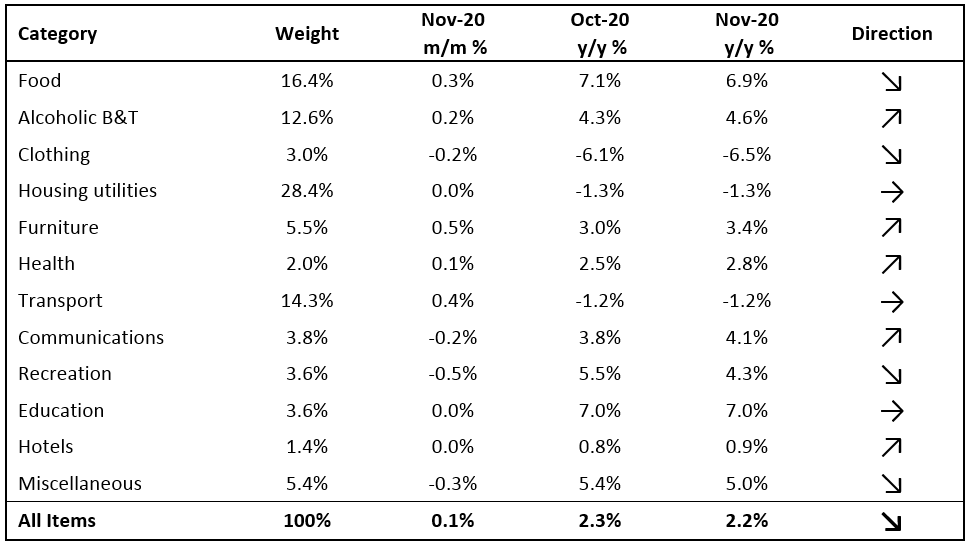

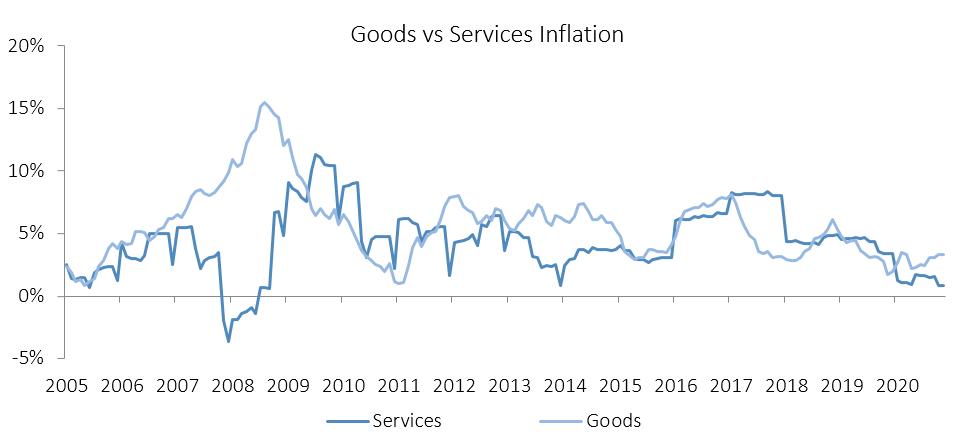

The Namibian annual inflation rate moderated slightly to 2.2% y/y in November, following the 2.3% y/y increase in prices recorded in October. Prices in the overall NCPI basket increased by 0.1% m/m, as inflationary pressure remains subdued. Overall, prices in five of the twelve basket categories rose at a faster annual rate than in October, while four categories recorded slower rates of inflation and two categories posted steady inflation. Prices for goods increased by 3.3% y/y while prices for services increased by 0.8% y/y.

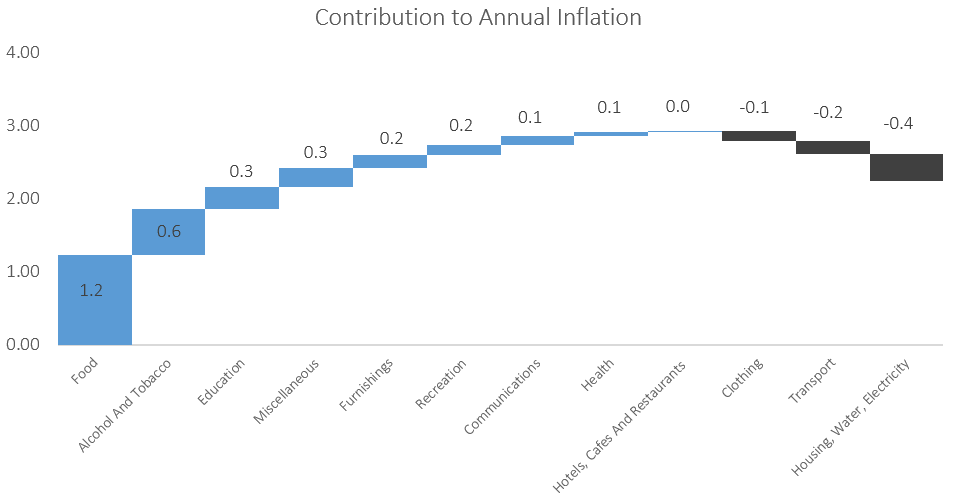

As it has been the case since April this year, food & non-alcoholic beverages were the largest contributors to annual inflation in November, accounting for 1.2 percentage points of the total 2.2% annual inflation rate. Prices in this category rose 0.3% m/m and 6.9% y/y. Prices in all thirteen sub-categories recorded increases on a year-on-year basis with the largest increases being observed in the prices of fruits which increased by 16.1% y/y and vegetables which increased by 11.5% y/y. Price increases in oils and fats, and meat products quickened to 11.4% y/y and 10.8% y/y respectively.

