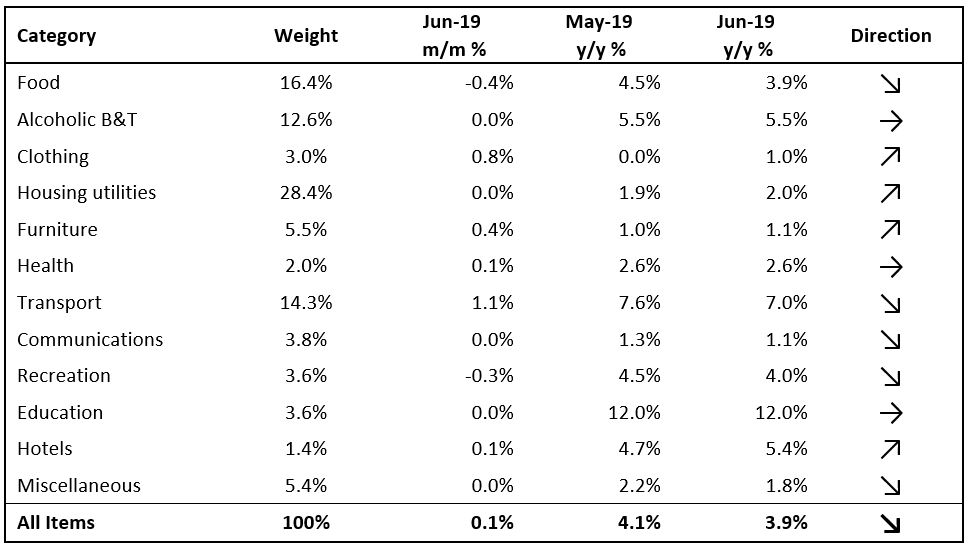

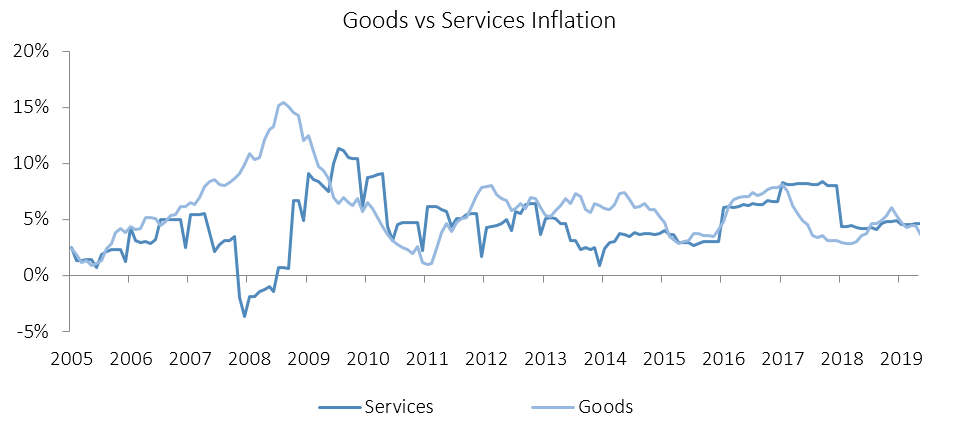

The Namibian annual inflation rate moderated to 3.9% y/y in June, following the 4.1% y/y increase in prices recorded in May. Prices increased by 0.1% m/m, compared to the overall basket price decrease of 0.1% m/m in May. Overall, prices in four of the basket categories rose at a faster annual rate than in May, prices in five categories rose at a slower annual rate and three categories recorded steady inflation rates. Prices for goods rose by 3.4% y/y in June, while prices for services rose by 4.7%.

