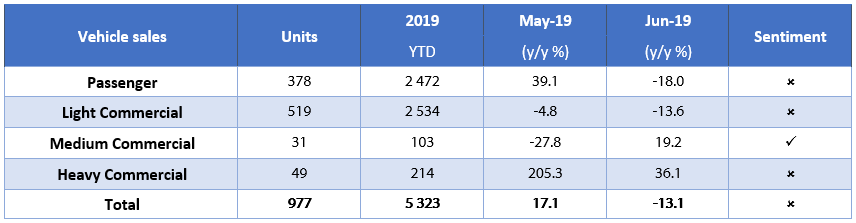

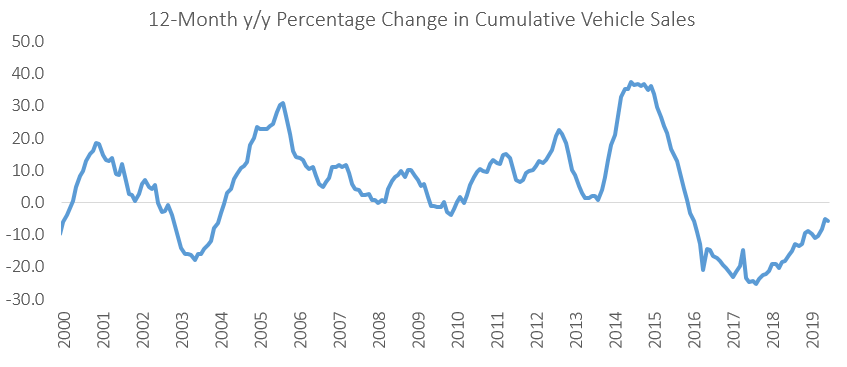

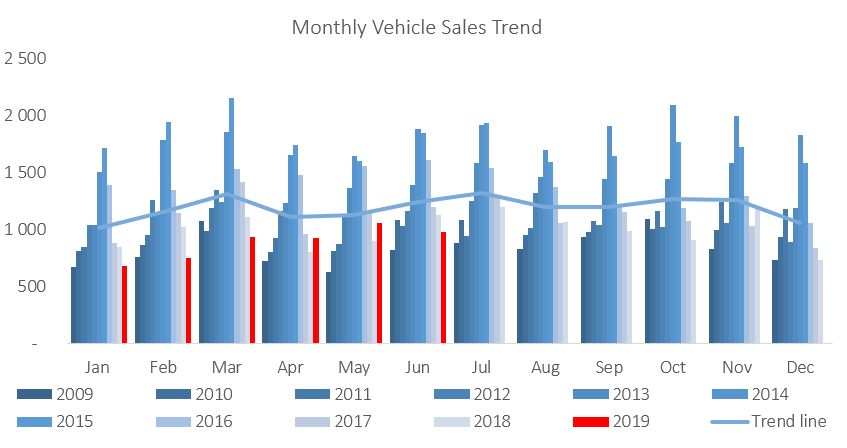

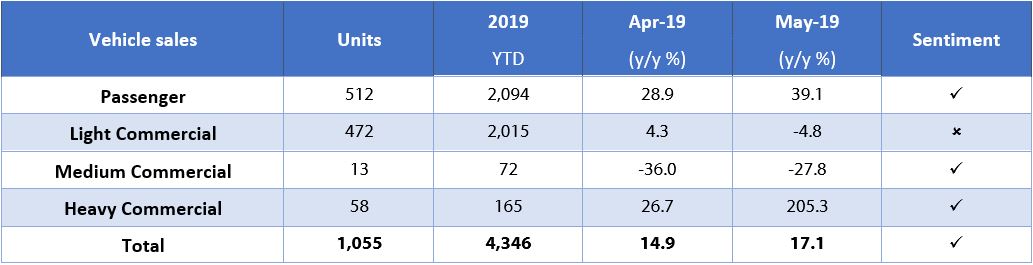

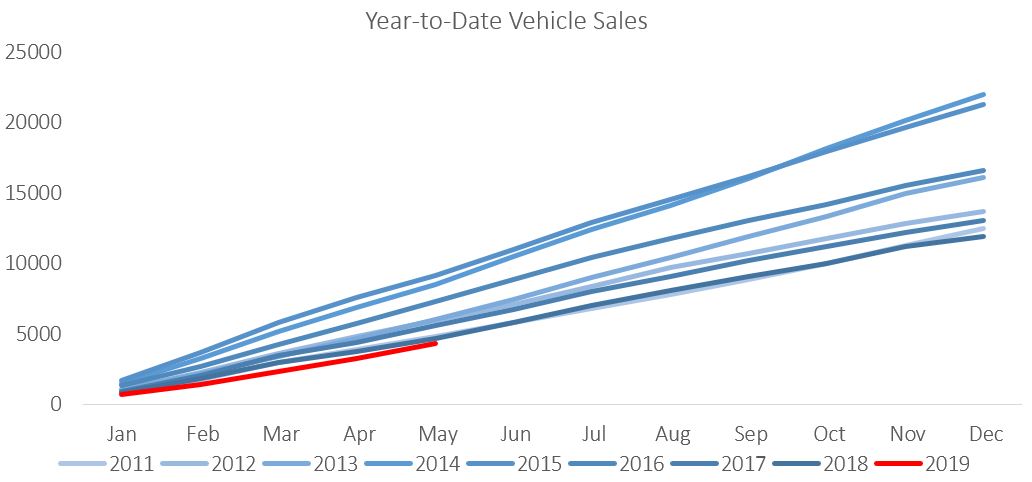

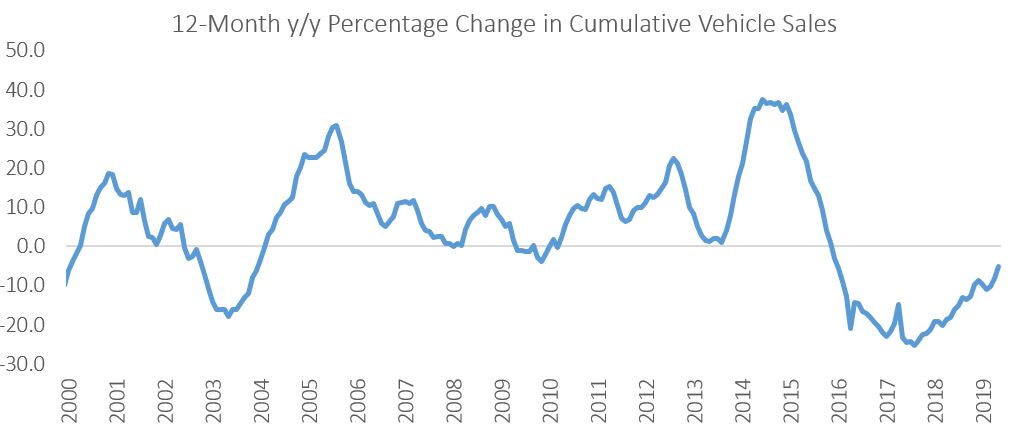

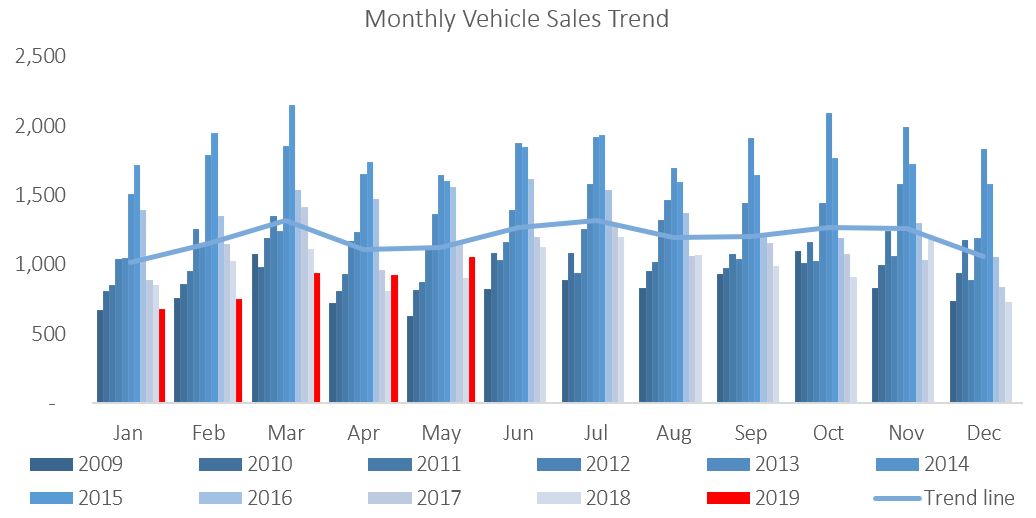

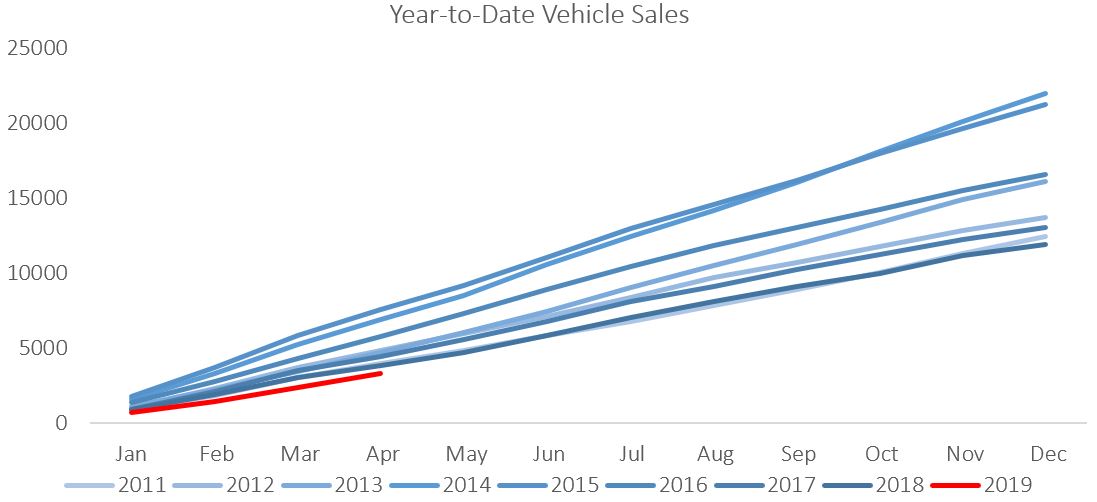

