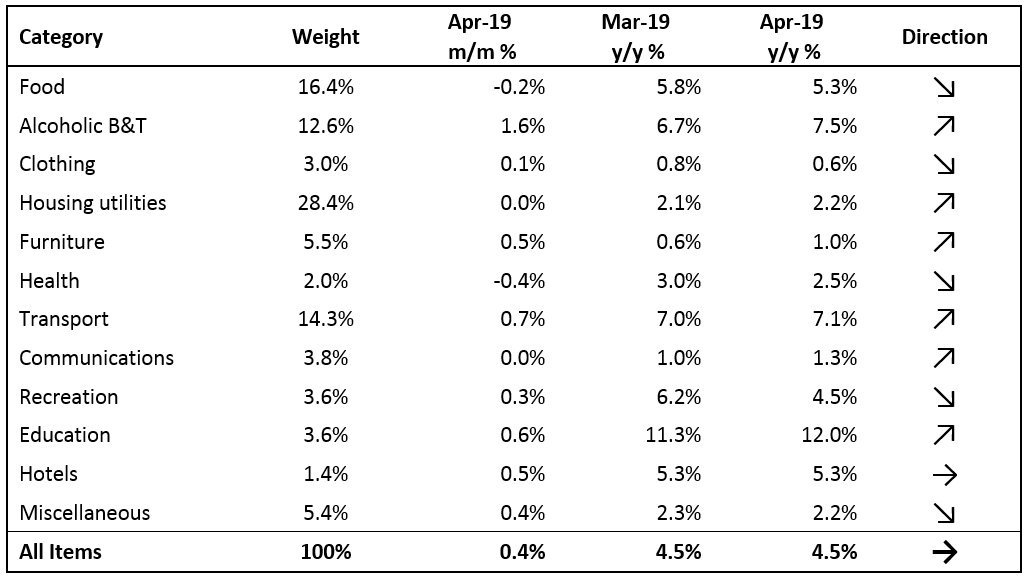

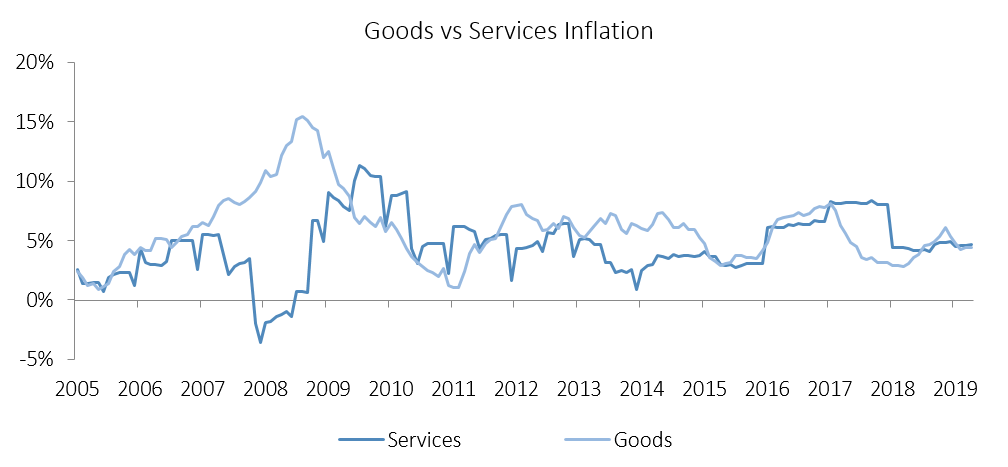

The Namibian annual inflation rate remained at 4.5% y/y in April, unchanged from March. On a month-on-month basis, prices increased by 0.4%, following the 0.2% m/m increase in March. Overall, prices in six of the basket categories rose at a faster annual rate than during the preceding month, five at a slower rate and one grew at a steady pace. Prices for goods rose by 4.4% y/y in April, while prices for services grew by 4.7%.

