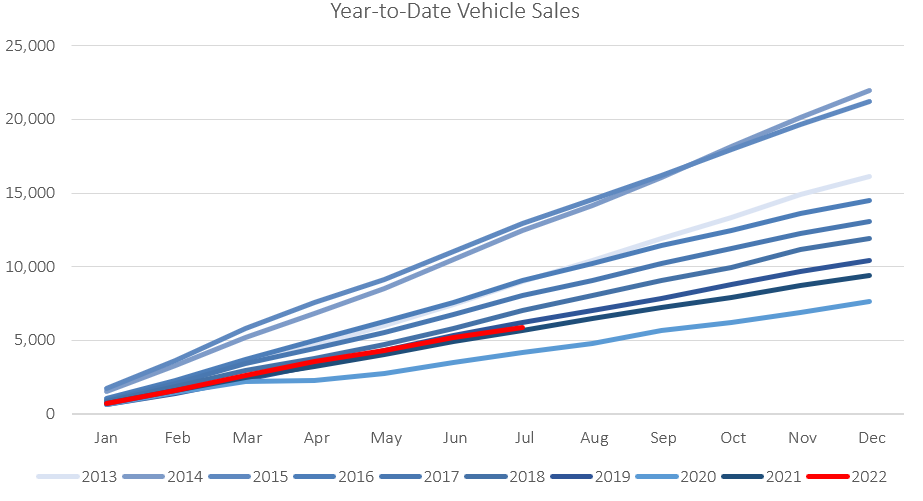

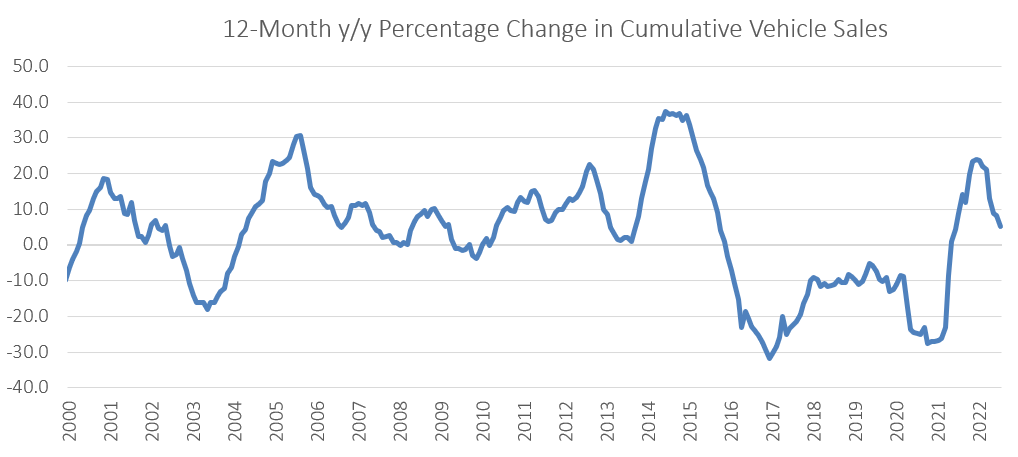

A total of 1,018 new vehicles were sold in September, which is 34 fewer than were sold in August, but represents a 32.7% y/y increase from the 767 new vehicles sold in September 2021. Year-to-date, a total of 7,932 new vehicles have been sold during the first three quarters of the year, of which 4,075 (or 51.4%) were passenger vehicles, 3,358 light commercial vehicles, and 499 medium and heavy commercial vehicles. On a twelve-month cumulative basis, a total of 10,139 new vehicles were sold up to the end of September 2022, representing an increase of 10.4% from the 9,186 new vehicles sold over the same period a year ago.

A total of 505 new passenger vehicles were sold in September, a 2.3% decrease from the 517 sold in August but a 32.9% increase compared to the same month last year. Toyota and Volkswagen’s sales accounted for 63.8% of the new passenger vehicles during the month. Year-to-date, new passenger vehicle sales are up 20.5% y/y. On a 12-month cumulative basis, sales have increased by 18.8% y/y to 5,176, the highest it has been since August 2018.

