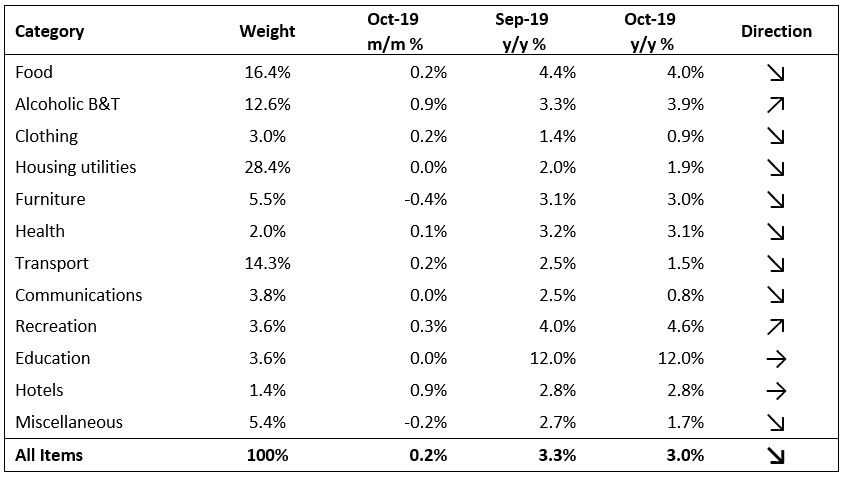

The Namibian annual inflation rate edged lower, moderating to 3.0% y/y in October, following the 3.3% y/y increase in prices recorded in September. On a month-on-month basis, prices rose by 0.2% following a 0.3% price change recorded in September. On an annual basis, prices in two of the twelve basket categories rose at a quicker rate in October than in September. Prices in two categories grew at a steady pace, while the rate of price increases in eight categories slowed during the month of October. Prices for goods rose by 2.7% y/y while prices for services increased by 3.4% y/y.

Food & non-alcoholic beverages, the second largest basket item in weighting, accounted for 0.7% of the total annual inflation figure. Prices in this category rose by 4.0% y/y, a slowdown from inflation of 4.4% y/y recorded in September. Most of the sub-categories of food and non-alcoholic beverages continue to show relatively low monthly price increases, while three of the sub-categories showed monthly price decreases. The largest increases were observed in the prices of fruits which increased by 14.5% y/y and vegetables which increased by 12.8% y/y. Meat prices increased by 1.9% y/y, compared to the 0.2% y/y decrease recorded in the previous month. Due to the ongoing drought over the past months there has been a large-scale slaughtering of cattle. This has reduced the number of livestock in the country and going forward meat prices will likely increase as restocking of farms will cause an upward pressure on prices.

The housing and utilities category was the second largest contributor to annual inflation in October, accounting for 0.5% of the total 3.0% inflation figure. Price inflation for this category came in at 1.9% y/y but remained relatively flat month-on-month. Annual inflation for rental payments remained unchanged at 2.3% y/y in October and will likely remain this low for the rest of the year. The regular maintenance and repair of dwellings subcategory recorded an increase in prices of 2.5% y/y, which is a lower rate of increase than the 3.4% y/y registered the previous month. Month-on-month, prices in this subcategory increased by -0.01%.

The alcohol and tobacco basket category recorded inflation of 3.9% y/y, alcoholic beverages recorded an increase of 1.0% m/m and 5.7% y/y and thereby caused the growth in inflation in the overall category. Tobacco prices recorded an increase of 0.6% m/m but decreased by 4.1% y/y.

