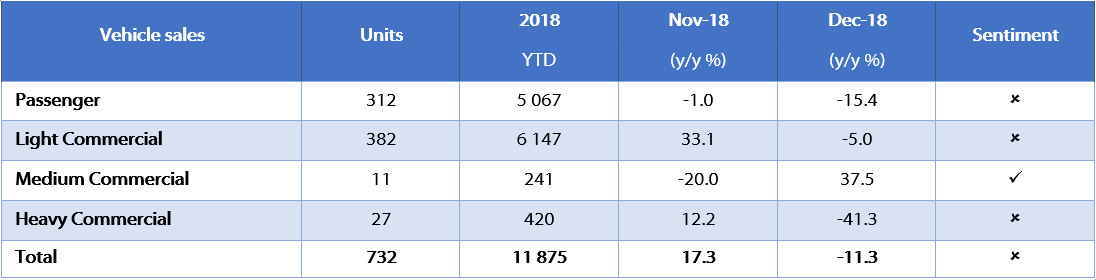

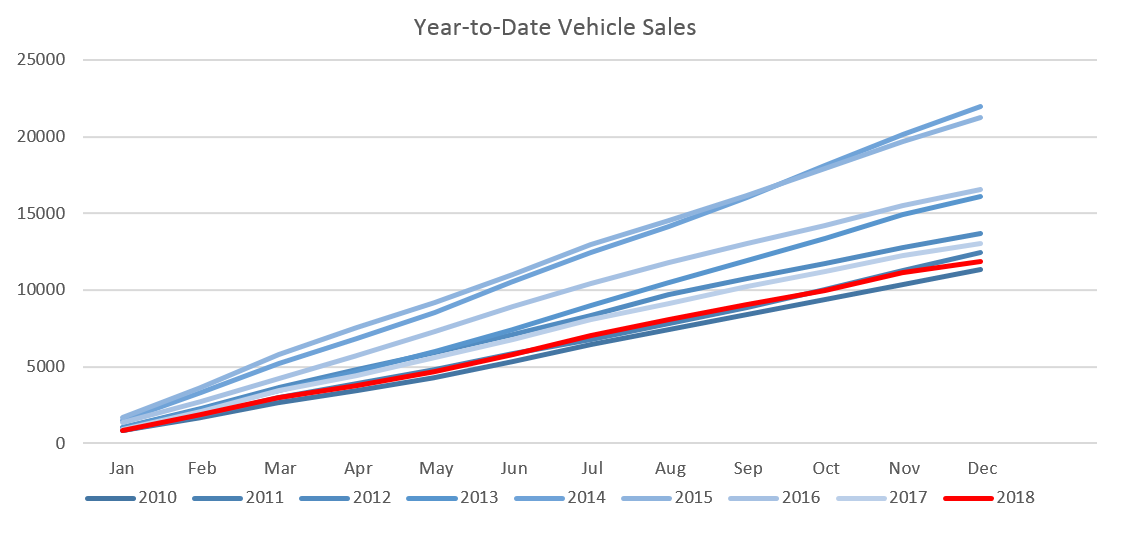

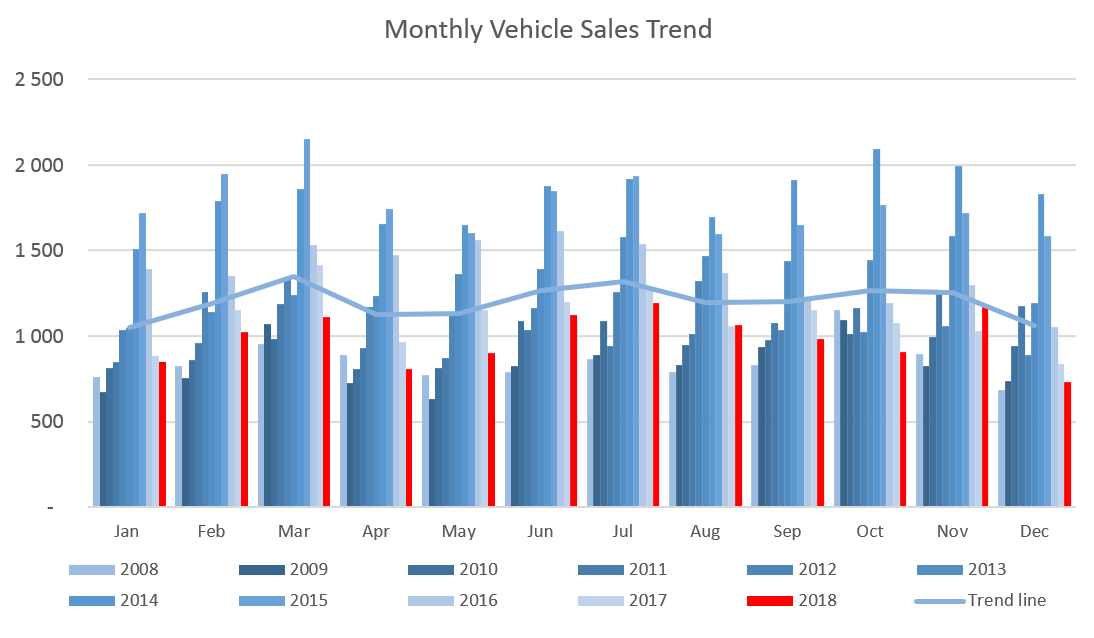

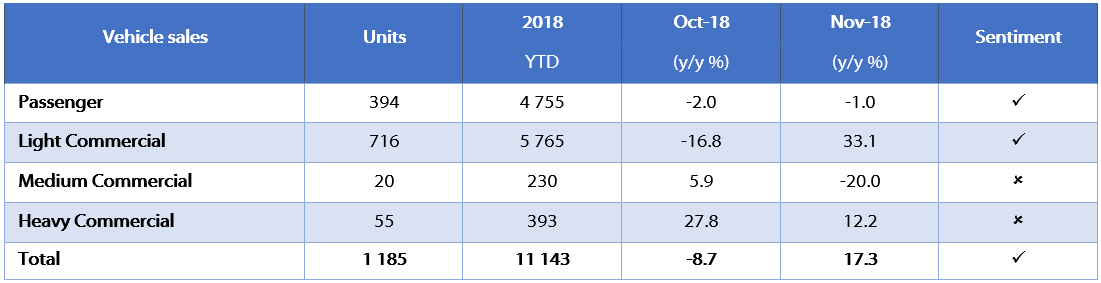

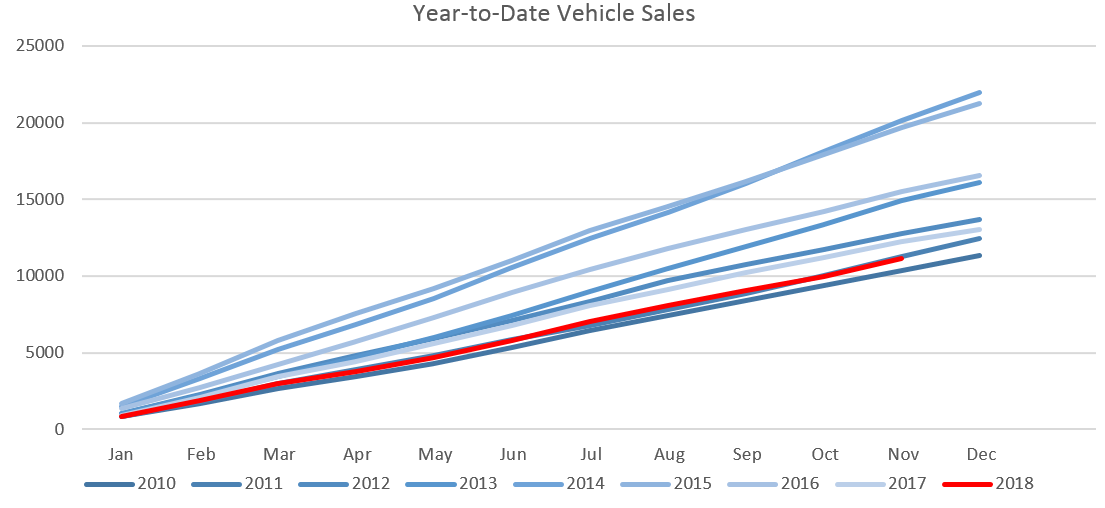