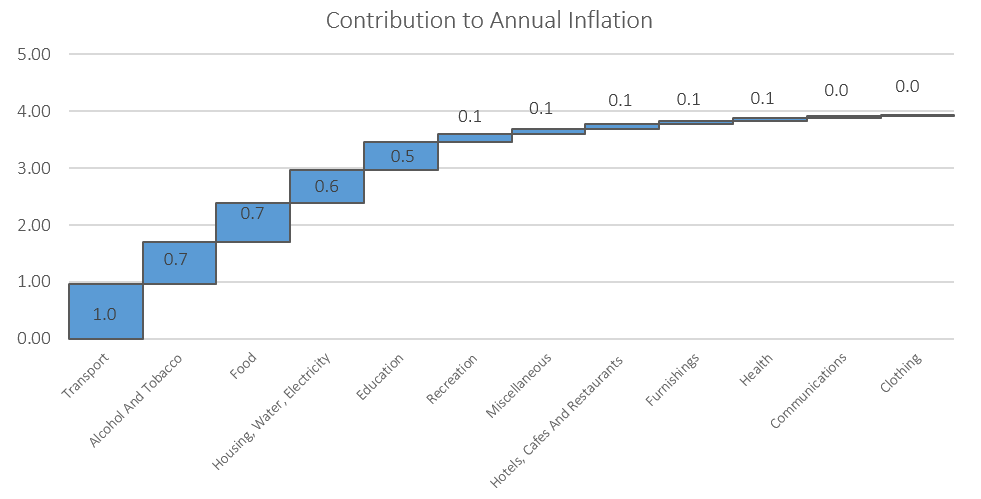

Transport accounted for 1.0 of the total 3.9% annual inflation recorded in June, making it the largest contributor to annual inflation for the month. Prices in the transport basket rose 1.1% m/m and 7.0% y/y. The purchase of vehicles subcategory saw price decreases of 0.5% m/m and 3.6% y/y. The operation transport equipment subcategory recorded price increases of 2.0% m/m and 5.0% y/y. The Ministry of Mines and Energy announced an increase in fuel pump prices of 30 c/l on all controlled products at the beginning of June.

In order to stabilise fuel prices, the Ministry decided not to pass on over-recoveries to the consumer, and kept pump prices unchanged. Brent Crude oil prices increased by 3.2% during June, reaching US$66.55 per barrel at the end of the month and the National Energy Fund saw it prudent to strengthen its financial position given the potential risks of further increases in the Brent Crude prices, citing political tension between USA and Iran specifically.

Alcohol and tobacco prices were flat on a month-on-month basis, but increased 5.5% y/y. The upward movement year-on-year resulted from increases in prices for the alcoholic beverages sub-component. Prices of alcoholic beverages, decreased by 0.2% m/m but increased by 7.9% y/y. However, tobacco prices recorded an increase of 0.8% m/m but decreased by 4.7% y/y.

Food & non-alcoholic beverages, the second largest basket item by weighting, was the second largest contributor to annual inflation, accounting for 0.7 of the 3.9% annual inflation rate. Prices in this category decreased by 0.4% m/m but rose by 3.9% y/y. Prices in ten of the thirteen sub-categories recorded increases on annual basis, with the largest increases being observed in the prices of bread and cereals, and fruits and vegetables.

The increase on an annual basis is likely of the second-round effects of increased transport prices which has filtered through to food prices, coupled with poor rainfall during Namibia’s rainy season that affects local food production.

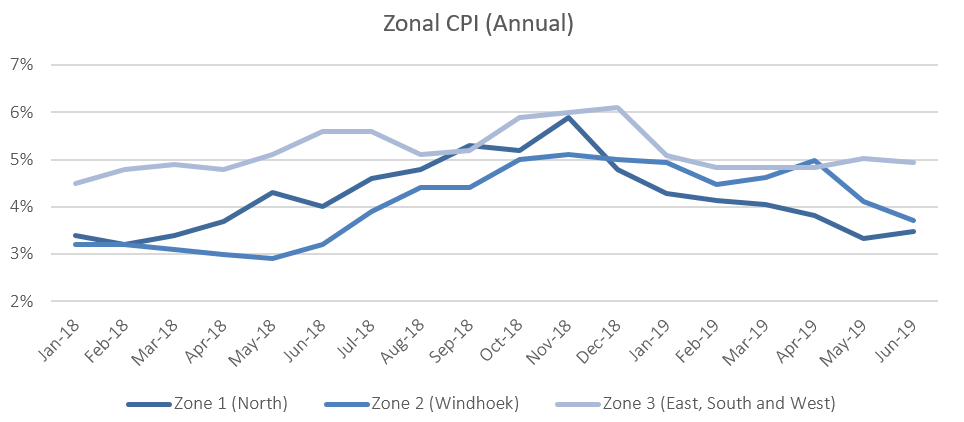

Zonal data shows that on a monthly basis prices were flat in the central zone 2 while rising elsewhere in the country. On an annual basis the northern regions, in zone 1, recorded the lowest inflation rate at 3.5%, with the mixed zone 3 covering the south, east and west of the country recording the highest rate of inflation at 4.9%. Inflation in zone 2 (Windhoek and surrounding) moderated to 3.7% y/y.

