Overall

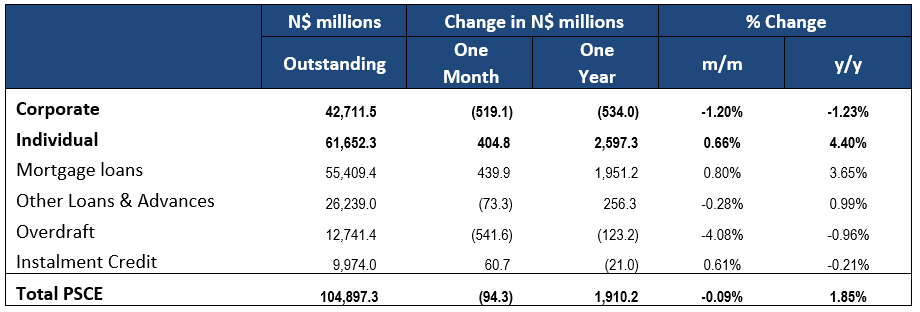

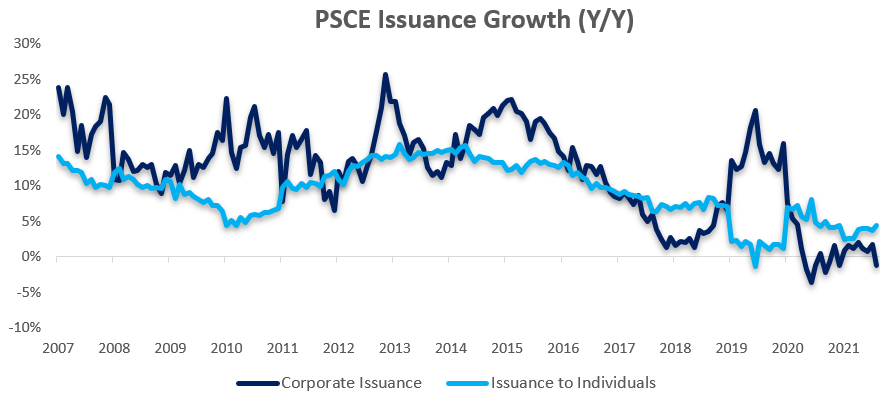

Private sector credit (PSCE) decreased by N$94.3 million or 0.09% m/m in August. On a year-on-year basis, PSCE grew by 1.85% y/y in August, down from July’s increase of 2.72% y/y. On a month-on-month basis, financial corporations, individuals and the non-resident private sector all increased their borrowings. Corporates, on the other hand, decreased their borrowings by N$519.1 million or 1.20% m/m. Cumulative credit extended to the private sector over the last 12-months amounted to N$1.91 billion, down 17.0% from the N$2.23 billion issued by this time last year. Individuals have taken up the majority of this cumulative issuance.

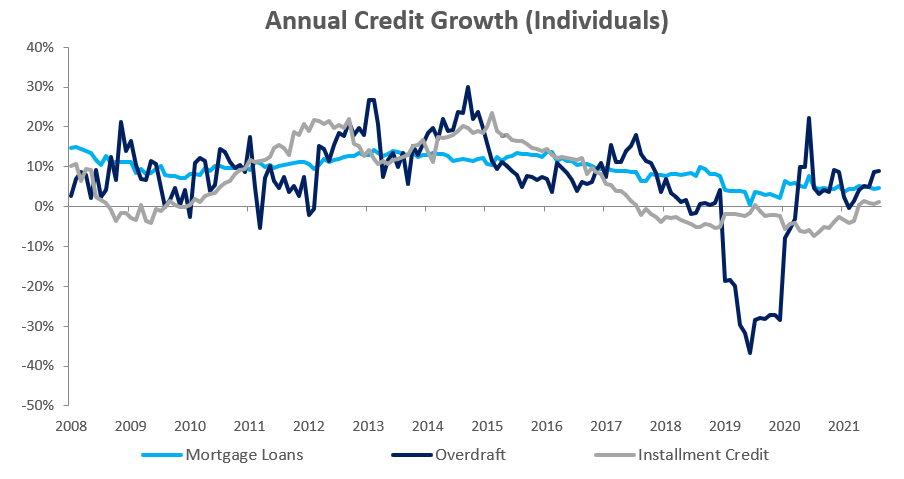

Credit Extension to Individuals

Credit extended to individuals increased by 0.66% m/m and 4.40% y/y in August. This is the largest year-on-year increase in 2021. This increase was driven strong growth mortgage loan growth of 4.6% y/y and 4.4% y/y growth in other loans & advances (credit card debt, personal- and term loans). Overdrafts grew by 9.1% y/y in August. All subcategories of loans and advances posted growth on a monthly basis with other loans and advances posting growth of 2.1% m/m, mortgage loans increasing by 0.4% m/m and overdrafts climbing by 0.2% m/m.

