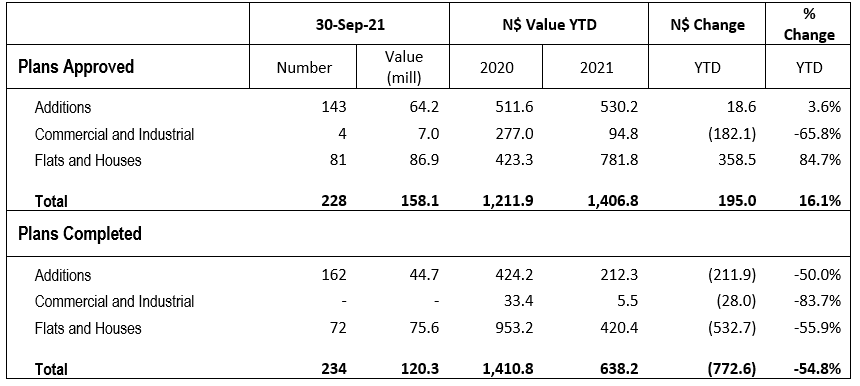

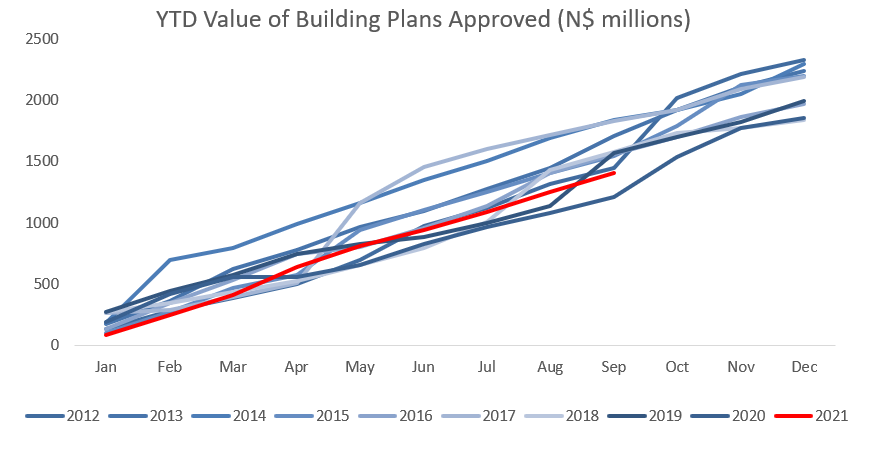

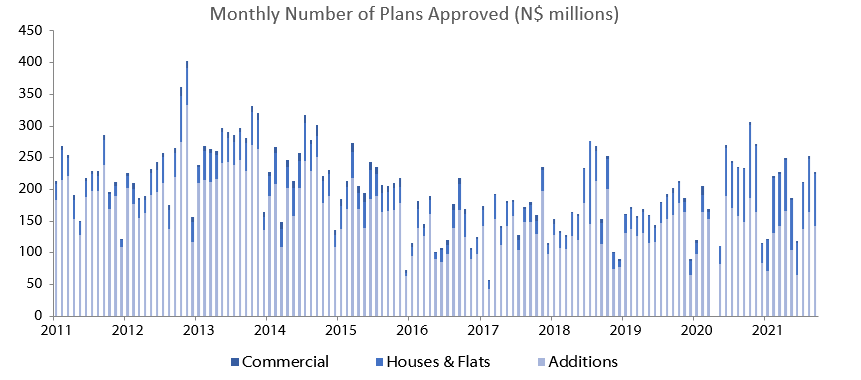

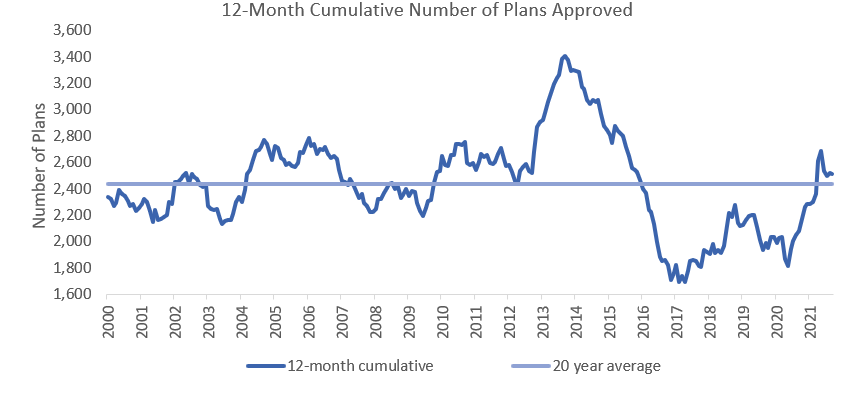

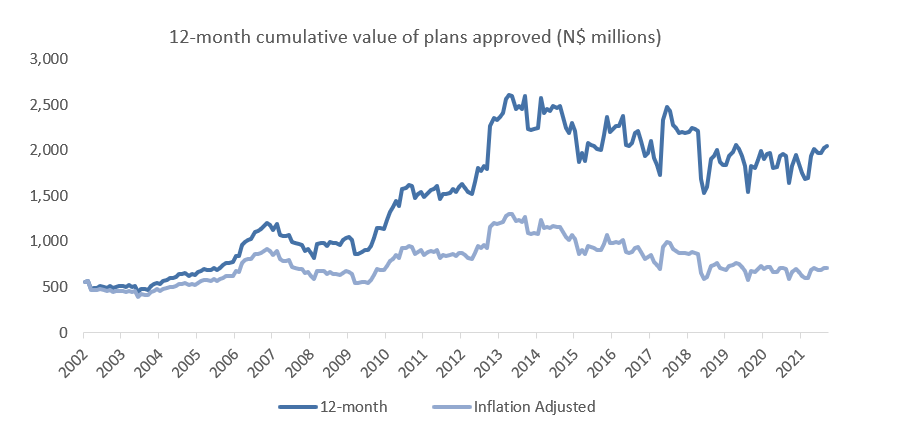

The City of Windhoek approved 228 building plans in September, a 9.9% m/m decrease from the 253 approved in August. The total value of approvals decreased by 2.2% m/m to N$158.1 million. So far in 2021 there have been 1,819 approvals, valued at N$1.41 billion. This year-to-date figure is 14.4% higher in number terms and 16.1% higher in value terms than at the same time last year. On a 12-month cumulative basis, the number of building plans approved rose by 20.7% y/y to 2,511, while the value of these approvals rose by 25.1% y/y to N$2.05 billion. 234 construction projects were completed in September at a value of N$120.3 million, a high in both number and value terms for the year. Year-to-date, 1,203 plans, valued at N$638.2 million have been completed, a 54.8% contraction in value terms compared to the same period a year ago. On a 12-month cumulative basis the value of completed projects is down 57.3% y/y.

Over the past decade additions to properties have averaged roughly 44% of the total value of approved construction projects. On trend, additions to properties made up 41% of the total value of approvals in September. 143 additions were approved at a value of N$64.2 million, a 13.3% m/m decrease in number, but a 12.5% m/m increase in value from the N$57.1 million approved in August. Year-to-date, 1,126 additions have been approved at a value of N$530.2 million, a 3.4% decrease in number, but a 3.6% increase in value from September 2020. Compared to the preceding three months September saw a large spike in the number and value of additions completed, with 162 additions completed in the month at a value of N$44.7 million. In fact, September saw a greater number, and value, of additions completed than in the previous three months (June, July and August) combined.

New residential units were the second largest contributor to the total number of building plans approved with 81 approvals. Residential units did however contribute the most value, with total residential approvals valued at N$86.9 million. In terms of value, that N$86.9 million represents a 3.3% m/m increase from August’s figure of N$84.1 million. Year-to-date, 664 units worth N$781.8 million have been approved. This represents a year-to-date increase in value of residential units of 84.7% y/y. On a 12-month cumulative basis, the number of residential units approved increased by 98.0% y/y and by 90.0% y/y in value.

