volatility has led to uncharacteristic oscillations in the year-on-year price movements of taxi fares.

Food & non-alcoholic beverages was the second biggest contributor to the annual inflation rate in September, contributing 1.0 percentage point. Prices in this basket increased by 0.9% m/m and 5.2% y/y. All sub-categories registered price increases on a monthly basis. Additionally, all sub-categories except for one, vegetables & tubers, registered price increases on a yearly basis. The largest year-on-year price increases came in the oils & fats and fruit categories, with increases of 16.9% y/y and 15.4% y/y respectively.

Inflation for the rest of the categories were relatively subdued, with the miscellaneous category being the third largest contributor to October’s annual inflation rate, increasing by 0.1% m/m and 6.6% y/y. Surprisingly, the category alcoholic beverages & tobacco was not amongst the largest contributors to annual inflation in October. Prices for alcoholic beverages decreased by 0.9% m/m and 0.1% y/y while prices for tobacco products increased by 0.7% m/m and 5.9% y/y.

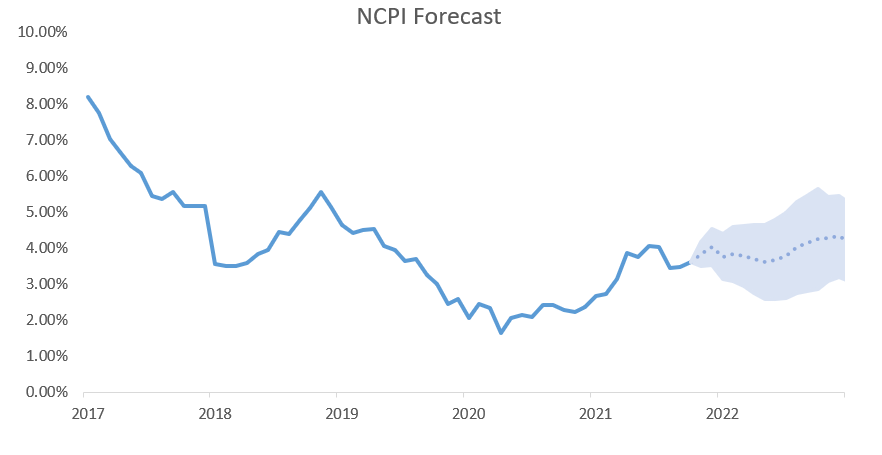

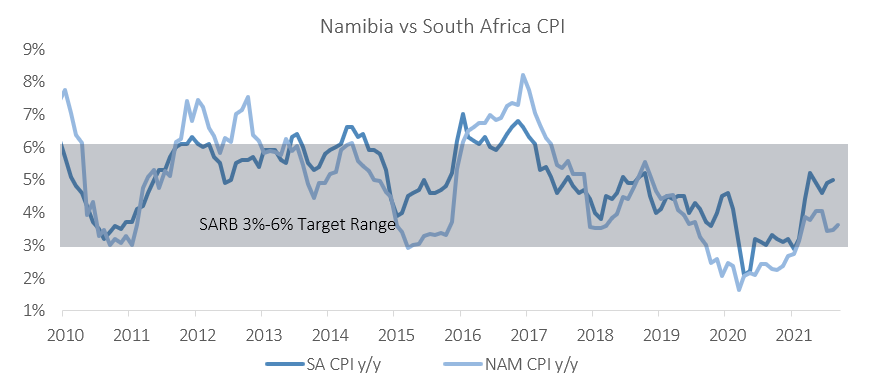

The 3.6% y/y annual inflation rate is in line with IJG’s average inflation forecast for the year. IJG’s inflation model predicted that annual inflation would be 3.5% y/y in October. Inflation risks globally and in Namibia remain to the upside. Our model currently estimates that inflation will rise to 3.8% y/y in November and 4.0% y/y in December. Average inflation for 2022 is forecast at 3.9% y/y. The estimated upper bound for average annual inflation in Namibia for 2022 is 5.0% y/y. Should the value of the rand continue to deteriorate, and if oil prices continue to rise, the forecast will inevitably trend towards the upper bound.