Alcoholic beverages and tobacco, the third-largest basket item by weighting, was the second-largest contributor to the annual inflation rate in November, contributing 0.6 percentage points to the total 2.2% annual inflation rate. The basket item recorded a price increase of 0.2% m/m and 4.6% y/y during the month. Prices for alcoholic beverages increased at a rate of 0.1% m/m and 3.6% y/y, while tobacco prices rose by 0.5% m/m and 9.2% y/y.

The education basket, the basket item with the eighth largest weighting (at only 3.6% of the CPI basket), was the third-largest contributor to the annual inflation rate. Primary and secondary education recorded price increases of 9.3% y/y, while tertiary education prices rose by 5.3% y/y. None of the three subcategories printed price increases on a month-on-month basis.

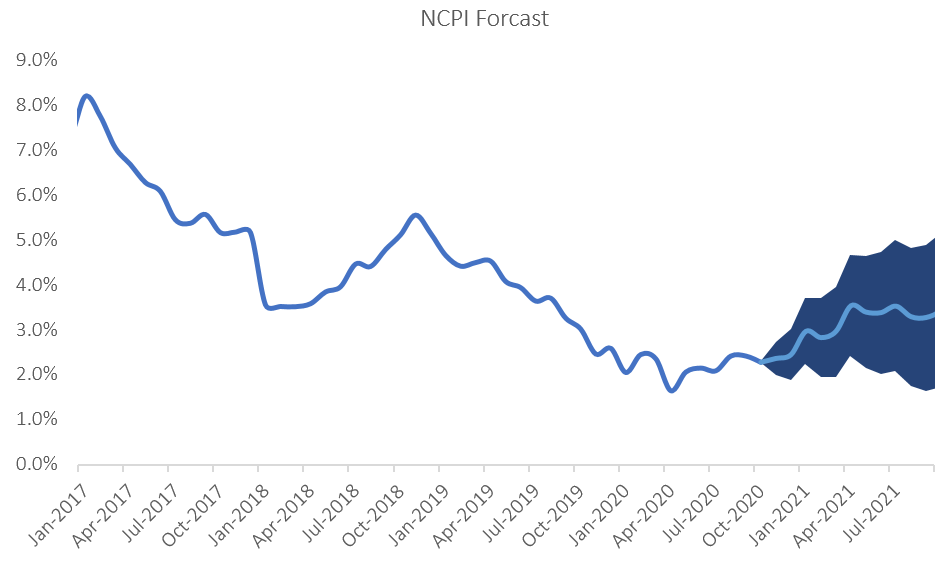

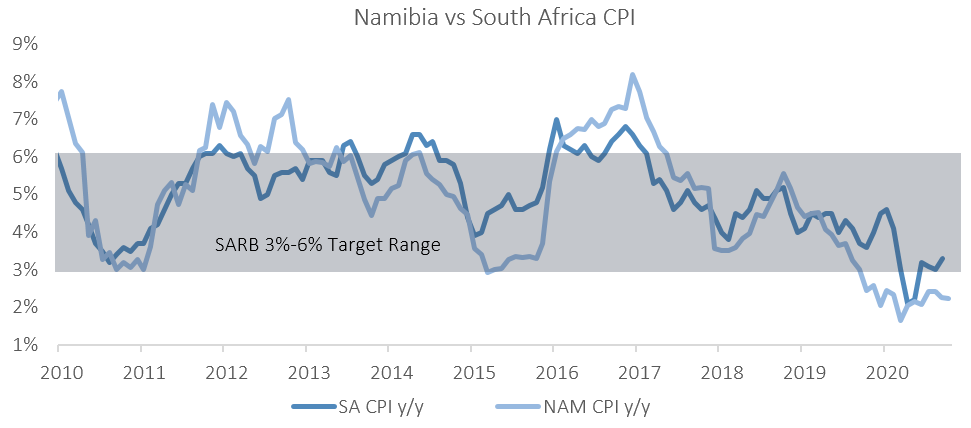

As expected, inflationary pressure in Namibia remains extremely subdued and the Namibian inflation rate continues to trend lower than neighbouring South Africa’s October figure (latest available release) of 3.3%. IJG’s inflation model forecasts an average inflation rate of 2.2% y/y in 2020 and 3.2% y/y in 2021. Global oil prices remain one of the larger risks to our inflation forecast. However, the announcement by the Ministry of Mines and Energy at the beginning of December to cut the petrol and diesel prices by 30 cents and 20 cents per litre respectively, means that the lower transport inflation will likely lead to an even lower inflation print for December. It is also unlikely that we will see lower rental prices in the next 12 months as many consumers remain under financial pressure. With these being the larger categories of the inflation basket, we do not foresee any sudden increases in Namibian inflation in the short-term.