A total of 513 new commercial vehicles were sold in September, down 4.1% m/m from the 535 commercial vehicles sold in August but up 32.6% y/y when compared to the 387 commercial vehicles sold in September 2021. Light commercial vehicle sales continue to make up the bulk of the new commercial vehicle sales with 448 sold in September, followed by 44 heavy and extra heavy commercial vehicles and 21 medium commercial vehicles. On a year-on-year basis, light commercial sales rose 47.4% y/y, medium commercial vehicles rose 31.3% y/y, while heavy and extra heavy vehicle sales contracted by 34.3% y/y. On a twelve-month cumulative basis, light commercial vehicle sales rose by 4.4% y/y, while medium- and heavy and extra heavy commercial vehicle sales are down by 0.5% y/y and 8.3% y/y, respectively.

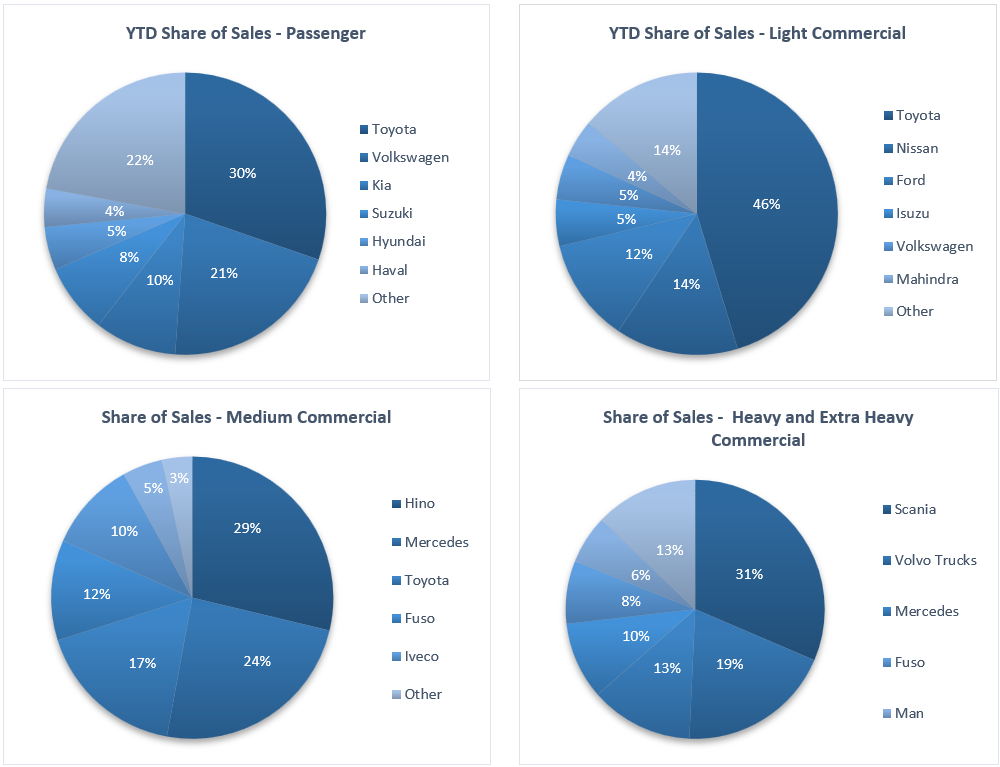

Toyota had a strong month and continues to retain its lead in the new passenger vehicle sales segment, accounting for 31.3% of the sales year-to-date, followed by Volkswagen with 23.0% market share. The two top brands have been maintaining their large gap over the rest of the market with Kia and Suzuki following with 9.0% and 7.9% of the market, respectively, leaving the remaining 28.7% of the market to other brands.

On a year-to-date basis, Toyota also maintained its dominance in the light commercial vehicle market with a 46.9% market share, with Nissan in second place with a 12.7% market share. Ford and Isuzu claimed 11.6% and 5.6% of the light commercial vehicle sales, respectively. Hino continues to lead the medium commercial vehicle segment with 27.0% of sales year-to-date. Scania retained its position as the leader in the heavy and extra-heavy commercial vehicle segment with 27.6% of the market share year-to-date.

The Bottom Line

In context, September’s new vehicle sales figure were in line with August sales, again breaching the 1,000 mark. On a 12-month cumulative basis, total new vehicle sales breached the 10,000 level for the first time since March 2020. New vehicle sales this year are trending around the levels seen in 2019. New passenger vehicle sales continue to tick up on a 12-month cumulative basis, while new commercial vehicle sales continue to hover around the 4,800 level, where it has been trending since April 2021.