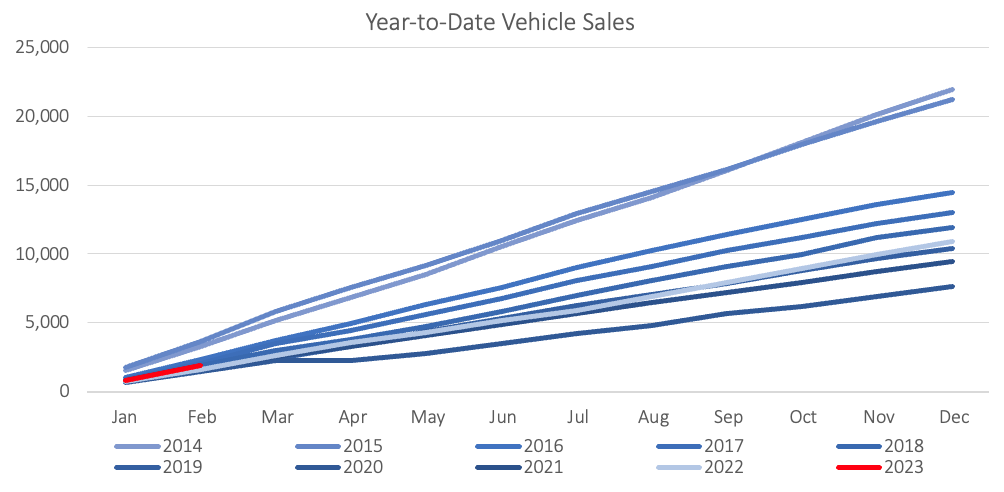

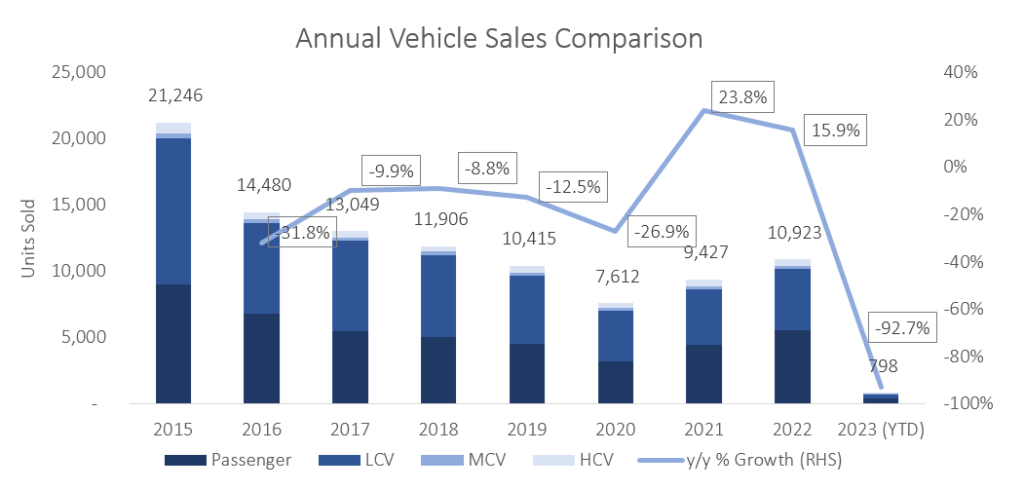

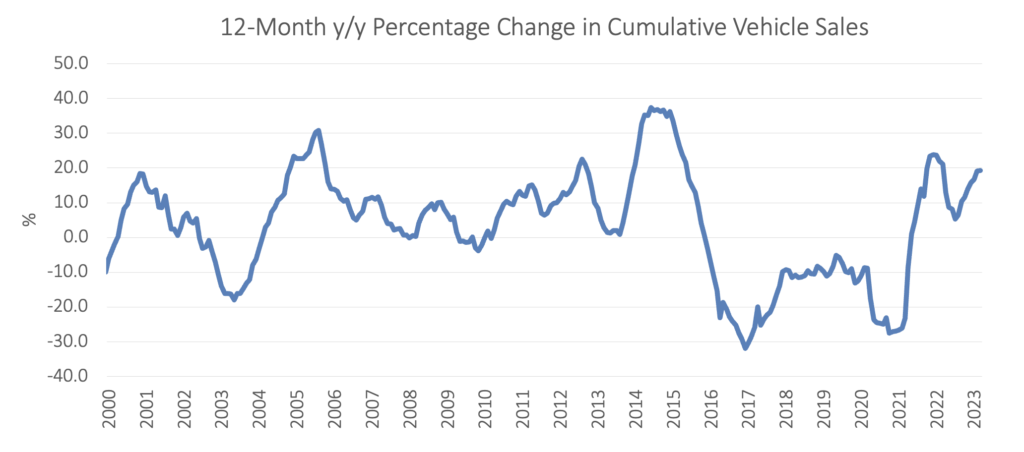

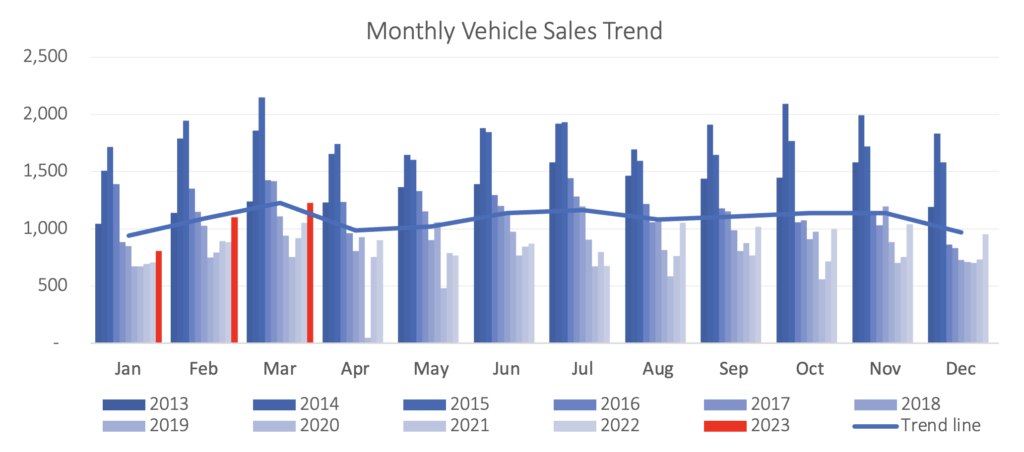

1,226 new vehicles were sold in March, an increase of 11.4% m/m and 16.3% y/y, and the highest monthly total since July 2017. 3,134 new vehicles were sold during the first quarter, of which 1,606 were passenger vehicles, 1,363 light commercial vehicles, and 165 medium- and heavy commercial vehicles. By comparison, the first three months of 2022 saw 2,645 new vehicles sold, indicating a robust start to 2023 for new vehicle sales. On a 12-month cumulative basis, a total of 11,412 new vehicles were sold as at March 2023, representing an increase of 19.3% y/y from the 9,567 sold over the comparative period a year ago.

575 new passenger vehicles were sold during March, representing an increase of 3.2% m/m and 8.7% y/y. Year-to-date, new passenger vehicle sales rose to 1,606 in the first quarter, 16.8% higher than during the same period in 2022 and 42.0% higher than the first quarter of 2021. On a 12-month cumulative basis, new passenger vehicle sales climbed to 5,805, a 22.8% y/y increase from the 4,728 over the corresponding period a year ago.

New commercial vehicle sales were similarly strong in March, with 651 units sold during the month the highest monthly figure since November 2018. New commercial vehicle sales rose 19.7% m/m and 24.0% y/y. 580 light commercial vehicles, 23 medium commercial vehicles, and 48 heavy and extra heavy commercial vehicles were sold during the month. All categories recorded increases on a year-on-year basis, with light commercial vehicles being 24.2% higher than in March 2022, medium commercial vehicles up 53.3% y/y, and heavy and extra heavy up 11.6% y/y. On a twelve-month cumulative basis, light commercial vehicle sales are 20.1% higher than during the corresponding period a year ago, medium commercial vehicle sales are up 21.8% y/y, while heavy commercial vehicle sales contracted by 16.5% y/y.