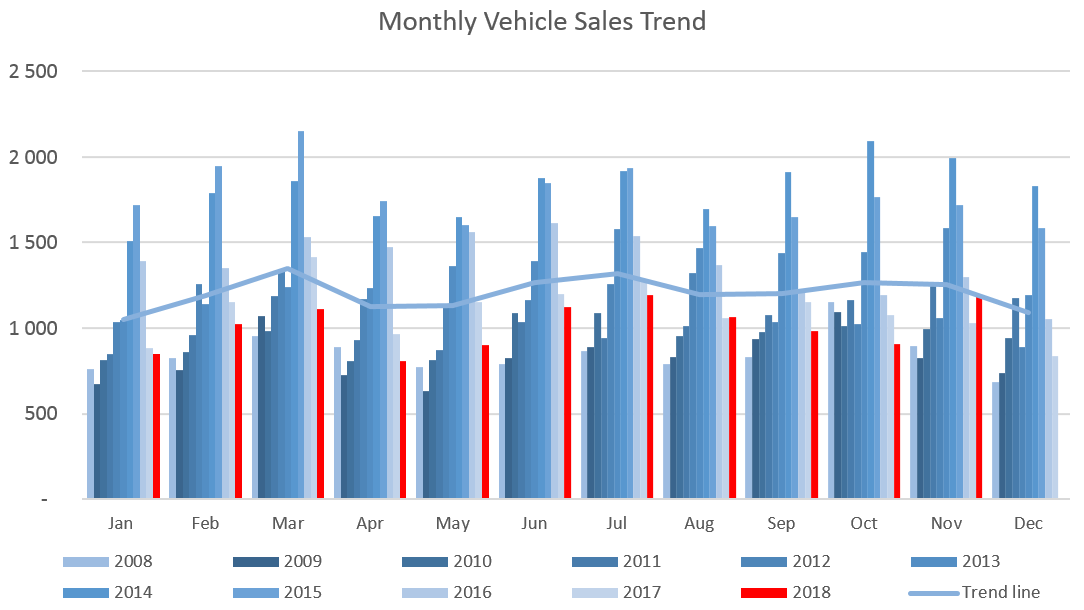

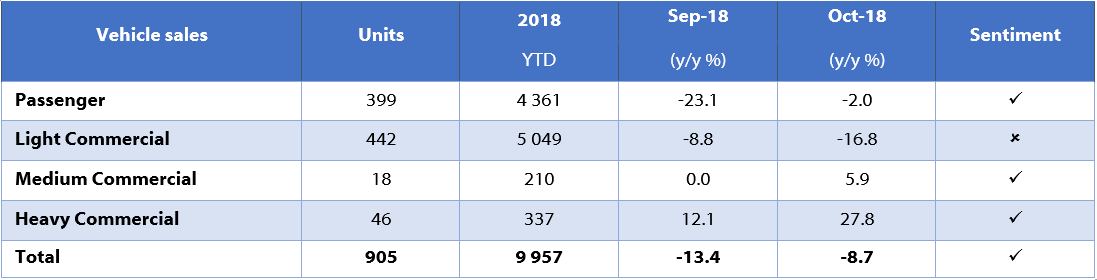

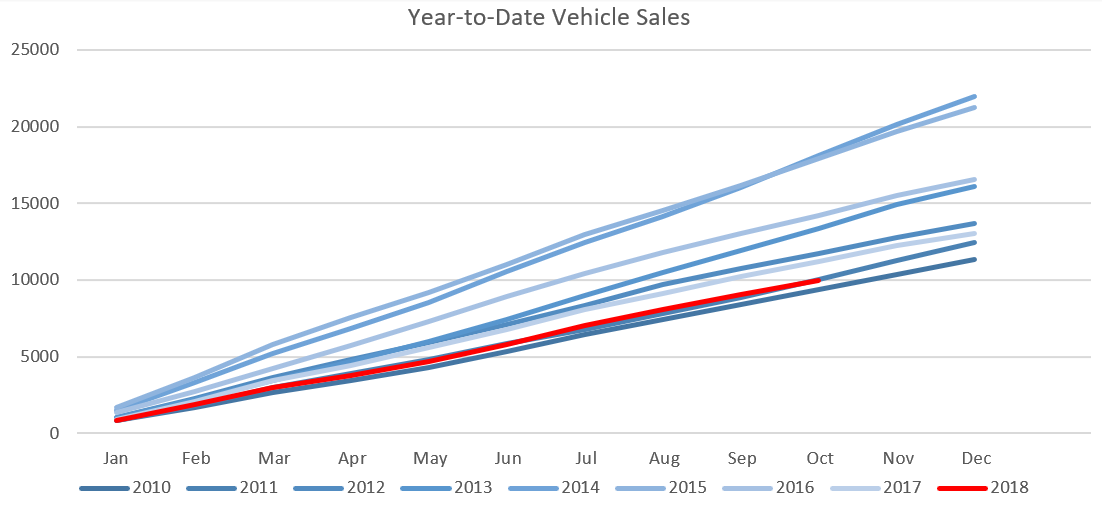

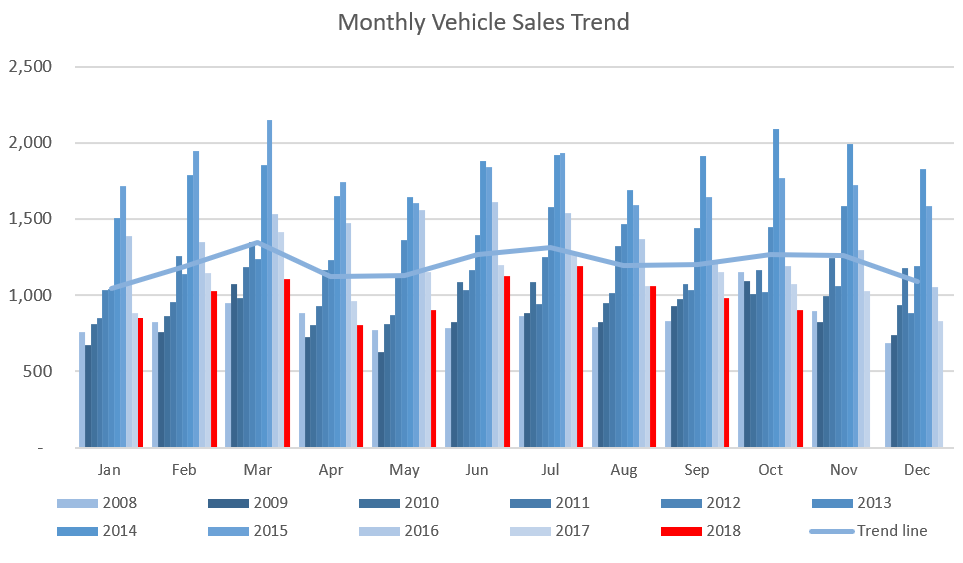

732 New vehicles were sold in December, down 38.2% m/m from the 1,185 vehicles sold in November, and a decrease of 11.3% y/y from the 825 new vehicles sold in December 2017. Year-to-date 11,875 vehicles have been sold, a 9.0% contraction from December last year and the lowest annual vehicle sales figure since December 2010. Of the 11,875 new vehicles sold during the year, 5,067 were passenger vehicles, 6,147 light commercial vehicles, and 661 medium and heavy commercial vehicles.

