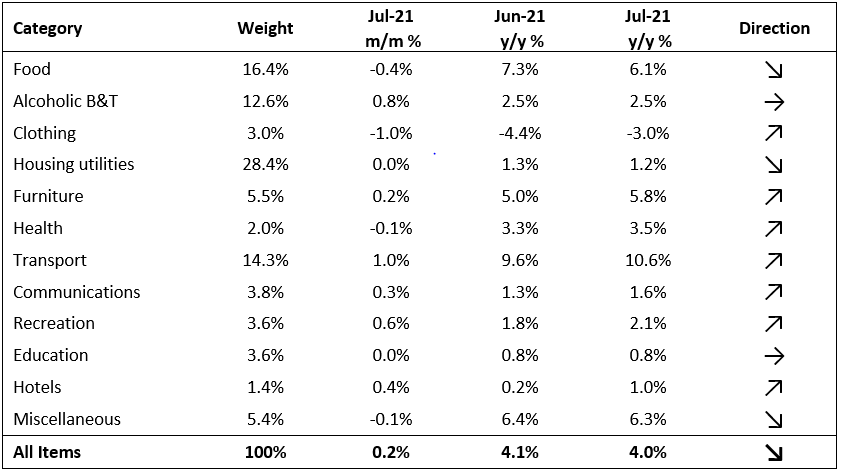

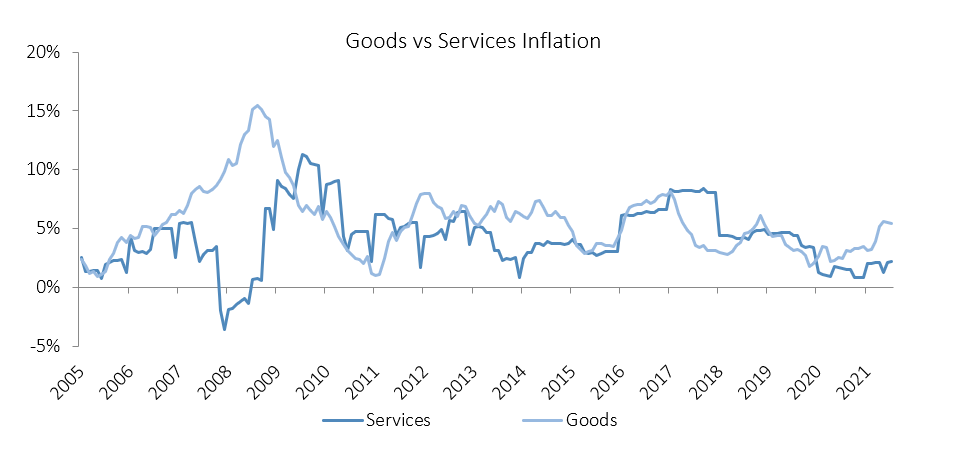

The annual Namibian Inflation rate slowed marginally to 4.0% in July, following the 4.1% y/y increase in June. The prices in the overall NCPI basket increased by 0.2% m/m. On a year-on-year basis, the overall prices of seven of the twelve basket categories rose at a quicker rate in July than in June, while three categories experienced slower rates of inflation and two categories posted steady inflation. Prices for goods increased 5.4% y/y while prices for services increased by 2.2% y/y in July.

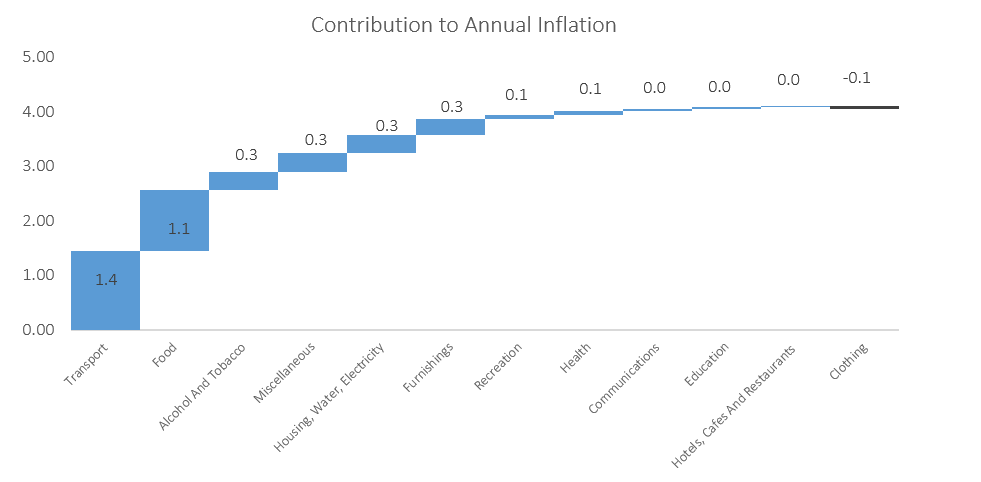

The transport and food categories were the largest contributors to annual inflation, making up 1.4 and 1.1 percentage points respectively. These were the main drivers of inflation in July. Food prices fell 0.4% m/m but rose 6.1% y/y, with all sub-categories except one increasing on an annual basis. Despite a bumper harvest for some vegetable products, Namibia’s reliance on South Africa for food imports is reflected in the increased prices of meat, oil and fats, and fruit. Increased transport prices have resulted from the recent upward trend in global oil prices and the depreciation of the Namibian dollar against the US dollar, making imports more expensive.