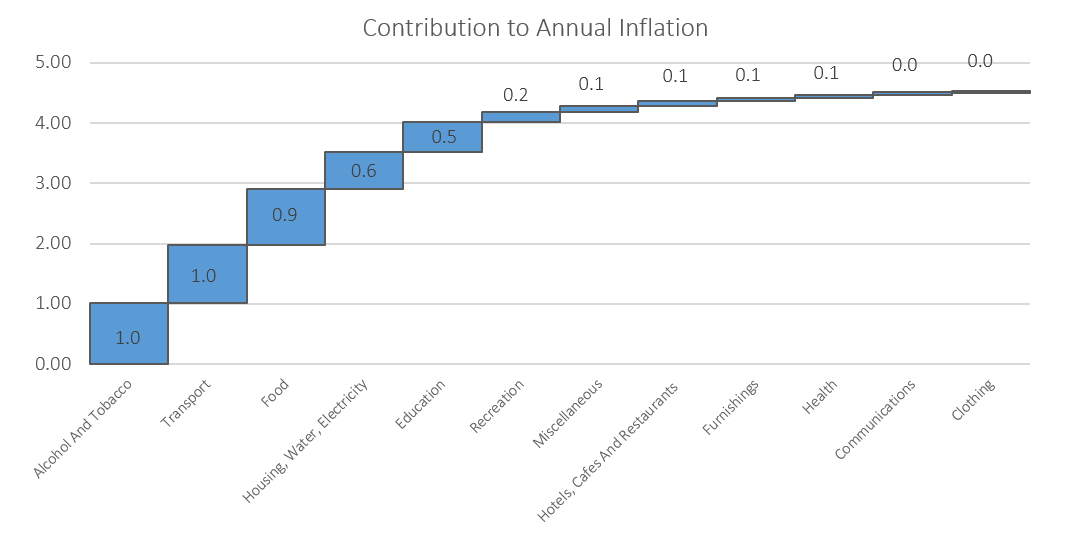

The alcoholic beverages and tobacco category displayed price increases of 1.6% m/m and 7.5% y/y in April, making it the largest contributor to annual inflation, accounting for 1.0% of the 4.5% annual inflation rate. The main driver in this basket category was alcohol prices which increased by 1.7% m/m and 7.6% y/y. Tobacco prices meanwhile increased at a rate of 0.8% m/m and 7.2% y/y. The relatively large increase in the prices of the alcoholic beverages and tobacco basket category can likely be explained by sin taxes that were announced during the budget speech in March, as well as second round effects stemming from the series of fuel price increases announced towards the end of 2018.

Transport, the third largest basket item, was the second largest contributor to annual inflation, accounting for 1.0% of the total 4.5% annual inflation figure. Transport costs increased by 0.7% m/m and 7.1% y/y. The purchase of vehicles subcategory saw price increases of 1.6% m/m and 4.6% y/y, while the operation of personal transport equipment subcategory recorded price increases of 0.6% m/m and 4.7% y/y. Brent Crude oil prices increased by about 6.5% during April, reaching US$73 per barrel at the end of the month. The Ministry of Mines and Energy once again announced that the government would finance the under-recoveries recorded during April, and subsequently kept fuel pump prices unchanged for the month.

Prices for the food & non-alcoholic beverages category was the third highest contributor to the annual inflation rate in April. Prices in this category fell by 0.2% m/m, but rose by 5.3% y/y. Prices in all thirteen sub-categories recorded increases on a year-on-year basis, with the largest increases being observed in the prices of vegetables, fruits and bread and cereals. We expect food price inflation to remain under upward pressure for the rest of the year, as poor rainfall during Namibia’s rainy season affects local food production.