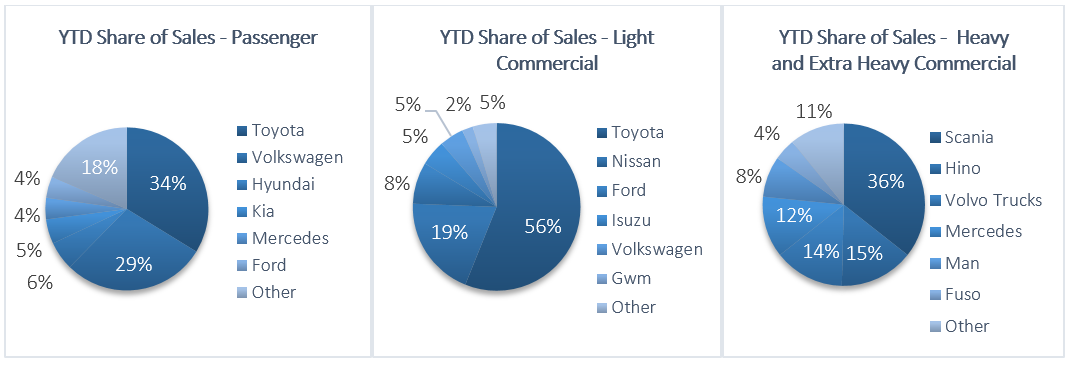

A total of 312 new passenger vehicles were sold during December, down 20.8% m/m and 15.4% y/y. 5,067 passenger vehicle were sold in total in 2018, an 8.2% decline from 2017 and lower annual sales than the preceding seven years. Passenger vehicle sales made up 42.7% of the total number of new vehicles sold during 2018, broadly in line with the trend over the last 4 years.

Commercial vehicle sales declined to 420 units in December, a 46.9% m/m, and 7.9% y/y contraction. During the month 382 light commercial vehicles, 11 medium commercial vehicles, and 27 heavy commercial vehicles were sold. On a year-on-year basis, light commercial sales have declined by 5.0%, medium commercial sales rose by 37.5%, and heavy and extra heavy sales have declined by 41.3%. On a twelve-month cumulative basis, light commercial vehicle sales dropped 10.2% y/y, while medium commercial vehicle sales rose 8.6% y/y, and heavy commercial vehicle sales fell 8.3% y/y.

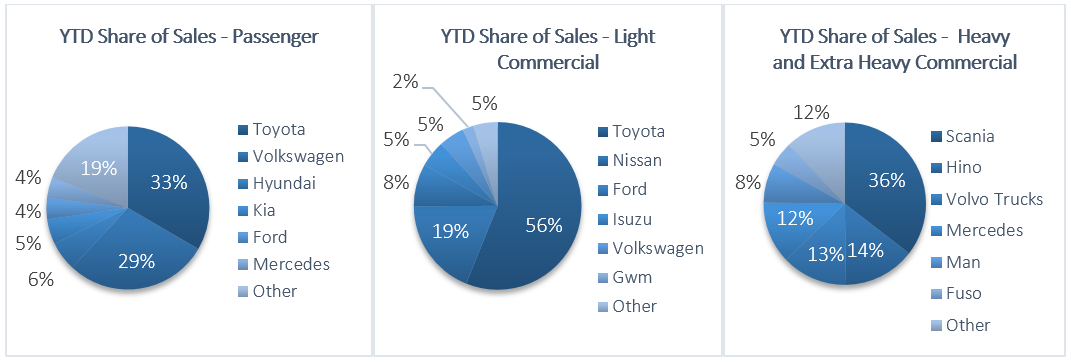

Toyota continued to lead the market for new passenger vehicle sales in 2018, claiming 33.4% of the market, followed by Volkswagen with a 28.5% share. They were followed by Hyundai and Kia at 5.8% and 5.0% respectively, while the rest of the passenger vehicle market was shared by several other competitors.

Toyota also remained the leader in the commercial vehicle space in 2018 with 56.1% market share, with Nissan in second place with an 18.8% share. Ford and Isuzu claimed 8.2% and 5.1% respectively of the number of new light commercial vehicles sold for the year. Hino lead the medium commercial vehicle category with 39.4% of sales while Scania was number one in the heavy and extra-heavy commercial vehicle segment with 35.5% of the market share during the year.