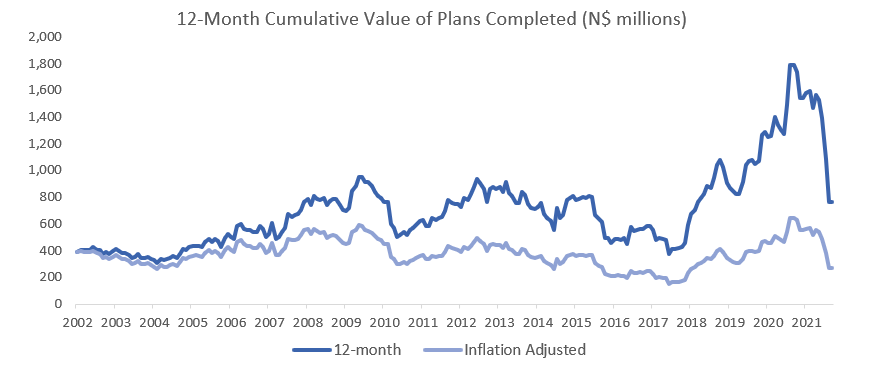

72 new residential units were completed in September at a value of N$75.6 million. In terms of value, September was the best month for residential construction in Windhoek in 2021. On a 12-month cumulative basis, the number of residential units completed comes to 563 at a value of N$511.4 million and while this translates to a year-on year decrease of the 12-month cumulative figure, the number and value of completed residential construction projects from July through to September 2020 was unnaturally high. So, with those values now omitted from the 12-month cumulative calculations it is unsurprising to see that the 12-month cumulative value of residential units completed has decreased by 50.8% y/y in value. This has everything to do with those three months in 2020 seeing abnormally high figures for the value of completed projects (see last month’s report for a more detailed explanation of why that is) and nothing do with 2021 being an unusually slow year for residential construction.

In September four commercial units, valued at N$7.0 million, were approved. Year-to-date, 29 commercial buildings have been approved at a combined value of N$94.8 million. September also marks the sixth consecutive month with zero commercial building project completions. Over this time, 25 projects have been approved. So, while projects are not being completed the fact that commercial projects continue to be approved is encouraging, although the value of these projects are significantly smaller than they were pre-pandemic.

On a 12-month cumulative basis, the number of buildings completed fell by 30.5% y/y and 57.3% y/y in terms of value. As alluded to in the previous paragraph, and as explained in the conclusion of the previous report, there is a simple mechanical explanation for this and now the 12-month cumulative value of plans completed simply gives a more accurate picture of short-term construction trends than it did two months ago. Additionally, the year-on-year change of the 12-month cumulative value of plans completed will remain negative for several more months while the overall health of the construction industry is likely to hover around its early 2019 level.

12-month cumulative approvals do paint a better picture, with a 20.7% y/y increase in number terms and 25.1% y/y in value, however these increases are from a low base and the majority of approvals continue to be made up of additions to properties which are of lower relative value.