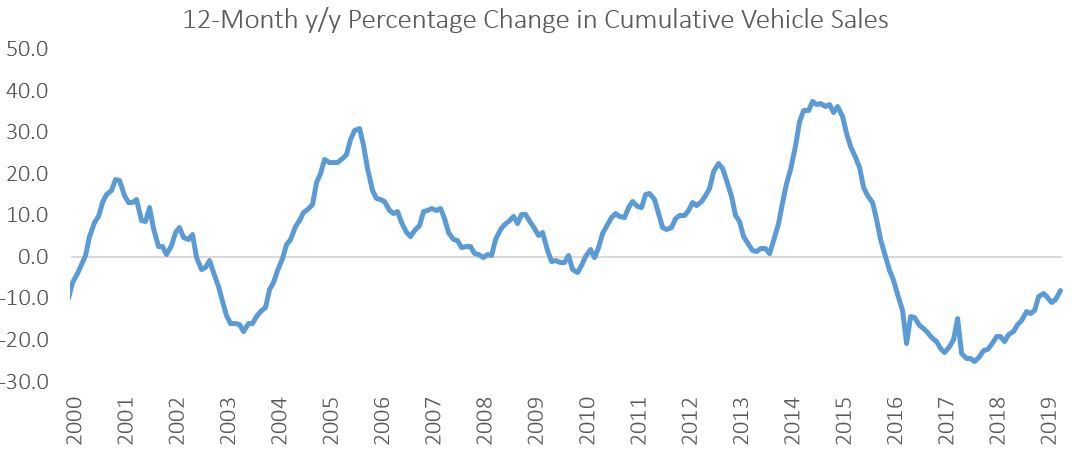

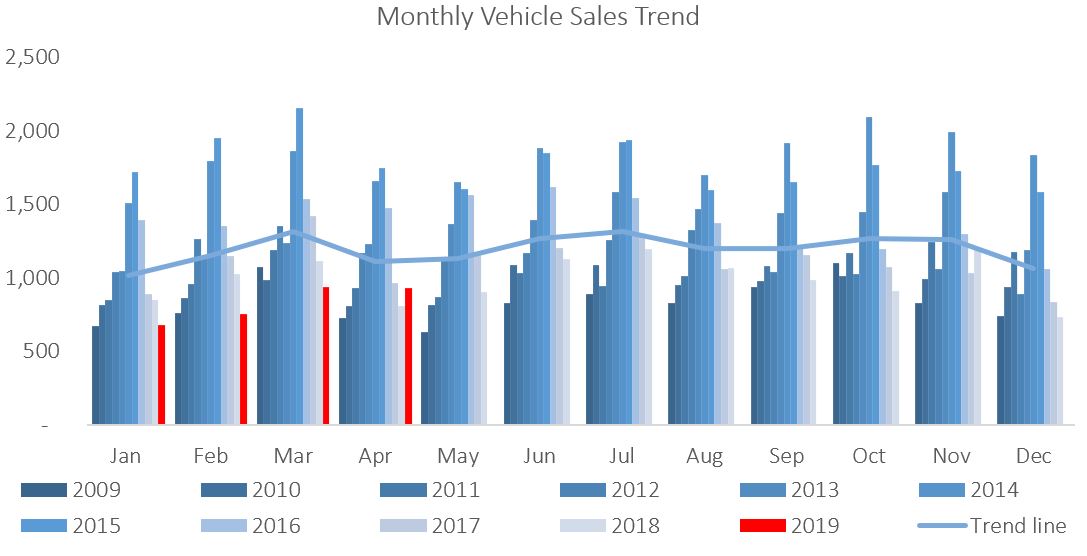

A total of 977 new vehicles were sold in June, representing a 7.4% m/m decrease from the 1,055 vehicles sold in May. Year-to-date, 5,323 vehicles have been sold of which 2,472 were passenger vehicles, 2,534 were light commercial vehicles, and 317 were medium and heavy