The Bottom Line

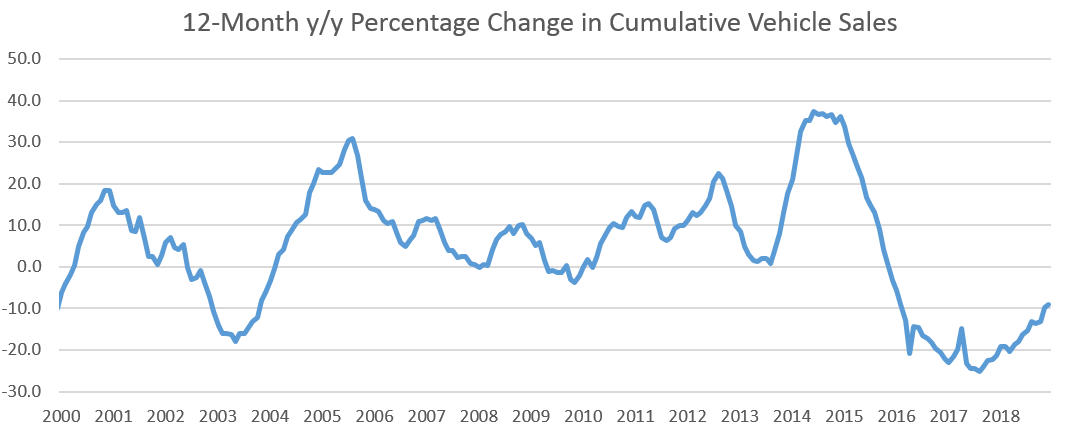

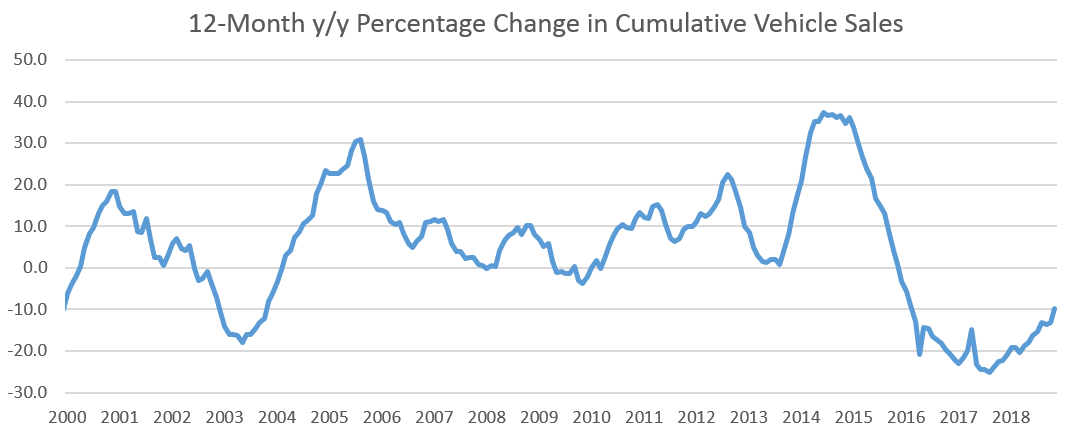

The outlook for new vehicle sales remains bleak with the cumulative number of new vehicle sales for the year amounting to 11,875, a decline of 9.0% from the cumulative number of vehicles sold in 2017 and a 47.6% contraction from the peak of 22,664 new vehicle sales recorded in April 2015. The fact that the 12-month cumulative figure is hovering around 2011 levels is a consequence of the recessionary environment we find ourselves in, characterised by depressed business and consumer confidence, as well as lower government spending. December new vehicle sales have historically been low when compared to most other months as people go on holiday and dealerships close, but 2018’s December figure was the lowest since 2008, pointing to the ongoing impact of the current recession on demand and investment.