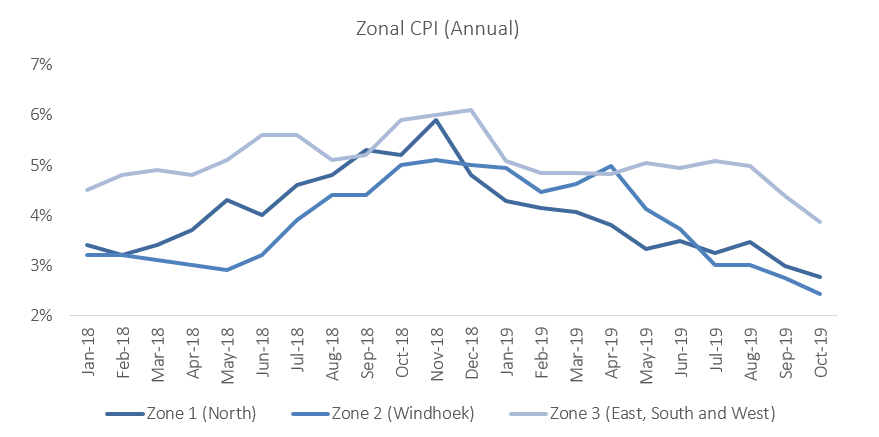

The zonal data shows that on a monthly basis, prices printed flat in the southern, eastern and western parts of the country while rising elsewhere in the country. On an annual basis, the Windhoek and surrounding area recorded the lowest inflation rate of 2.4% in October, with the mixed zone 3 covering the south, east and west of the country recording the highest rate of inflation at 3.9% y/y. Inflation in the northern region of the country increased to 2.8% y/y.

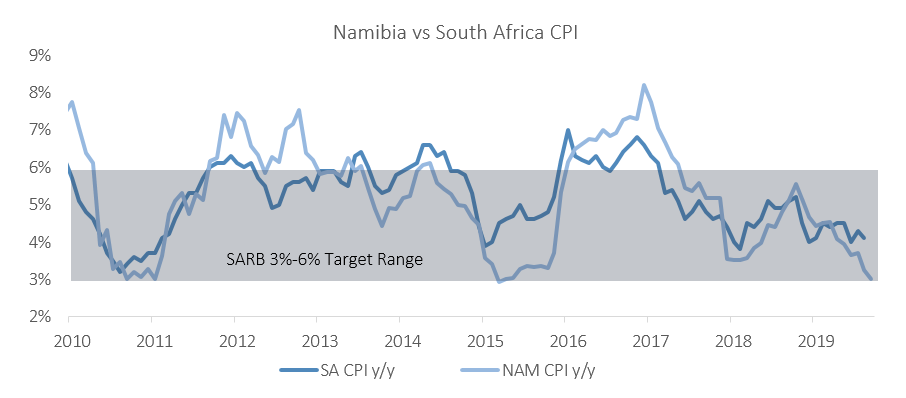

The Namibian annual inflation rate continues to slow down, reaching 3.0% in October, and is the lowest annual rate since May and June 2015. The Namibian annual inflation rate has been below 4.1% for six consecutive months. The inflation rate continues to trend below that of neighbouring South Africa’s September inflation figure of 4.1% y/y. In September a lower inflation rate was recorded due to the base effects as the increase in prices of public transport rolled out of the measurement period. October’s low inflation rate is as a result of the low inflation rate in the food, and housing, water, and electricity categories.

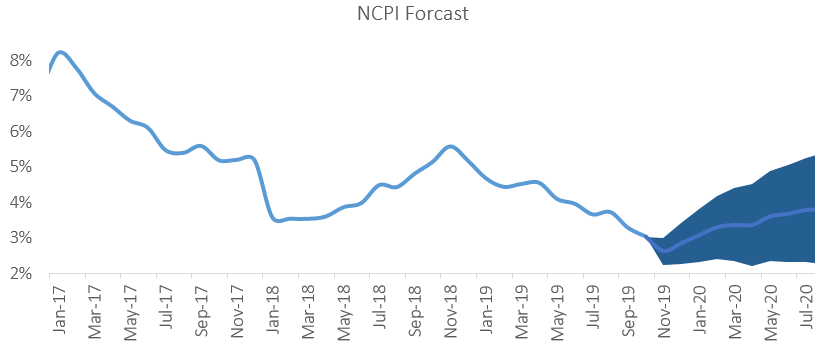

The low business and consumer confidence continue to dampen the demand for goods and services, which results in lower overall inflation. IJG’s inflation model forecasts an average inflation rate of 3.8% y/y in 2019 and 3.4% y/y in 2020. The largest upside risk to this forecast is higher food costs as the drought affects local food production.