commercial vehicles. On a rolling 12-month basis a total of 11,412 new vehicles were sold as at June 2019, representing a contraction of 5.7% from the 12,100 sold over the comparable period a year ago.

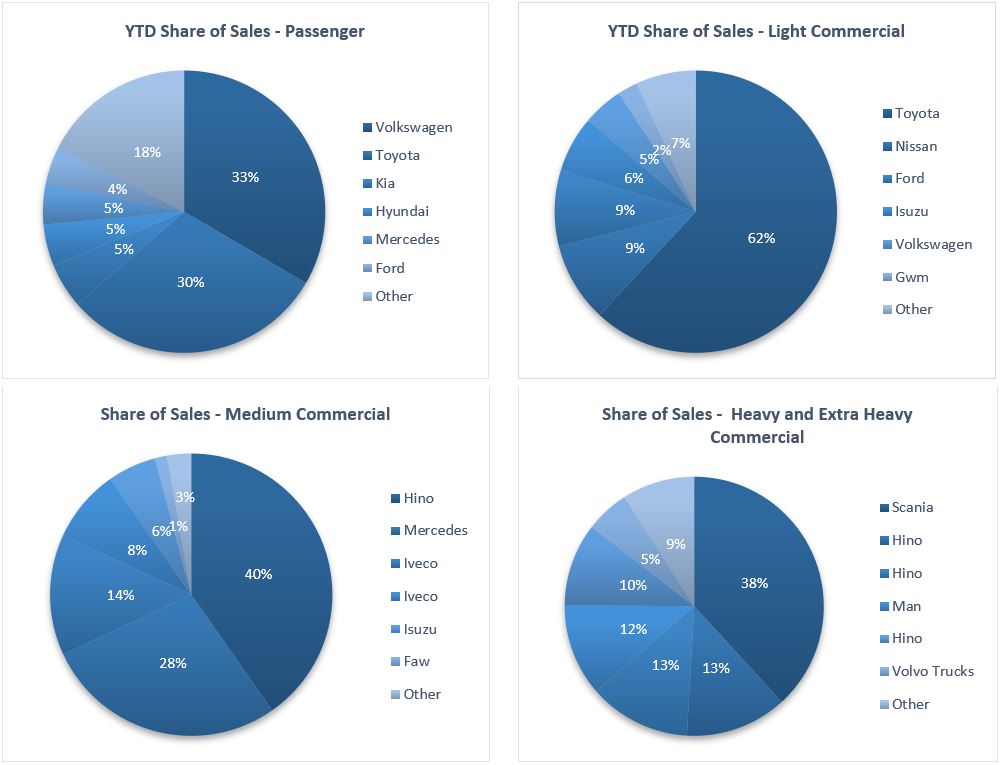

378 New passenger vehicles were sold in June, declining by 26.2% m/m and 18.0% y/y. Year-to-date passenger vehicle sales rose to 2,472 units, down 5.0% when compared to the number sold in the first half of last year. Twelve-month cumulative passenger vehicle sales fell 1.6% m/m and 2.4% y/y. Passenger vehicles have made up 46.4% of the total number of new vehicles sold in the first six months of 2019, compared to 44.7% in the same period last year.