Alcoholic beverages and tobacco prices contributed 0.3 points to annual inflation, as they did in June, increasing by 0.8% m/m and 2.5% y/y in July. The miscellaneous category also contributed 0.3 percentage points to inflation alongside transport and housing, water and electricity. Driven by higher fuel prices, transport costs have increased by 1.0% m/m and 10.6% y/y in July.

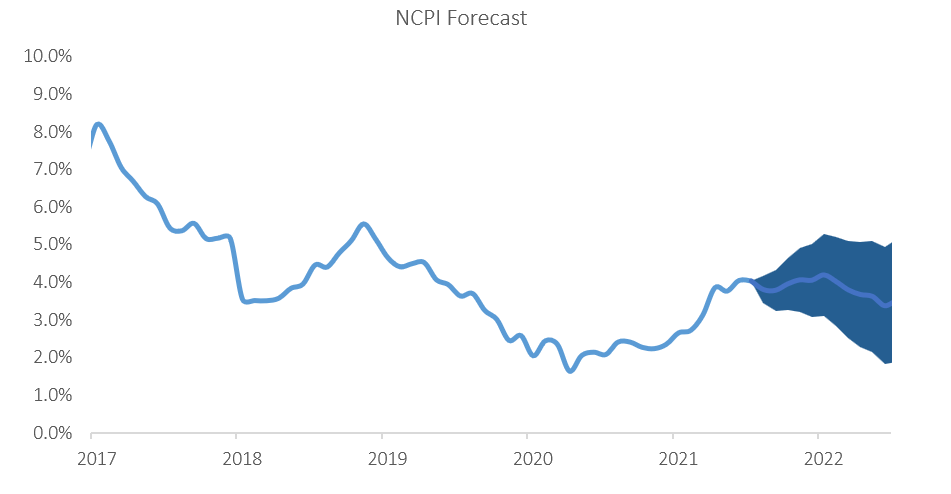

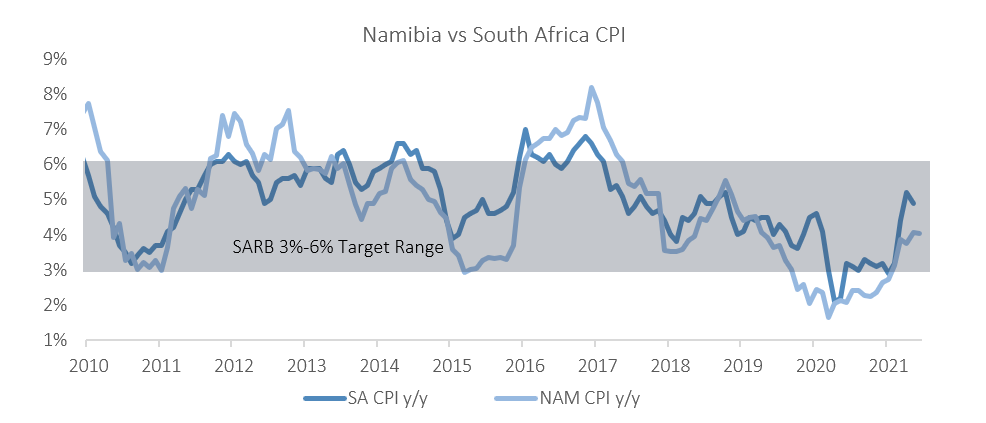

The 4.0% y/y increase in annual inflation is towards the upper end of IJG’s inflation forecast for the year. The main driver of inflation in the last couple of months has been food inflation which has been averaging 6.2% y/y since the beginning of the year. While risks remain to the upside, we see these as muted in the short-term in what is currently a very accommodative global monetary environment. Higher oil prices remain the largest risk in the short-term, while domestic and South African fiscal deterioration pose medium-term risks as debt levels increase unchecked, eating into the already limited productive portion of expenditure. IJG’s inflation model currently forecasts an average inflation rate of 3.7% y/y in 2021 and in 2022. Given that economic growth is expected to be low, and that inflation will likely remain muted, we expect monetary policy to remain accommodative over the short- to medium-term.