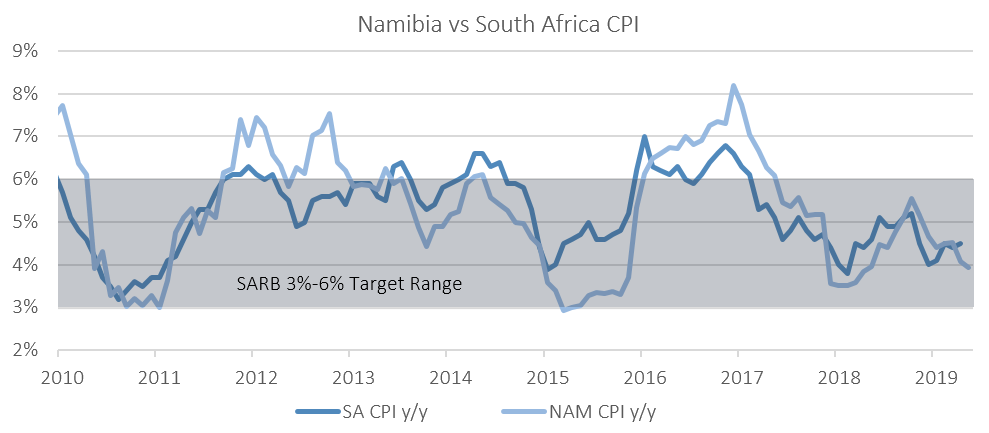

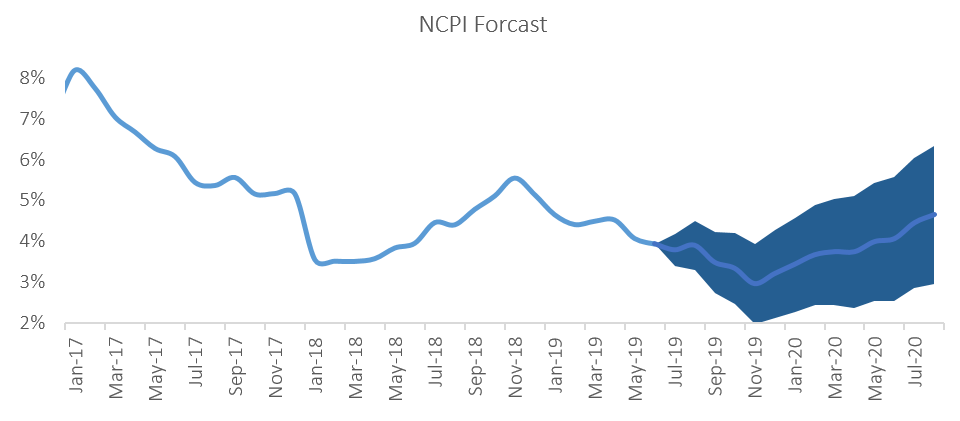

The Namibian annual inflation rate of 3.9% y/y for June is lower than that of neighbouring South Africa’s 4.5% y/y for May. South Africa is yet to announce the June inflation rate, but thus far inflation outcome has been within the 3-6% inflation target. Due to a deteriorating growth outlook for South Africa, as well as the SARB’s latest inflation forecasts, we expect the SARB’s MPC to announce a 25bp rate cute later this week. We believe that the more dovish outlook by central banks in advanced economies gives the SARB enough room to cut rates, with the Bank of Namibia likely to follow suit at its next MPC meeting in August. IJG’s inflation model forecasts an average inflation of 3.9% y/y in 2019. The largest upside risk to this forecast, is higher transport and food costs and the upper band of 4.3% currently looks more likely.