A total of 599 new commercial vehicles were sold in June, representing a 10.3% m/m increase, but a 9.7% y/y contraction. Of the 599 commercial vehicles sold in June 519 were classified as light commercial vehicles, 31 as medium commercial vehicles and 49 as heavy or extra heavy commercial vehicles. On a twelve-month cumulative basis, light commercial vehicle sales dropped 10.5% y/y, while medium commercial vehicle sales rose 5.0% y/y, and heavy commercial vehicle sales rose by 25.4% y/y. While medium- and heavy commercial vehicles continue to record growth on a twelve-month cumulative basis, the light segment of the market continues to see lower volumes sold than in 2018.

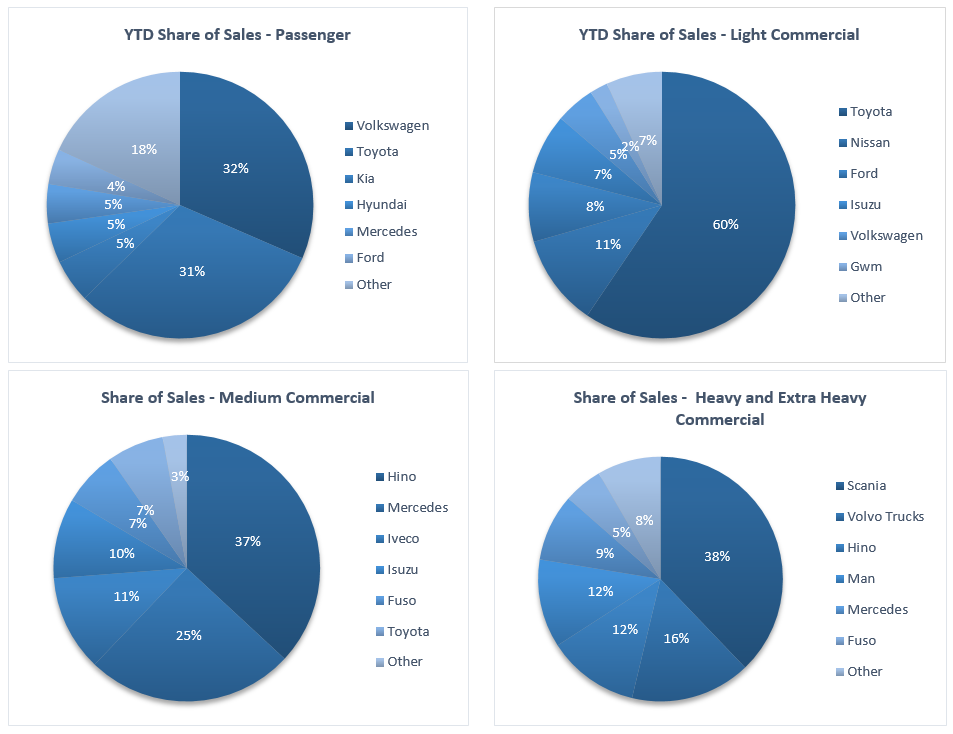

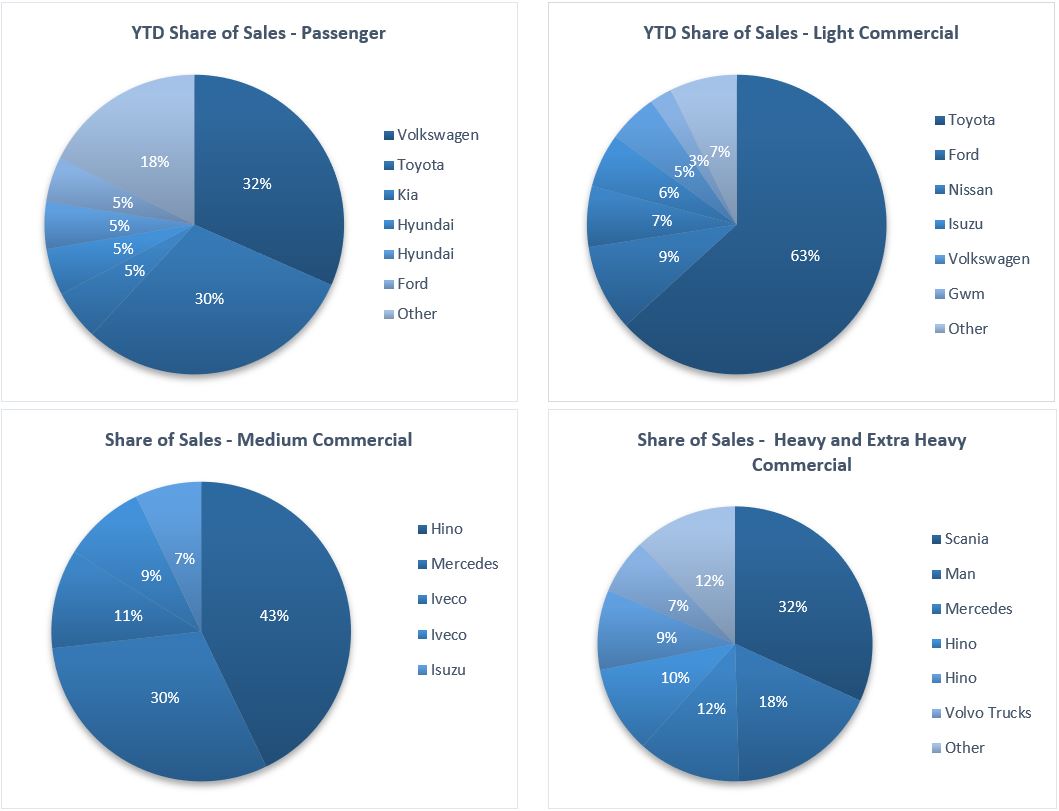

Volkswagen narrowly leads the passenger vehicle sales segment with 31.5% of the segment sales year-to-date. Toyota retained second place with 31.2% of the market share as at the end of June. Kia, Hyundai, Mercedes and Ford each command around 5.0% of the market in the passenger vehicles segment, leaving the remaining 18.2% of the market to other brands.