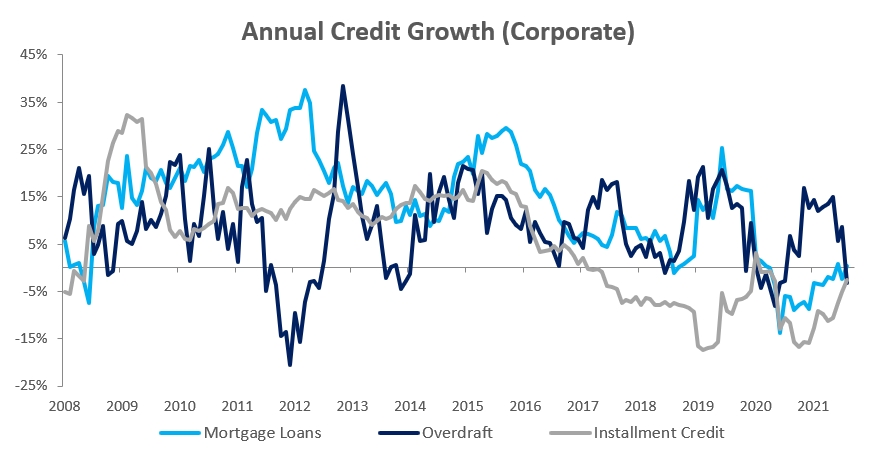

Credit Extension to Corporates

Credit extended to corporates contracted by 1.20% m/m and 1.23% y/y in August, as businesses continued to delever their balance sheets. This is the first year-on-year decrease in corporate credit extensions in 2021. The decline is largely due to overdrafts to corporates decreasing by 5.1% m/m and 3.1% y/y. Other loans & advances shrunk by 1.7% m/m and 1.0% y/y. Instalment credit grew marginally by 1.5% m/m but contracted by 2.6% y/y, the 19th consecutive month of contraction on an annual basis. Corporate mortgages increased by 2.1% m/m and 0.4% y/y.

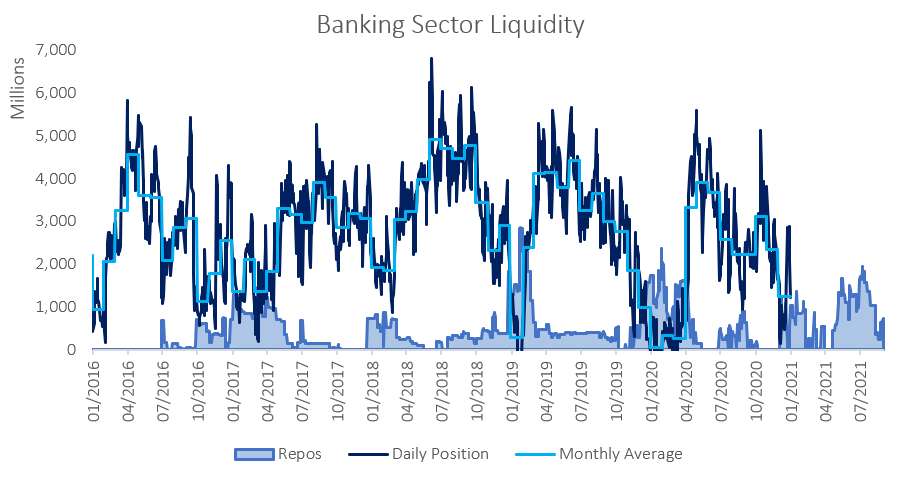

Banking Sector Liquidity

The overall liquidity position of Namibia’s commercial banks increased significantly in August, rising by roughly N$1.24 billion to an average of N$1.80 billion in August. As a result of the improved liquidity, the balance of repo’s outstanding decreased. The repo balance at the start of August was N$1.02 billion, by the end of the month it stood at N$734.6 million.

Reserves and Money Supply

Broad Money Supply contracted by N$1.38 billion or 1.1% y/y in August, according to the BoN’s latest monetary statistics. The money supply did however increase month-on-month and now stands at N$123.1 billion compared to N$121.5 billion at the end of July. The BoN’s stock of international reserves decreased by 4.1% m/m to N$40.9 at the end of August. The central bank attributes this decrease to both increased government payments and commercial bank purchases of foreign currency for import payments in August.

Outlook

Even if, interest rates remain steady for the remainder of 2021, as expected, this is unlikely to meaningfully increase the growth rate of PSCE. Despite growth in the economy in Q2 2021, consumers are likely to remain cautious and prioritise saving over consumption. The data bears this out as year-on-year increases in credit extensions to individuals in 2021 are similar to those seen in 2020. Meaningful PSCE growth is therefore likely to return only once macroeconomic conditions improve meaningfully and both consumers and businesses can spend more freely.