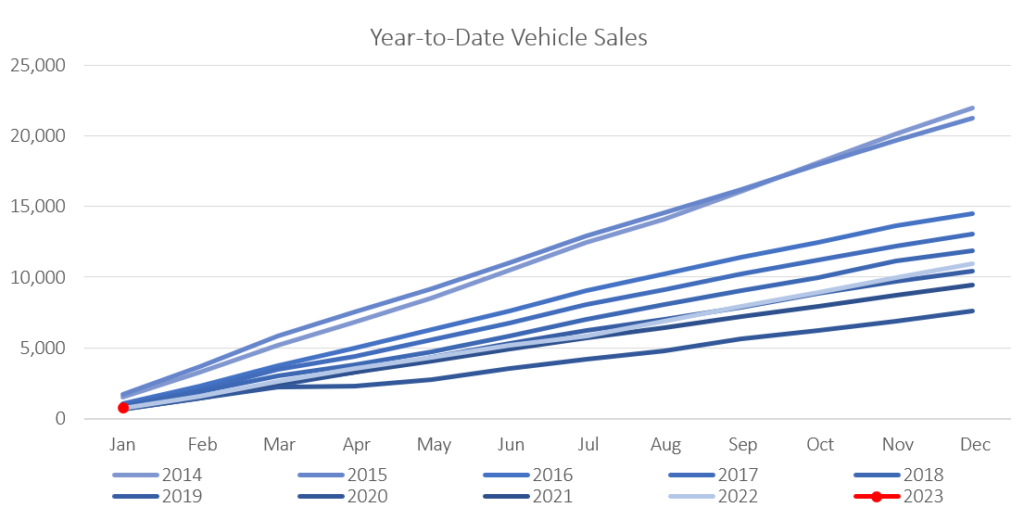

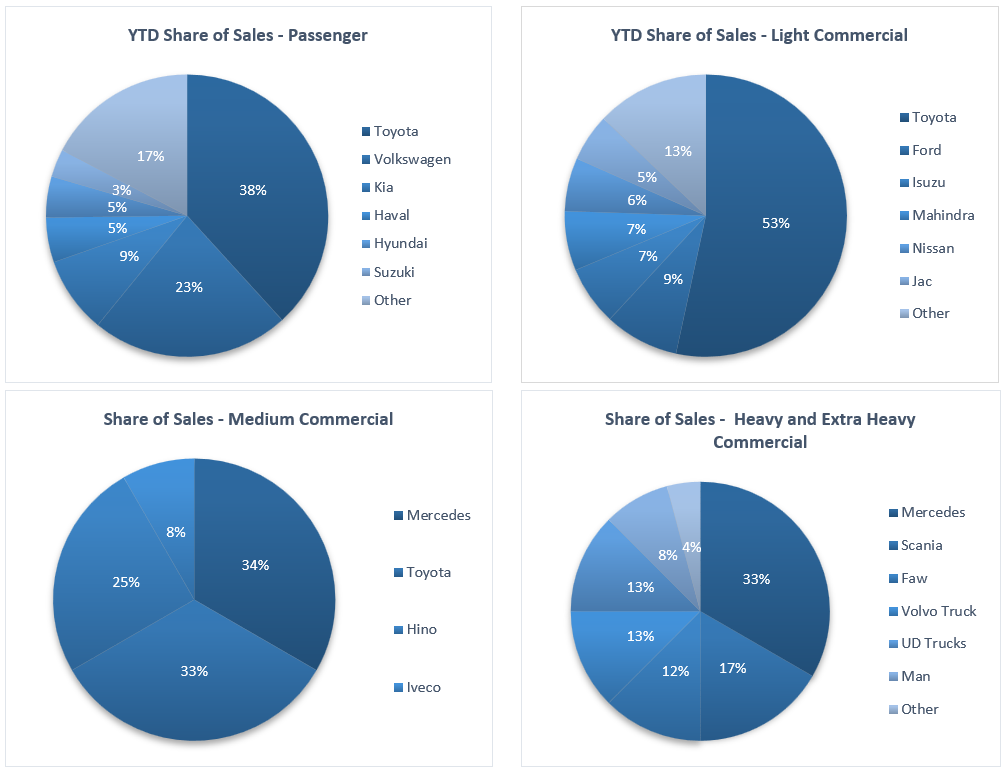

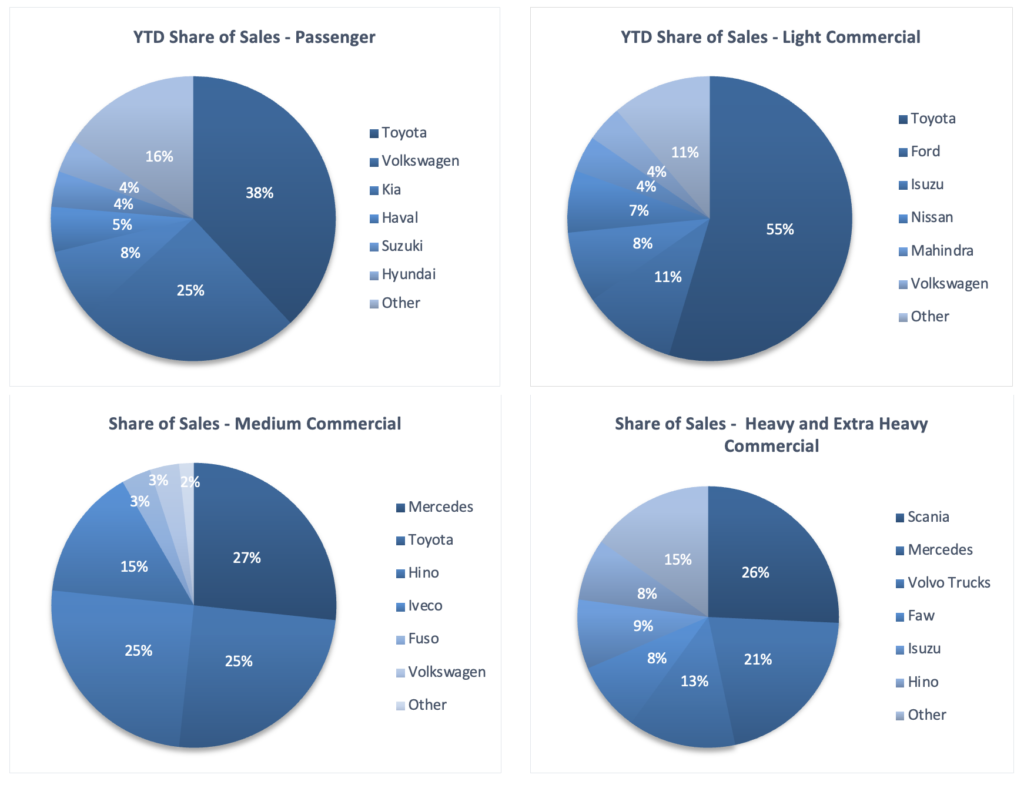

Toyota continues to enjoy a strong lead in the new passenger vehicle sales segment, claiming 38.0% of the sales on a year-to-date basis, followed by Volkswagen with a 25.1% share. They were followed by Kia and Haval with 8.1% and 5.1% of the market, respectively, leaving the remaining 23.7% of the market to other brands.

Toyota also has a dominant lead in the light commercial vehicle segment with 54.6% of the sales year-to-date. Ford came in second place, claiming a market share of 10.7%. Mercedes leads the medium commercial vehicle segment with a 26.7% market share, while Scania is number one in the heavy- and extra heavy commercial segment with 25.7% of the market share year-to-date.

The Bottom Line

Demand for new vehicles remained strong in March among all segments. The uptick in March was primarily driven by a 107 unit increase in commercial vehicle sales, supported by a strong passenger figure. The 2023 Q1 new passenger vehicle sales figure is the highest since 2017 and the 12-month cumulative sales figure is trending at its highest level since mid-2017. Q1 new commercial vehicle sales were the highest since 2018 and the 12-month cumulative sales figure is at its highest since March 2020.