Toyota, with a strong market share of 59.5% year-to-date commands the light commercial vehicles sales segment. Nissan remains in second position in the segment with 11.1% of the market, while Ford makes up third place with 8.4% of the year-to-date sales. Hino leads the medium commercial vehicle segment with 36.9% of sales year-to-date, while Scania was number one in the heavy- and extra-heavy commercial vehicle segment with 37.9% of the market share year-to-date.

The Bottom Line

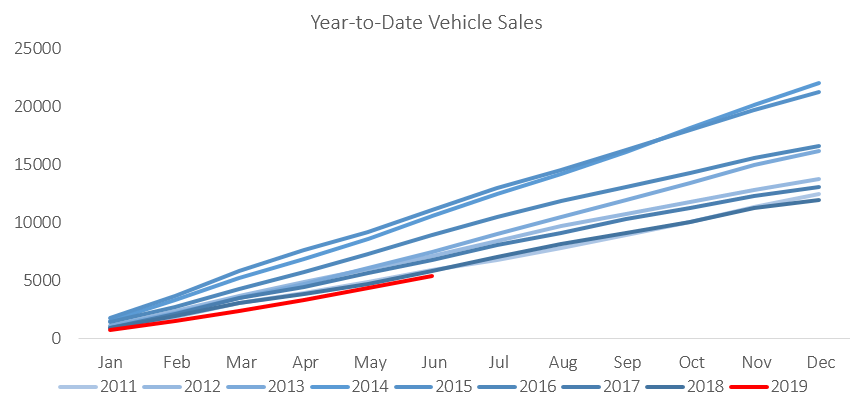

Vehicle sales remain under pressure, with the year-to-date new vehicle sales in 2019 currently below 2011 levels, and the total new vehicle sales for the last 12 months down 5.7% from the same period in 2018. The prospects for new vehicle sales remain dim in the short- to medium-term as government remains committed to fiscal consolidation and the economy remains in a recession, putting pressure on demand and investment.