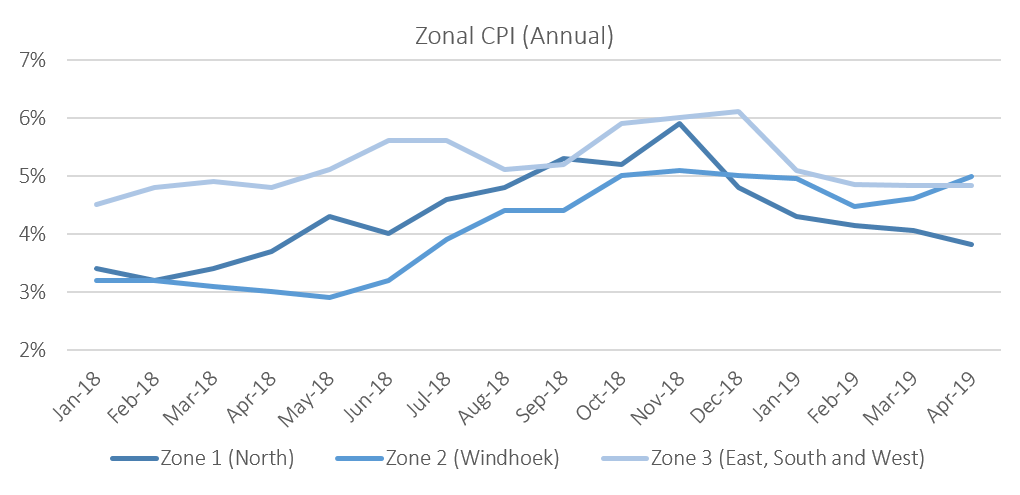

The Namibia Statistics Agency (NSA) for the first time released regional CPI data for Namibia, grouping the country into three zones, based on the then Central Bureau of Statistics’ (CBS) 2005 grouping. Zone 1 consists of regions in the northern part of the country, namely Kavango East, Kavango West, Kunene, Ohangwena, Omusati, Oshana, Oshikoto, Otjozondjupa and Zambezi. Zone 2 covers the Khomas region and Zone 3 covers the remaining //Karas, Erongo, Hardap, and Omaheke regions. The zonal data shows that Zone 2 (Windhoek) has the highest annual inflation at 5.0% y/y, Zone 3 (East, South and West) the second highest at 4.8% y/y and Zone 1 (North) in third place with an annual inflation rate of 3.8%.

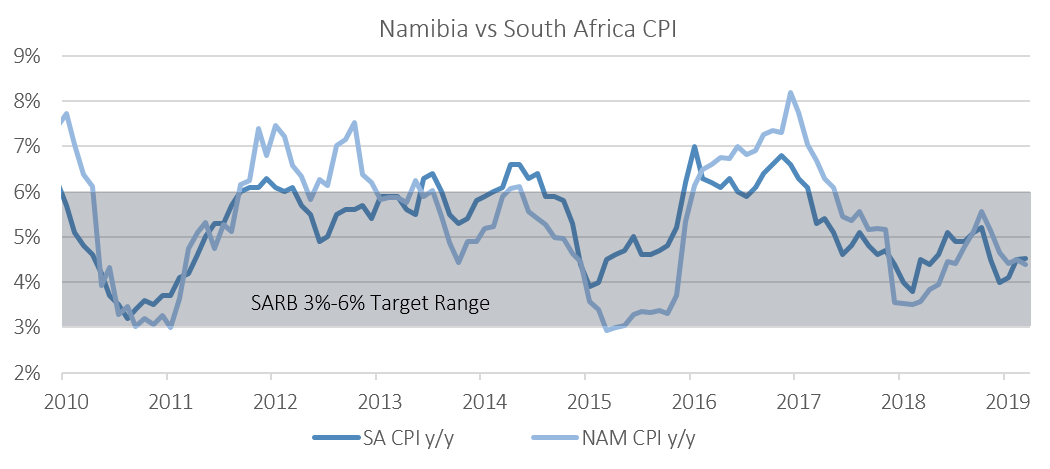

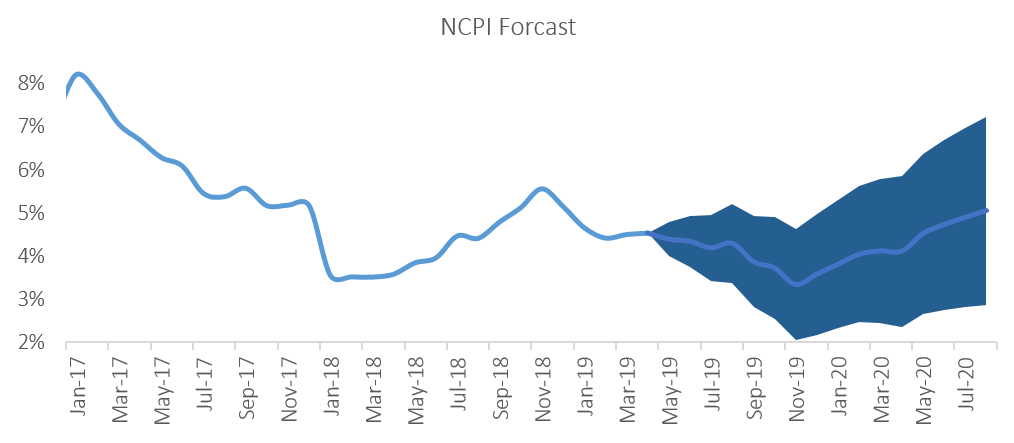

The Namibian annual inflation rate of 4.5% y/y continues to trend marginally higher than that of neighbouring South Africa’s 4.4% y/y. The South African Reserve Bank’s Monetary Policy Committee (MPC) yesterday announced their decision to leave the Repo rate unchanged. The SARB’s MPC lowered its forecast for core inflation from 4.8% to 4.5% in 2019. The probability of the SARB cutting rates has been increasing lately as a result of subdued inflation pressure and low growth forecasts, but these will likely need to be even lower to sway the MPC to cut rates. We expect the Bank of Namibia to follow the SARB’s decision at its next MPC meeting in June. IJG’s inflation model forecasts average inflation of 4.3% in 2019. The largest upside risk to this forecast, however, is higher transport and food costs.